Arkansas Partnership Agreement for Startup

Description

How to fill out Partnership Agreement For Startup?

If you desire to total, download, or create endorsed document templates, utilize US Legal Forms, the largest collection of legal forms, that is accessible online.

Leverage the site’s simple and user-friendly search to find the documents you need.

A variety of templates for business and personal purposes are categorized by groups and states or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

Step 6. Choose the format of the legal form and download it to your device.Step 7. Complete, modify, and print or sign the Arkansas Partnership Agreement for Startup.

- Use US Legal Forms to obtain the Arkansas Partnership Agreement for Startup with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download option to find the Arkansas Partnership Agreement for Startup.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

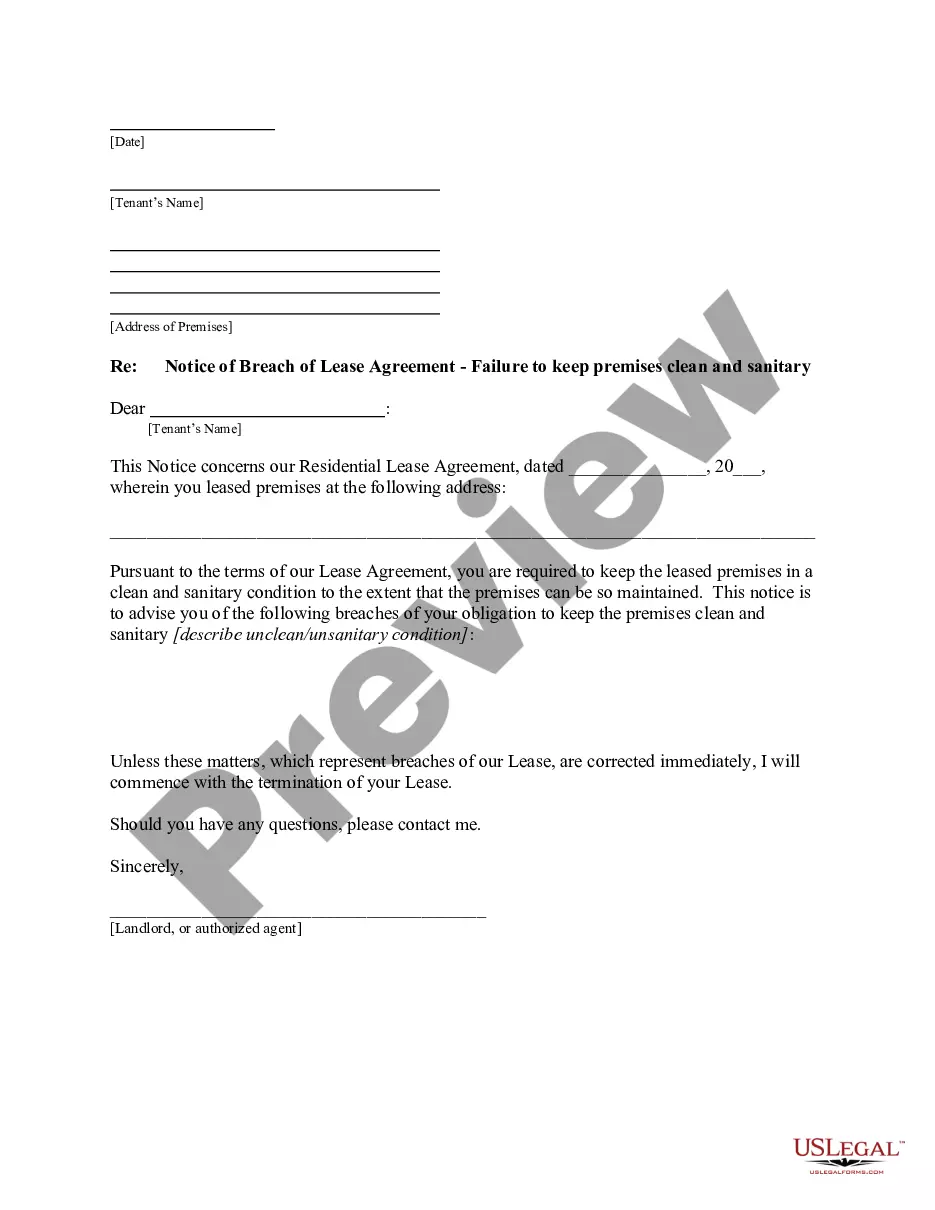

- Step 2. Use the Preview option to review the form’s details. Make sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other forms from the legal document design.

- Step 4. Once you have found the form you need, select the Buy now option. Choose the payment plan you prefer and enter your credentials to register for an account.

Form popularity

FAQ

Start now and decide later.Choose a Business Idea. Take some time to explore and research ideas for your business.Decide on a Legal Structure.Choose a Name.Create Your Business Entity.Apply for Arkansas Licenses and Permits.Pick a Business Location and Check Zoning.File and Report Taxes.Obtain Insurance.More items...

written partnership agreement will reduce the risk of misunderstandings and disputes between the owners. Without a written agreement, owners in a company will be stuck with the state's default rules.

In general, an LLC offers better liability protection and more tax flexibility than a partnership. But the type of business you're in, the management structure, and your state's laws may tip the scales toward partnership.

In this way, a partnership agreement is similar to corporate bylaws or a limited liability company's (LLC) operating agreement. There's no state that requires a partnership agreement, and it's possible to start a business without one.

Based on ContractsCounsel's marketplace data, the average cost of a project involving a partnership agreement is $603.89 . Partnership agreement cost depends on many variables, which includes the service requested, number of partners, and the number of custom terms needed to be included in the document.

You don't have to file any paperwork to establish a partnership -- you can create a partnership simply by agreeing to go into business with another person.Choose a business name.Register a fictitious business name.Draft and sign a partnership agreement.Comply with tax and regulatory requirements.Obtain Insurance.

Requirements:Registration with DTI or SEC (depending on partnership's capital)Submission of duly notarized Articles of Partnership.Submission of SEC form F-105 (for partnerships with foreign members)Procurement of licenses and clearances from necessary government offices.Registration with BIR.More items...

A general partnership is the simplest. It has only general partners, who share equally in the ownership and management duties of the business. A GP is easy to set up, but it's risky because you and the business are one and the same.

How to Write a Business Partnership Agreementname of the partnership.goals of the partnership.duration of the partnership.contribution amounts of each partner (cash, property, services, future contributions)ownership interests of each partner (assets)management roles and terms of authority of each partner.More items...

Before creating a partnership, it is important to draft a well-thought-out operating agreement that will cover the following: Name of the partners and the process of adding new partners or removing them. Outline of the company. Each partner's percentage of investment and profit.