Alabama Clauses Relating to Capital Calls

Description

How to fill out Clauses Relating To Capital Calls?

Are you presently in the position where you need to have papers for either business or individual functions just about every day? There are tons of authorized file web templates available on the net, but locating versions you can rely is not easy. US Legal Forms delivers a huge number of type web templates, just like the Alabama Clauses Relating to Capital Calls, that happen to be composed to satisfy state and federal demands.

When you are previously informed about US Legal Forms internet site and get a free account, merely log in. Next, you are able to acquire the Alabama Clauses Relating to Capital Calls format.

Should you not have an bank account and would like to begin using US Legal Forms, adopt these measures:

- Discover the type you will need and ensure it is for the right area/area.

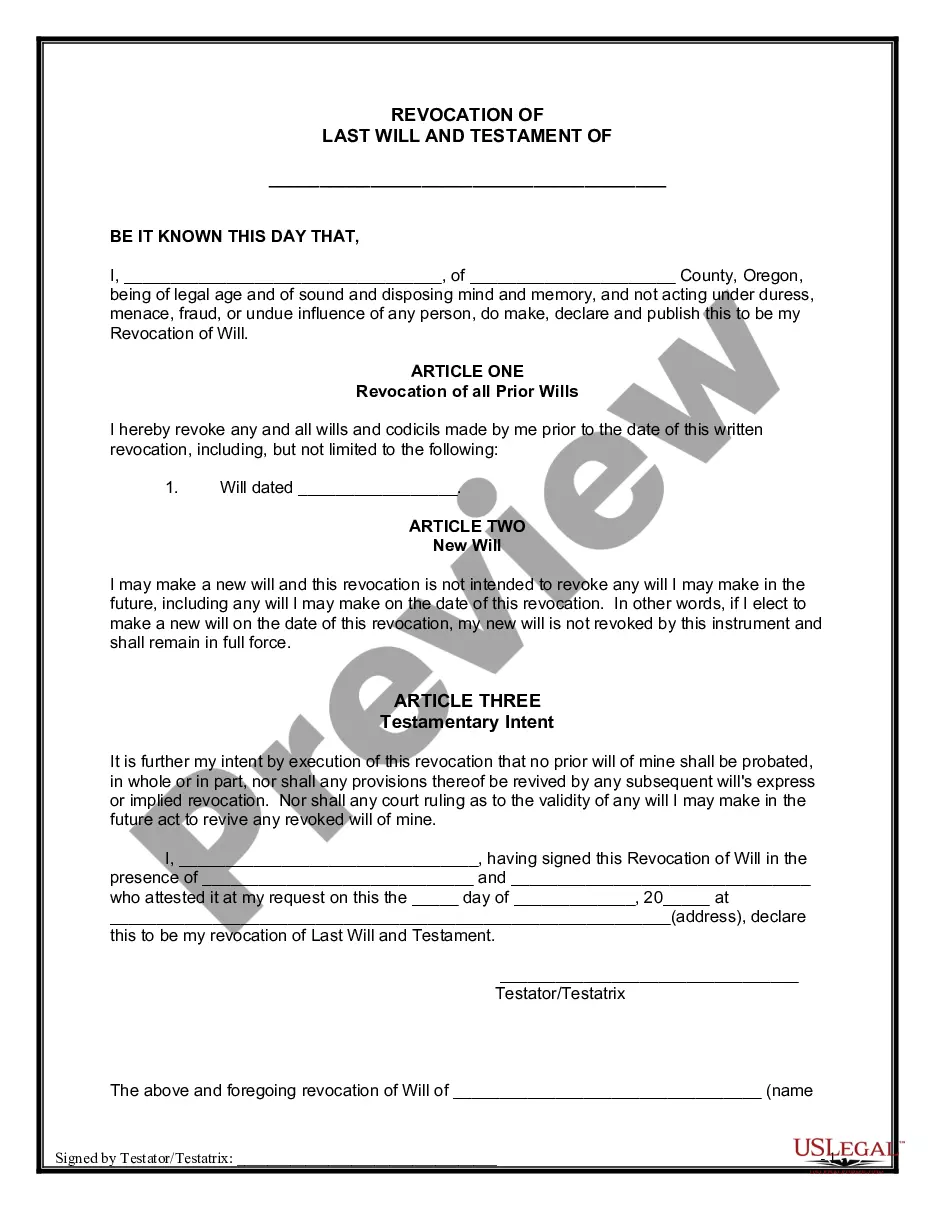

- Utilize the Preview switch to analyze the form.

- See the outline to ensure that you have chosen the right type.

- In the event the type is not what you are seeking, use the Research area to get the type that meets your needs and demands.

- Once you get the right type, simply click Acquire now.

- Pick the prices prepare you need, complete the necessary info to generate your account, and pay for your order utilizing your PayPal or Visa or Mastercard.

- Choose a handy file file format and acquire your duplicate.

Get all of the file web templates you have bought in the My Forms menus. You can aquire a further duplicate of Alabama Clauses Relating to Capital Calls anytime, if required. Just select the required type to acquire or produce the file format.

Use US Legal Forms, by far the most extensive selection of authorized varieties, to save some time and prevent faults. The services delivers skillfully made authorized file web templates which can be used for a variety of functions. Produce a free account on US Legal Forms and start generating your daily life easier.

Form popularity

FAQ

If a credit is transferred, an incentivized company that is later determined by the Secretary of Commerce to have defaulted under the project agreement shall be liable for the underpayment of tax attributable to the credit and for penalties and interest thereon.

Tax Penalties Charged If you file a return late, the late-filing penalty is 10% of the tax due or $50, whichever is higher. If you file but don't pay, the late penalty is 1% of the tax due every month, up to a total penalty of 25%. For instance, if you owe $1,000 and pay a day late, your penalty is $10.

Final assessment means the final notice of value, underpayment, or nonpayment of any tax administered by the department.

A. A preliminary assessment may be entered at any time if no return is filed as required, or if a false or fraudulent return is filed with the intent to evade tax.

The provisions of the Capital Credit include: The credit of up to 5 percent of the capital costs of a qualifying project. The credit can be applied against the Alabama income tax liability or financial institution excise tax generated by the project income each year for 20 years.

What does this mean? If you received a Final Assessment, you either: filed tax returns without the payment of the tax liability. and/or you previously received a Notice of Preliminary Assessment and did not respond or timely respond.

( Ala Code Sec. 40-2A-7(b)(1)(a) ) The Department may enter a preliminary assessment for the correct tax or value, including any applicable penalty and interest.

Section 40-14A-24(a), Code of Alabama 1975, establishes the net worth apportionment requirements for the Alabama business privilege tax. Line 10. ? Total Alabama Net Worth. Multiply line 8 (Net Worth Subject to Apportionment) by line 9 (Apportionment Factor).