Alabama Cease and Desist for Debt Collectors

Description

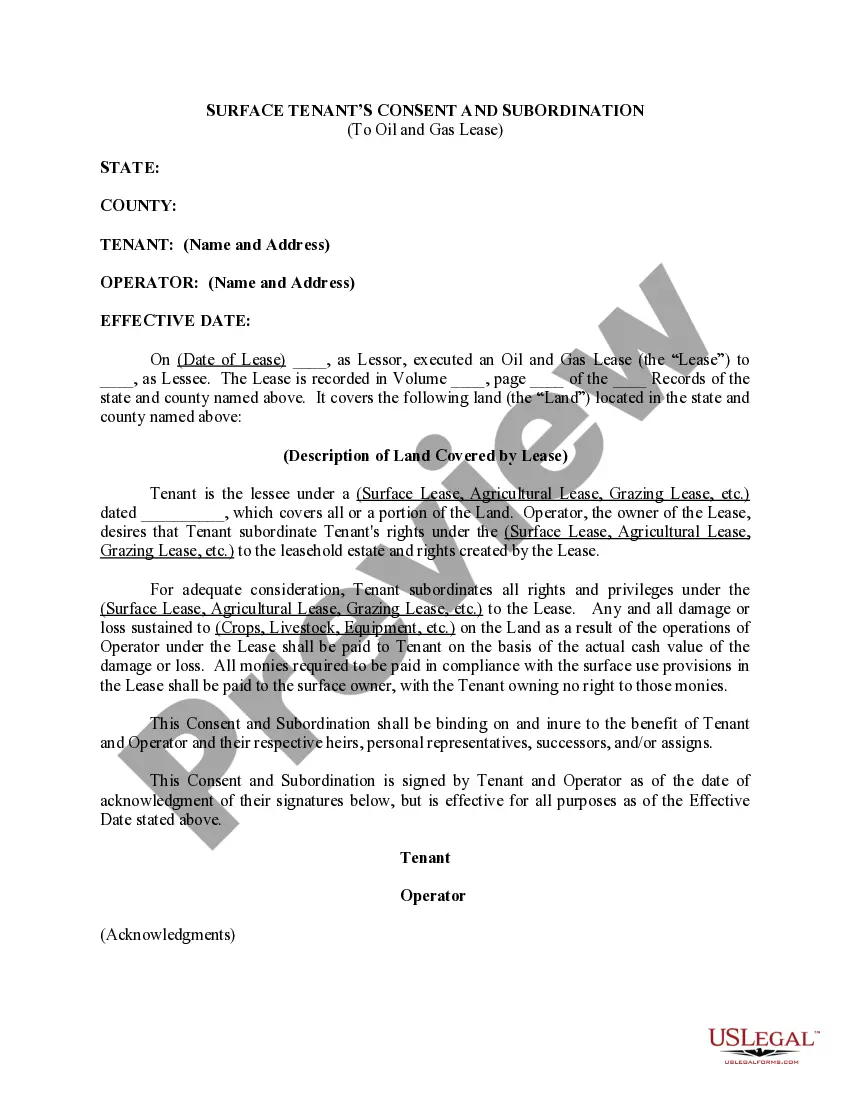

How to fill out Cease And Desist For Debt Collectors?

If you need to total, obtain, or print valid document templates, utilize US Legal Forms, the largest selection of legal forms available online. Take advantage of the site's straightforward and user-friendly search feature to locate the documents you need. Various templates for business and personal purposes are organized by categories and states, or keywords.

Employ US Legal Forms to find the Alabama Cease and Desist for Debt Collectors with just a few clicks. If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Alabama Cease and Desist for Debt Collectors. You can also access forms you have previously saved in the My documents section of your account.

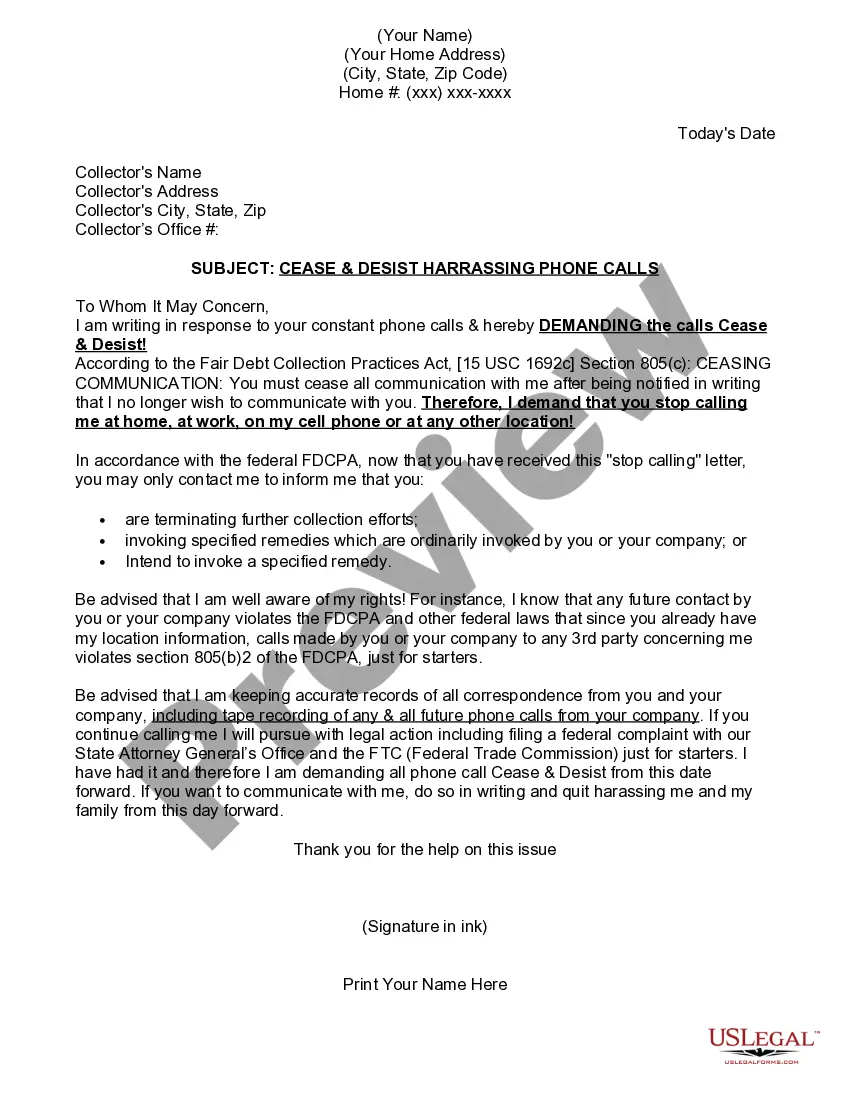

If you are using US Legal Forms for the first time, follow the instructions outlined below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Use the Preview option to review the form's details. Remember to read the information carefully. Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template. Step 4. Once you have located the form you need, click the Download now button. Choose the pricing plan you prefer and enter your credentials to sign up for an account. Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Alabama Cease and Desist for Debt Collectors.

- Every legal document template you obtain is yours permanently.

- You will have access to each form you saved in your account.

- Go to the My documents section and select a form to print or download again.

- Stay competitive and acquire, and print the Alabama Cease and Desist for Debt Collectors with US Legal Forms.

- There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

Form popularity

FAQ

Yes, you can instruct a debt collector to cease and desist all communication with you. By sending a cease and desist letter, you formally ask them to stop contacting you, which can significantly reduce stress. It’s essential to understand your rights in this matter, and the Alabama Cease and Desist for Debt Collectors provides a solid foundation for your request. For assistance in drafting an effective letter, the US Legal Forms platform can guide you through the process.

In Alabama, the statute of limitations for most consumer debts is typically six years. This means that creditors have six years from the date of the last payment or acknowledgment of the debt to take legal action. After this period, the debt becomes uncollectible, and you can use the Alabama Cease and Desist for Debt Collectors to prevent further attempts to collect. Knowing this timeline empowers you to manage your financial obligations effectively.

Yes, you can write a cease and desist letter to a debt collector, effectively requesting them to stop contacting you regarding a debt. This letter serves as a formal notification that you do not wish to receive further communications. Utilizing a cease and desist letter can help protect your peace of mind and assert your rights under the Alabama Cease and Desist for Debt Collectors guidelines. For a streamlined approach, consider using the US Legal Forms platform to create a customized letter.

A 609 letter is a request you send to a debt collector, asking them to validate the debt they claim you owe. This type of letter references Section 609 of the Fair Credit Reporting Act, which allows you to obtain specific information about the debt. By using a 609 letter, you can ensure that the debt collector provides proof before you take further action. This process is a crucial step in protecting your rights under the Alabama Cease and Desist for Debt Collectors framework.

The 777 rule refers to a guideline that suggests debt collectors must cease communication after three requests from the debtor. This means that if you send a cease and desist letter, the collector must stop contacting you after their third attempt. Understanding this rule can empower you in your dealings with collectors. For more detailed information and assistance, check out USLegalForms for resources on Alabama Cease and Desist for Debt Collectors.

Yes, cease and desist letters can be quite effective for debt collectors. When you send this letter, you inform the collector that you do not wish to be contacted, which they must legally honor. This can lead to reduced stress and a break from constant calls. For those looking for guidance, USLegalForms offers resources to help you navigate the Alabama Cease and Desist for Debt Collectors process.

To write an effective cease and desist letter to a debt collector, start by clearly stating your intent to stop all communication. Include your personal information and account details to identify the debt. It’s important to mention that you are aware of your rights under the Fair Debt Collection Practices Act. Utilizing a platform like USLegalForms can simplify this process, providing templates specifically designed for Alabama Cease and Desist for Debt Collectors.

Yes, you can tell a debt collector to cease and desist. Expressing this verbally is a good first step, but it is crucial to follow it up with a written request. An Alabama Cease and Desist for Debt Collectors letter is more effective, as it creates a formal record of your request. Utilizing USLegalForms can help you craft a clear and legally sound letter to ensure your wishes are respected.

To support your cease and desist letter, you should keep a record of all communications with the debt collector. This includes phone calls, emails, and any other correspondence. In addition, retaining copies of your letter and any responses you receive can provide valuable proof if the debt collector continues to contact you. An Alabama Cease and Desist for Debt Collectors can help you create a strong, documented case against unwanted communication.

Yes, you can send a cease and desist letter to a debt collector. This letter serves as a formal request for the collector to stop contacting you regarding the debt. It is an important step in protecting your rights under the Fair Debt Collection Practices Act. Using an Alabama Cease and Desist for Debt Collectors template from USLegalForms can simplify the process and ensure your letter meets legal standards.