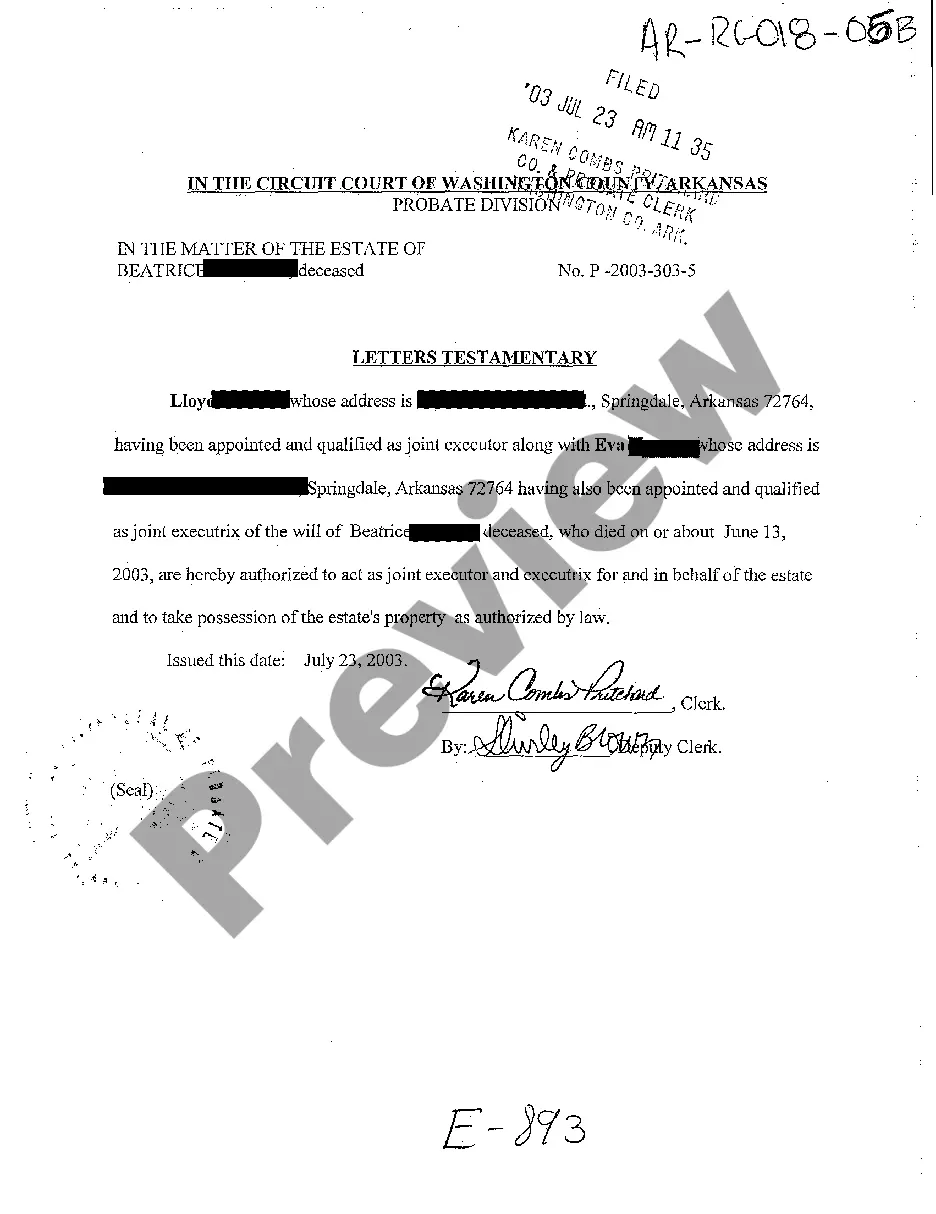

Arkansas Letters Testamentary

Description

How to fill out Arkansas Letters Testamentary?

Among numerous free and paid samples available on the web, you cannot be sure of their trustworthiness.

For instance, who created them or whether they possess the expertise required to meet your needs.

Always remain composed and utilize US Legal Forms!

Do much more for less with US Legal Forms!

- Obtain Arkansas Letters Testamentary templates designed by qualified attorneys and sidestep the expensive and lengthy process of searching for a lawyer and then compensating them to create a document for you that you can easily locate independently.

- If you already have a subscription, Log In to your account and find the Download button next to the form you are looking for.

- You will also have access to all of your previously purchased templates in the My documents section.

- If you are using our platform for the first time, follow the instructions below to easily obtain your Arkansas Letters Testamentary.

- Ensure that the document you find is applicable in your area.

- Review the file by checking the description using the Preview feature.

Form popularity

FAQ

Transferring a house after death in Arkansas typically requires initiating the probate process to secure the necessary legal authority. Once you have the letters of testamentary, you can transfer the title to the beneficiaries. Using a deed for the transfer is essential, and it must be filed with the county recorder’s office. For detailed guidance on this process, US Legal Forms offers helpful resources to assist you.

If you don't file for probate in Arkansas, the deceased's estate may become unmanageable, and assets could remain frozen indefinitely. Without probate, beneficiaries cannot legally claim their inheritance or settle debts. This could lead to additional legal complications. To simplify the probate process and ensure compliance with Arkansas laws, consider using resources from US Legal Forms.

The estate administration of a decedent in Arkansas involves managing and distributing the deceased's assets according to their will or state law. This process includes identifying and valuing the assets, paying debts and taxes, and distributing what is left to the beneficiaries. If you need more help navigating this process, platforms like US Legal Forms can simplify the necessary paperwork and legal requirements.

To obtain letters of testamentary in Arkansas, you must file a petition with the probate court that includes the decedent's will, if applicable. The court will then review the documents, and if everything is in order, they will issue the letters. These letters grant you the authority to manage the estate. For assistance in this process, consider using US Legal Forms, which offers useful tools and resources.

Probate rules in Arkansas require the appointment of a personal representative who will manage the deceased's estate. This process typically involves submitting the will to the probate court along with any required forms. Understanding these rules is crucial, as they dictate how assets are distributed and debts are settled. Resources like US Legal Forms can help clarify these rules for individuals.

To obtain a small estate affidavit in Arkansas, you must first determine if the estate qualifies under Arkansas law. This typically means that the total value of the estate is less than $100,000, excluding certain types of property. You can visit the court where the decedent lived to request the affidavit forms, or explore resources like US Legal Forms, which can provide guidance and templates.

A testamentary writing document is a legal instrument that expresses your wishes regarding the distribution of your property after death. This document serves as the foundation for creating a will or appointing an executor. Understanding the significance of this document is essential, and platforms such as US Legal Forms can assist in drafting an effective testamentary writing that adheres to Arkansas regulations.

To write a testamentary document, focus on clarity and explicit instructions regarding asset distribution. Begin with your personal information, state your intentions, and appoint an executor who will carry out your wishes. Using tools like US Legal Forms can simplify the process and ensure that your testamentary writing complies with Arkansas laws.

An executor in a testamentary context is the individual responsible for managing the deceased’s estate according to the will. The executor is tasked with ensuring that assets are distributed fairly and debts are settled. In Arkansas, it is crucial to choose someone who is trustworthy and capable of handling financial responsibilities, as they will hold significant authority.

To obtain letters testamentary in Arkansas, you must first file a petition in the probate court where the deceased resided. After the court approves the petition, you will receive the letters testamentary that empower you to act as the executor of the estate. It's advisable to consult legal resources or professionals to navigate the process smoothly.