Alabama Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc.

Description

How to fill out Plan Of Merger Between Stamps.Com, Inc., Rocket Acquisition Corp. And Iship.Com, Inc.?

Are you presently in the place where you will need documents for either business or personal reasons virtually every working day? There are a lot of legal file layouts available online, but getting kinds you can depend on isn`t effortless. US Legal Forms offers a huge number of type layouts, much like the Alabama Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc., which are published to fulfill state and federal demands.

If you are currently familiar with US Legal Forms internet site and also have your account, merely log in. Following that, you may obtain the Alabama Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc. design.

If you do not offer an profile and would like to start using US Legal Forms, abide by these steps:

- Obtain the type you need and ensure it is for that proper metropolis/area.

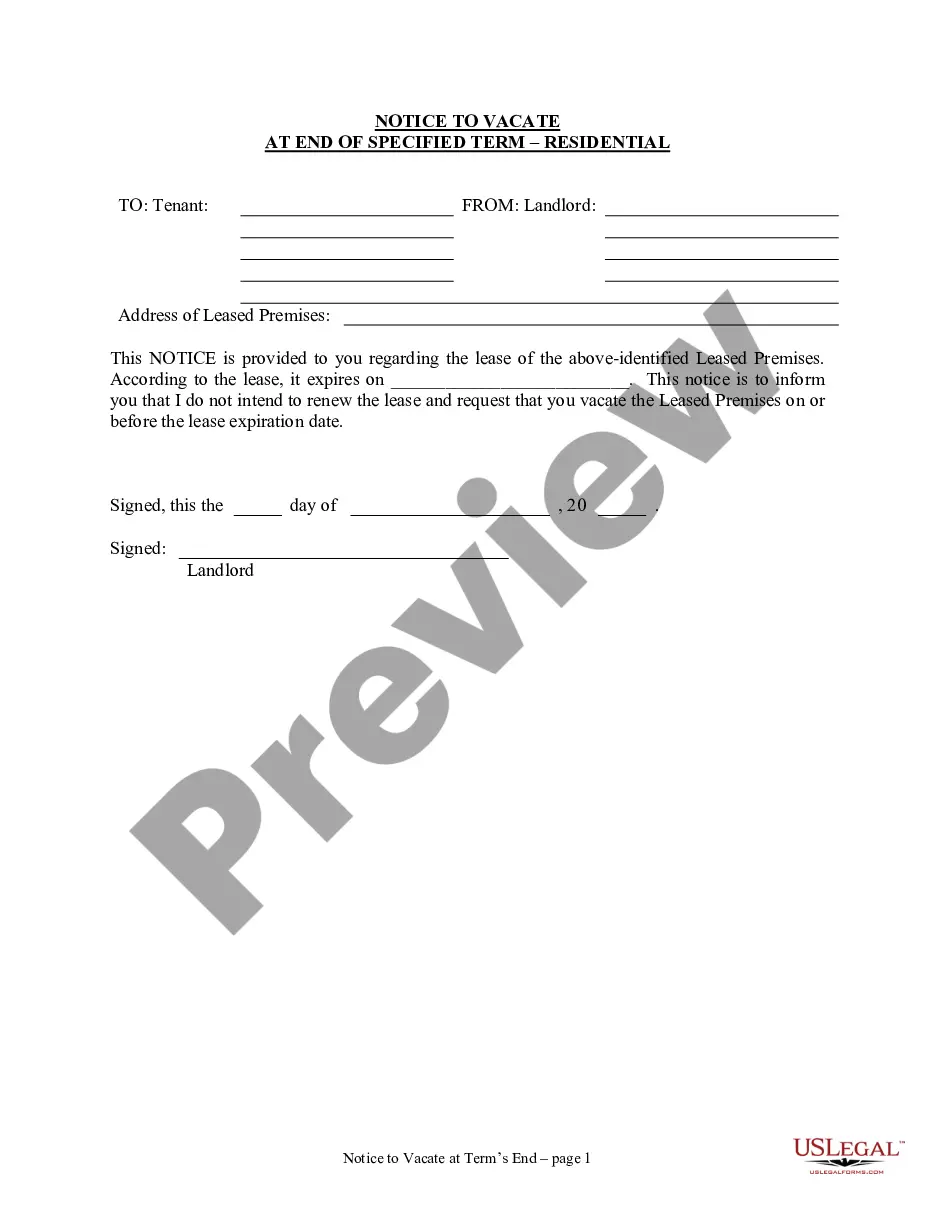

- Make use of the Preview key to examine the shape.

- Read the information to actually have chosen the right type.

- If the type isn`t what you`re searching for, use the Research area to discover the type that meets your requirements and demands.

- If you discover the proper type, just click Purchase now.

- Opt for the rates plan you would like, complete the specified details to make your account, and pay money for the order making use of your PayPal or charge card.

- Pick a handy paper format and obtain your version.

Locate every one of the file layouts you possess bought in the My Forms food list. You can aquire a extra version of Alabama Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc. whenever, if needed. Just select the required type to obtain or print the file design.

Use US Legal Forms, probably the most extensive assortment of legal forms, to save lots of time and prevent mistakes. The support offers appropriately created legal file layouts that can be used for a range of reasons. Generate your account on US Legal Forms and commence creating your way of life easier.

Form popularity

FAQ

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).

After that, I'll also very briefly introduce you to several other common mergers and acquisitions (M&A) transaction documents, including: Confidentiality Agreements. Letters of Intent. Exclusivity Agreements. Disclosure Schedules. HSR Filings. Third Party Consents. Legal Opinions. Stock Certificates.

There are two basic merger structures: direct and indirect. In a direct merger, the target company and the buying company directly merge with each other. In an indirect merger, the target company will merge with a subsidiary company of the buyer.

The Company and each of its subsidiaries is duly organized, validly existing and in good standing (with respect to jurisdictions that recognize the concept of good standing) under the laws of the jurisdiction of its organization and has all requisite corporate or similar power and authority to own, lease and operate ...

12.2 Merger Clause. This Agreement and the other agreements, documents or instruments contemplated hereby shall constitute the entire agreement between the Parties, and shall supersede all prior agreements, understandings and negotiations between the Parties with respect to the subject matter hereof.

Parts of merger and acquisition contracts ?Parties and recitals. ?Price, currencies, and structure. ?Representations and warranties. ?Covenants. ?Conditions. ?Termination provisions. ?Indemnification. ?Tax.