Arkansas Personal Property Inventory

Description

How to fill out Personal Property Inventory?

Are you in a situation where you need documents for both business and specific purposes nearly every working day.

There are numerous legitimate document templates available online, but finding trustworthy ones can be challenging.

US Legal Forms offers thousands of template options, including the Arkansas Personal Property Inventory, which can be filled out to comply with federal and state regulations.

Once you find the appropriate template, click Buy now.

Select the pricing plan you prefer, fill in the required information to set up your account, and complete the payment using your PayPal or credit card. Choose a convenient document format and download your version. Access all the document templates you have purchased in the My documents list. You can obtain another copy of Arkansas Personal Property Inventory anytime you wish. Just click on the desired template to download or print the document format. Use US Legal Forms, potentially the largest collection of legal forms, to save time and avoid mistakes. The service provides correctly crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Arkansas Personal Property Inventory template.

- If you do not have an account and want to use US Legal Forms, follow these steps.

- Locate the template you need and ensure it matches your city/state.

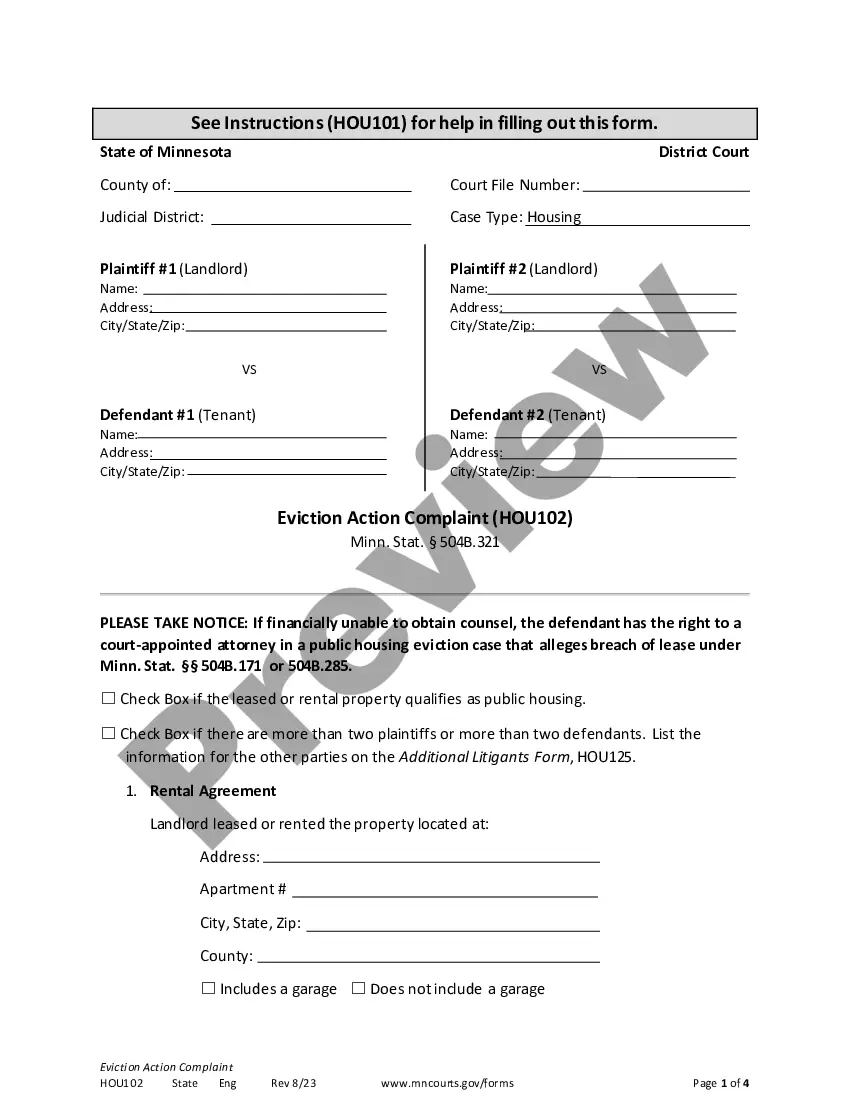

- Utilize the Review button to examine the document.

- Read the description to confirm you have selected the right template.

- If the template isn’t what you're looking for, use the Search box to find a template that suits your needs.

Form popularity

FAQ

To calculate personal property tax in Arkansas, multiply the assessed value of your property by the local tax rate. The tax rate can vary depending on your location. A well-organized Arkansas Personal Property Inventory can help you accurately determine your assessed values and make tax calculations straightforward.

In Arkansas, various types of personal property must be assessed, including vehicles, boats, business supplies, and machinery. Items that are used for personal purposes, like furniture and electronic devices, may also be included. Proper documentation through the Arkansas Personal Property Inventory can simplify this reporting process.

The assessed value of personal property in Arkansas is a percentage of its market value, typically set at 20%. This value is crucial for calculating your personal property taxes. Using the Arkansas Personal Property Inventory aids in accurately reporting your assets to reflect their true worth.

In Arkansas, personal property is assessed by local assessors who review inventory items. You need to report your property annually, which includes listing assets such as vehicles, machinery, and personal belongings. This process helps determine the value of your personal property inventory for taxation purposes.

Inventory itself is not directly taxable in Arkansas, but it must be included in your Arkansas Personal Property Inventory declaration. This information contributes to property tax assessments that businesses must file annually. Therefore, while there is no inventory tax, accurate reporting is essential to comply with state tax laws. Keeping good records helps ensure you report your inventory correctly.

In Arkansas, certain items are exempt from sales tax, including prescription medications, certain agricultural products, and some manufacturing equipment. Understanding these exemptions can help businesses manage their Arkansas Personal Property Inventory more effectively. Awareness of tax-exempt items can also lead to significant savings. You can consult resources or platforms like uslegalforms for detailed guidance on exemptions.

In Arkansas, personal property for tax purposes includes tangible items such as furniture, machinery, and inventory. This encompasses Arkansas Personal Property Inventory, which businesses use for resale or production. Understanding what qualifies as personal property ensures compliance with state tax regulations. Accurate reporting of your assets can help you optimize your tax situation.

Arkansas does not impose a specific inventory tax on businesses. However, businesses must report their inventory as part of their Arkansas Personal Property Inventory for ad valorem tax purposes. This means while inventory itself is not taxed, it contributes to the overall assessment of personal property taxes. Staying informed about local tax laws can help you avoid unexpected liabilities.

Yes, inventory is considered personal property under Arkansas law. This classification means that businesses must account for their inventory in their financial statements and tax filings. Proper management of Arkansas Personal Property Inventory is essential for accurate reporting and compliance with state regulations. By keeping detailed records, you can ensure your inventory is correctly valued and reported.

Writing an inventory of your personal belongings starts with systematic organization. Begin by categorizing items, then list them with corresponding values and descriptions. Include photographs if possible, and consider using services like USLegalForms for structured templates. This organized approach ensures you capture all valuable items efficiently and helps in future asset management.