Alabama Air Filtration Contractor Agreement - Self-Employed

Description

How to fill out Air Filtration Contractor Agreement - Self-Employed?

You may commit hours on-line trying to find the authorized file format that suits the state and federal specifications you want. US Legal Forms supplies thousands of authorized varieties which are reviewed by experts. It is possible to down load or printing the Alabama Air Filtration Contractor Agreement - Self-Employed from my service.

If you have a US Legal Forms accounts, you may log in and click the Obtain switch. Following that, you may total, edit, printing, or indication the Alabama Air Filtration Contractor Agreement - Self-Employed. Each authorized file format you get is yours for a long time. To get another copy for any purchased form, visit the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms internet site initially, keep to the easy instructions under:

- First, be sure that you have selected the proper file format for your county/town of your choosing. Browse the form information to ensure you have picked out the right form. If available, make use of the Review switch to look from the file format as well.

- If you want to discover another model in the form, make use of the Research field to discover the format that meets your requirements and specifications.

- Upon having found the format you desire, just click Buy now to proceed.

- Pick the prices strategy you desire, key in your accreditations, and sign up for a merchant account on US Legal Forms.

- Total the deal. You may use your Visa or Mastercard or PayPal accounts to purchase the authorized form.

- Pick the structure in the file and down load it to the product.

- Make changes to the file if possible. You may total, edit and indication and printing Alabama Air Filtration Contractor Agreement - Self-Employed.

Obtain and printing thousands of file web templates making use of the US Legal Forms web site, that provides the largest collection of authorized varieties. Use professional and express-particular web templates to handle your organization or person needs.

Form popularity

FAQ

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Independent contractors generally must pay income tax and self-employment tax, which is a combination of Medicare and Social Security taxes. Specific tax obligations will depend on whether the business resulted in a net profit or a net loss.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

The IRS says that someone is self-employed if they meet one of these conditions:Someone who carries on a trade or business as a sole proprietor or independent contractor,A member of a partnership that carries on a trade or business, or.Someone who is otherwise in business for themselves, including part-time business.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

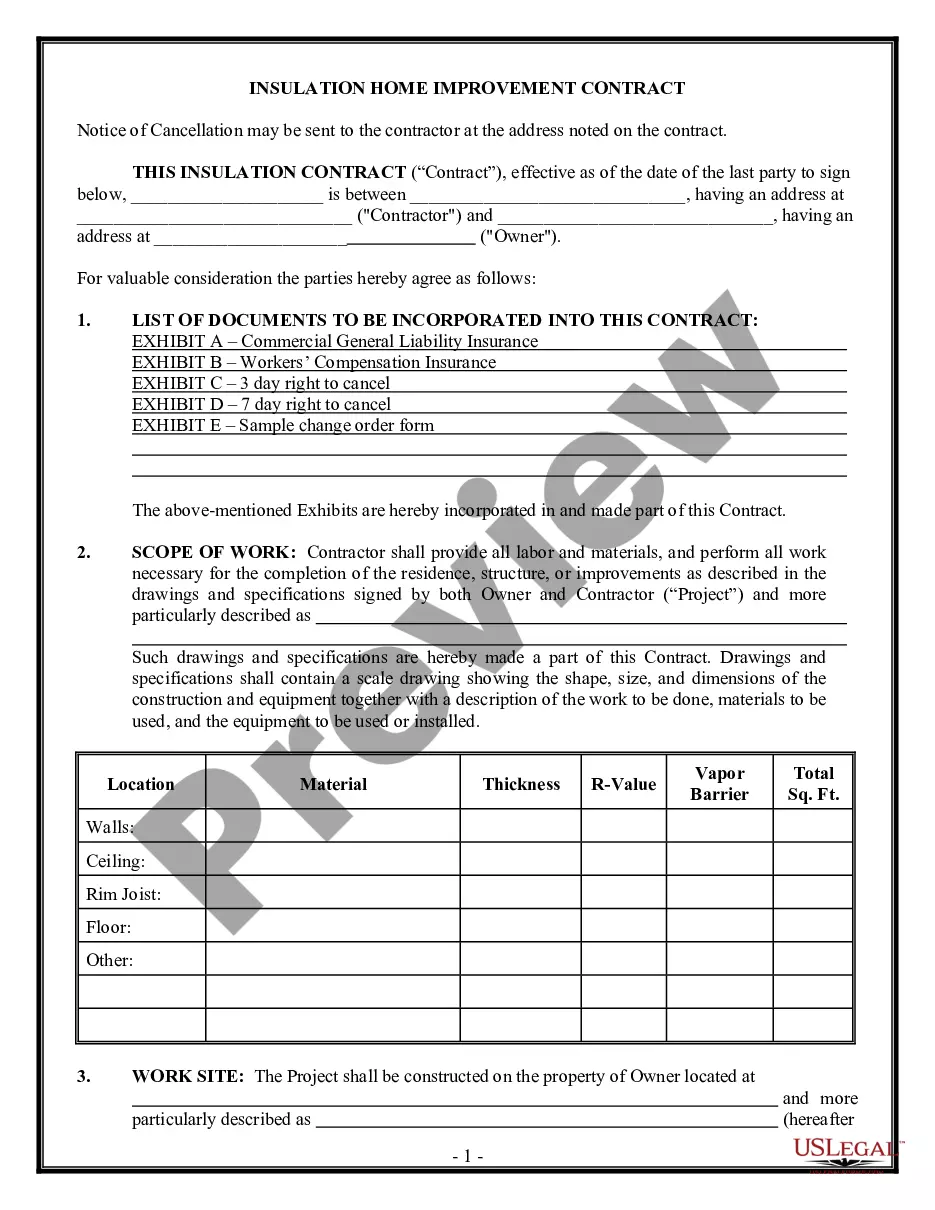

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.