Arkansas Notice of Default on Promissory Note Installment

Description

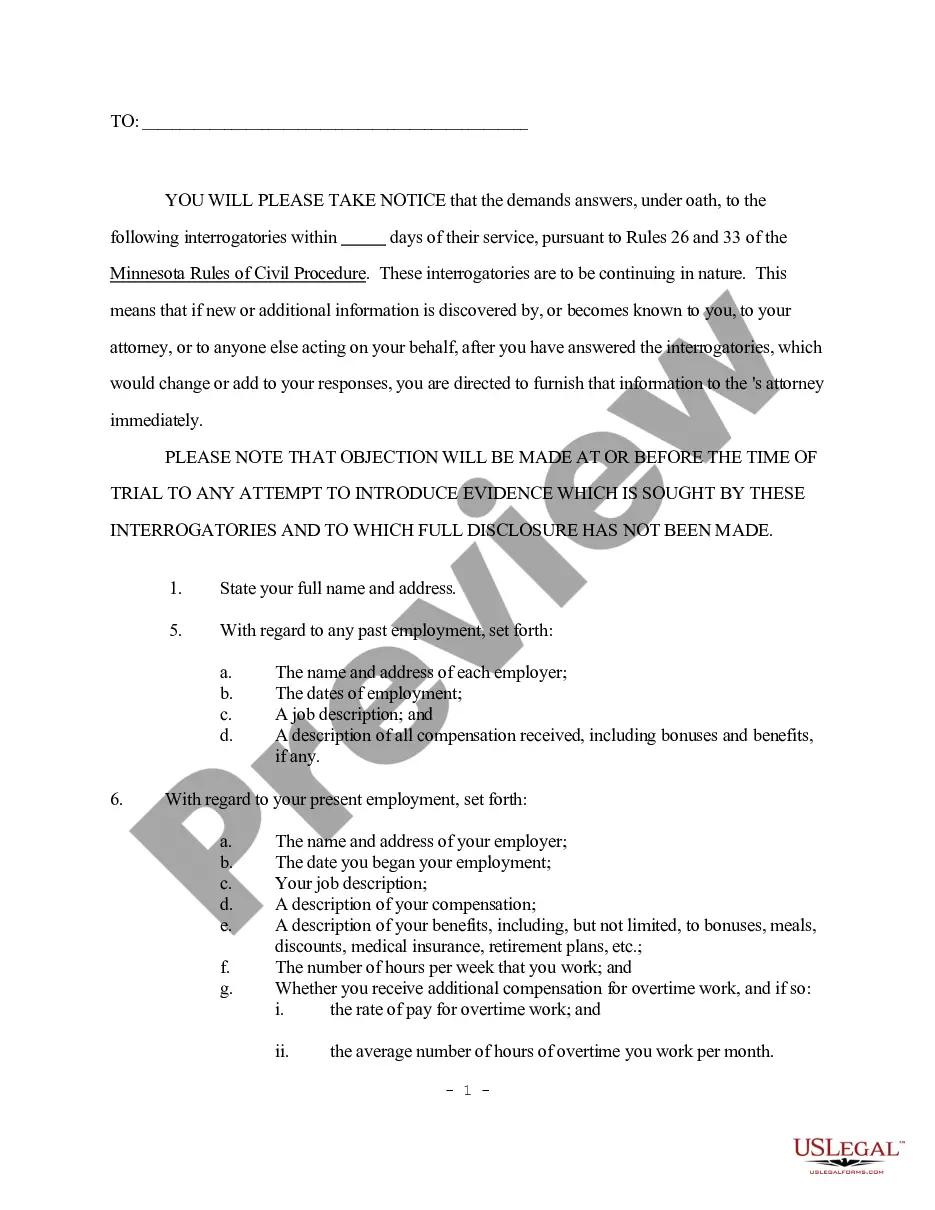

How to fill out Notice Of Default On Promissory Note Installment?

If you require extensive, acquire, or print lawful document templates, utilize US Legal Forms, the most extensive selection of legal documents available online.

Take advantage of the site’s straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are organized by types and states, or keywords.

Step 4. After finding the form you wish to use, click the Get now button. Choose your preferred payment method and enter your details to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to locate the Arkansas Notice of Default on Promissory Note Installment in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and press the Download button to obtain the Arkansas Notice of Default on Promissory Note Installment.

- You may also access documents you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

The default provisions in a promissory note outline the specific events or actions that constitute a default. Generally, these can include late payments, failure to comply with debt obligations, or bankruptcy. Understanding these terms helps clarify the lender's rights, including the issuance of an Arkansas Notice of Default on Promissory Note Installment if you fail to meet your obligations.

Defaulting on a promissory note typically means failing to comply with the payment schedule outlined in the agreement. This can prompt the lender to issue an Arkansas Notice of Default on Promissory Note Installment, warning you about the potential consequences. To avoid escalating penalties, consider negotiating with your lender or seeking legal advice as soon as possible.

If a borrower defaults on a promissory note, the lender may initiate a series of actions to recover the owed amount. This situation often leads to the issuance of an Arkansas Notice of Default on Promissory Note Installment, allowing the lender to claim legal rights over the collateral. As a result, the borrower could face foreclosure, asset seizure, or other legal remedies dictated by the terms of the note.

If someone defaults on a promissory note, your first action should be to review the terms of the note for any specified remedies. You may begin the process by sending an Arkansas Notice of Default on Promissory Note Installment to inform the borrower of their failure to comply. Following this, you can explore options such as negotiation, mediation, or legal action. Using uslegalforms can simplify the creation of your default notice and other important documents.

To enforce a promissory note, you must first ensure that the note is properly executed, meaning both parties signed it with clear terms. If the borrower defaults, you can issue an Arkansas Notice of Default on Promissory Note Installment as a formal step to initiate collection. It's advisable to maintain clear documentation throughout this process. Utilizing platforms like uslegalforms can help you create the necessary legal documents efficiently.

Writing an Arkansas Notice of Default on Promissory Note Installment requires a clear and concise format. Start by including your name, the borrower's name, and details of the promissory note, including the amount and payment schedule. Clearly state the nature of the default and any required steps the borrower must take to rectify the situation. Consider utilizing US Legal Forms for templates that ensure you cover all necessary legal elements.

To issue a default notice, prepare the document with all relevant information, including the borrower's details and the nature of the default. Deliver the notice to the borrower through certified mail or another traceable method to ensure they receive it. Using tools like the Arkansas Notice of Default on Promissory Note Installment from US Legal Forms can simplify this process and ensure compliance with legal standards.

An example of a default notice includes a letter that specifies the amount owed, the payment due date, and instructions for resolving the issue. It should clearly state the consequences of failing to respond, such as further legal action. Using the Arkansas Notice of Default on Promissory Note Installment as a reference can help you draft a precise and effective default notice.

When someone defaults on a promissory note, it is crucial to first communicate with the borrower. Discuss possible solutions such as restructuring payments or setting a grace period. If informal measures fail, proceed by issuing an Arkansas Notice of Default on Promissory Note Installment to document the default and inform the borrower of the next steps.

Remedies for default on a promissory note may include formal collection actions, negotiating a payment plan, or even pursuing legal action. Courts may enforce the terms of the note, requiring the borrower to make the payments or face possible foreclosure. Understanding these options through the Arkansas Notice of Default on Promissory Note Installment ensures you know your rights and responsibilities.