Alabama Qualified Written RESPA Request to Dispute or Validate Debt

Description

How to fill out Qualified Written RESPA Request To Dispute Or Validate Debt?

You can spend hours online searching for the authentic document template that meets the local and federal requirements you need.

US Legal Forms offers thousands of authentic forms that are reviewed by professionals.

You can easily download or print the Alabama Qualified Written RESPA Request to Challenge or Validate Debt from their service.

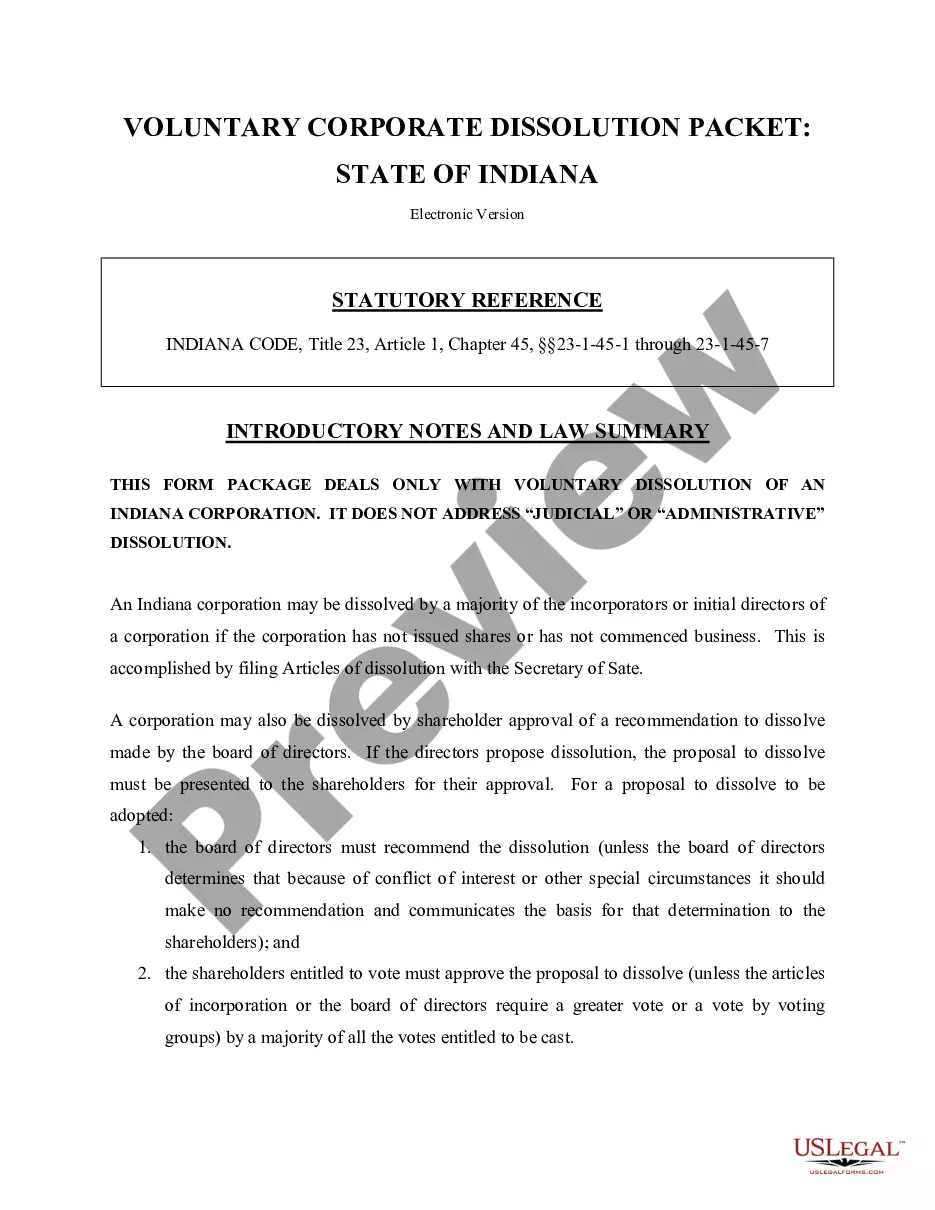

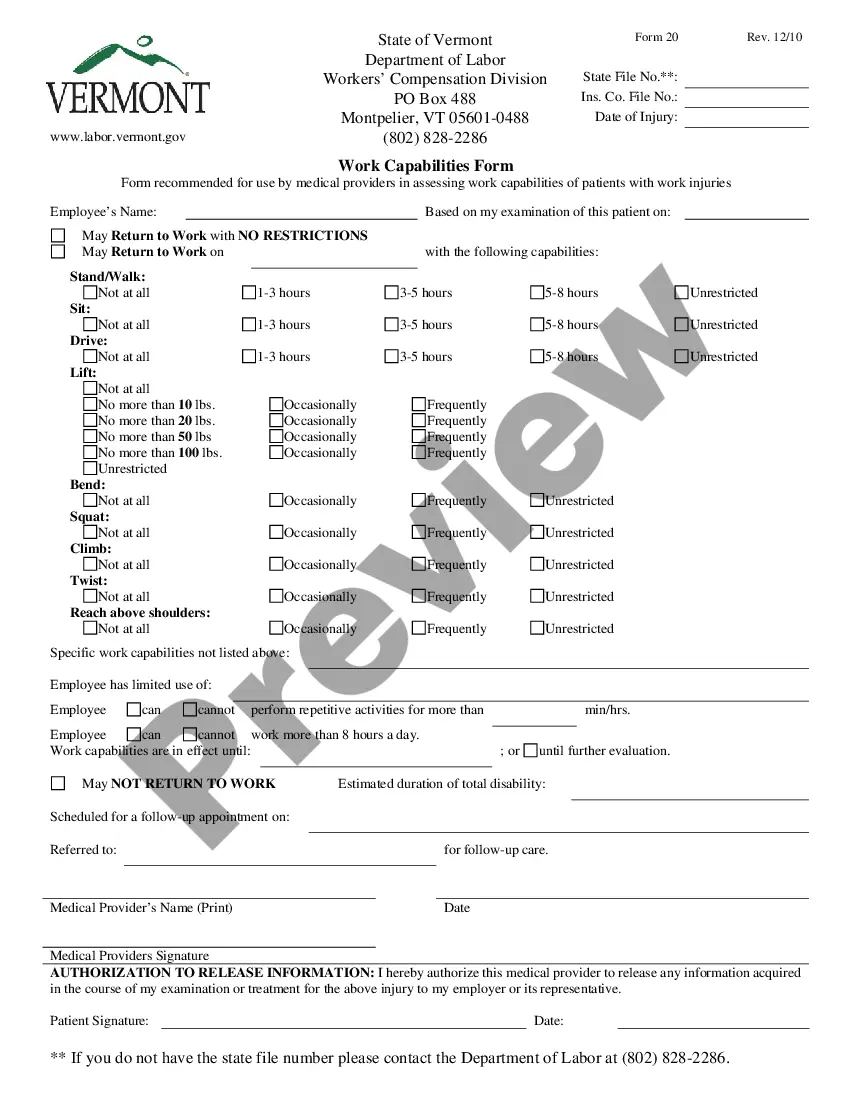

If available, utilize the Preview option to review the document template as well.

- If you have a US Legal Forms account, you can Log In and select the Download option.

- After that, you can complete, modify, print, or sign the Alabama Qualified Written RESPA Request to Challenge or Validate Debt.

- Each authentic document template you download is yours permanently.

- To obtain another copy of any downloaded form, go to the My documents section and click on the appropriate option.

- If you are using the US Legal Forms website for the first time, follow these simple steps.

- First, make sure you have selected the correct document template for your state/region you choose.

- Check the form description to ensure you have selected the right form.

Form popularity

FAQ

To write a letter disputing the validity of a debt, include your contact information, the date, and the collector’s details at the top. Clearly state that you are submitting an Alabama Qualified Written RESPA Request to Dispute or Validate Debt, and describe why you believe the debt is invalid. Request specific documentation to support their claim. A well-crafted letter sets the stage for a potential dispute resolution.

A certified letter to validate debt is a formal communication sent to a debt collector, using certified mail for proof of delivery. This method serves as an Alabama Qualified Written RESPA Request to Dispute or Validate Debt. By sending a certified letter, you ensure your request for validation is legally documented. This approach also encourages the collector to respond with the necessary evidence to support their claim.

To file a debt validation claim, you should prepare a detailed letter outlining your dispute. Make it clear that it is an Alabama Qualified Written RESPA Request to Dispute or Validate Debt and include all relevant information about the debt. Sending this letter via certified mail ensures you have a record of your communication. This step is vital for resolving any issues with the debt collector efficiently.

When you receive a debt validation letter, review the details carefully. If you believe the debt is valid, you may choose to negotiate payment terms. However, if you find discrepancies, you can send an Alabama Qualified Written RESPA Request to Dispute or Validate Debt. This response should clearly outline your concerns and request additional documentation or evidence.

The best sample for a debt validation letter includes clear elements such as your contact information, the date, and the collector's details. You should indicate that the letter is an Alabama Qualified Written RESPA Request to Dispute or Validate Debt and provide specifics of the debt. You can find templates online, but ensure that it meets your unique situation. A well-structured letter enhances the chances of a successful dispute.

Yes, you can dispute a valid debt if you believe there is an error or if you need more information about it. An Alabama Qualified Written RESPA Request to Dispute or Validate Debt allows you to request clarification from the creditor or debt collector. This request helps ensure that your rights are protected and that you are informed about any inaccuracies. Transparency is key; don't hesitate to seek validation.

To write a letter disputing a debt, start with your personal information, including your name and address, followed by the recipient's details. Clearly state that the letter serves as an Alabama Qualified Written RESPA Request to Dispute or Validate Debt. Include details about the debt in question and specify the reasons for your dispute. Finally, ask for documentation related to the debt to support your claim.

In Alabama, a debt collector can pursue old debt for a period of up to six years. This timeframe starts from the last time you made a payment or acknowledged the debt. If you receive a notice regarding an Alabama Qualified Written RESPA Request to Dispute or Validate Debt, you have the right to challenge the validity of the debt. It's crucial to understand your rights and options, and platforms like US Legal Forms can guide you through the process effectively.

When you receive an Alabama Qualified Written RESPA Request to Dispute or Validate Debt, you must acknowledge receipt within five days. This acknowledgement is a crucial step in the process and establishes your commitment to resolving any issues. You should also review the request carefully, gathering necessary information to address the concerns raised. By responding promptly and adequately, you ensure compliance and build trust with your clients.

RESPA prohibits certain practices that can harm consumers and promote transparency in the mortgage process. For instance, it prevents kickbacks or referral fees that can inflate costs. Additionally, it prohibits servicers from failing to provide timely responses to qualified written requests, allowing you the right to dispute or validate your debt through an Alabama Qualified Written RESPA Request.