Arkansas Security Agreement regarding Member Interests in Limited Liability Company

Description

How to fill out Security Agreement Regarding Member Interests In Limited Liability Company?

Locating the appropriate official document template can be significantly challenging.

Of course, there is a wide range of templates available online, but how do you find the official form you require.

Utilize the US Legal Forms website.

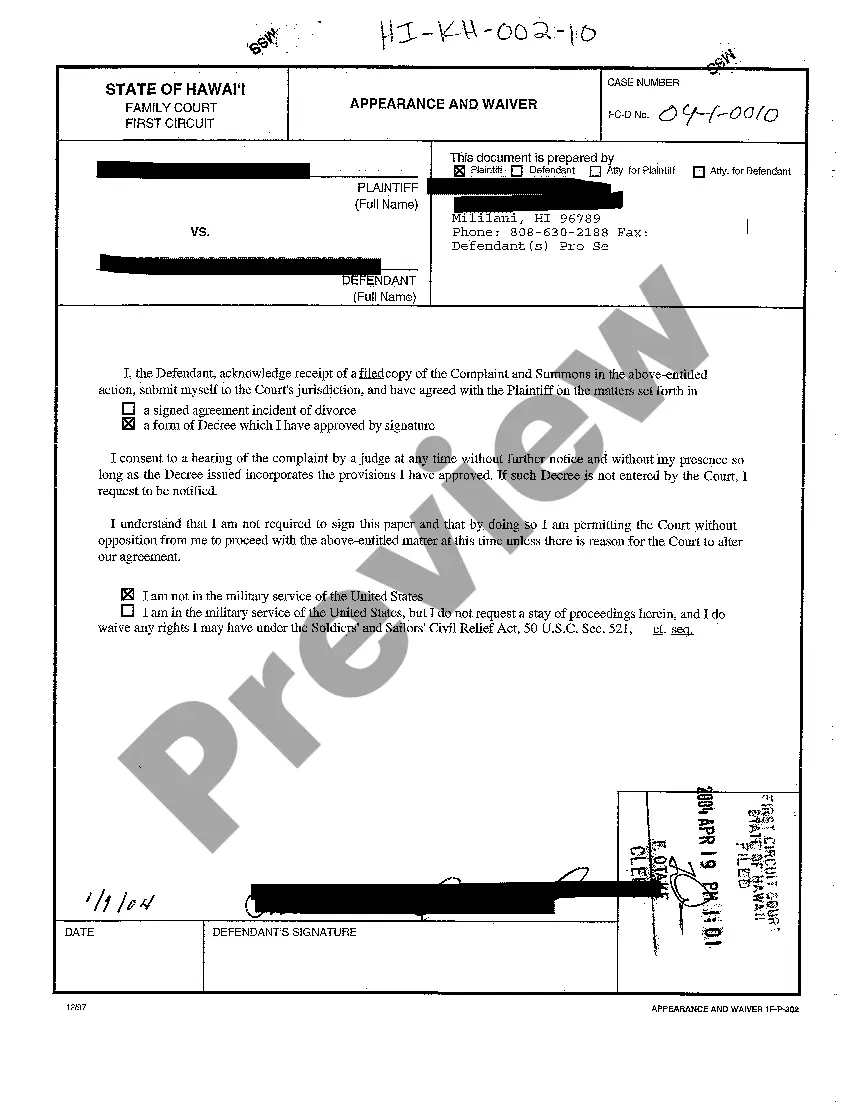

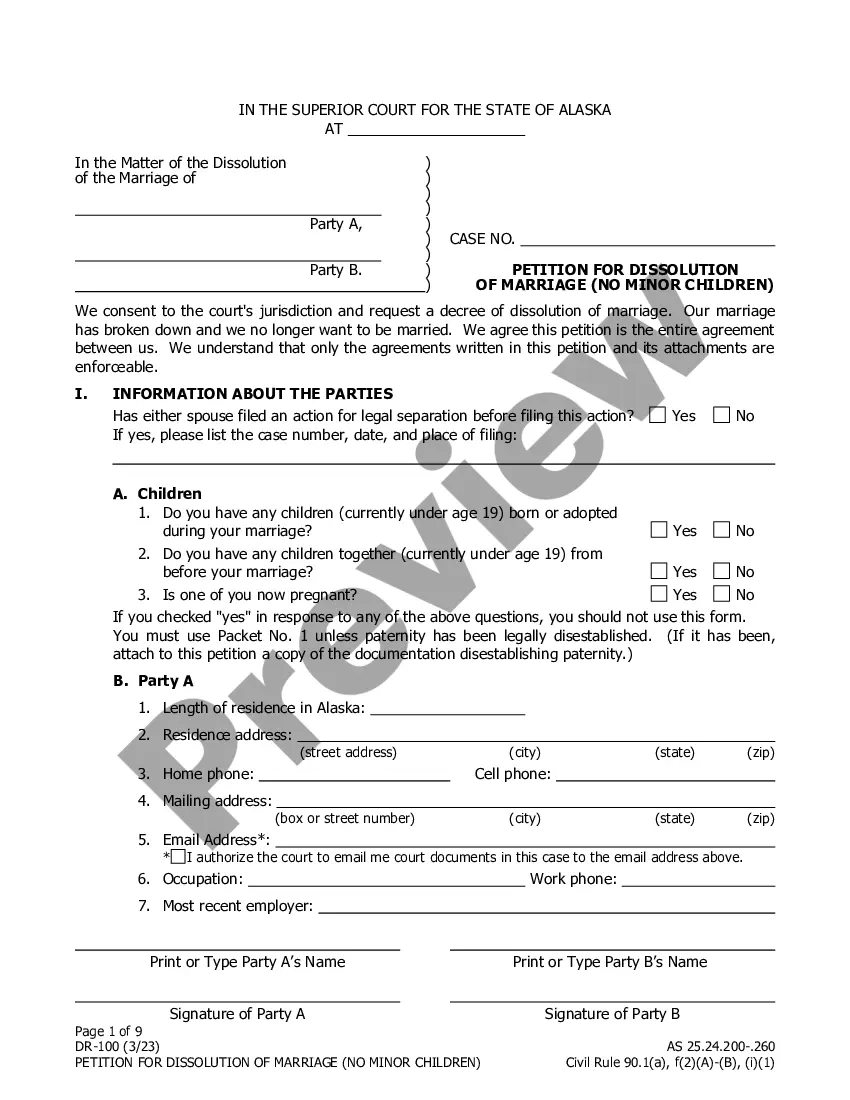

Initially, ensure you have selected the correct form for your city/region. You can preview the form using the Preview button and review the form outline to ensure it is the correct one for your needs.

- The service provides numerous templates, such as the Arkansas Security Agreement concerning Member Interests in Limited Liability Company, which you can utilize for both business and personal purposes.

- All documents have been reviewed by professionals and comply with federal and state regulations.

- If you are already a registered user, Log In to your account and click the Download button to obtain the Arkansas Security Agreement concerning Member Interests in Limited Liability Company.

- Use your account to review the legal documents you have purchased previously.

- Go to the My documents tab of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

A membership interest represents an investor's (called a "member") ownership stake in an LLC. A person who holds a membership interest has a profit and voting interest in the LLC (although these may be amended by contract). Ownership in an LLC can be expressed by percentage ownership interest or membership units.

Single member LLCs are treated the same as sole proprietorships. Profits are reported on Schedule C as part of your individual 1040 tax return. Self-employment taxes on Arkansas LLC net income must be paid just as you would with any self-employment business.

With LLCs, members own membership interests (sometimes called limited liability company interests) in the Company which are not naturally broken down into units of measure. You simply own a membership interest in the Company and part of your agreement with the other members is to describe what and how much you own.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

Arkansas does not legally require LLC owners to submit an operating agreement to the Secretary of State when filing the Articles of Organization (the formal paperwork needed to form an LLC officially).

The transfer of membership interest in LLC entities is done through an LLC Membership Interest Assignment. This document is used when an owner (member) of an LLC wants to transfer their interest to another party. They are typically used when a member plans to leave or wants to relinquish their interest in the business.

While membership interests are freely transferable in the sense that any member generally can transfer his or her economic rights in the LLC (subject to the operating agreement, a stand-alone buy-sell agreement, and state law), the management or voting rights in the LLC are usually what are restrictedotherwise, other

With LLCs, members own membership interests (sometimes called limited liability company interests) in the Company which are not naturally broken down into units of measure. You simply own a membership interest in the Company and part of your agreement with the other members is to describe what and how much you own.

An Arkansas LLC operating agreement is a legal document that outlines the internal operations of a company and protects individual members' stake. The document also offers tax advantages to the business and its contributing members.