Alabama Stock Option Agreement of Intraware, Inc.

Description

How to fill out Stock Option Agreement Of Intraware, Inc.?

Choosing the right legal papers design could be a have difficulties. Naturally, there are plenty of layouts available online, but how can you find the legal kind you will need? Use the US Legal Forms site. The services offers 1000s of layouts, for example the Alabama Stock Option Agreement of Intraware, Inc., that you can use for organization and personal demands. Every one of the kinds are checked by pros and satisfy state and federal needs.

Should you be presently listed, log in to your account and click on the Obtain button to get the Alabama Stock Option Agreement of Intraware, Inc.. Make use of account to look with the legal kinds you possess bought earlier. Check out the My Forms tab of the account and obtain another backup of your papers you will need.

Should you be a brand new user of US Legal Forms, allow me to share simple recommendations that you can follow:

- First, be sure you have chosen the correct kind for the area/area. You may examine the form making use of the Preview button and look at the form explanation to make certain this is basically the right one for you.

- When the kind will not satisfy your expectations, use the Seach industry to discover the right kind.

- When you are certain that the form is suitable, go through the Buy now button to get the kind.

- Opt for the rates prepare you need and enter in the needed info. Create your account and purchase the order with your PayPal account or Visa or Mastercard.

- Opt for the document format and download the legal papers design to your product.

- Total, edit and print and indication the obtained Alabama Stock Option Agreement of Intraware, Inc..

US Legal Forms is definitely the greatest collection of legal kinds in which you can discover numerous papers layouts. Use the company to download appropriately-made documents that follow express needs.

Form popularity

FAQ

A stock option provides an employee with the opportunity to purchase a set number of shares of company stock at a certain price within a certain period of time. The price is called the ?grant price? or ?strike price.? This price is usually based on a discounted price of the stock at the time of hire. 10 Tips About Stock Option Agreements When Evaluating a ... Melmed Law Group P.C. ? how-to-evaluate-stoc... Melmed Law Group P.C. ? how-to-evaluate-stoc...

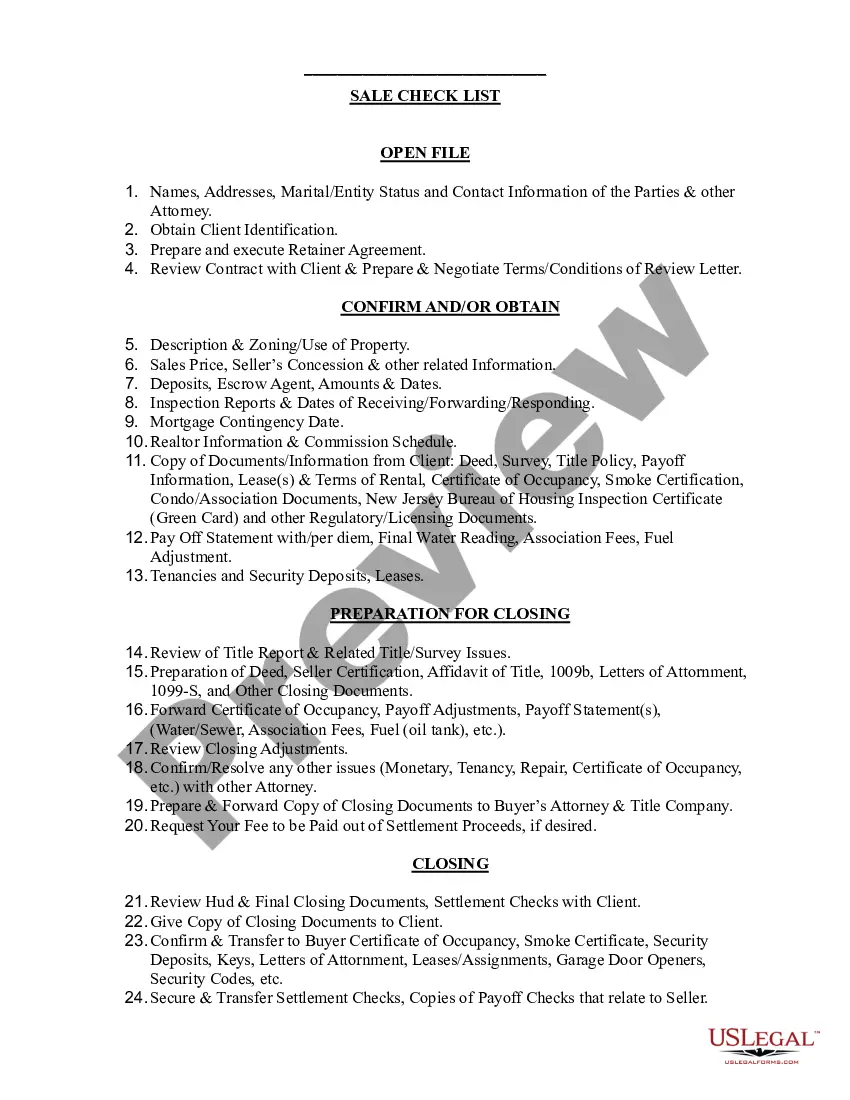

A. The Key Documents Stock Option Plan. This is the overarching general plan that is adopted by the startup regarding issuances of stock options. ... Stock Option Agreement. ... Exercise Agreement. ... Dates. ... Number and Type of Shares. ... Exercise Price. ... Type of Option. ... Vesting Schedule. Stock Options for Employees - Startup Legal Stuff startuplegalstuff.com ? stock-options-for-em... startuplegalstuff.com ? stock-options-for-em...

The value of the options is typically determined using Black-Scholes or similar valuation formulas, which take into account such factors as the number of years until the option expires, prevailing interest rates, the volatility of the stock price, and the stock's dividend rate. What You Need to Know About Stock Options - Harvard Business Review hbr.org ? 2000/03 ? what-you-need-to-know-abo... hbr.org ? 2000/03 ? what-you-need-to-know-abo...

A share vesting agreement (SVA) is a contract between a business and an employee, whereby the employee is provided with new shares that vest over time. These agreements lay out the terms and conditions regarding vested shares, as well as the options in relation to vesting. What is a Share Vesting Agreement? - OpenLegal openlegal.com.au ? what-is-a-share-vesting-agree... openlegal.com.au ? what-is-a-share-vesting-agree...

For example, you may be granted the right to buy 1,000 shares, with the options vesting 25% per year over four years with a term of 10 years. So 25% of the ESOs, conferring the right to buy 250 shares would vest in one year from the option grant date, another 25% would vest two years from the grant date, and so on. Employee Stock Options (ESOs): A Complete Guide - Investopedia investopedia.com ? terms ? eso investopedia.com ? terms ? eso

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees. Stock Options Explained: What You Need to Know - Carta carta.com ? blog ? equity-101-stock-option-basics carta.com ? blog ? equity-101-stock-option-basics

A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the ?exercise? or ?strike price.? You take actual ownership of granted options over a fixed period of time called the ?vesting period.? When options vest, it means you've ?earned? them, though you still need to ... What are stock options & how do they work? - Empower empower.com ? the-currency ? money ? ho... empower.com ? the-currency ? money ? ho...

Deciding when to exercise stock options should be largely dictated by your vesting schedule. Vesting criteria restrict your ability to cash in on your options until you meet certain thresholds, which are typically based on your tenure at a company or performance level. Strategies for when to exercise your stock options - Empower empower.com ? the-currency ? work ? strat... empower.com ? the-currency ? work ? strat...