This form is a model Authority to Cancell Lien. Lienholder files with court certifying that indebtedness has been satisfied and lien should be cancelled. Adapt to fit your specific facts and circumstances.

Arkansas Authority to Cancel

Description

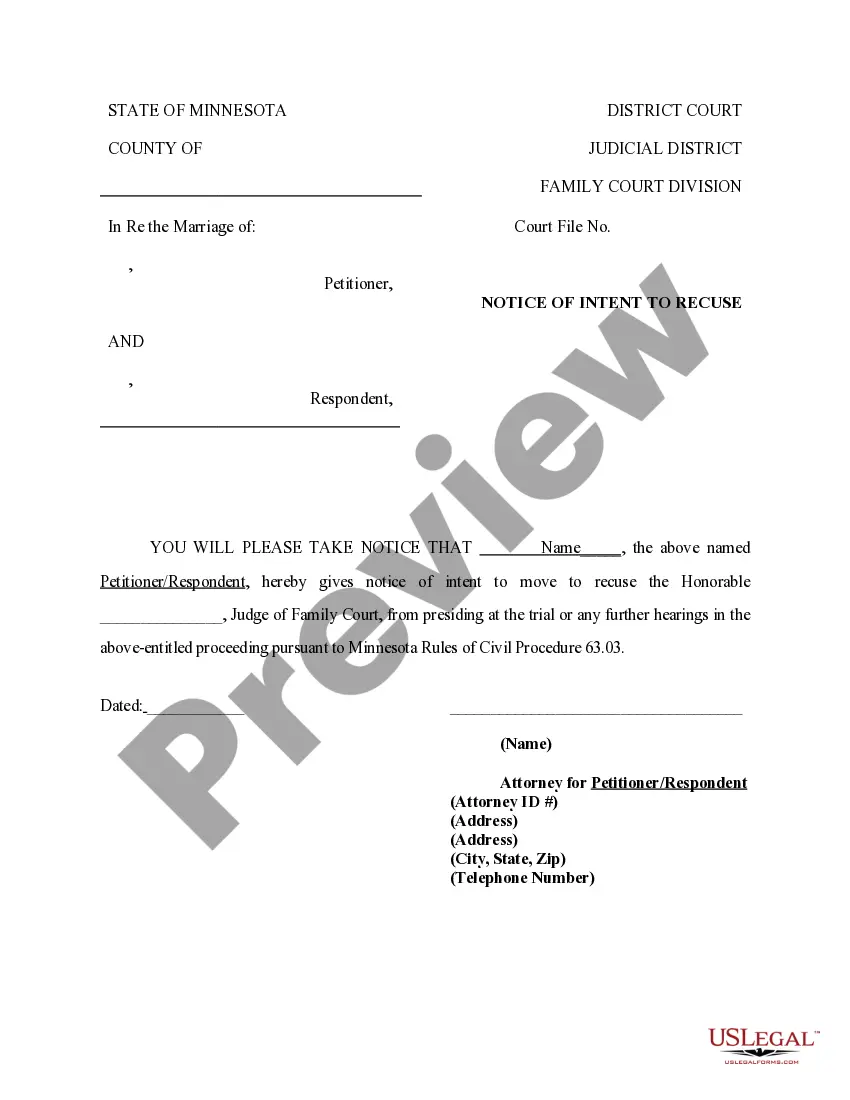

How to fill out Authority To Cancel?

It is feasible to spend time online searching for the valid document format that aligns with the state and federal requirements you seek.

US Legal Forms offers thousands of valid templates that are verified by experts.

You can easily download or print the Arkansas Authority to Cancel from my services.

If available, utilize the Review button to browse through the document format as well.

- If you have an account with US Legal Forms, you can Log In and click the Acquire button.

- After that, you can complete, edit, print, or sign the Arkansas Authority to Cancel.

- Every valid document format you purchase is yours indefinitely.

- To obtain another copy of the purchased document, go to the My documents tab and click the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for the county/region of your choice.

- Check the document description to verify you have chosen the correct form.

Form popularity

FAQ

To obtain your Arkansas Certificate of Authority, you will submit an Application for Certificate of Authority, along with required certificates or certified copies from your home state. You will need to appoint a registered agent in order for your filing to be approved.

How do you dissolve an Arkansas Corporation? To dissolve your Arkansas corporation, submit a completed dissolution form to the Arkansas Secretary of State, Business and Commercial Services (BCS) by mail or in person. You cannot file Arkansas articles of dissolution online.

To close their business account, a sole proprietor needs to send the IRS a letter that includes the complete legal name of their business, the EIN, the business address and the reason they wish to close their account.

You have to file the appropriate form with the Arkansas Secretary of State, Business and Commercial Services (BCS) to withdraw your foreign business entity from Arkansas. You have to file a paper withdrawal form, you can't apply for withdrawal/cancellation online.

If you don't pay your Arkansas Franchise Tax for three years, your LLC will enter revoked status.

How to close a corporation: 6 stepsStep 1: Hold a board meeting.Step 2: File articles of dissolution.Step 3: Review labor laws.Step 4: File tax forms.Step 5: Close accounts, cancel licenses and remit final payments.Step 6: Liquidate or distribute assets.

Things you need to do before you Dissolve an Arkansas Corporation.Hold a Directors meeting and record a resolution to Dissolve the Arkansas Corporation.Hold a Shareholder meeting to approve Dissolution of the Arkansas Corporation.File all required Annual Franchise Tax Reports with the Arkansas Secretary of State.More items...

Sole proprietorships must register DBA names at the county level. All other business entities must register with the Arkansas Secretary of State and then, once approved, a copy of the form will be sent back that needs to then be filed with the county clerk's office where your business's registered office is located.

Manage Your Arkansas DBA Your fictitious name registration does not expire. You must complete a new registration to change your fictitious name. To withdraw or cancel your fictitious name, you must complete and submit the Cancellation of Fictitious Name form and submit it by mail or in-person.