Alabama Self-Employed X-Ray Technician Self-Employed Independent Contractor

Description

How to fill out Self-Employed X-Ray Technician Self-Employed Independent Contractor?

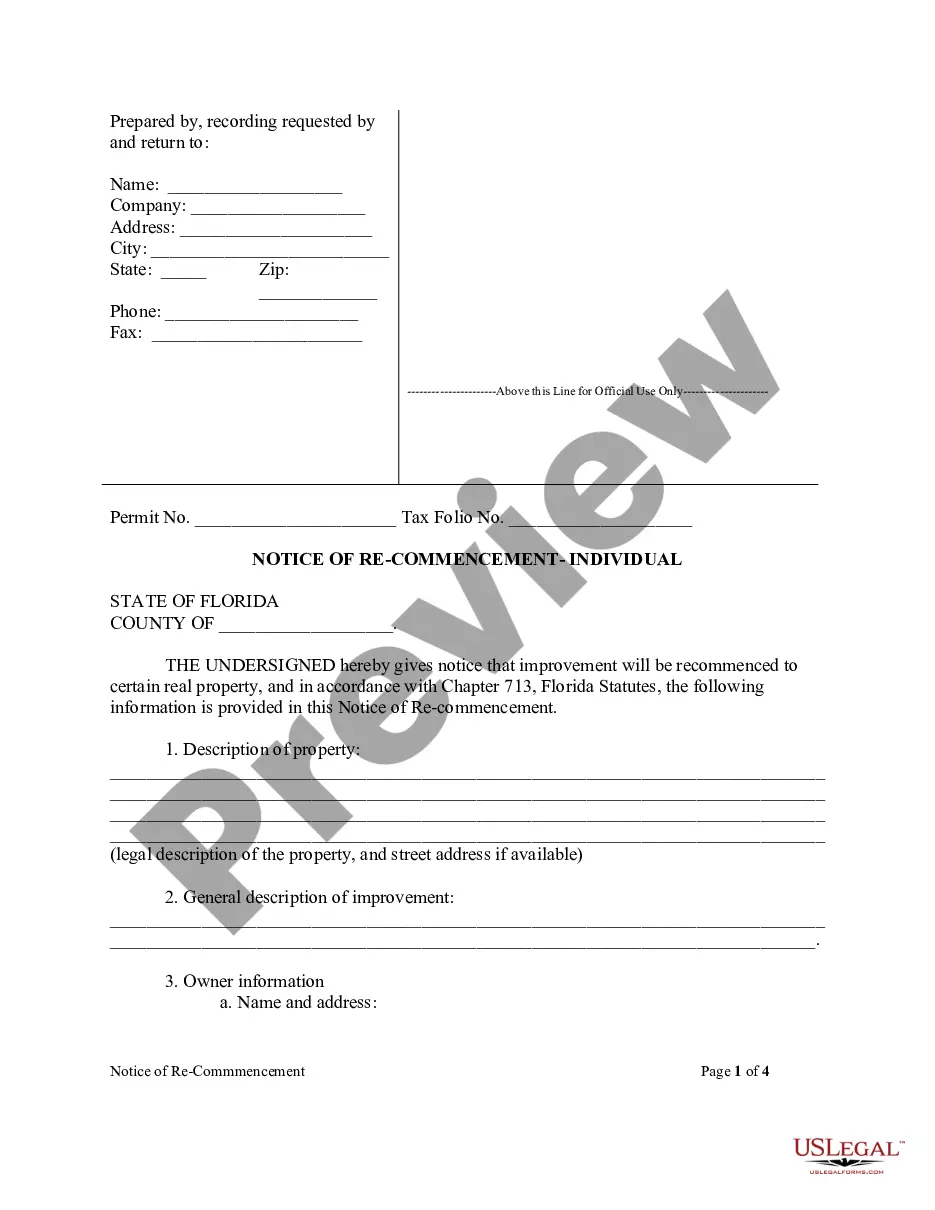

US Legal Forms - one of many largest libraries of authorized forms in the States - provides a variety of authorized record templates you can download or print. Using the web site, you can get a huge number of forms for company and personal uses, sorted by classes, says, or search phrases.You can get the newest versions of forms just like the Alabama Self-Employed X-Ray Technician Self-Employed Independent Contractor in seconds.

If you already possess a registration, log in and download Alabama Self-Employed X-Ray Technician Self-Employed Independent Contractor through the US Legal Forms library. The Acquire switch will show up on every single type you see. You get access to all previously delivered electronically forms from the My Forms tab of the accounts.

If you would like use US Legal Forms initially, here are easy instructions to obtain started:

- Be sure to have selected the proper type for your city/state. Click on the Review switch to review the form`s content material. Browse the type outline to ensure that you have selected the right type.

- In case the type doesn`t match your demands, use the Search area near the top of the monitor to obtain the one who does.

- In case you are pleased with the shape, confirm your option by clicking on the Acquire now switch. Then, choose the rates strategy you like and offer your references to register for the accounts.

- Procedure the transaction. Make use of Visa or Mastercard or PayPal accounts to perform the transaction.

- Pick the structure and download the shape on your product.

- Make modifications. Fill out, edit and print and indicator the delivered electronically Alabama Self-Employed X-Ray Technician Self-Employed Independent Contractor.

Every single format you added to your money does not have an expiration date which is your own for a long time. So, if you would like download or print another duplicate, just visit the My Forms section and click about the type you want.

Get access to the Alabama Self-Employed X-Ray Technician Self-Employed Independent Contractor with US Legal Forms, the most comprehensive library of authorized record templates. Use a huge number of professional and condition-certain templates that fulfill your organization or personal requires and demands.

Form popularity

FAQ

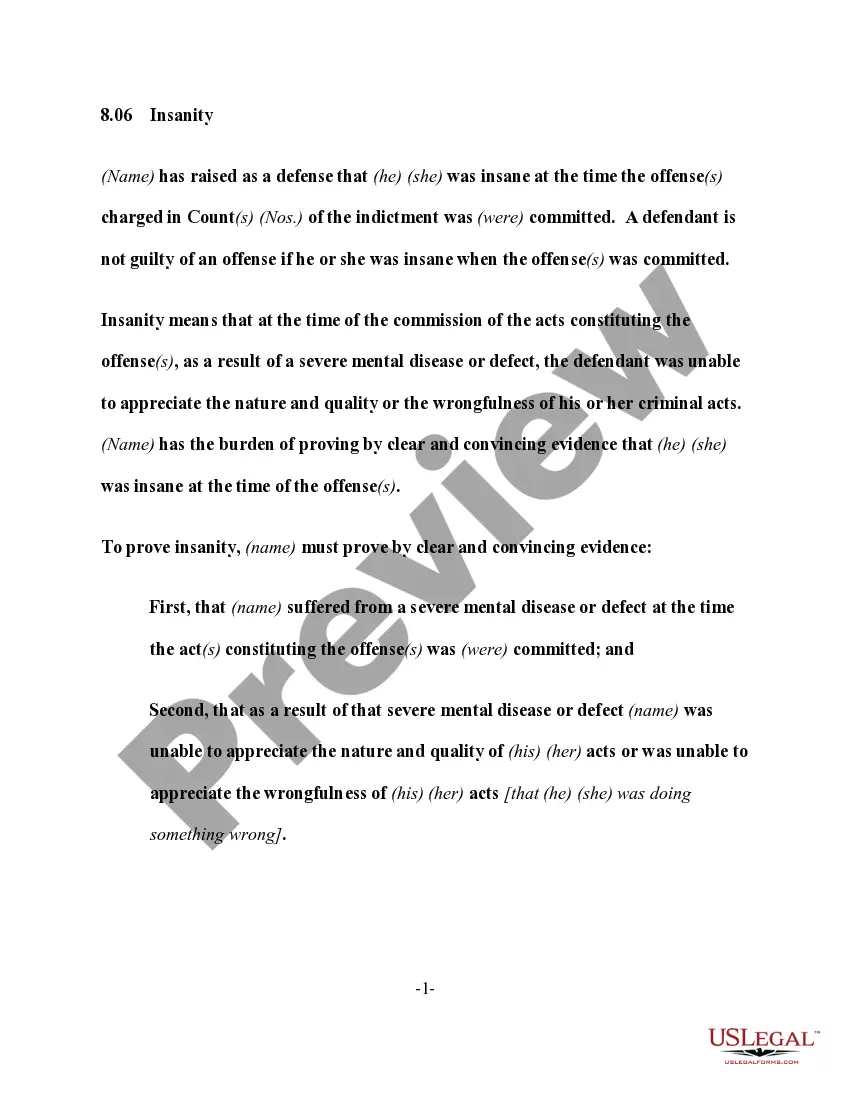

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

An independent contractor can be anyone to provides services to the general public and who does not operate within an employer-employee relationship....Some examples include:Doctors in a private practice.Lawyers, bookkeepers, accountants.IT, web designers, programmers.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Here's what you need to know to start and build a successful business as a self-employed contractor.Be Sure You Want to Be Self-Employed.Get Financing in Place Beforehand.Create a Business Plan.Name, Register, and Insure Your Contracting Business.Market Your Business.Be Your Own Accountant, for Starters.More items...?

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Contractors can also be self-employed, but they perform tasks on a contractual basis, rather than selling any products or rolling, bookable services. For example, a plumber would work for a client according to an agreed, one-off contract.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.