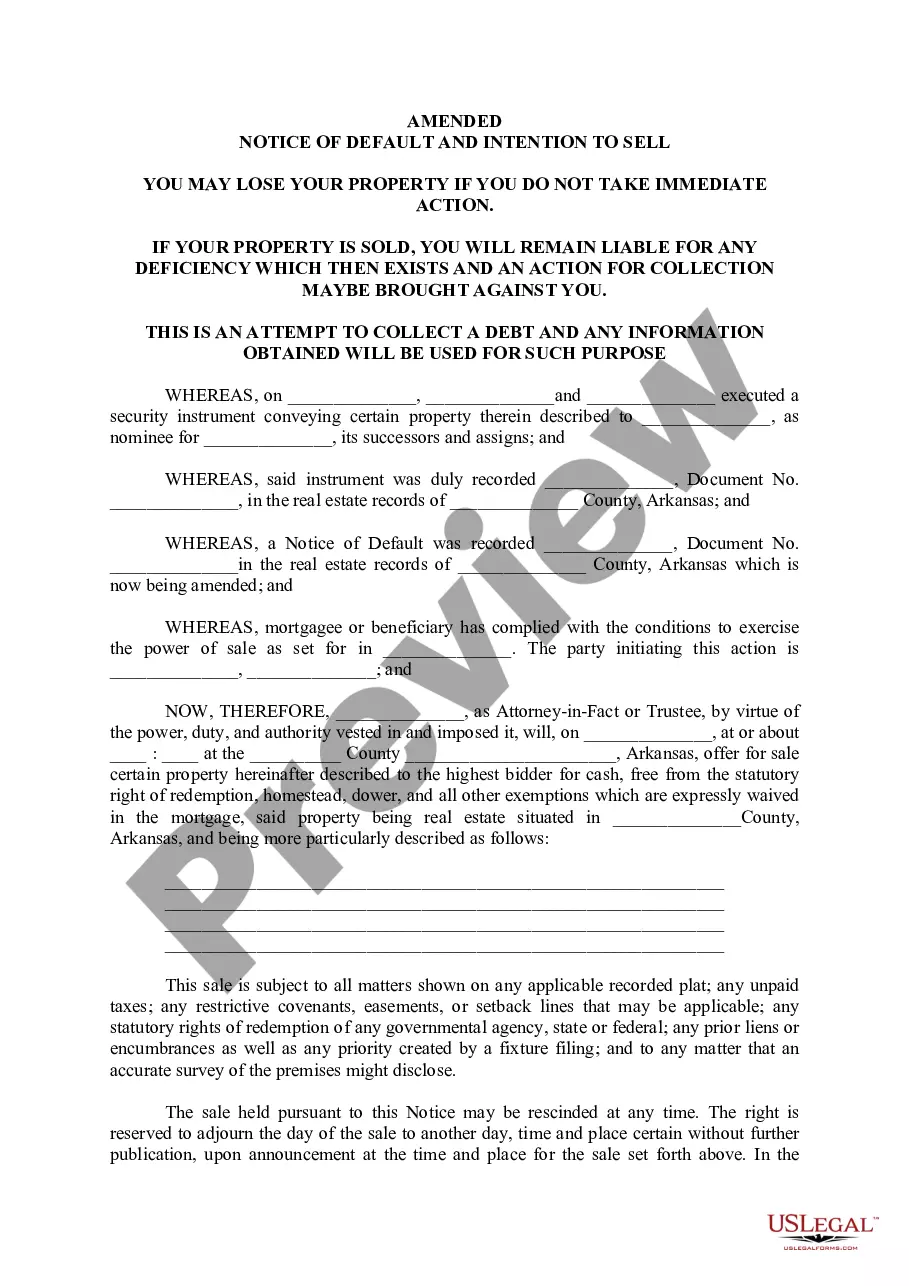

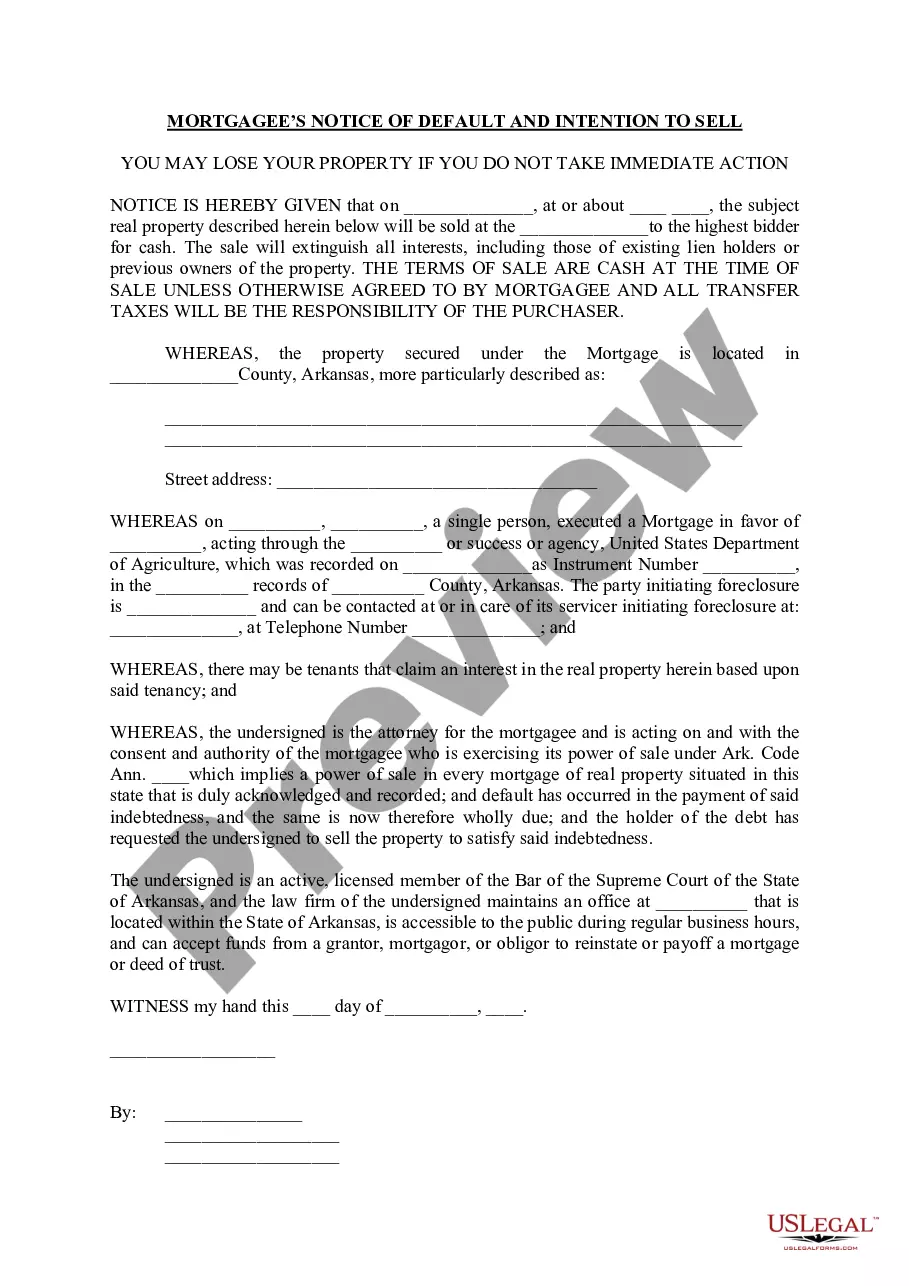

Arkansas Amended Notice of Default andIntention to Sell

Description

How to fill out Arkansas Amended Notice Of Default AndIntention To Sell?

Using the Arkansas Revised Notification of Default and examples crafted by experienced attorneys helps you avoid hassles when completing paperwork.

Simply download the template from our site, fill it in, and seek legal advice to review it.

By doing this, you can save significantly more time and energy than asking a lawyer to create a document entirely from the beginning for you.

Make use of the Preview feature and check the description (if available) to confirm if you need this particular template; if yes, click Buy Now.

- If you already have a US Legal Forms membership, just Log In to your account and navigate back to the form page.

- Locate the Download button next to the forms you are reviewing.

- After downloading a document, you will find all your saved templates in the My documents section.

- If you do not have a subscription, it’s not a major issue.

- Just follow the steps below to register for an online account, obtain, and complete your Arkansas Revised Notification of Default and template.

- Ensure you are downloading the correct state-specific form.

Form popularity

FAQ

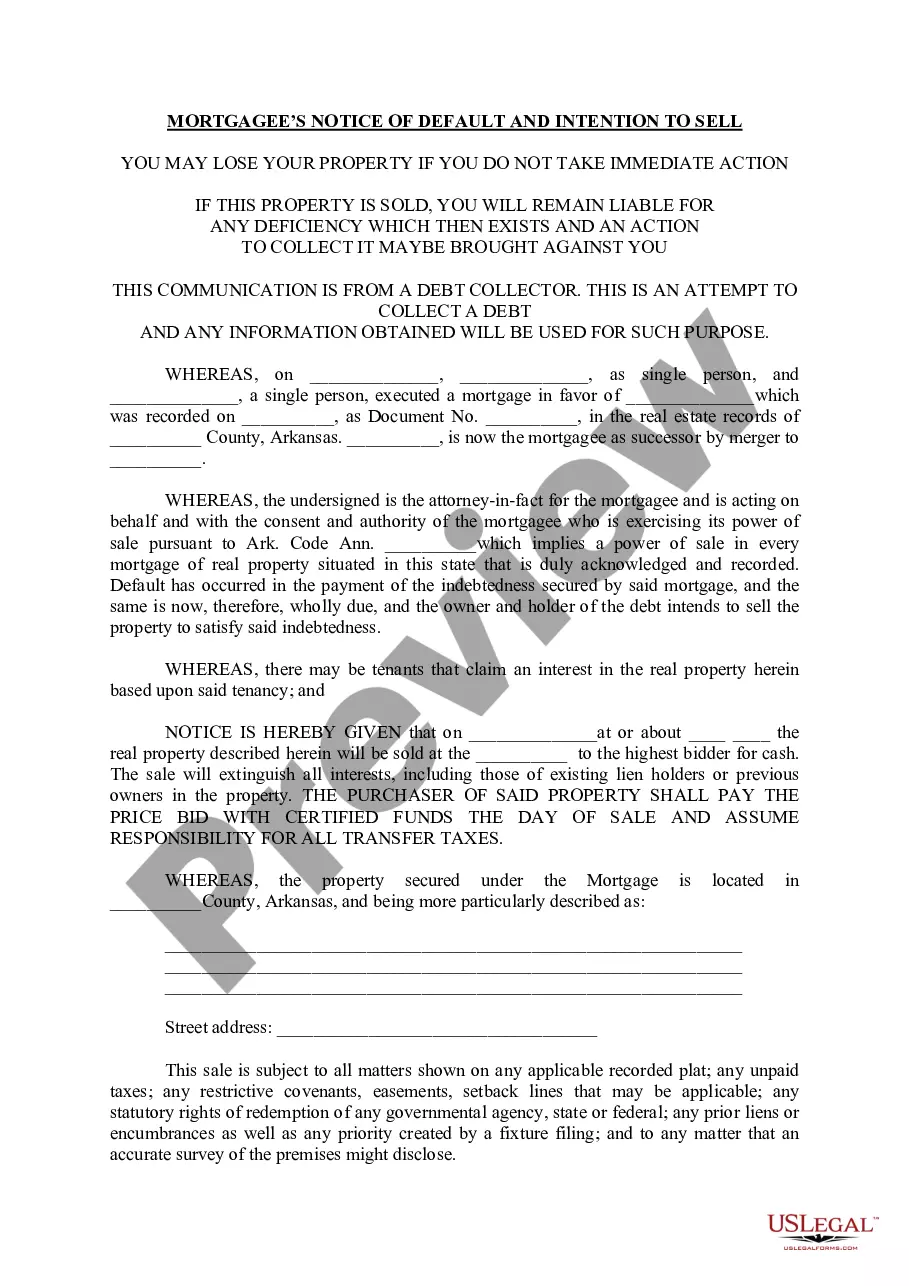

The 120 day rule for foreclosure in Arkansas is a crucial timeline for homeowners facing default. After receiving an Arkansas Amended Notice of Default and Intention to Sell, you have 120 days to cure the default before the lender can initiate foreclosure proceedings. This rule provides you with an opportunity to either settle your outstanding payments or find alternatives to foreclosure. Understanding this timeline can help you make informed decisions and avoid losing your home.

Yes, you can make an offer on a pre-foreclosure property, which can be an advantageous situation for buyers. It is critical to understand that the homeowner may still have options to resolve their debt, often indicated by the Arkansas Amended Notice of Default and Intention to Sell. Engaging with the homeowner or using a platform like USLegalForms can help facilitate negotiations and streamline the process.

Preforeclosure is the period before the property officially enters foreclosure, allowing homeowners the chance to rectify their missed payments. During this phase, you may receive an Arkansas Amended Notice of Default and Intention to Sell, giving you time to negotiate or sell. Foreclosure, on the other hand, involves the legal process where the property is repossessed by the lender due to unpaid debts, leading to a sale at auction.

In Arkansas, generally, a homeowner may face foreclosure after missing three to four mortgage payments. Upon missing these payments, the lender may issue an Arkansas Amended Notice of Default and Intention to Sell, which begins the process of foreclosure. It's crucial to communicate with your lender as soon as possible to explore alternatives before facing this potential outcome.

In Arkansas, a house can remain in preforeclosure for several months, typically ranging from three to six months. During this time, the homeowner may receive an Arkansas Amended Notice of Default and Intention to Sell, indicating the need to address outstanding payments. It's important to take action quickly to avoid moving into foreclosure, as this stage allows for options such as reinvesting or negotiating with lenders.

To stop a foreclosure auction immediately, you can file for a temporary restraining order or seek to negotiate with your lender. Presenting an Arkansas Amended Notice of Default and Intention to Sell can formally express your intent to address the situation. Additionally, proving extenuating circumstances or financial hardship may aid in your request. Engaging with a legal professional can provide the needed guidance to halt proceedings.

To stop foreclosure in Arkansas, you should immediately assess your financial options and communicate with your lender. You can also file an Arkansas Amended Notice of Default and Intention to Sell to express your desire to resolve the situation. Consider negotiating a repayment plan or exploring local resources for assistance. Consulting a legal expert is always advisable to navigate your options effectively.

A 10-day pre-foreclosure notice in Arkansas serves as a warning from the lender, informing the borrower of the impending foreclosure action due to missed payments. This notice is crucial as it gives you time to respond, explore alternatives, or organize finances. Addressing this notice promptly can significantly impact your options for stopping foreclosure. Consider the Arkansas Amended Notice of Default and Intention to Sell for formal declaration.

The five stages of a foreclosure action typically include pre-foreclosure, initiation of foreclosure, court procedures, auction, and post-auction. Initially, the lender may send the Arkansas Amended Notice of Default and Intention to Sell, signaling the start of the process. Understanding each stage allows you to prepare and respond effectively. Legal services like those provided by uslegalforms can support you throughout these stages.

In Arkansas, the foreclosure process can take anywhere from a few months to a year, depending on various factors like court scheduling and the lender's approach. Once the Arkansas Amended Notice of Default and Intention to Sell is issued, the timeline will begin. Being proactive in addressing your financial situation can prevent delays and complications. For more specific guidance, consider reaching out to a legal professional.