Arkansas Land Installment Contract

Description

How to fill out Land Installment Contract?

If you need to finalize, acquire, or print sanctioned document templates, utilize US Legal Forms, the largest compilation of legal forms available online.

Leverage the site’s straightforward and user-friendly search to find the documents you require.

An assortment of templates for business and personal needs are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the payment.

- Utilize US Legal Forms to locate the Arkansas Land Installment Contract within a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Arkansas Land Installment Contract.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Make sure you have selected the form for the correct city/state.

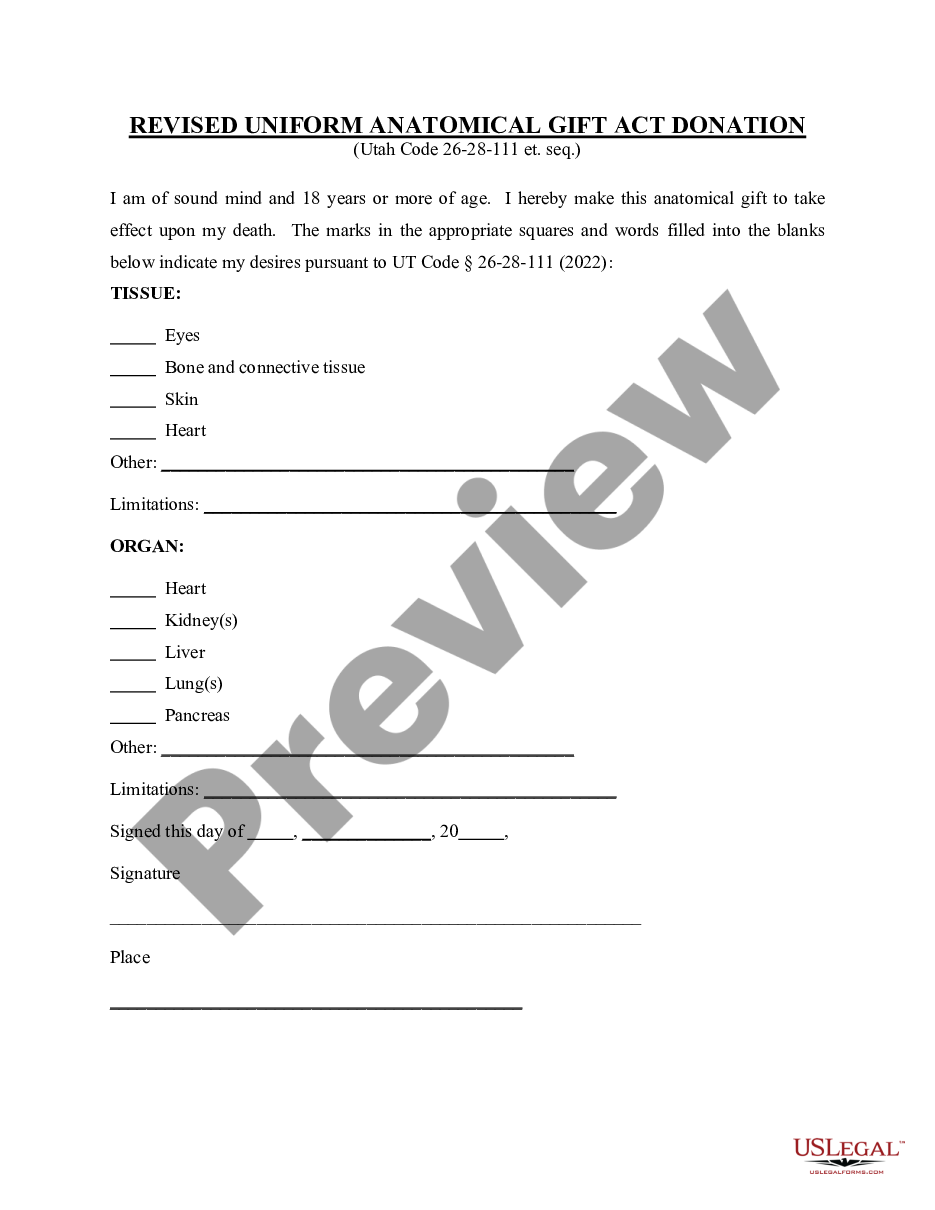

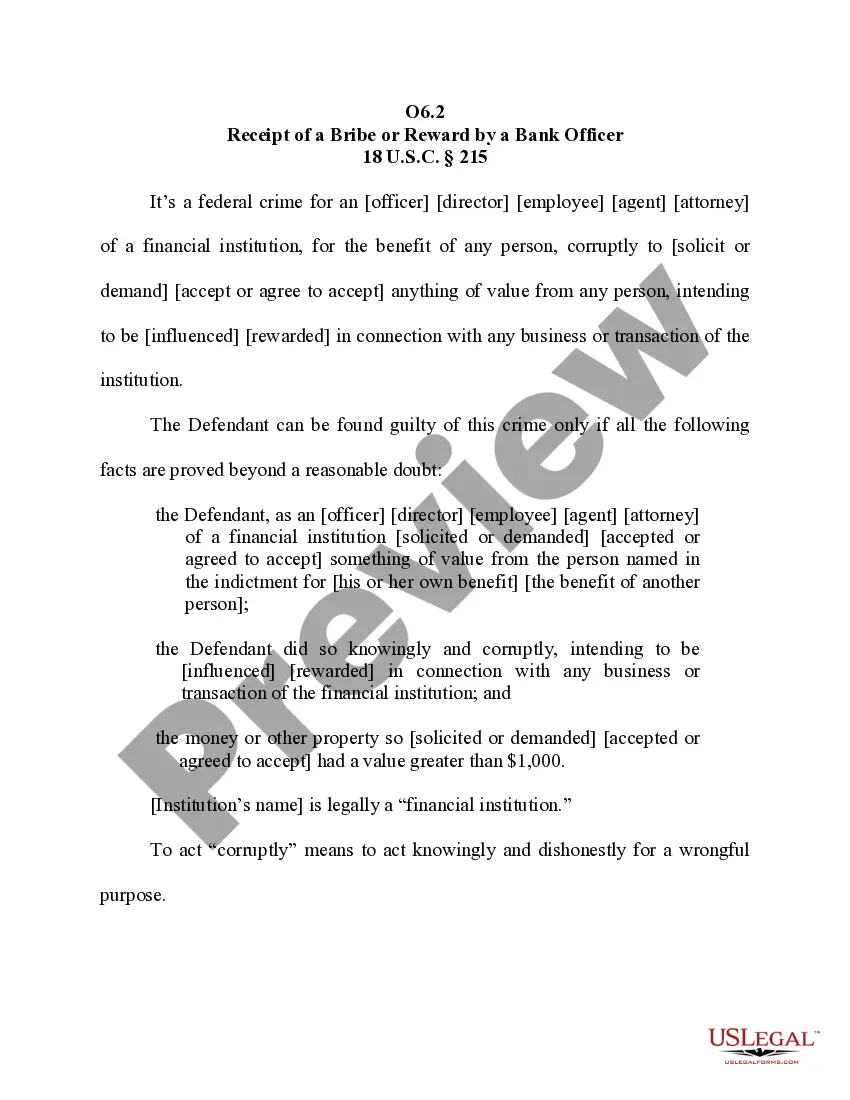

- Step 2. Use the Preview option to review the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the page to find other versions of the legal form template.

Form popularity

FAQ

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

Introduction. An installment contract (also called a land contract or articles of agreement for warranty deed or contract for deed) is an agreement between a real estate seller and buyer, under which the buyer agrees to pay to the seller the purchase price plus interest in installments over a set period of time.

The most significant disadvantage of a land contract is the amount of risk both parties take on.

An installment purchase agreement is a contract used to finance the acquisition of assets. Under the terms of such an agreement, the buyer pays the seller the full purchase price by making a series of partial payments over time. The payments include stated or imputed interest.

An installment land sales contract is an agreement to buy land over time, without transferring title to the land until all the payment have been made. The Seller agrees to allow the Buyer to pay the purchase price over a period of time in installment amounts.

The seller transfers the property deed to the buyer when land contracts are paid in full. They complete the process by filing the necessary legal documents with the County Clerk and Recorder's Office in which the property is situated. The County Clerk will record the new ownership information.

The advantages of a land contract to the buyer are that it provides an ownership interest in the real estate, which helps to quickly build equity in the property and good credit history. A major disadvantage is that the buyer is almost always responsible for structural and mechanical repairs to the house.

An Arkansas land contract formalizes an agreement for the purchase and sale of vacant land. The terms between the parties are to be negotiated, written, and signed by the parties. Once signed, the due diligence period will begin and an earnest money deposit is commonly expected from the buyer.

With owner financing, the buyer and seller come to an agreement on the purchase price of the home and the terms of the loan. The home buyer will borrow the purchase price from the seller, then repay the money according to the terms that the buyer and seller have negotiated.

As a type of specialty home financing, a land contract is similar to a mortgage, but rather than borrowing money from a lender or bank to buy real estate, the buyer makes payments to the real estate owner, or seller, until the purchase price is paid in full.