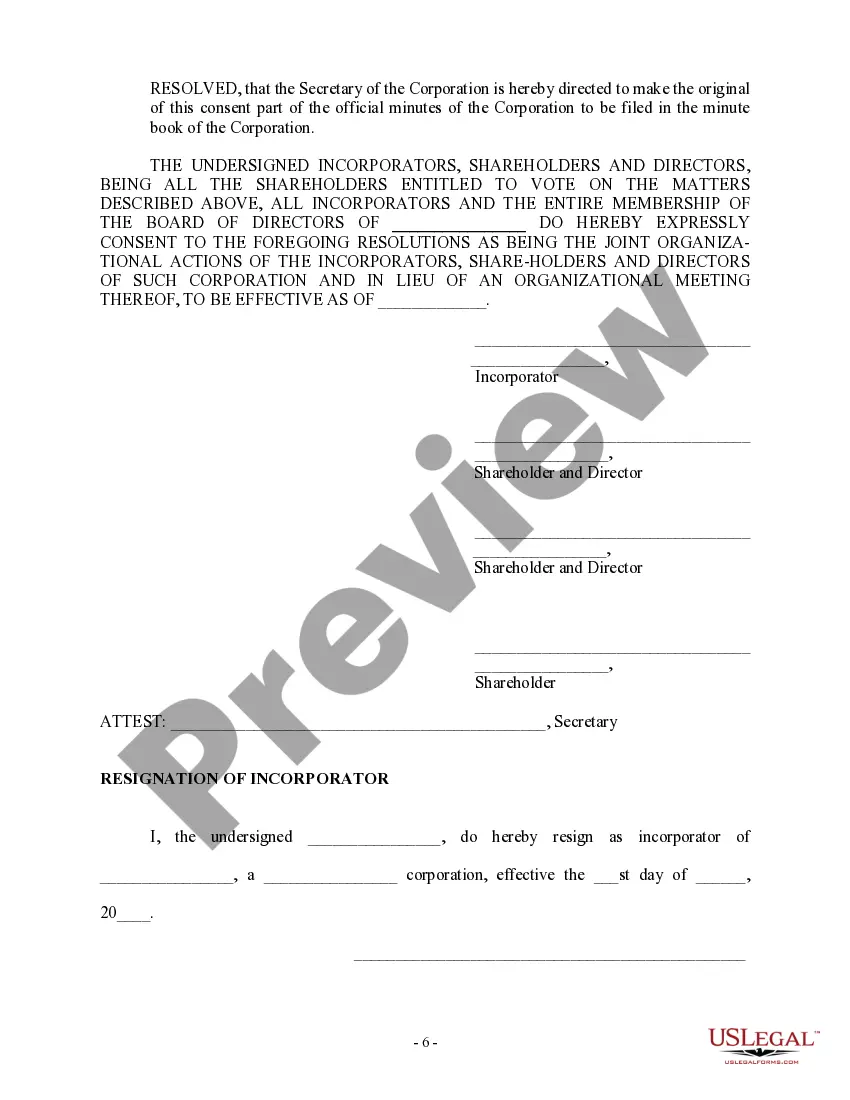

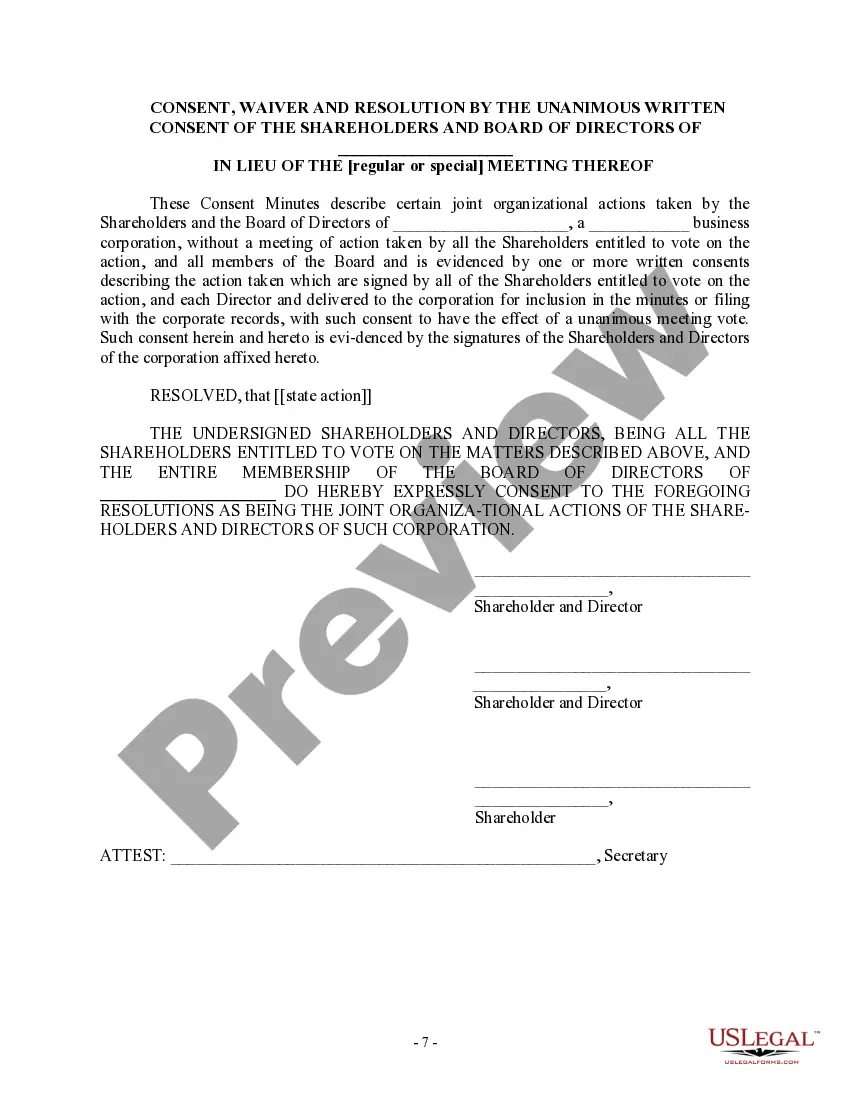

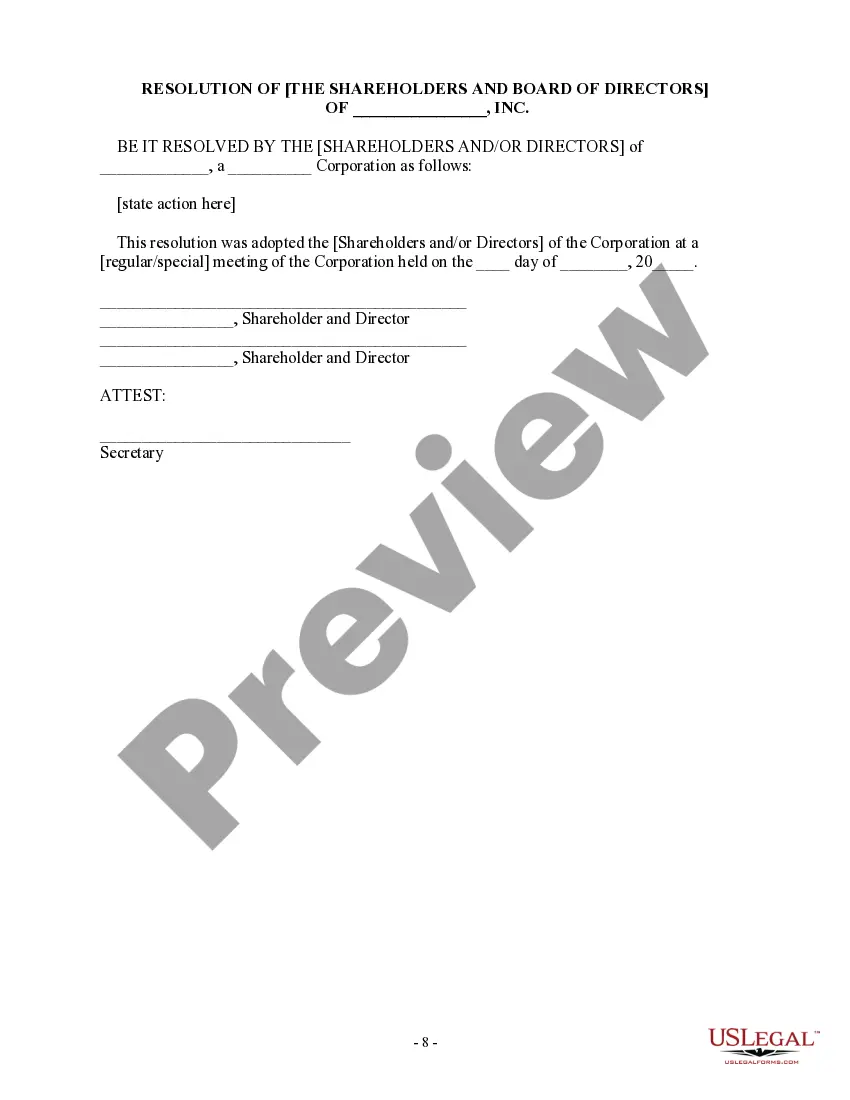

Arkansas Corporation - Minutes

Description

How to fill out Corporation - Minutes?

US Legal Forms - one of the premier collections of legal documents in the United States - offers a vast selection of legal template documents that you can download or create.

Through the website, you can find countless documents for business and personal use, organized by categories, states, or keywords. You can discover the latest versions of documents like the Arkansas Corporation - Minutes in moments.

If you already have an account, Log In to download the Arkansas Corporation - Minutes from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously saved documents in the My documents section of your account.

Once you are satisfied with the document, confirm your choice by clicking the Purchase now button. Then, select your preferred pricing plan and provide your details to register for an account.

Proceed with the purchase. Use your credit card or PayPal account to complete the transaction. Choose the format and download the document to your device. Edit. Complete, modify, print, and sign the downloaded Arkansas Corporation - Minutes. Every document you save in your account has no expiration date and is yours permanently. Thus, if you wish to download or create another copy, simply visit the My documents section and click on the document you need. Gain access to the Arkansas Corporation - Minutes with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- If you want to use US Legal Forms for the first time, here are simple instructions to get you started.

- Make sure you have selected the appropriate document for your area/region.

- Click on the Review button to view the document's content.

- Read the document description to ensure it is the right document.

- If the document does not meet your needs, use the Search field at the top of the screen to find the one that does.

Form popularity

FAQ

Shareholder meetings are a regulatory requirement which means most public and private companies must hold them. Notification of the meeting's date and time is often accompanied by the meeting's agenda.

The IRS says you need to keep your records as long as needed to prove the income or deductions on a tax return. In general, this means you need to keep your tax records for three years from the date the return was filed, or from the due date of the tax return (whichever is later).

Corporations are required to hold meetings only once a year, especially if the corporation is small. The corporation must give adequate notice to company shareholders or directors and maintain annual meeting minutes, which are a written record of proceedings at the meeting.

Basic Requirements Corporations are required to hold meetings only once a year, especially if the corporation is small. The corporation must give adequate notice to company shareholders or directors and maintain annual meeting minutes, which are a written record of proceedings at the meeting.

Scheduled meetings Your business should hold at least one annual shareholders' meeting. You can have more than one per year, but one per year is often the required minimum. An annual board of directors meeting is often also held in conjunction with the shareholders' meeting as well.

If you run an S corporation, you are not required by law to keep meeting minutes. However, they can be a good way to record the progress your company makes toward meeting corporate objectives. Minutes can also be useful as a legal record of corporate activities in the event of a lawsuit or tax audit.

1. The Law Requires Corporate Minutes to Be Kept. The California Corporations Code requires each corporation to keep adequate and correct written minutes of shareholder and board of directors proceedings (Corporations Code § 1500).

How to Write Meeting Minutesthe name of the company, date, and location of the meeting.the type of meeting (annual board of directors meeting, special meeting, and so on.)the names and titles of the person chairing the meeting and the one taking minutes.the names of attendees and the names of those who did not attend.More items...

A business should keep its minutes for at least seven years, and make them available to members of the corporation (e.g., shareholders, directors, and officers) who make a reasonable request to review them.

Failure to Keep Meeting Minutes The most severe consequence is the loss of liability protection. If this happens, shareholders' personal assets may be exposed to liability for the corporation's debts.