If you have to comprehensive, down load, or print legal record layouts, use US Legal Forms, the greatest assortment of legal varieties, which can be found on the web. Utilize the site`s basic and practical look for to obtain the documents you require. A variety of layouts for business and person uses are sorted by classes and says, or key phrases. Use US Legal Forms to obtain the Arkansas Complaint for Wrongful Repossession of Automobile and Impairment of Credit within a handful of clicks.

Should you be presently a US Legal Forms buyer, log in in your bank account and then click the Acquire switch to have the Arkansas Complaint for Wrongful Repossession of Automobile and Impairment of Credit. You can also entry varieties you previously acquired from the My Forms tab of your own bank account.

If you work with US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have chosen the shape to the correct city/land.

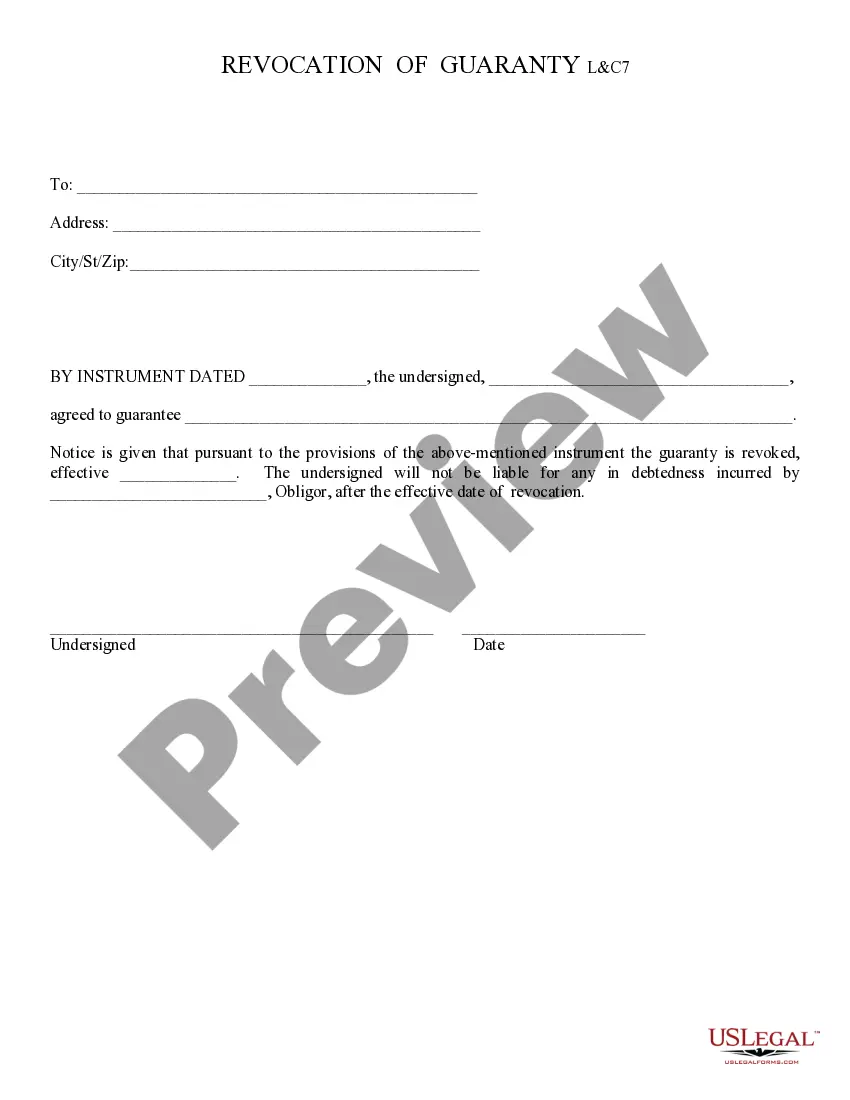

- Step 2. Make use of the Preview choice to look through the form`s content material. Never forget to learn the information.

- Step 3. Should you be not happy with all the develop, use the Look for industry at the top of the monitor to locate other types of your legal develop template.

- Step 4. Upon having discovered the shape you require, click on the Buy now switch. Opt for the prices program you choose and add your credentials to sign up for an bank account.

- Step 5. Procedure the financial transaction. You may use your charge card or PayPal bank account to accomplish the financial transaction.

- Step 6. Pick the structure of your legal develop and down load it in your product.

- Step 7. Full, change and print or indicator the Arkansas Complaint for Wrongful Repossession of Automobile and Impairment of Credit.

Every legal record template you purchase is the one you have for a long time. You have acces to each and every develop you acquired inside your acccount. Select the My Forms segment and pick a develop to print or down load again.

Remain competitive and down load, and print the Arkansas Complaint for Wrongful Repossession of Automobile and Impairment of Credit with US Legal Forms. There are millions of skilled and state-certain varieties you may use for your business or person requires.