Alabama Letter to Debt Collector - Only call me on the following days and times

Description

How to fill out Letter To Debt Collector - Only Call Me On The Following Days And Times?

You can spend considerable time online seeking the valid document template that meets the federal and state specifications you need.

US Legal Forms offers a vast array of valid forms that are reviewed by experts.

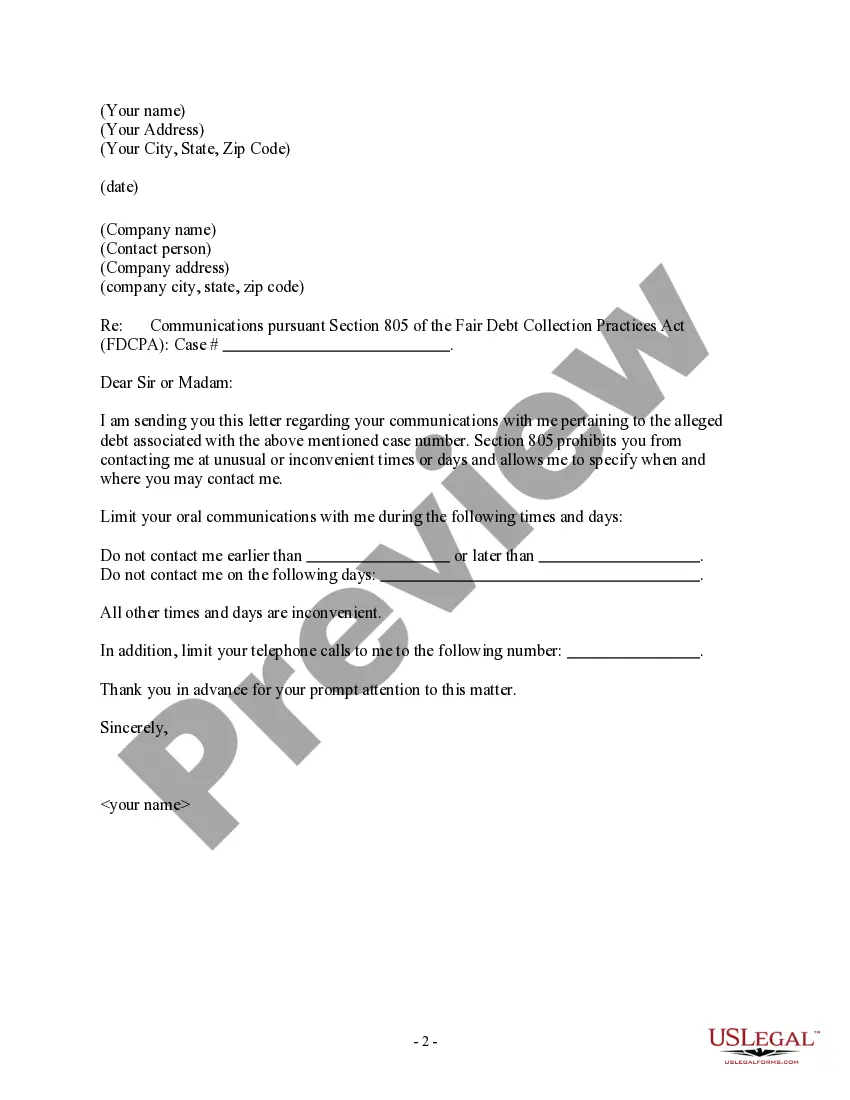

You can acquire or print the Alabama Letter to Debt Collector - Only contact me on the following days and times through your service.

If available, utilize the Preview button to view the document template as well.

- If you already hold a US Legal Forms account, you can sign in and click the Download button.

- After that, you can complete, modify, print, or sign the Alabama Letter to Debt Collector - Only contact me on the following days and times.

- Every valid document template you obtain is permanently yours.

- To get an additional copy of any purchased form, visit the My documents tab and click on the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for your county/town that you choose.

- Review the form details to confirm you have selected the right one.

Form popularity

FAQ

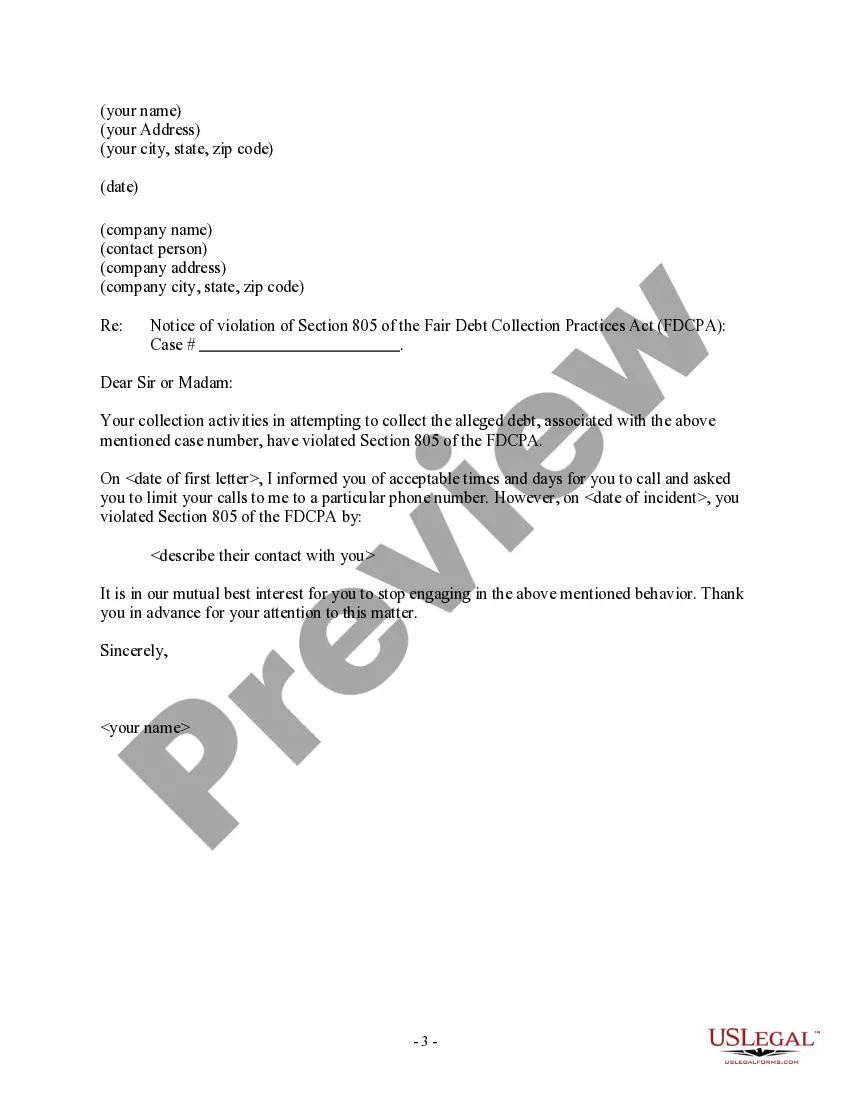

According to the FDCPA, a debt collector cannot call a debtor more than once per day for each debt. This means that if you only have one outstanding debt, then your debt collector is only allowed to call you one time per day.

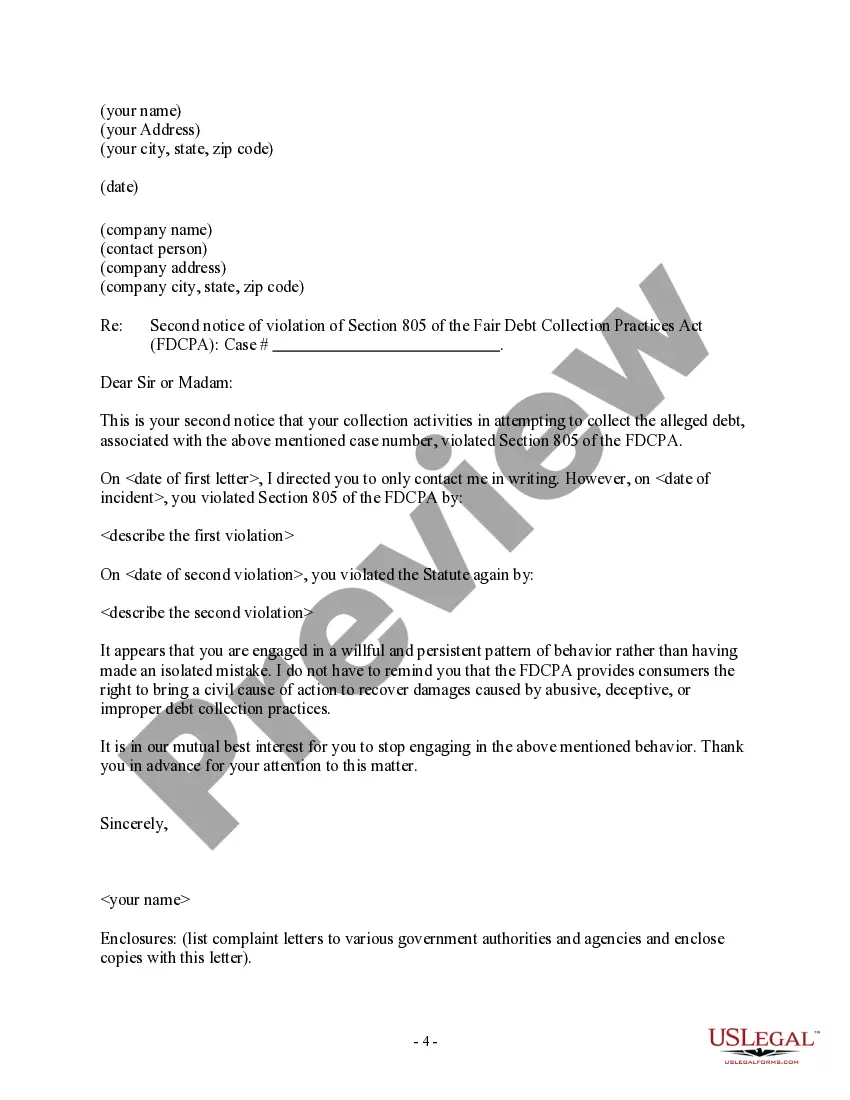

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Dear debt collector: Pursuant to my rights under the state and federal fair debt collection laws, I hereby request that you immediately cease all calls to your phone number in relation to the account of wrong person's full name. This is the wrong number to contact that person.

Cease and desist letters are legally binding notices to debt collectors telling them to stop contacting you. You don't need a lawyer for this -- just get your debt collector's name, address, and your account information and write a letter telling them to stop all contact, and by law, they have to do so.

Also, debt collectors can't call you numerous times a day. Doing so is considered a form of harassment by the Federal Trade Commission (FTC) and is explicitly not allowed.

Does disputing a debt restart the clock? Disputing the debt doesn't restart the clock unless you admit that the debt is yours. You can get a validation letter in an effort to dispute the debt to prove that the debt is either not yours or is time-barred.

Even if the debt is yours, you still have the right not to talk to the debt collector and you can tell the debt collector to stop calling you. However, telling a debt collector to stop contacting you does not stop the debt collector or creditor from using other legal ways to collect the debt from you if you owe it.

Generally, debt collectors cannot call you at an unusual time or place, or at a time or place they know is inconvenient to you and they are prohibited from contacting you before 8 a.m. or after 9 p.m.

Under the FDCPA, you can tell a debt collector to stop contacting you; but it's not always a good idea. The federal Fair Debt Collection Practices Act (FDCPA) gives you the right to force a debt collector to stop communicating with you.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.