Arkansas General Letter of Credit with Account of Shipment

Description

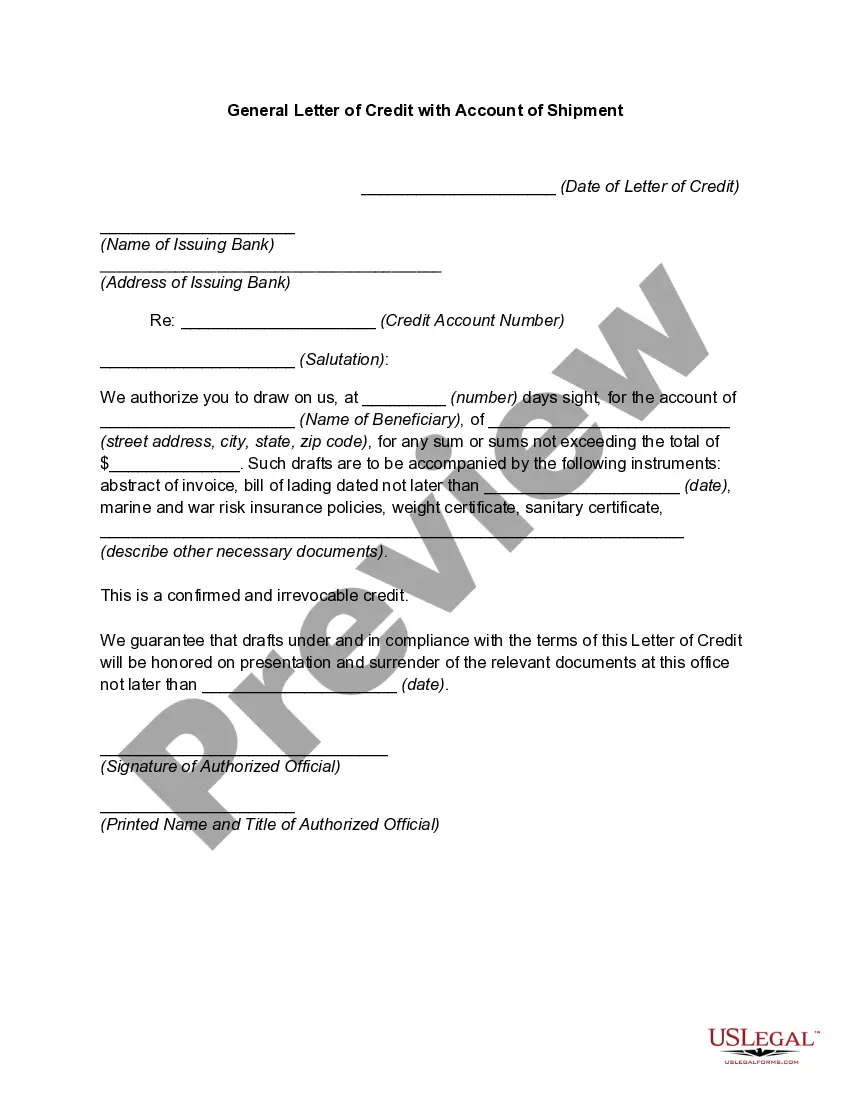

How to fill out General Letter Of Credit With Account Of Shipment?

Discovering the right legitimate file format could be a battle. Naturally, there are tons of templates available on the net, but how can you discover the legitimate type you want? Take advantage of the US Legal Forms internet site. The service delivers a huge number of templates, like the Arkansas General Letter of Credit with Account of Shipment, which can be used for organization and personal requires. Each of the forms are checked out by professionals and satisfy federal and state requirements.

In case you are presently registered, log in to the account and click the Acquire key to find the Arkansas General Letter of Credit with Account of Shipment. Make use of your account to appear from the legitimate forms you might have acquired earlier. Proceed to the My Forms tab of your own account and have yet another backup from the file you want.

In case you are a brand new consumer of US Legal Forms, allow me to share basic recommendations that you should stick to:

- Very first, make sure you have selected the appropriate type for your personal town/county. You are able to check out the form utilizing the Review key and read the form description to make certain it will be the right one for you.

- When the type is not going to satisfy your needs, use the Seach area to get the correct type.

- Once you are certain the form is acceptable, click on the Purchase now key to find the type.

- Select the costs plan you desire and type in the needed information. Make your account and purchase the transaction using your PayPal account or charge card.

- Pick the file format and acquire the legitimate file format to the system.

- Complete, revise and produce and sign the attained Arkansas General Letter of Credit with Account of Shipment.

US Legal Forms is the greatest local library of legitimate forms that you will find various file templates. Take advantage of the company to acquire expertly-created paperwork that stick to status requirements.

Form popularity

FAQ

A Letter of Credit is an arrangement whereby Bank acting at the request of a customer (Importer / Buyer), undertakes to pay for the goods / services, to a third party (Exporter / Beneficiary) by a given date, on documents being presented in compliance with the conditions laid down.

A bank guarantee is a promise from a lending institution that ensures the bank will step up if a debtor can't cover a debt. Letters of credit are also financial promises on behalf of one party in a transaction and are especially significant in international trade.

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.

A note on Cash Against Documents vs Letter of Credit: There are a few key differences between Cash Against Documents and Letter of Credit terms. With Letters of Credit, the process is initiated by the importer, whereas exporters initiate the process when it comes to Cash Against Documents.

Export Letter of Credit (LC) LCs provide Exporters with the confidence to allow them to ship their goods in advance of the receipt of payment. An LC is a conditional payment guarantee provided by the Importer's bank to the Exporter. The Exporter normally receives the payment guarantee prior to the shipment of goods.

Under Generally Accepted Accounting Principles, assets, liabilities, revenue and expenses are only recognized when they actually happen. Since a letter of credit guarantees a future liability, there's no actual liability to recognize. As a result, letters of credit are disclosed as a footnote to the balance sheet.

This is where a letter of credit or LC comes in handy. It is a guarantee issued by a bank for payment to the buyer while ensuring that the goods are shipped in good order.

Cash Against Document is a payment method where the exporter ships the goods and sends the document representing the ownership of the goods to the importer's bank through banking system and where the delivery of the document to the importer is subject to the payment of the document price.