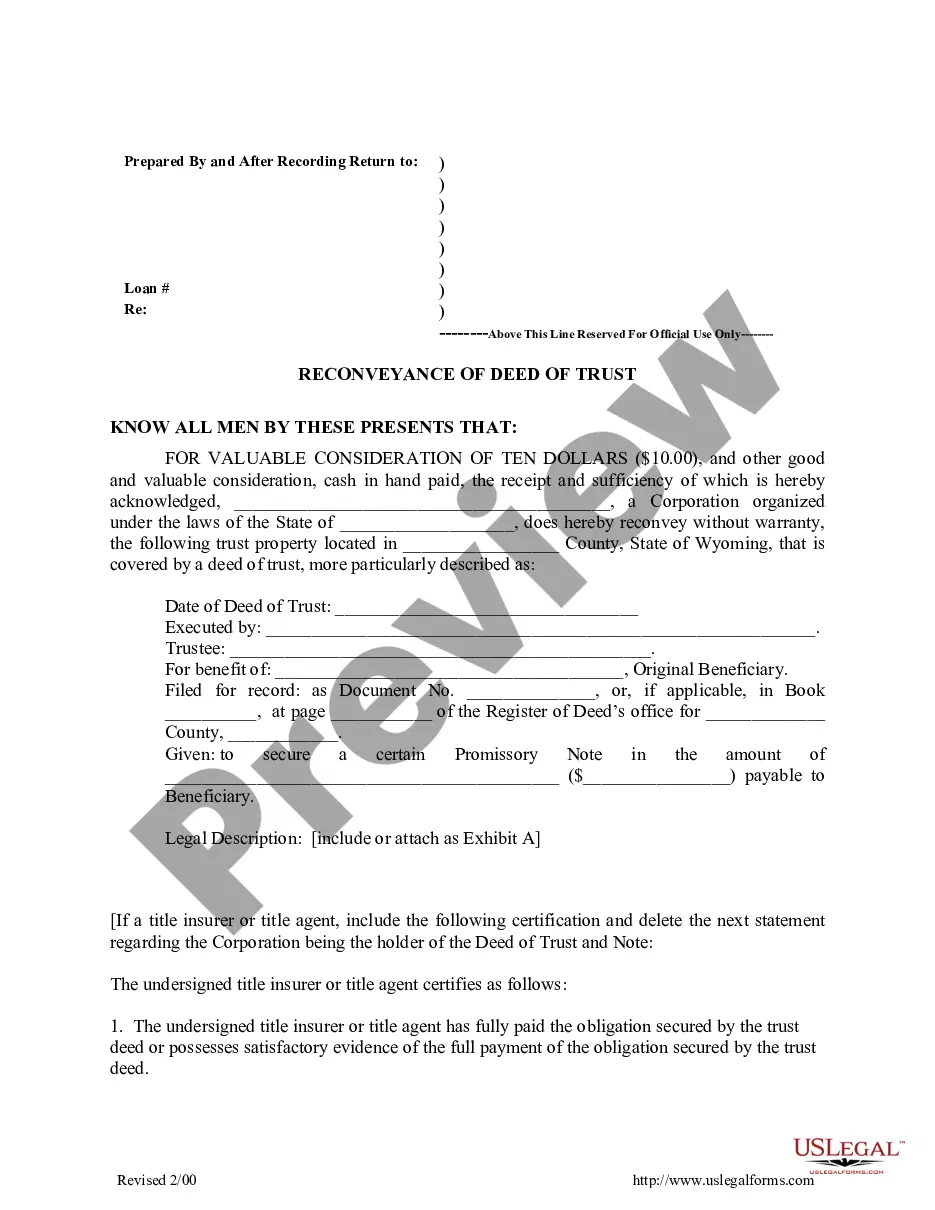

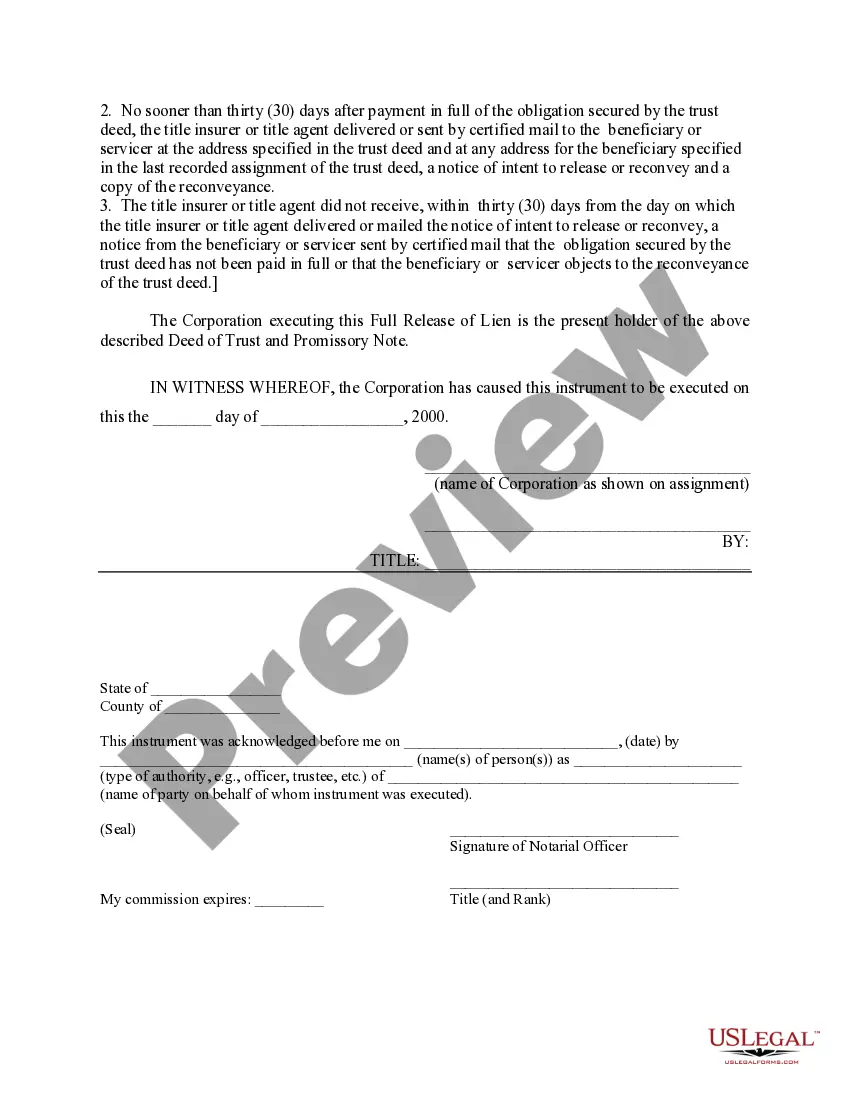

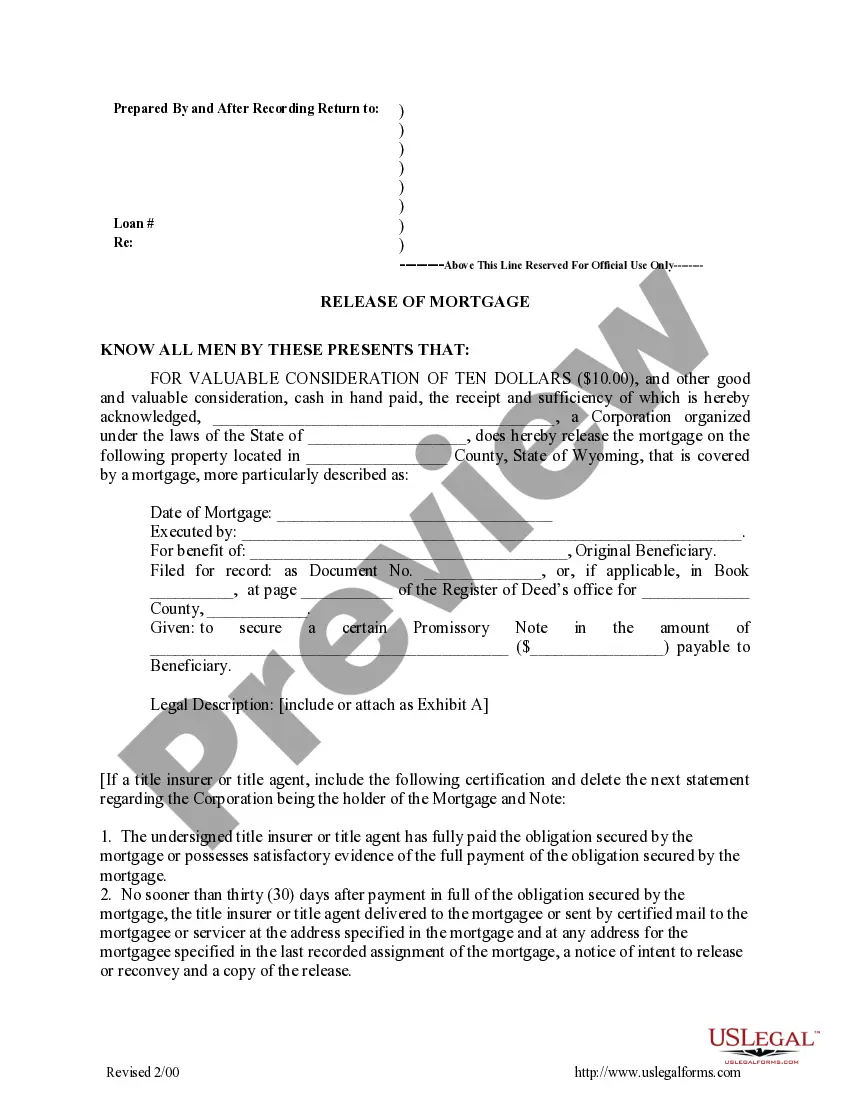

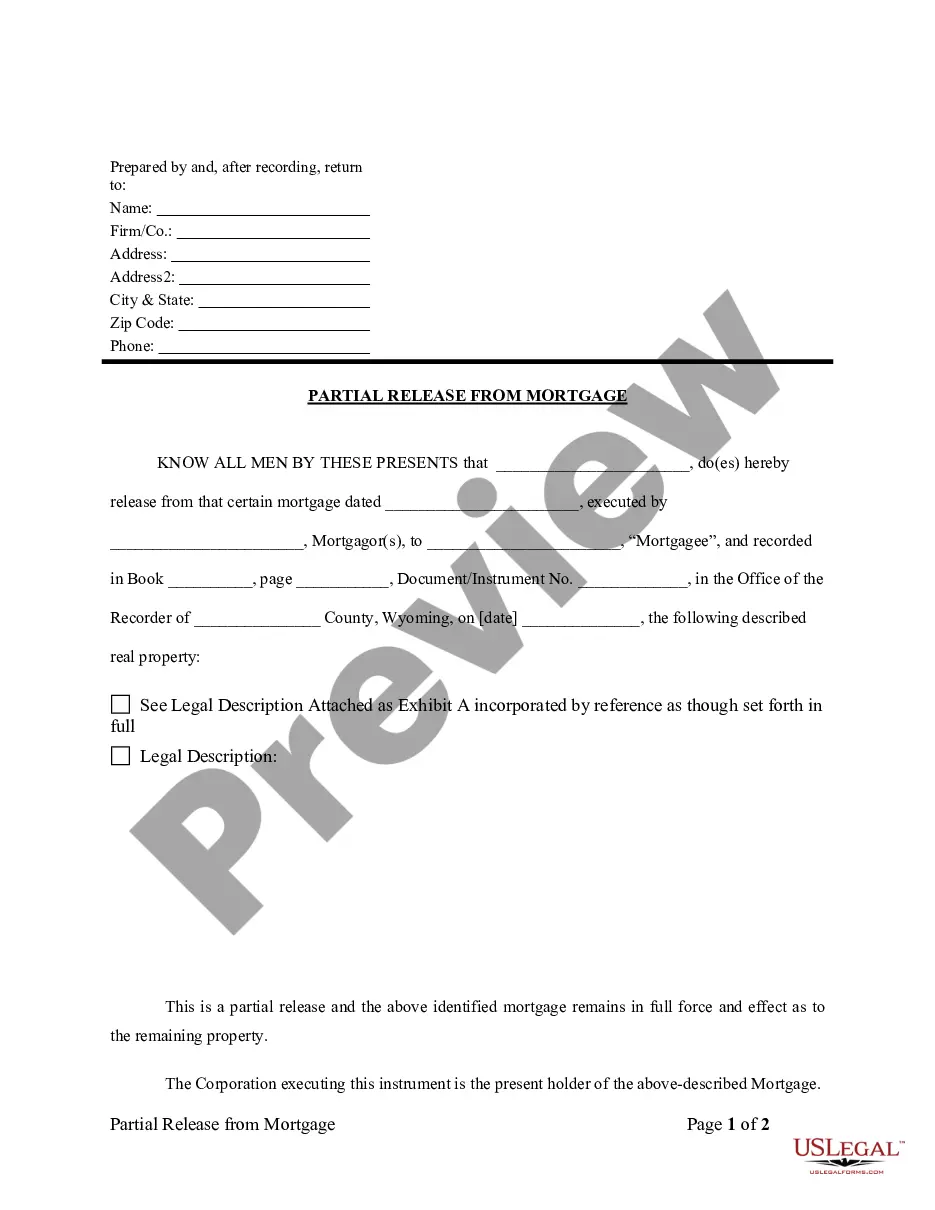

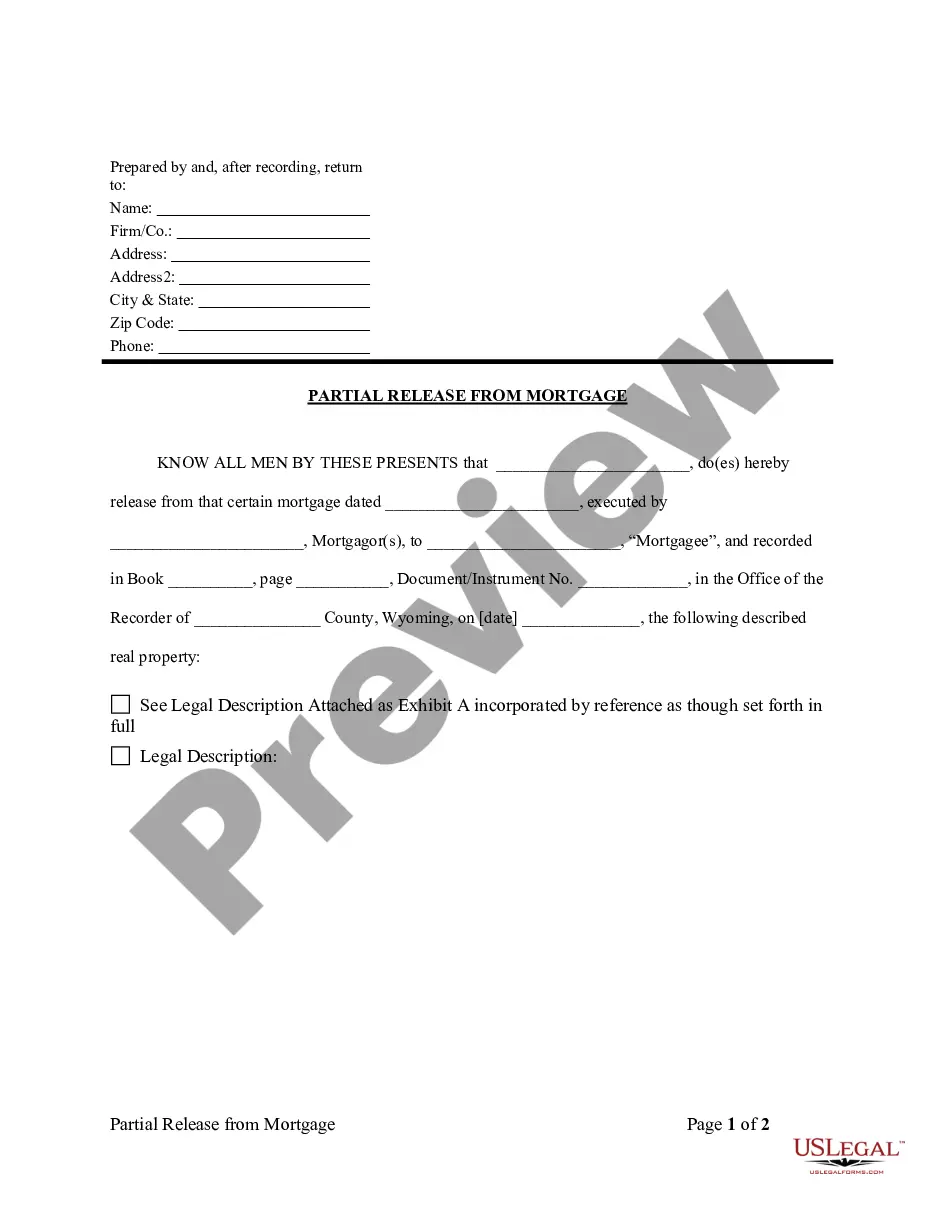

This is for the satisfaction or release of a deed of trust and mortgage for the state of Wyoming by a Corporation. A deed of trust is a document which pledges real property to secure a loan, used instead of a mortgage in certain states. A deed of trust involves a third party called a trustee, usually a title insurance company or escrow company, who acts on behalf of the lender. This form grants the release of a deed of trust because the loan has either been repayed or renegotiated.

Wyoming Satisfaction, Release or Cancellation of Deed of Trust by Corporation and Release of Mortgage

Description

How to fill out Wyoming Satisfaction, Release Or Cancellation Of Deed Of Trust By Corporation And Release Of Mortgage?

Use US Legal Forms to get a printable Wyoming Satisfaction, Release or Cancellation of Deed of Trust by Corporation and Release of Mortgage. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most complete Forms catalogue online and offers affordable and accurate samples for consumers and legal professionals, and SMBs. The documents are grouped into state-based categories and a number of them can be previewed before being downloaded.

To download templates, users must have a subscription and to log in to their account. Hit Download next to any template you want and find it in My Forms.

For those who do not have a subscription, follow the tips below to quickly find and download Wyoming Satisfaction, Release or Cancellation of Deed of Trust by Corporation and Release of Mortgage:

- Check out to make sure you get the proper form with regards to the state it’s needed in.

- Review the document by looking through the description and by using the Preview feature.

- Click Buy Now if it is the template you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it many times.

- Make use of the Search engine if you want to find another document template.

US Legal Forms provides a large number of legal and tax templates and packages for business and personal needs, including Wyoming Satisfaction, Release or Cancellation of Deed of Trust by Corporation and Release of Mortgage. Above three million users have already used our service successfully. Choose your subscription plan and have high-quality documents in just a few clicks.

Form popularity

FAQ

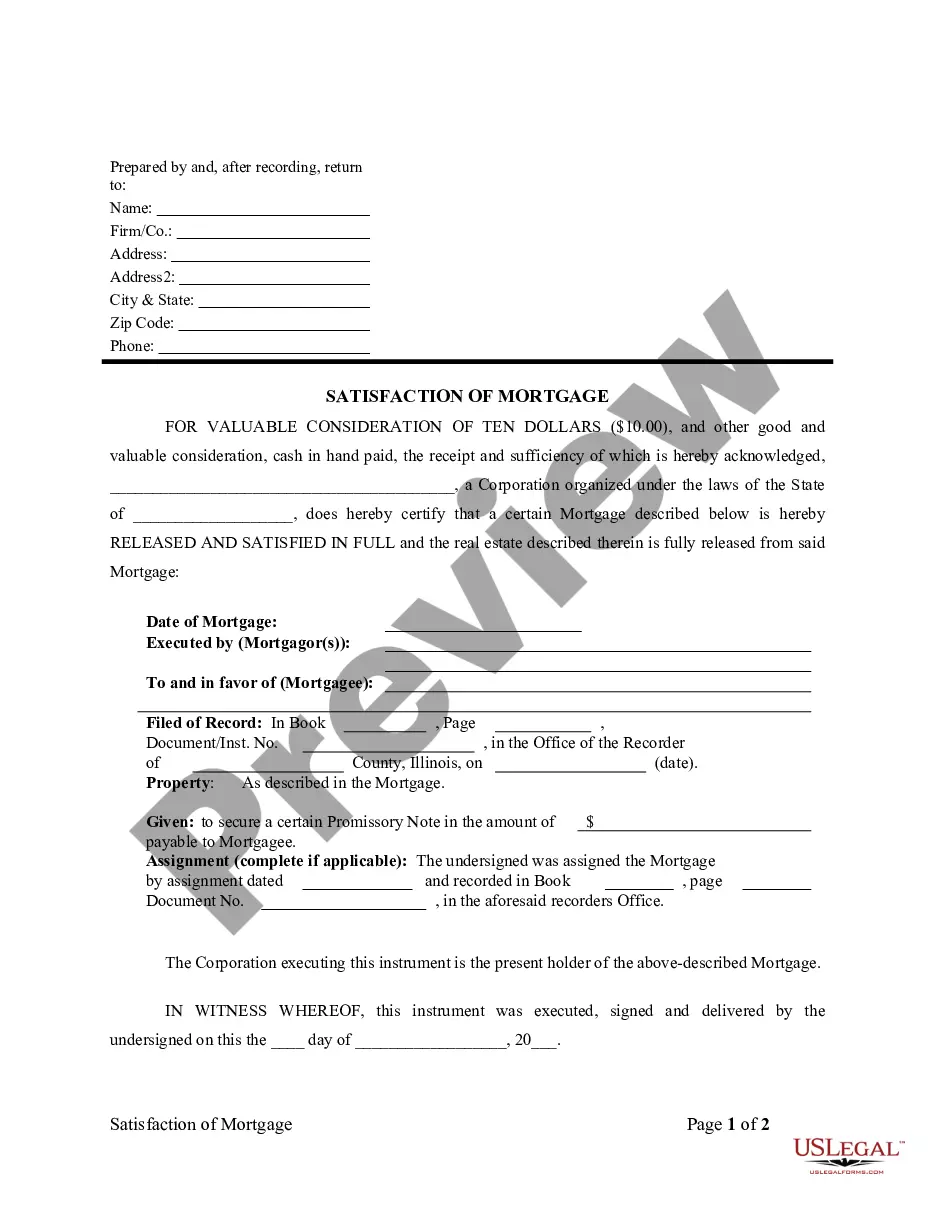

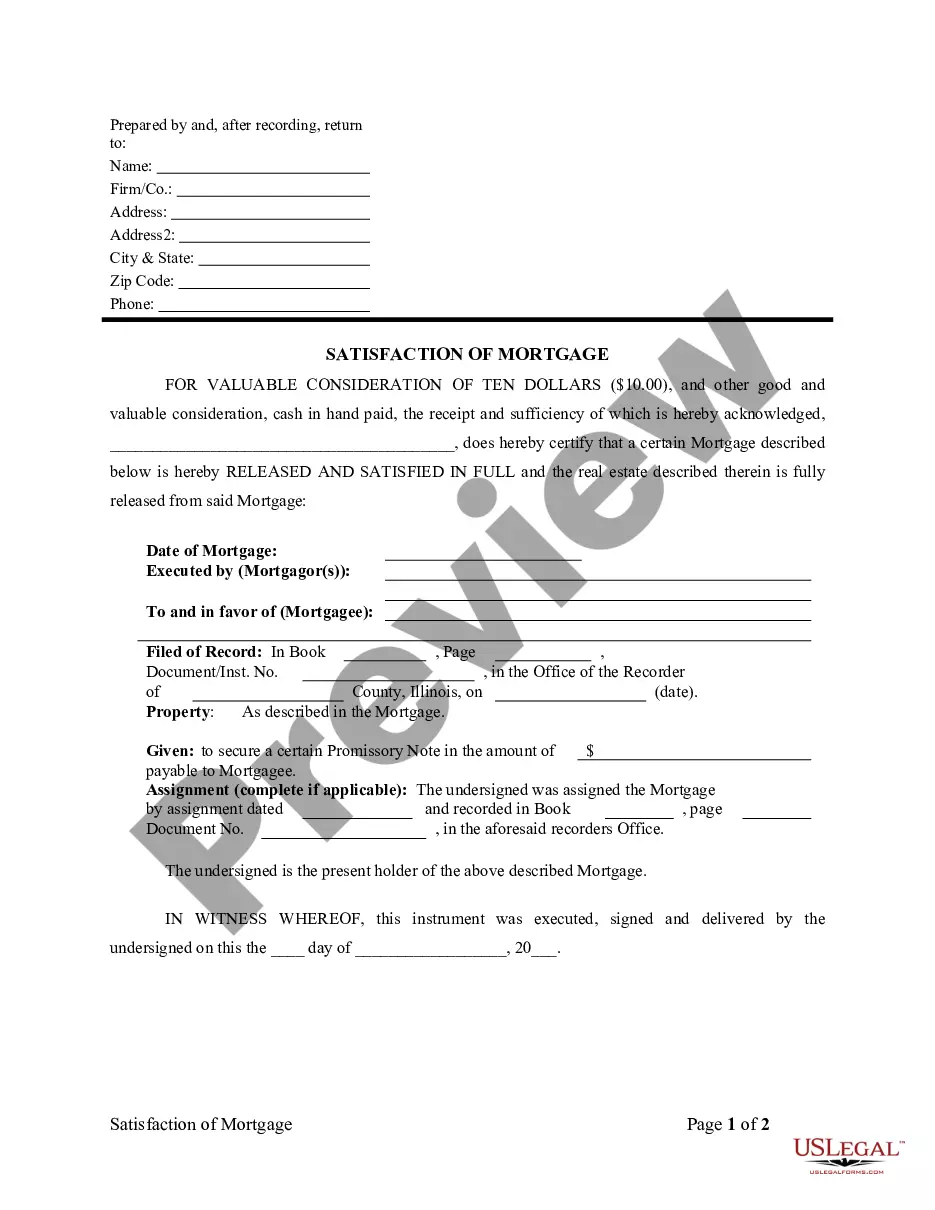

A satisfaction of mortgage is a document that confirms a mortgage has been paid off and details the provisions for the transfer of collateral title rights.

A Satisfaction of Mortgage is used to acknowledge the same of a Mortgage agreement.In essence, the Deed of Reconveyance and Satisfaction of Mortgage both serve the same function, which is to show that the borrower has repaid the loan fully and that the lender has no further interest in the property.

Go to the county recorder's office or local courthouse to find recorded mortgages. In states such as California, deeds, liens, mortgage documents and various types of land documents are available for review in the recorder's office.

In order to clear the title to the real property owned by the mortgagor, the Satisfaction of Mortgage document must be recorded with the County Recorder or Recorder of Deeds. If the mortgagee fails to record a satisfaction within the set time limits, the mortgagee may be responsible for damages set out by statute.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

If you have cleared a debt, a mortgage satisfaction document will give you clear title to real property. In other words, mortgage satisfaction is a document that results in release or discharge of a mortgage lien, and indicates that a borrower has cleared his/her debt.

What is Satisfaction of Mortgage? A Satisfaction of Mortgage, also known as a Mortgage Lien Release, is a legal document provided by the mortgagee (financial institution) advising that the mortgage has been paid in full, all terms of the loan have been satisfied and there will no longer be a lien on the property.

In some cases, a mortgage may have been sold by the mortgage lender to another financial institution. If sold, the owner of the mortgage at the time of the final payment is responsible for completing the satisfaction of mortgage documentation.