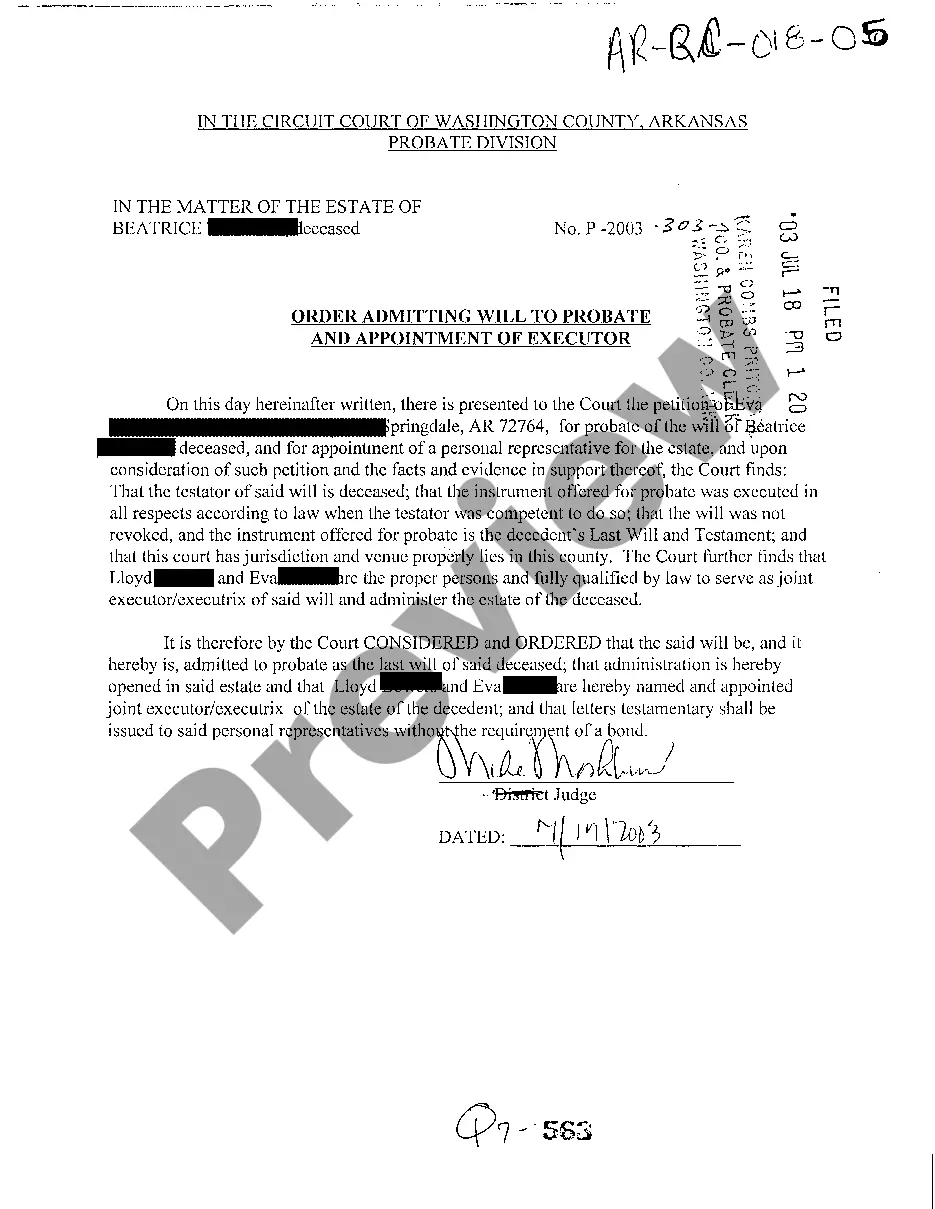

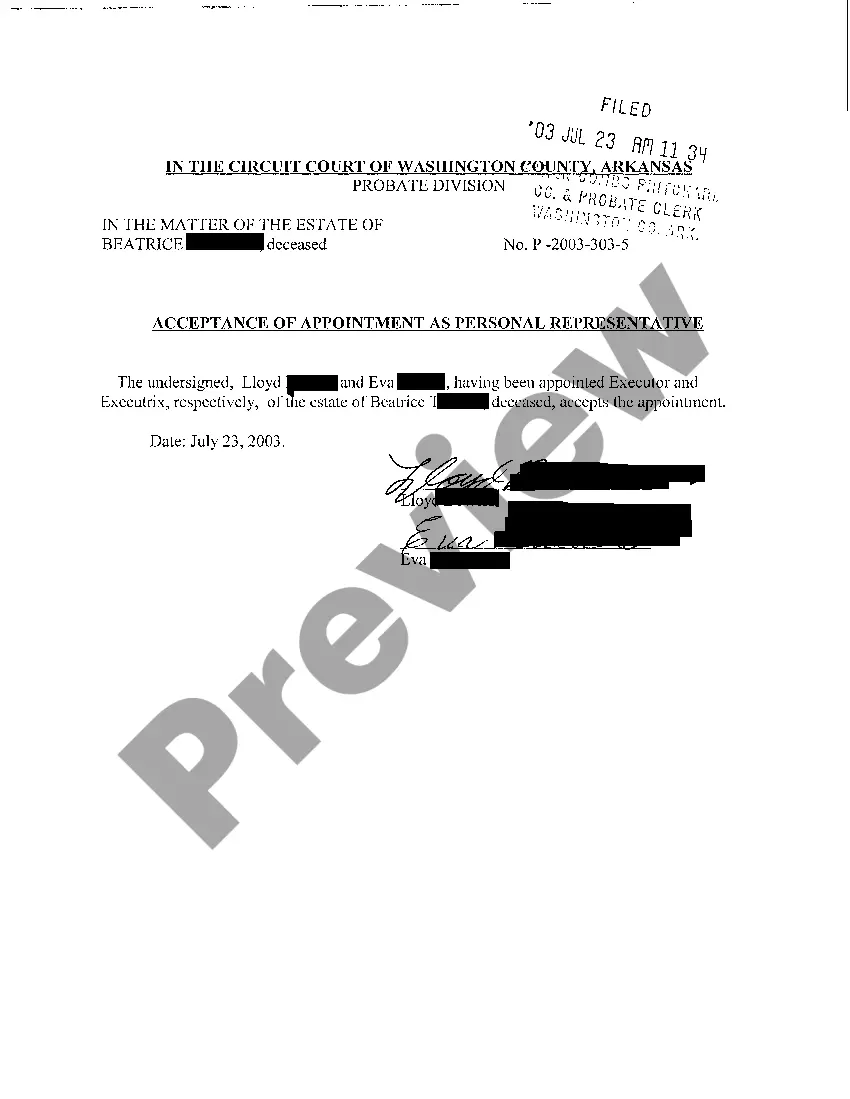

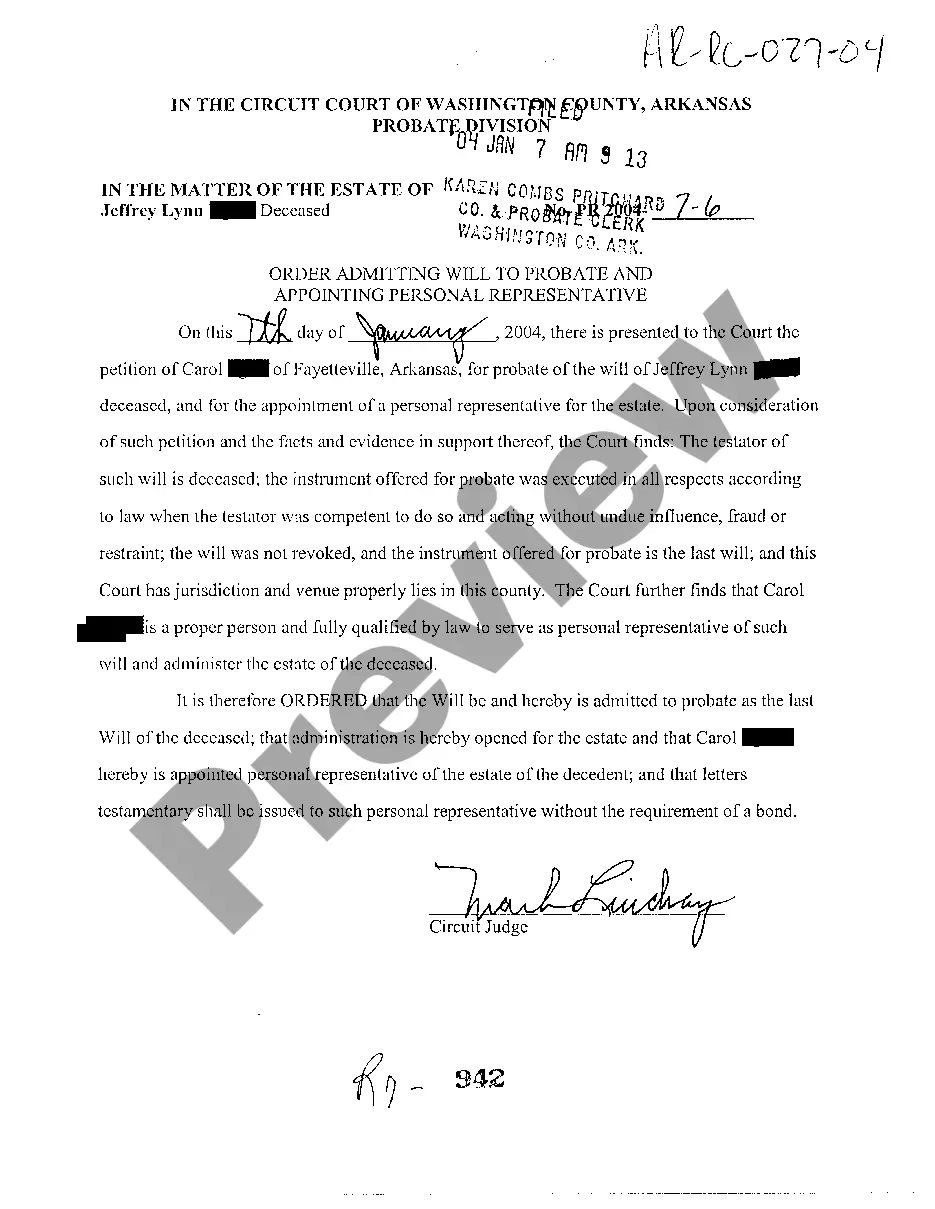

Arkansas Order Admitting Will To Probate and Appointment of Executor

Description

How to fill out Arkansas Order Admitting Will To Probate And Appointment Of Executor?

Amid numerous complimentary and paid samples available online, you cannot guarantee their precision.

For instance, who created them or if they possess the necessary competency to address your specific needs.

Always stay calm and make use of US Legal Forms!

Make sure that the document you find is applicable in your residing state.

- Find Arkansas Order Admitting Will To Probate and Executor Appointment templates crafted by qualified legal professionals.

- Avoid the expensive and lengthy procedure of searching for an attorney.

- Bypassing the cost of having them draft documents for you that you can procure on your own.

- If you already possess a subscription, Log In to your account to find the Download button next to your desired file.

- You will also have access to all previously saved documents in the My documents section.

- Follow the steps below for first-time users to easily obtain your Arkansas Order Admitting Will To Probate and Executor Appointment.

Form popularity

FAQ

Not all wills necessarily go through probate in Arkansas. If the estate meets certain criteria, such as being below a specific value, you might avoid probate altogether. However, when probate is required, obtaining the Arkansas Order Admitting Will To Probate and Appointment of Executor helps facilitate the process effectively.

Probating a will in Arkansas is legally required only if the estate's value exceeds the threshold for probate. Obtaining the Arkansas Order Admitting Will To Probate and Appointment of Executor is essential to ensure the wishes of the deceased are honored. For smaller estates, there may be easier, alternative processes available.

Probate in Arkansas is triggered when a person passes away leaving behind an estate that requires legal distribution. If the deceased had a will, the Arkansas Order Admitting Will To Probate and Appointment of Executor enables the transfer of assets according to their wishes. Furthermore, certain financial assets may also necessitate probate based on their structure.

To file a petition for probate in Arkansas, prepare and submit the necessary documents to the local probate court. This includes presenting the Arkansas Order Admitting Will To Probate and Appointment of Executor. It’s often wise to consult an attorney or utilize resources like USLegalForms for assistance in correctly drafting your petition.

Certain assets do not go through probate in Arkansas. These include life insurance policies with designated beneficiaries, retirement accounts, and assets held in joint tenancy. By understanding these exemptions, you can streamline the process after obtaining the Arkansas Order Admitting Will To Probate and Appointment of Executor.

In Arkansas, an estate generally must be valued at over $100,000 to require probate. If the estate's assets exceed this amount, you will need to initiate the Arkansas Order Admitting Will To Probate and Appointment of Executor. However, if the estate is below this threshold, you might consider alternative methods for asset transfer.

While it is not mandatory to hire an attorney for probate in Arkansas, many people find it beneficial. Probate can be complex, particularly when dealing with the Arkansas Order Admitting Will To Probate and Appointment of Executor. An attorney can guide you through the process, helping ensure compliance with local laws and reducing the risk of errors.

Typically, assets such as real estate, bank accounts, and personal property that are solely titled in the deceased's name pass through probate in Arkansas. However, assets held in a living trust, joint accounts, or those with designated beneficiaries often bypass this process. Familiarizing yourself with the Arkansas Order Admitting Will To Probate and Appointment of Executor can clarify which assets are subject to probate and help you plan accordingly.

In most cases, a vehicle in Arkansas will need to go through probate if it is solely in the deceased's name. If the vehicle is jointly owned or has a designated beneficiary, it may not require probate, simplifying the transfer process. Understanding the requirements of the Arkansas Order Admitting Will To Probate and Appointment of Executor can help estate representatives address these issues effectively.

Yes, probate is generally mandatory for estates in Arkansas unless specific conditions are met. When a decedent's assets exceed a certain value or are not held in a way that allows for transfer outside of probate, the Arkansas Order Admitting Will To Probate and Appointment of Executor becomes necessary. However, there are exceptions for particular assets or small estates, making it vital to assess the situation properly.