US Legal Forms - among the most significant libraries of legitimate forms in the United States - delivers an array of legitimate papers web templates you are able to obtain or printing. While using web site, you can get a huge number of forms for business and specific reasons, sorted by classes, claims, or keywords and phrases.You can find the newest versions of forms like the Arkansas Alimony Trust in Lieu of Alimony and all Claims in seconds.

If you already have a registration, log in and obtain Arkansas Alimony Trust in Lieu of Alimony and all Claims from your US Legal Forms catalogue. The Acquire option will appear on every develop you look at. You have accessibility to all earlier downloaded forms in the My Forms tab of your respective profile.

If you wish to use US Legal Forms the very first time, allow me to share easy directions to help you get started off:

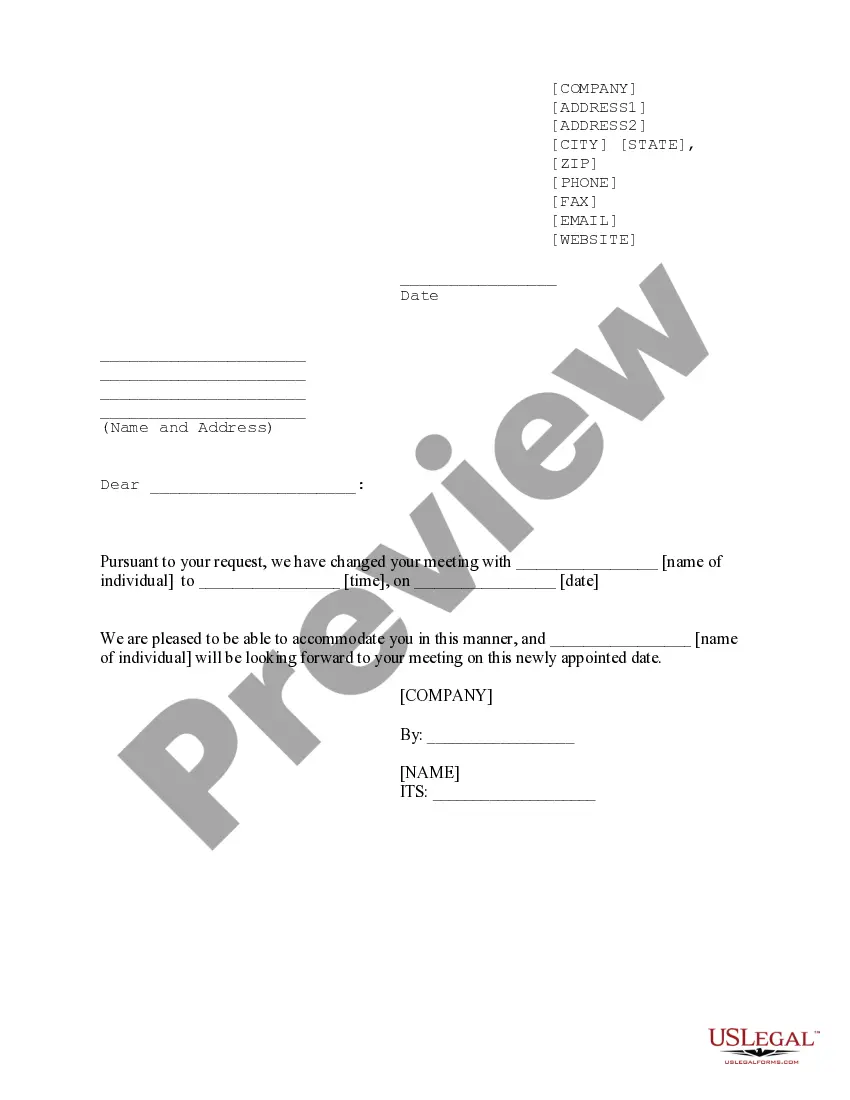

- Be sure you have picked the best develop for your personal metropolis/area. Click on the Preview option to examine the form`s content. Read the develop outline to actually have chosen the right develop.

- If the develop doesn`t fit your demands, take advantage of the Research area near the top of the screen to discover the one that does.

- When you are satisfied with the form, confirm your decision by simply clicking the Purchase now option. Then, pick the pricing program you like and offer your credentials to register for an profile.

- Process the transaction. Utilize your bank card or PayPal profile to accomplish the transaction.

- Select the file format and obtain the form on your gadget.

- Make adjustments. Complete, revise and printing and sign the downloaded Arkansas Alimony Trust in Lieu of Alimony and all Claims.

Every single design you added to your money does not have an expiry particular date and it is your own property for a long time. So, in order to obtain or printing another duplicate, just go to the My Forms section and click around the develop you require.

Get access to the Arkansas Alimony Trust in Lieu of Alimony and all Claims with US Legal Forms, one of the most substantial catalogue of legitimate papers web templates. Use a huge number of specialist and express-certain web templates that fulfill your company or specific requirements and demands.