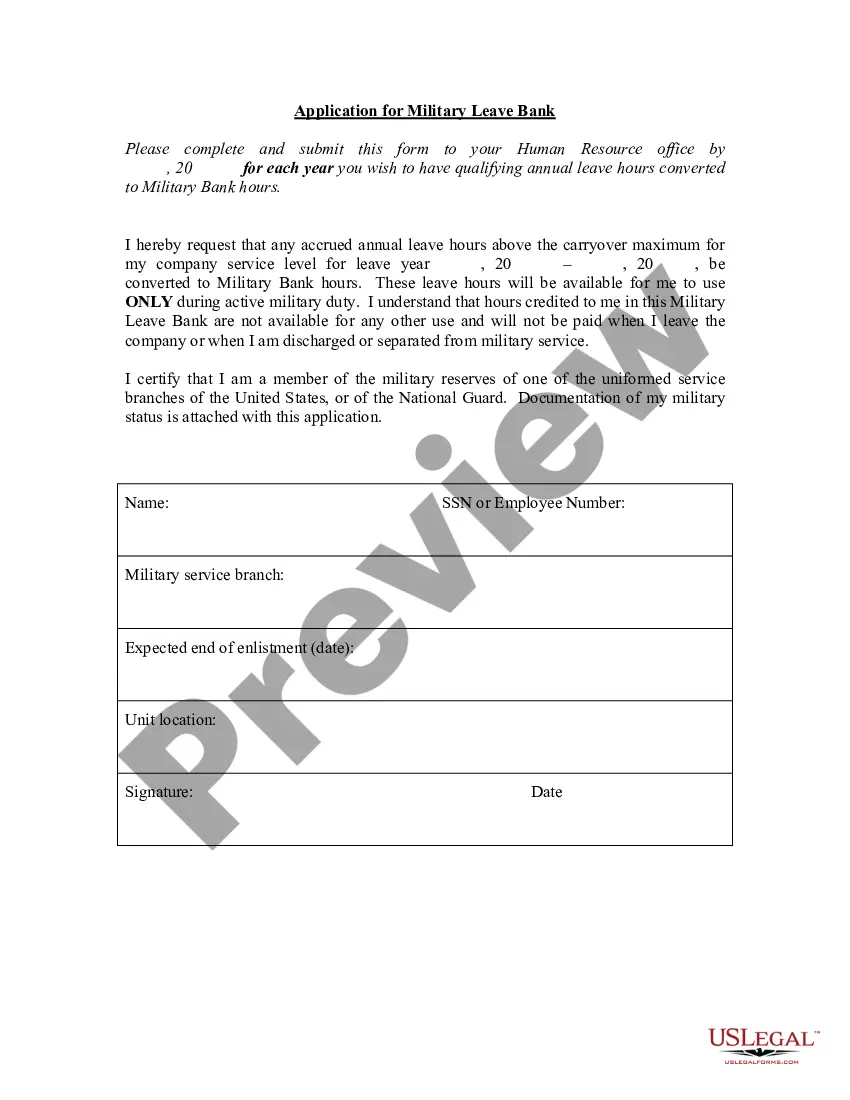

Arkansas Application for Military Leave Bank

Description

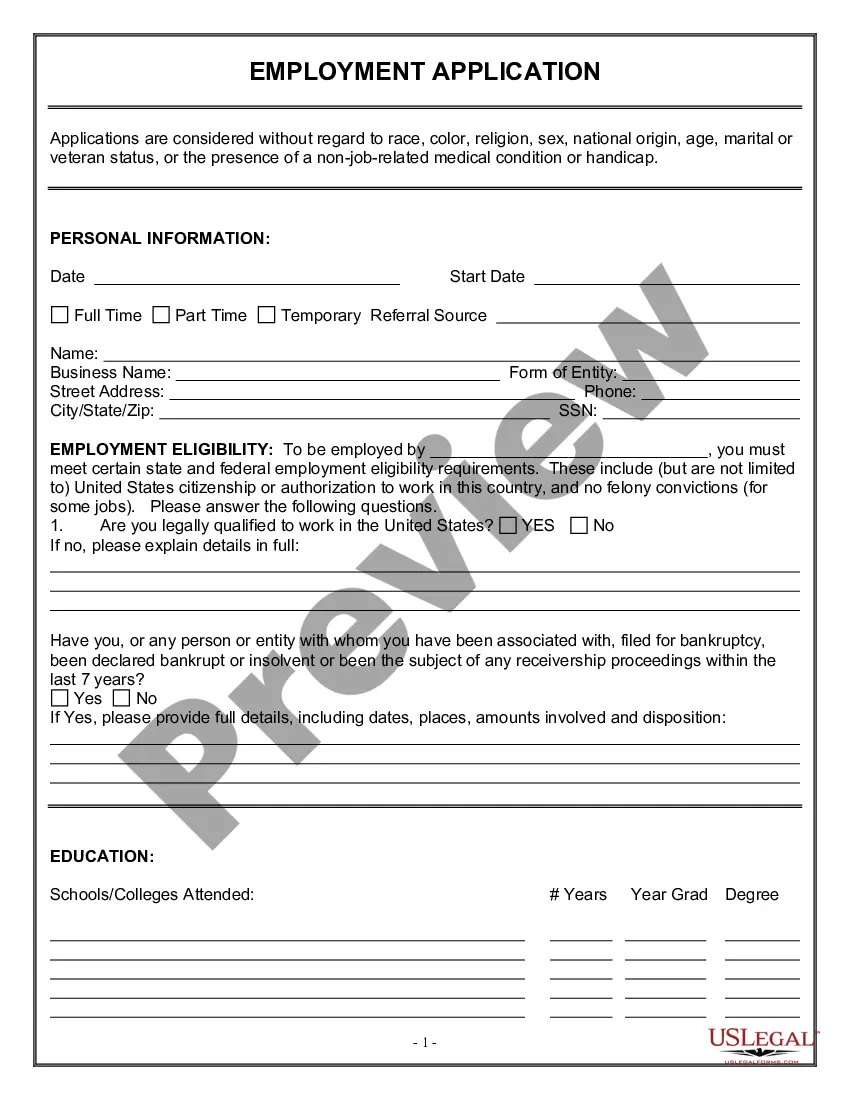

How to fill out Application For Military Leave Bank?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal template options that you can download or print.

Through the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms like the Arkansas Application for Military Leave Bank in just seconds.

If you already have a subscription, Log In to download the Arkansas Application for Military Leave Bank from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

Choose the format and download the form to your device.

Edit. Fill out, modify, print, and sign the saved Arkansas Application for Military Leave Bank. All templates you add to your account do not expire and are yours forever. Therefore, if you want to download or print another version, simply navigate to the My documents section and click on the form you need.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your region/state.

- Click the Review button to view the form's details.

- Check the form summary to confirm you've picked the right one.

- If the form doesn’t meet your needs, use the Search bar at the top of the screen to find a suitable alternative.

- If you are satisfied with the form, confirm your choice by clicking the Buy Now button. Then, select your preferred payment plan and enter your credentials to register for an account.

- Complete the purchase. Use your credit card or PayPal account to finish the transaction.

Form popularity

FAQ

Arkansas Veteran Financial BenefitsPersonal Property Tax Exemption.Income Tax.Free Tuition for Dependents.Discounted Hunting & Fishing Licenses.Active Duty Hunting & Fishing Licenses.Arkansas State Parks.

In the military, the federal government generally only taxes base pay, and many states waive income taxes. Other military paythings like housing allowances, combat pay or cost-of-living adjustmentsisn't taxed.

Arkansas military retirement pay is exempt from state taxes: Act 141 of Arkansas' 91st General Assembly exempts Military Retired Pay from Arkansas State Income Taxes effective 1 January 2018. The full text of Act 141 can be accessed HERE.

Arkansas is an ideal State for Retiring and Transitioning Military. Tax Benefits: Military Retired Pay is exempt from state income tax, and some veterans are eligible for Homestead and Personal Property Tax Exemption, as well as Gross Receipt of Tax Exemption.

What are my Arkansas Military/ Veteran State Taxes Benefits? Military Pay Exempt from Arkansas State Taxes: Military pay received by members of the U.S. Armed Forces is exempt from Arkansas income tax.

Summary of Arkansas Military and Veterans Benefits: Arkansas offers special benefits for Service members, Veterans and their Families including property tax exemptions, state employment preferences, education and tuition assistance, vehicle tags, as well as hunting and fishing license privileges.

Arkansas Statute 26-3-306 provides tax exemption for homestead and personal property owned by the disabled veteran and, with restrictions, the surviving spouse and minor dependent children for residents of Arkansas.

Military income: Military pay is taxable if stationed in California.

Arkansas military retirement pay is exempt from state taxes: Act 141 of Arkansas' 91st General Assembly exempts Military Retired Pay from Arkansas State Income Taxes effective 1 January 2018.

Benefit Fact SheetMilitary retirement pay based on age or length of service is considered taxable income for Federal income taxes. However, military disability retirement pay and Veterans' benefits, including service-connected disability pension payments, may be partially or fully excluded from taxable income.