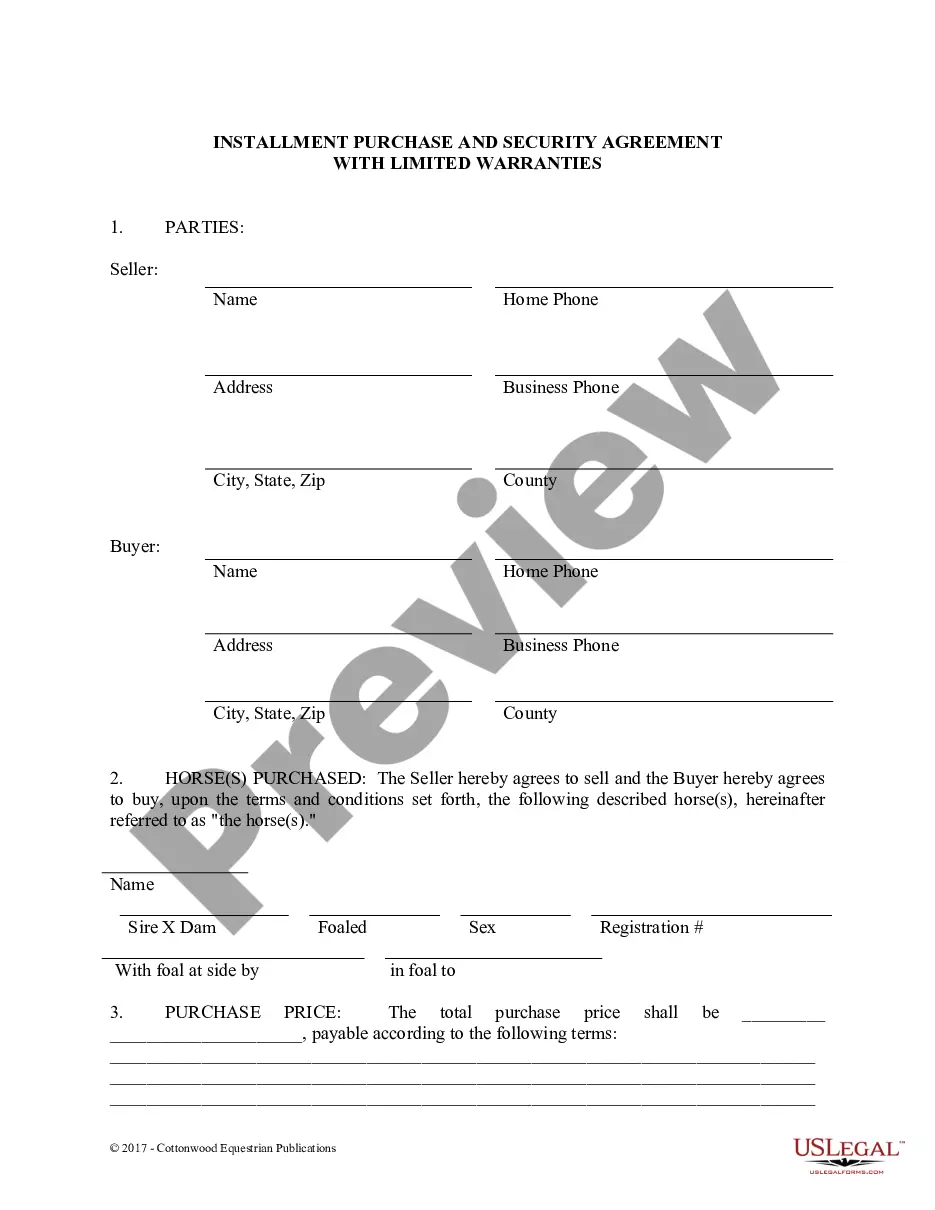

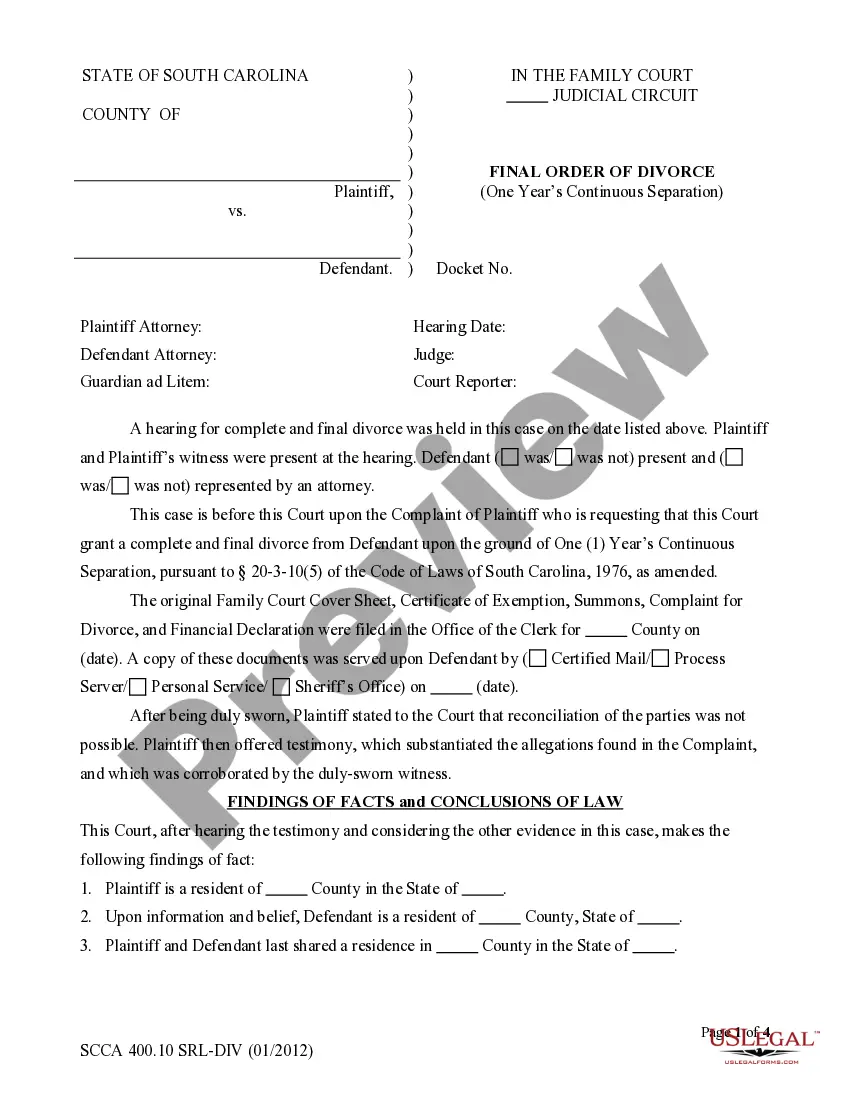

An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Arkansas Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary

Description

How to fill out Assignment By Beneficiary Of An Interest In The Trust Formed For The Benefit Of Beneficiary?

You can invest hours online attempting to locate the official document template that satisfies the federal and state requirements you need.

US Legal Forms provides numerous legal templates that can be reviewed by professionals.

You can conveniently download or print the Arkansas Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary from our service.

First, ensure that you have selected the correct document template for the area/city you chose. Review the form description to make sure you have selected the right template. If available, utilize the Preview button to look through the document template as well. If you wish to find another version of the form, use the Search field to find the template that meets your needs and requirements. Once you have found the template you wish to use, click Buy now to proceed. Choose the pricing plan you want, enter your details, and register for your account on US Legal Forms. Complete the transaction using your Visa or Mastercard or PayPal account to buy the legal form. Select the format of the document and download it to your device. Make modifications to your document if necessary. You can complete, edit, sign, and print the Arkansas Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary. Download and print numerous document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Arkansas Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary.

- Each legal document template you purchase is yours indefinitely.

- To obtain another copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

Form popularity

FAQ

The interest held in a trust refers to the value or possession that beneficiaries can legally claim under the trust's terms. This interest can vary depending on the specifics outlined in the trust agreement. Familiarity with documents like the Arkansas Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can empower beneficiaries in managing their interests effectively.

On form 1041, applicable deductions can include administrative expenses, trustee fees, and certain tax payments. Understanding these deductions can significantly affect the tax obligations of the trust, so thorough knowledge of the Arkansas Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is beneficial for minimizing tax liabilities effectively.

If a simple trust does not distribute its income, it may be subject to taxation on that income, impacting the overall benefits for the beneficiary. It's essential to address the distribution terms and consider the implications of the Arkansas Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary to ensure compliance and optimize benefit.

Beneficiaries' interests in a trust can include financial benefits, the right to request information about the trust, and the potential to receive assets at certain times. These interests depend on the terms set forth in the trust document. By engaging with tools like the Arkansas Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, beneficiaries can more effectively understand and fulfill their rights.

The interest of a beneficiary refers to the rights they hold in the trust's assets. This interest can include the right to receive distributions and benefits as specified by the trust document. Knowing your rights under the Arkansas Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is crucial for maximizing the advantages of your position within a trust.

To file a trust in Arkansas, you need to prepare a trust document and ensure it meets state laws. Then, you generally do not need to formally file unless you are seeking to register it for legal recognition. Utilizing the Arkansas Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary may simplify the process of managing your trust and its benefits.

Typically, the beneficiary of the trust account receives interest. The trustee manages the trust and ensures that the beneficiary receives payments as specified in the trust agreement. If you're navigating the complexities of trust accounts, understanding the Arkansas Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can streamline this process for you.

Yes, a trust can be contested in Arkansas, but there are specific grounds for doing so. Challenges can arise from issues such as lack of capacity, undue influence, or failure to follow legal formalities during the trust's creation. If you believe a trust is invalid, pursuing the right legal path is essential, often with reference to the Arkansas Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. Consulting an attorney can provide clarity in these situations.

To obtain a beneficiary deed in Arkansas, you typically need to draft and file the appropriate legal document with your county clerk's office. This deed allows you to designate a beneficiary to receive your property upon your death, bypassing probate. Ensuring that the deed is properly executed and aligns with the Arkansas Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is vital. Consider legal assistance to ensure compliance with all requirements.

Yes, a beneficiary can assign their interest in a trust, but the assignment must comply with the terms of the trust agreement and applicable state laws. This process involves legal documentation to ensure that the assignment is valid and enforceable. It’s crucial to fully understand how such assignments work within the framework of the Arkansas Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. A legal expert can provide invaluable guidance in this area.