Arkansas Option to Purchase Package

Overview of this form package

The Arkansas Option to Purchase Package provides all the necessary forms to secure a right to purchase property. This package differentiates itself by including specific options tailored to various types of real estate, whether residential, commercial, or agricultural. By utilizing this package, you can ensure your right to buy is clearly defined and legally binding.

Forms included in this package

- Option to Purchase Addendum to Residential Lease - Lease or Rent to Own

- Residential Rental Lease Agreement

- Option For the Sale and Purchase of Real Estate - Residential Lot or Land

- Option For the Sale and Purchase of Real Estate - Residential Home

- Option For the Sale and Purchase of Real Estate - Commercial Lot or Land

- Option For the Sale and Purchase of Real Estate - Commercial Building

- Option For the Sale and Purchase of Real Estate - Farm Land

- Option For the Sale and Purchase of Real Estate - General Form

Common use cases

This package is ideal in situations where you are considering purchasing a property but want to secure the right to do so at a later date. Use it when:

- You are a tenant wishing to purchase the property you are renting.

- You want to retain the option to buy a residential or commercial property within a designated timeframe.

- You are negotiating sale terms before committing to a purchase.

- You want to ensure options are clearly documented and enforceable in Arkansas.

Intended users of this form package

- Residential tenants looking to buy their rental home.

- Buyers interested in securing an option on various types of properties.

- Real estate investors seeking flexible purchasing options.

- Landlords wanting to offer purchase options to their tenants.

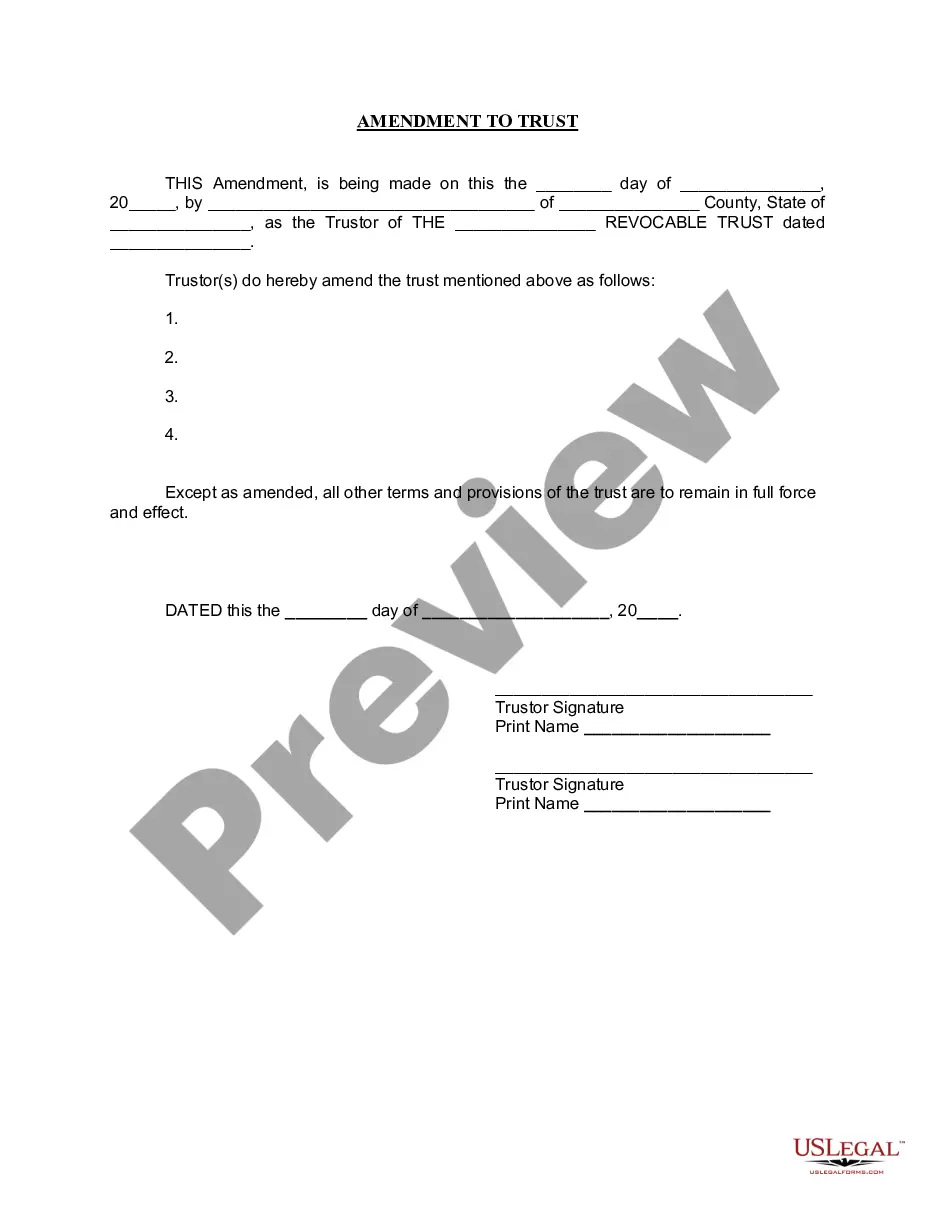

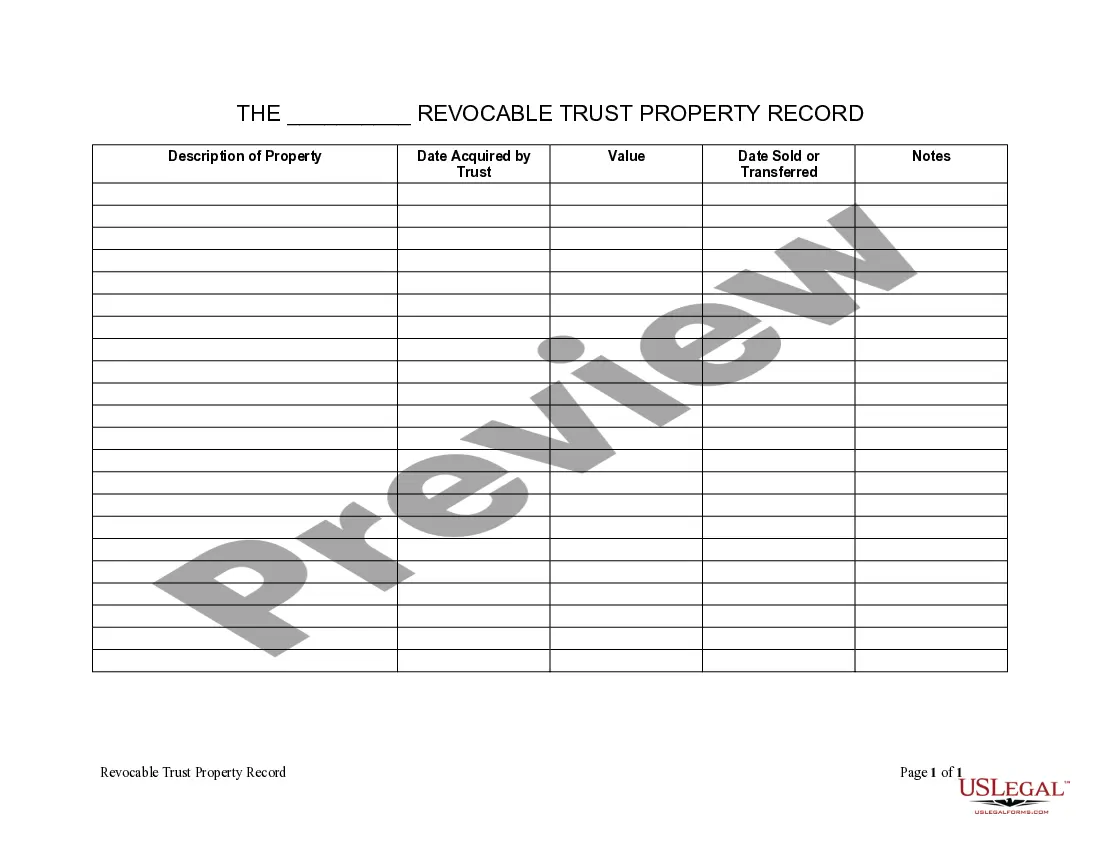

How to prepare this document

- Review all included forms to understand your rights and obligations.

- Identify all parties involved in the transaction, including buyers and sellers.

- Enter relevant property details, including address and legal descriptions.

- Specify terms such as purchase price and option duration.

- Sign and date the agreements per the instructions provided in each form.

Do documents in this package require notarization?

Notarization is required for one or more forms in this package. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to specify the option price clearly in the agreement.

- Not following the notice requirements for exercising the option.

- Overlooking the need for mutual signatures to validate the agreement.

- Avoiding necessary legal advice when drafting or modifying terms.

Benefits of completing this package online

- Convenience of immediate access to legally vetted forms.

- Ability to customize forms easily based on specific transaction needs.

- Reliable legal framework provided by licensed attorneys.

- Instant download option for immediate use.

Looking for another form?

Form popularity

FAQ

An option to buy contract is one way that you can gain equitable interest in the house. Once you have the option contract, you can market it, you can sell it, you can assign it, and you can make money on the deal.

The strike price of $70 means that the stock price must rise above $70 before the call option is worth anything; furthermore, because the contract is $3.15 per share, the break-even price would be $73.15.

The primary difference is that an option contract entitles the buyer to the option to purchase the items at a later time, whereas a firm offer gives the buyer the right to buy the items outright at any time.

Sell one out-of-the-money put option for every 100 shares of stock you'd like to own. Wait for the stock price to decrease to the put options' strike price. If the options are assigned by the options exchange, buy the underlying shares at the strike price.

An option- to-purchase agreement is an arrangement in which, for a fee, a tenant or investor acquires the right to purchase real property sometime in the future.

A lease-option is a contract in which a landlord and tenant agree that, at the end of a specified period, the renter can buy the property. The tenant pays an up-front option fee and an additional amount each month that goes toward the eventual down payment.

Typically, the seller grants the buyer an option to purchase the property based on the terms and conditions in the Option to Purchase, in return of a sum of money from the buyer called the Option Fee. The Option Fee is typically 1% of the sale price of the property, but is negotiable between parties.

How long does an option last? An option typically lasts 24 months but the timeframe to exercise is completely negotiable at the agreement stage.