Arkansas Notice of Default under Security Agreement in Purchase of Mobile Home

Description

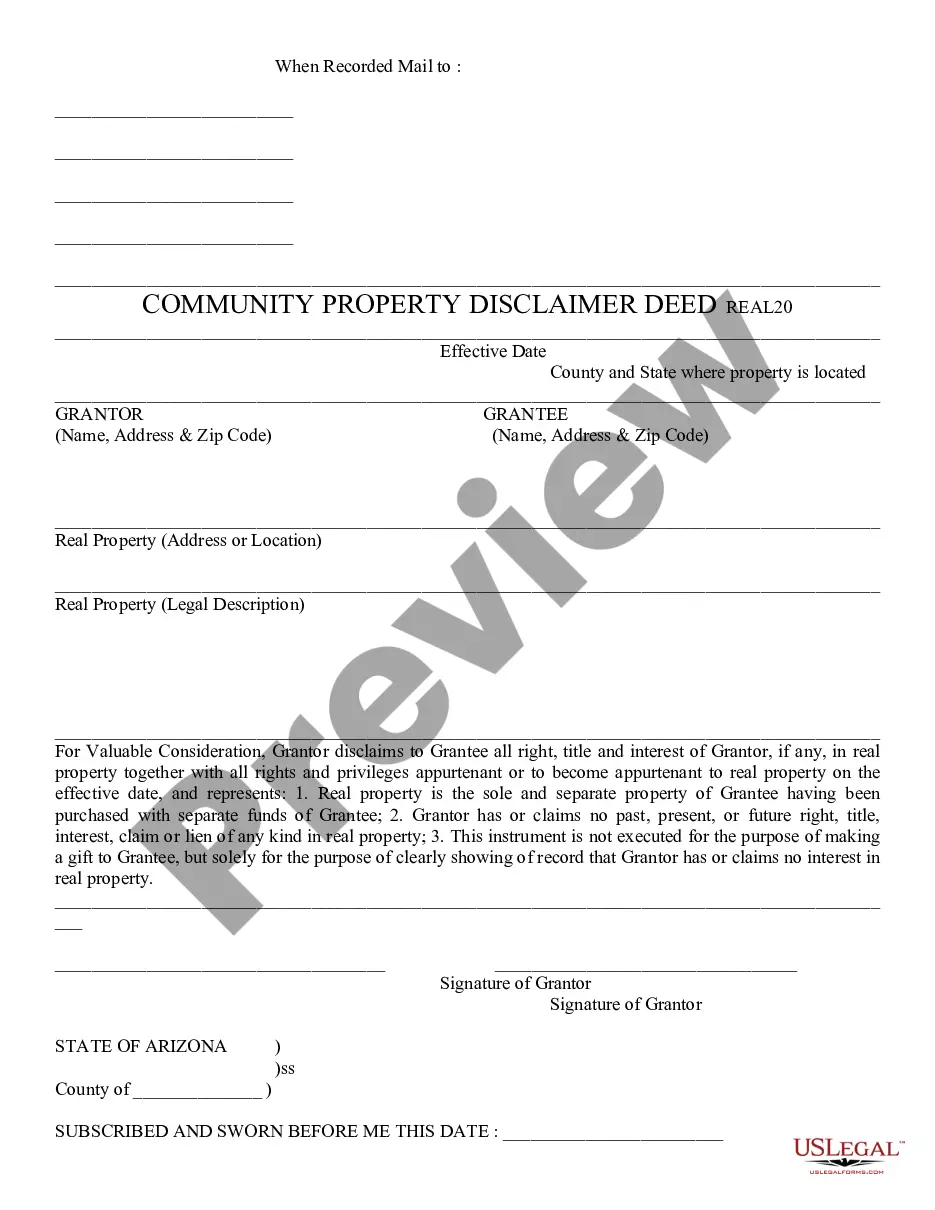

A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor (the secured party) requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor. A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Personal property is basically anything that is not real property.

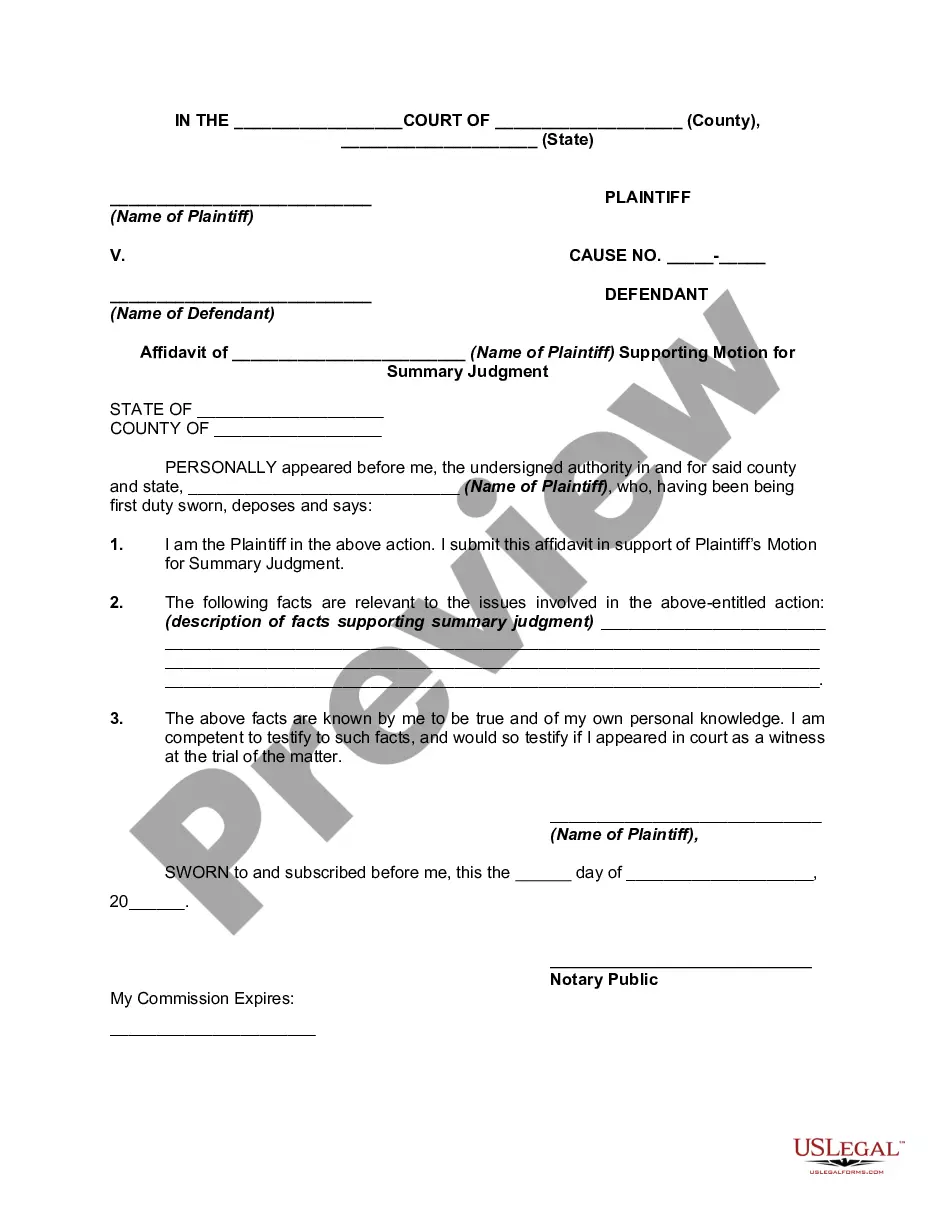

How to fill out Notice Of Default Under Security Agreement In Purchase Of Mobile Home?

US Legal Forms - one of the largest databases of legal documents in the United States - provides a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of documents like the Arkansas Notice of Default under Security Agreement in Purchase of Mobile Home within minutes.

If you already have a subscription, Log In to download the Arkansas Notice of Default under Security Agreement in Purchase of Mobile Home from the US Legal Forms collection. The Download button will appear on each form you view. You can access all previously obtained forms from the My documents tab in your account.

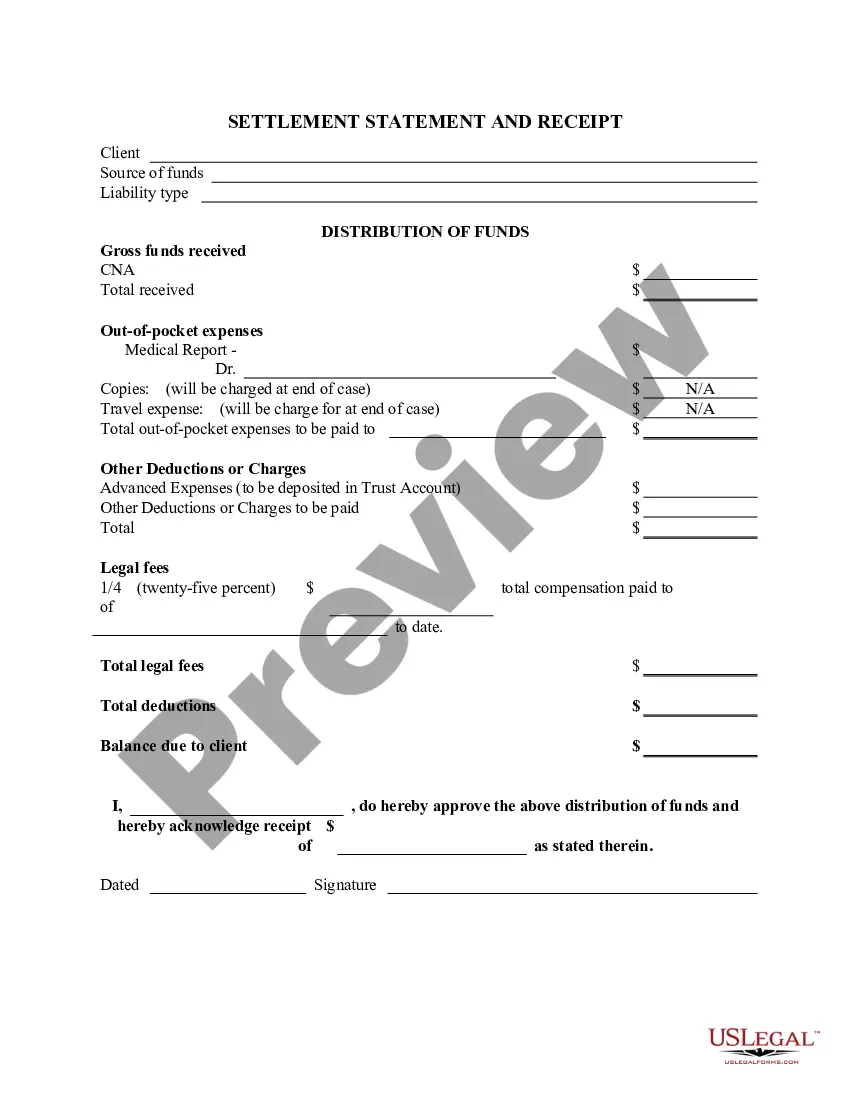

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the form to your device. Edit it. Fill out, modify, print, and sign the acquired Arkansas Notice of Default under Security Agreement in Purchase of Mobile Home. Each template you add to your account has no expiration date and is yours forever. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you desire. Access the Arkansas Notice of Default under Security Agreement in Purchase of Mobile Home with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If this is your first time using US Legal Forms, here are some simple steps to help you get started.

- Ensure you have selected the correct form for your locality.

- Click the Preview button to review the form's details.

- Examine the form information to confirm that you have chosen the appropriate document.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, finalize your selection by clicking the Buy Now button.

- Next, select the pricing plan you prefer and enter your credentials to register for an account.

Form popularity

FAQ

To locate notice of default properties, consider searching local real estate listings, or contact a real estate agent familiar with distressed properties. Additionally, you can check public records in Arkansas, which may list properties under notice of default. Utilizing platforms like uslegalforms can help streamline this process while ensuring you have the right legal documentation.

In the context of mortgage foreclosure, a notice of default is a formal notice that a lender filed with courts to notify the borrower who has failed to make payments that the lender intends to conduct a sale foreclosure.

If you are on the receiving end of a Default Notice, here's what you need to do:Check all the information on the default notice carefully.Contact the lender immediately.Discuss payment options.

A default occurs when a borrower does not make his or her mortgage loan payment and falls behind. When this happens, he or she risks the home heading into the foreclosure process. Usually, the foreclosure process is started within thirty days after the due date is not met.

A default notice is a formal letter sent to you by a lender or creditor when you're in arrears with your repayments to them. They are legally obliged to let you know in writing when you have missed payments.

In some states, the notice of default is attached to the home, often on the front window or door. It states that the person who holds the loan on the house is behind on mortgage payments and the bank is in the process of taking action. If the mortgage is not paid up to date, the lender will seize the home.

How to Cure the Default. You can cure a default in payments by paying the amount due, plus any allowable costs and fees, by a specific time before a foreclosure sale. The cure amount includes just overdue payments, plus fees, costs, and interestnot future payments or accelerated payments.

Information on notices of default normally includes the borrower and lender's name and address, the legal address of the property, the nature of the default, as well as other pertinent details. A notice of default is often considered the first step toward foreclosure.

A chattel mortgage is a loan used to purchase an item of movable personal property, such as a manufactured home or a piece of construction equipment. The property, or chattel, secures the loan, and the lender holds an ownership interest in it.

When you fail to pay several EMIs on time, your lender reports you as a defaulter. Some lenders may offer a grace period after the payment date during which you can make the payment; however, a late fee will be charged, but you won't earn the title of a defaulted.