This form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a trustee on behalf of a trust. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

Arkansas Quitclaim Deed - Husband and Wife to Trust

Description

How to fill out Arkansas Quitclaim Deed - Husband And Wife To Trust?

Employing Arkansas Quitclaim Deed - Husband and Wife to Trust templates produced by professional legal practitioners helps you steer clear of difficulties when filling out documents.

Simply obtain the template from our site, complete it, and ask a legal expert to review it.

It can assist you in conserving significantly more time and expenses than pursuing a lawyer to draft a document from scratch tailored to your specifications would.

Use the Preview option and read the description (if available) to determine if you require this specific template, and if so, simply click Buy Now. Seek another template using the Search field if necessary. Select a subscription that suits your requirements. Begin by using your credit card or PayPal. Choose a file format and download your document. Once you’ve completed all the aforementioned steps, you will be able to fill out, print, and sign the Arkansas Quitclaim Deed - Husband and Wife to Trust template. Remember to verify all entered information for accuracy before submitting or sending it out. Reduce the time you invest in document creation with US Legal Forms!

- If you have already purchased a US Legal Forms subscription, simply Log In to your account and navigate back to the sample page.

- Locate the Download button next to the template you are examining.

- After downloading a file, you will find all of your saved templates in the My documents tab.

- If you do not have a subscription, there’s no need to worry.

- Just follow the steps below to register for an online account, obtain, and fill out your Arkansas Quitclaim Deed - Husband and Wife to Trust template.

- Confirm that you are downloading the appropriate state-specific form.

Form popularity

FAQ

A quitclaim deed may not be suitable in situations where there are existing liens or mortgages on the property. This type of deed does not guarantee clear title, so it can create problems if there are claims against the property. Additionally, if you need to transfer property rights to someone who is not a spouse or if the property is part of a divorce settlement, an Arkansas Quitclaim Deed - Husband and Wife to Trust might not be the best option. Always consider consulting with a legal professional when dealing with complex property matters to ensure a secure transaction.

Yes, a quitclaim deed can be utilized to transfer property out of a trust. When you apply an Arkansas Quitclaim Deed - Husband and Wife to Trust, both spouses can execute the deed to ensure seamless ownership transition. This method allows for efficient management of assets within the trust. It is important to follow proper legal procedures to maintain clarity and legality in property transfers.

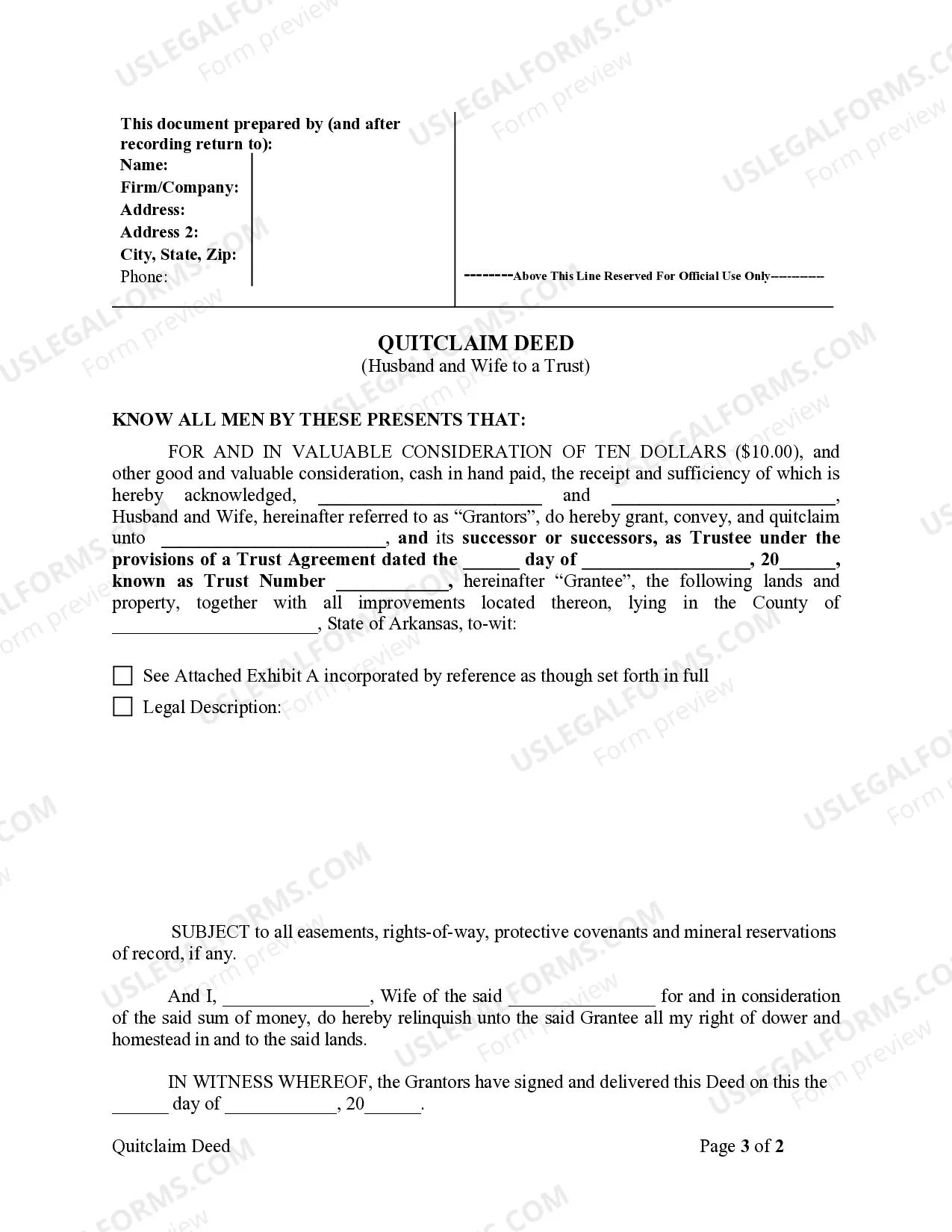

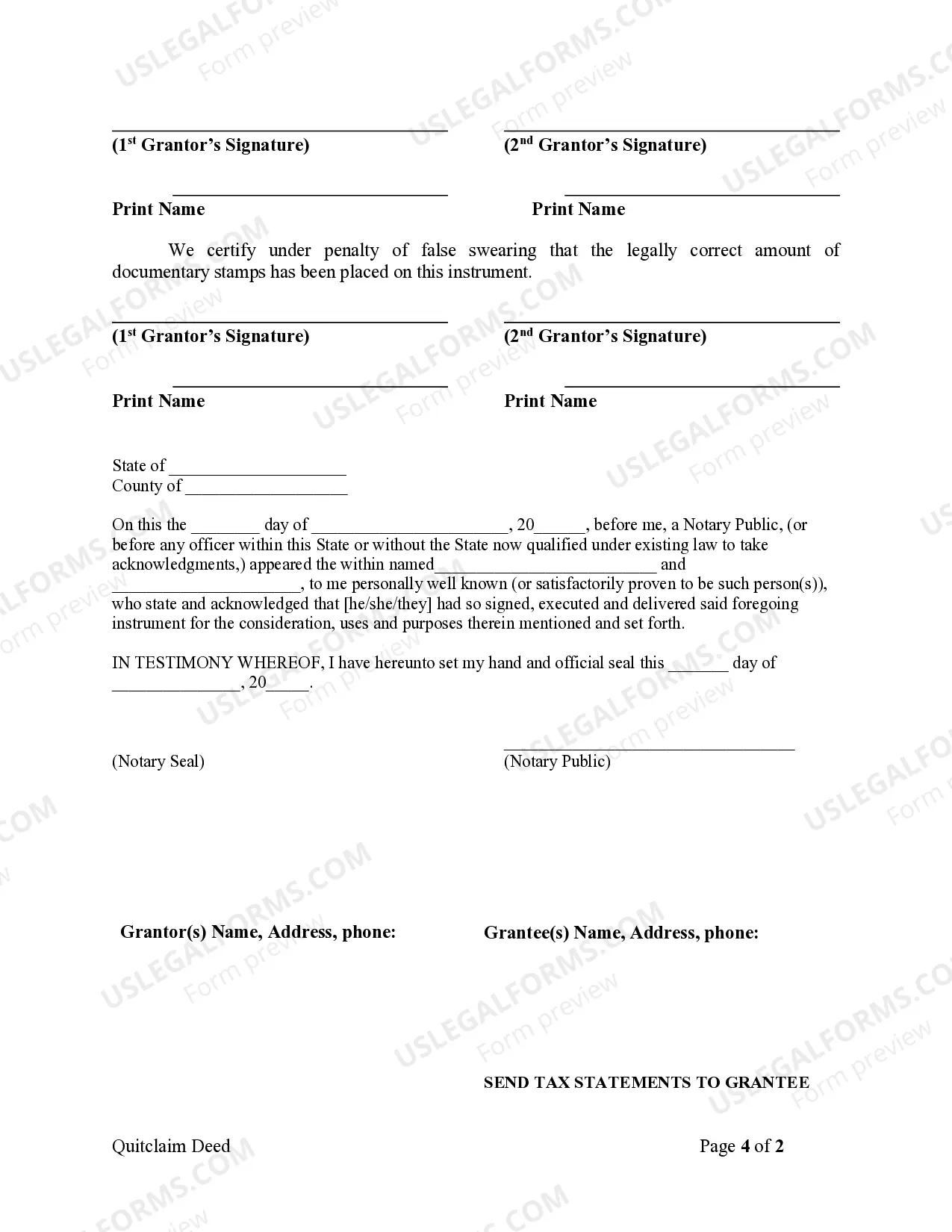

To fill out a quitclaim deed to add your spouse, gather necessary information such as property details and both parties' names. Complete the quitclaim form, ensuring all information is accurate, and both parties sign it in front of a notary. Once signed, file the deed at your local county recorder’s office. Digital resources like US Legal Forms can provide guidance and ensure you correctly fill out an Arkansas Quitclaim Deed - Husband and Wife to Trust.

To transfer a property title to a family member in Arkansas, you can utilize a quitclaim deed. This method is straightforward and allows you to transfer your interest easily. Consider the Arkansas Quitclaim Deed - Husband and Wife to Trust if you plan to include your spouse in the transfer process, as it simplifies ownership issues within families. Always verify the procedure with an attorney to ensure compliance.

You can add your spouse to your deed using a quitclaim deed without refinancing your mortgage. Simply draft the quitclaim deed and have both parties sign it in front of a notary. After that, file it with your county's recorder office to make it official. The Arkansas Quitclaim Deed - Husband and Wife to Trust can serve this process effectively, ensuring proper property ownership while avoiding complex refinancing.

Filling out a quitclaim deed in Arkansas involves obtaining the correct form and providing essential information such as the names of the grantor and grantee, property description, and signature. You also need to ensure that the document meets Arkansas’s legal requirements. By utilizing resources from platforms like US Legal Forms, you can simplify this process. They provide tailored documents that guide you in filling out an Arkansas Quitclaim Deed - Husband and Wife to Trust correctly.

Typically, individuals who need to quickly transfer property without a lengthy process benefit the most from a quitclaim deed. This approach is particularly advantageous for spouses in trust situations, as it allows easy adjustments to property interests. Moreover, if you're looking to transfer assets for estate planning, the Arkansas Quitclaim Deed - Husband and Wife to Trust simplifies this task. Always assess your situation to determine if it's right for you.

Yes, a quit claim deed can be used to transfer property from a trust. In this case, the trustee has the authority to execute the deed transferring ownership to another party. This option is beneficial, especially within the context of an Arkansas Quitclaim Deed - Husband and Wife to Trust, as it simplifies the transfer process. Always confirm the trust's terms to ensure compliance.

When you add your spouse to a deed, it can be viewed as a gift in many scenarios. This typically applies if the property has significant value. However, if you are working within a trust framework, like an Arkansas Quitclaim Deed - Husband and Wife to Trust, the implications may differ. It's wise to consult with a legal expert to understand the tax implications and ensure proper handling.

The most efficient way to transfer a property title between family members is often through a quitclaim deed. Specifically, the Arkansas Quitclaim Deed - Husband and Wife to Trust allows you to easily move property into a trust while ensuring that both parties agree on the terms. Using platforms like USLegalForms can streamline the preparation of this deed, ensuring that your family's property transfers are completed smoothly and legally. This approach minimizes potential disputes and fosters a harmonious family relationship.