Alabama Purchase by company of its stock

Description

How to fill out Purchase By Company Of Its Stock?

Choosing the best legitimate papers design might be a have a problem. Obviously, there are plenty of templates available on the net, but how would you discover the legitimate kind you require? Utilize the US Legal Forms internet site. The services gives a large number of templates, like the Alabama Purchase by company of its stock, that can be used for enterprise and personal needs. All the forms are examined by professionals and meet state and federal needs.

If you are presently registered, log in in your account and click on the Obtain key to find the Alabama Purchase by company of its stock. Make use of account to look throughout the legitimate forms you have bought earlier. Check out the My Forms tab of the account and obtain another copy of the papers you require.

If you are a brand new consumer of US Legal Forms, listed here are basic instructions so that you can follow:

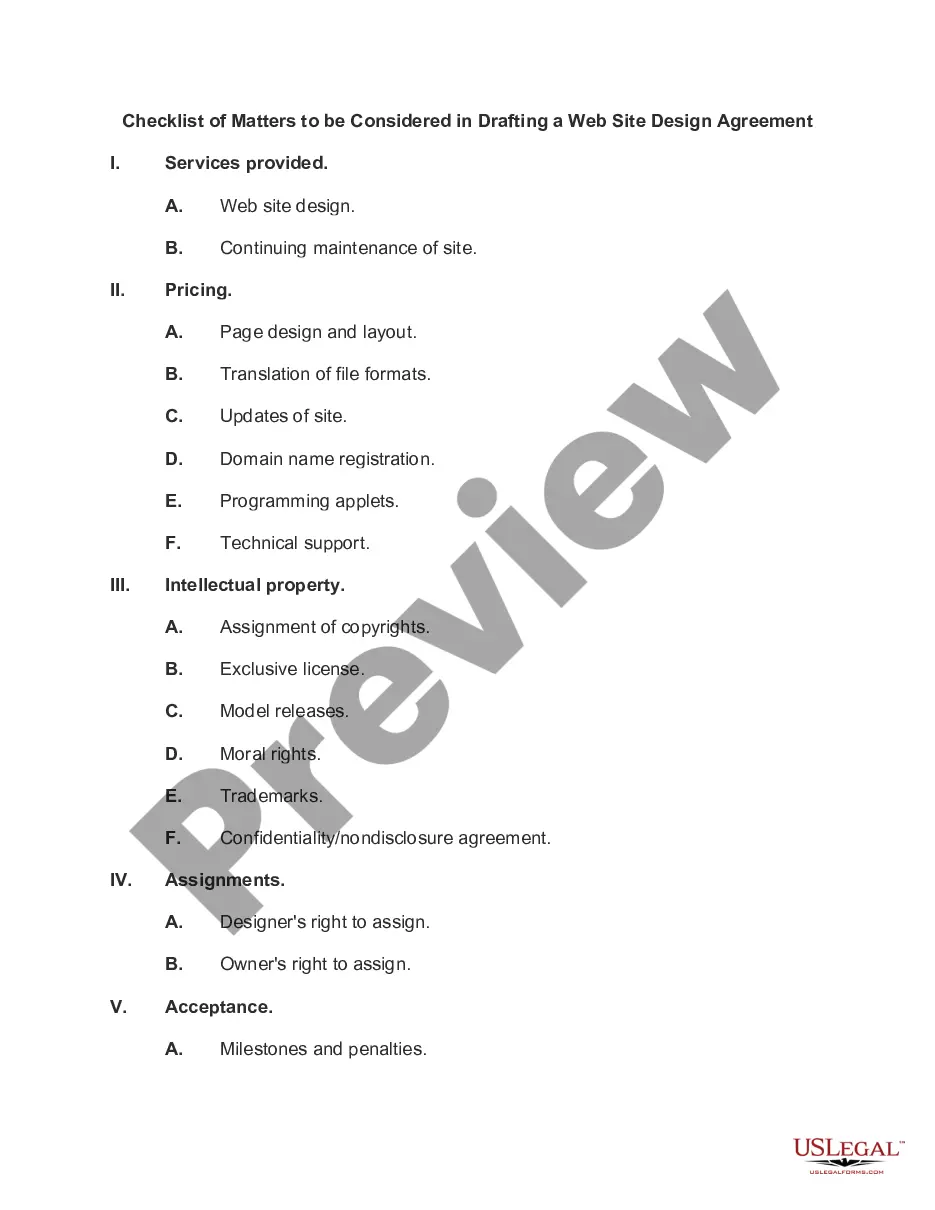

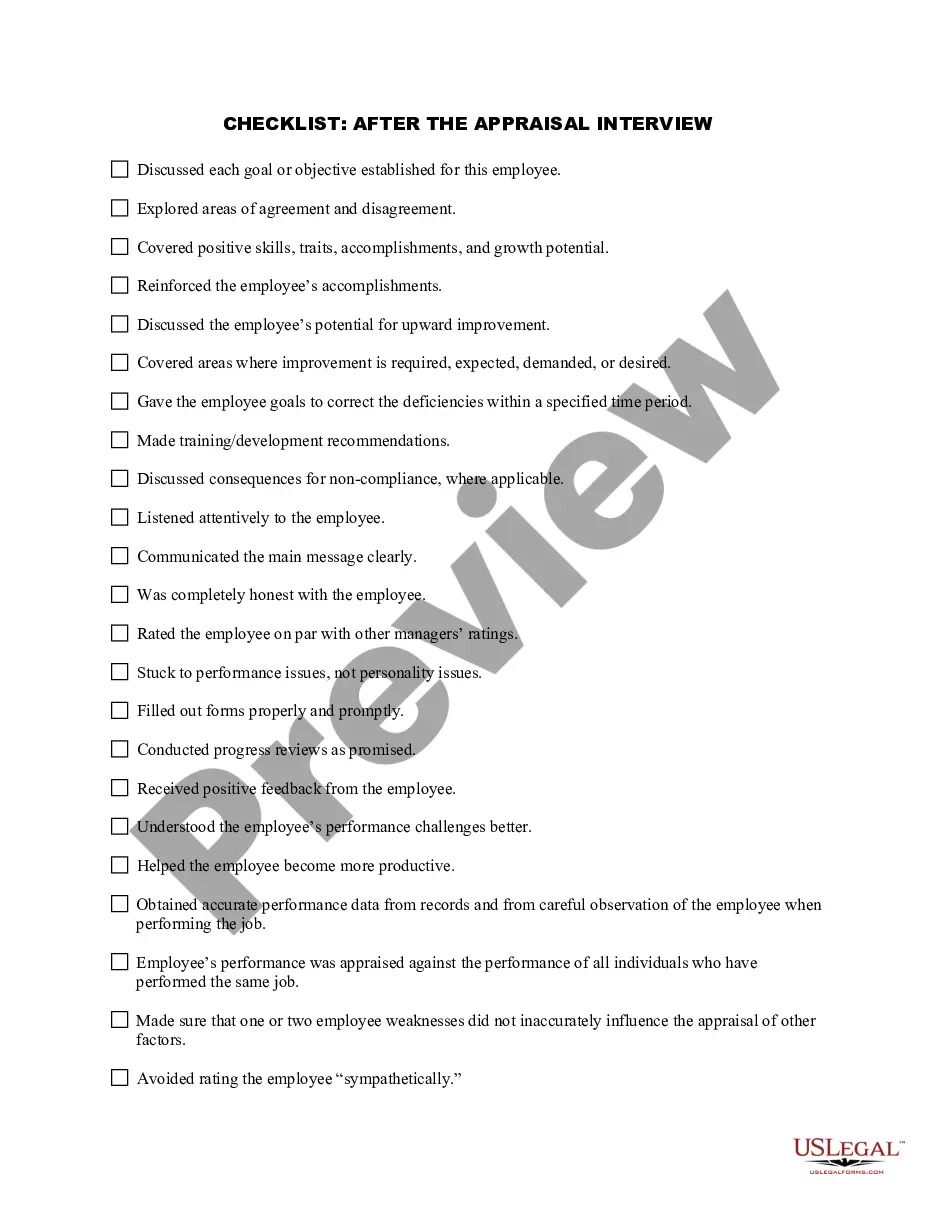

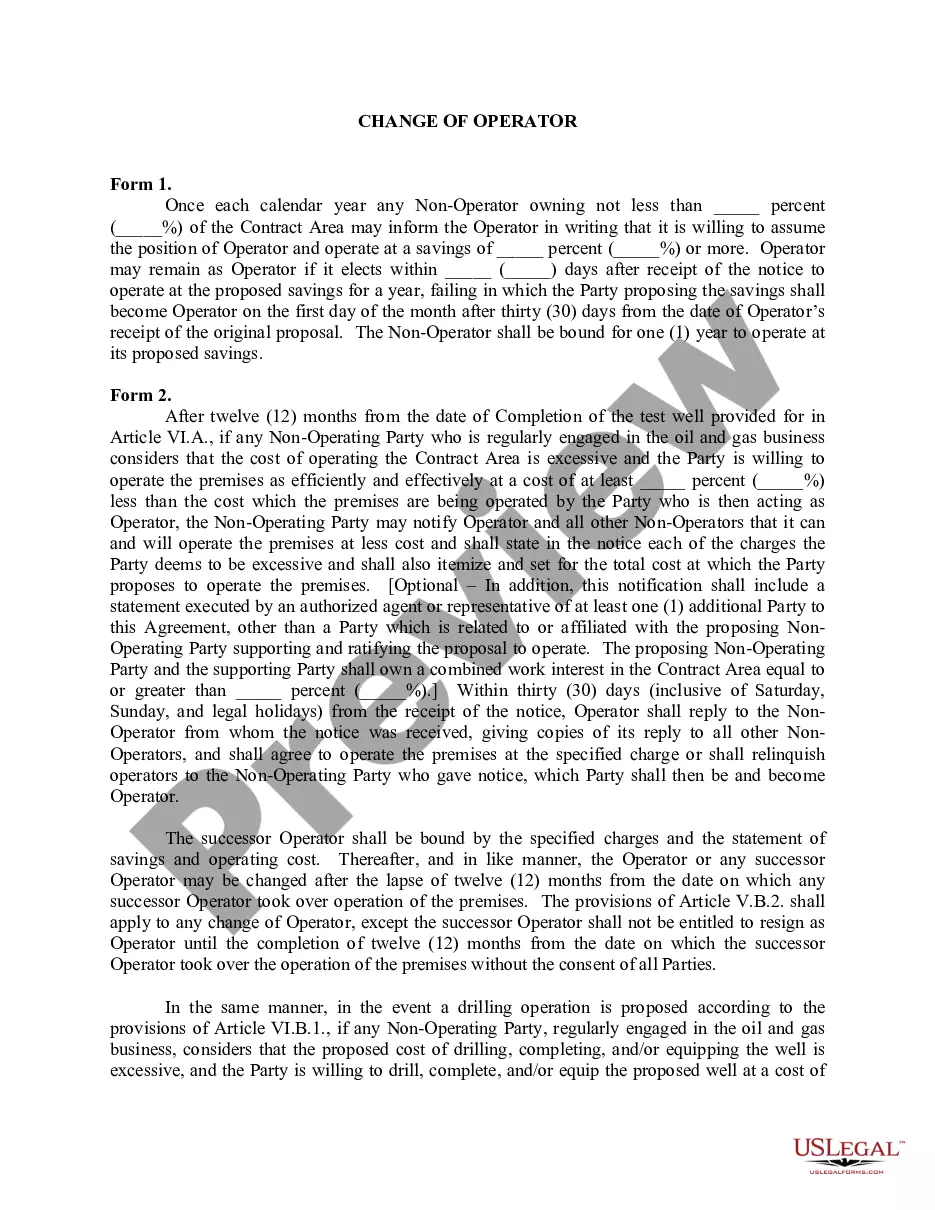

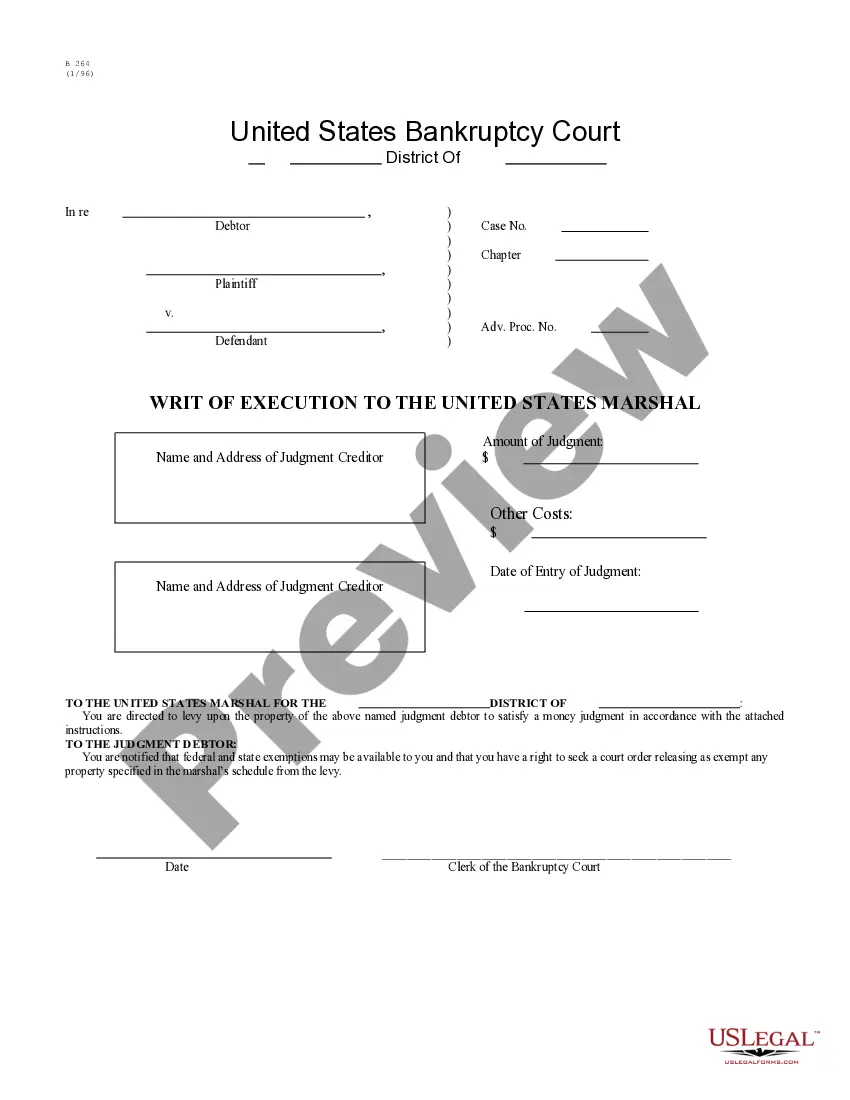

- First, make certain you have selected the proper kind to your city/state. You may look over the form while using Review key and browse the form outline to ensure it will be the right one for you.

- When the kind will not meet your expectations, utilize the Seach industry to get the correct kind.

- Once you are certain that the form is acceptable, click on the Purchase now key to find the kind.

- Select the rates strategy you need and enter the essential information. Create your account and pay money for your order utilizing your PayPal account or charge card.

- Select the submit format and down load the legitimate papers design in your product.

- Complete, change and print out and indication the acquired Alabama Purchase by company of its stock.

US Legal Forms may be the largest catalogue of legitimate forms in which you can find different papers templates. Utilize the company to down load appropriately-produced documents that follow state needs.

Form popularity

FAQ

Business Privilege Tax Rate The tax rate for business privilege tax is graduated based on the entity's federal taxable income apportioned to Alabama. The rates range from $0.25 to $1.75 for each $1,000 of net worth in Alabama.

Ing to the Alabama business privilege tax law, every corporation, limited liability entity, and disregarded entity doing business in Alabama or organized, incorporated, qualified, or registered under the laws of Alabama is required to file an Alabama Business Privilege Tax Return and Annual Report.

PPT ? S Corps, Limited Liability Companies, and PLLCs file a PPT form for their business privilege tax. The PPT form also includes the AL-, which is used for the annual report. Both are filed with Alabama's Department of Revenue.

C Corporations will need to file ?Form CPT? and S Corporations/Limited Liability Entities will need to file ?Form PPT.? If you own a C or S corporation, you'll be required to attach an Alabama Annual Report (Schedule AL-CAR) to your tax return. Again, this form does not apply to Limited Liability Entities.

Minimum privilege tax is $100; plus the $10 Secretary of State annual report fee for corporations. For the taxable year beginning after December 31, 2022, taxpayers who would otherwise be subject to the minimum tax due of $100 shall pay $50 in lieu thereof.

Ing to the Alabama business privilege tax law, every corporation, limited liability entity, and disregarded entity doing business in Alabama or organized, incorporated, qualified, or registered under the laws of Alabama is required to file an Alabama Business Privilege Tax Return and Annual Report.

The penalty for failure to timely file an Alabama business privilege tax return by the due date is 10% of the tax shown due with the return or $50, whichever is greater.