Alabama Checklist for Proving Entertainment Expenses

Description

How to fill out Checklist For Proving Entertainment Expenses?

Are you currently in a situation where you need documents for either professional or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can rely on is not easy.

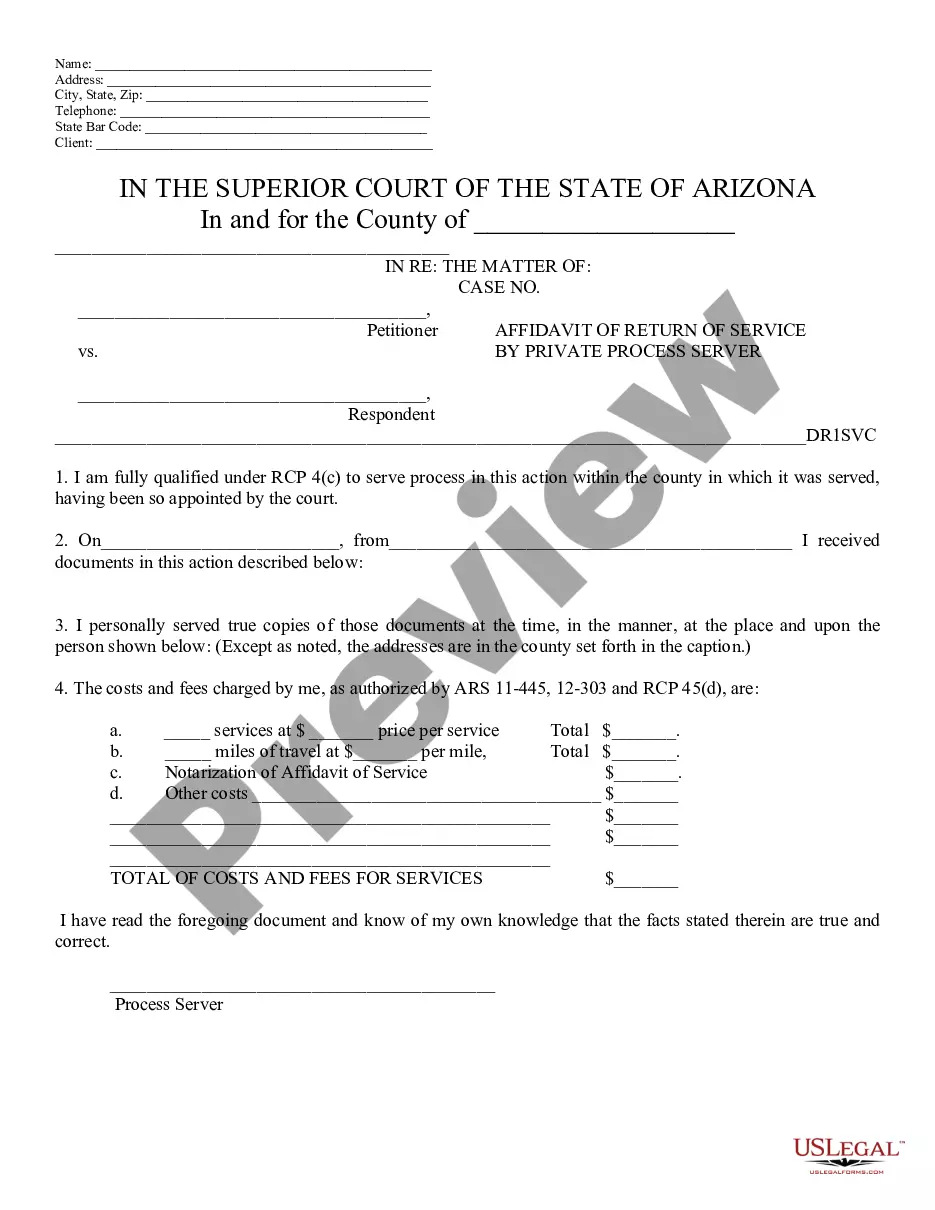

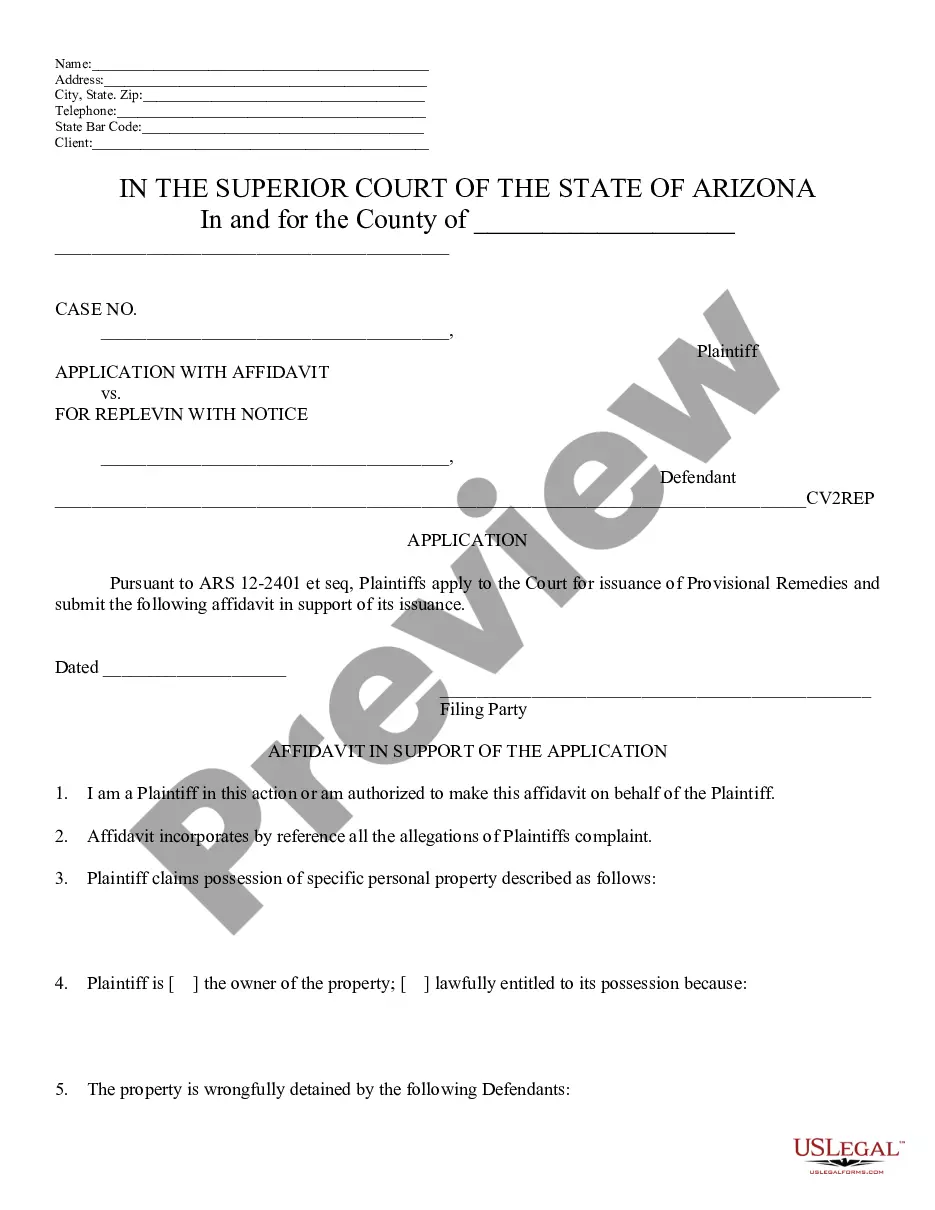

US Legal Forms offers thousands of form templates, including the Alabama Checklist for Proving Entertainment Expenses, which are designed to meet state and federal requirements.

Once you find the right form, click Purchase now.

Select the pricing plan you prefer, fill in the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Alabama Checklist for Proving Entertainment Expenses template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/area.

- Use the Preview option to review the form.

- Check the information to confirm you have selected the right form.

- If the form is not what you're looking for, use the Search section to find a form that matches your needs.

Form popularity

FAQ

Entertaining clients (concert tickets, golf games, etc.) Wondering how this breaks down? If you're dining out with a client at a restaurant, you can consider that meal 100% tax-deductible. However, if you're entertaining that same client in-office with snacks purchased at a grocery store, the meal is 50% deductible.

If you paid taxes on any of the following items during the last tax year, you could deduct them from your taxable income:Real estate taxes.FICA tax (Social security and Medicare)Federal self-employment taxes.Railroad retirement tax.City, county, and occupational tax.State unemployment insurance tax.Federal gift taxes.More items...?

Tax relief for staff entertaining Staff entertaining is generally considered to be an allowable business expense and is therefore tax deductible. Allowable costs in this context include food, drink, entertainment, venue hire, transport and overnight accommodation.

Depending on a number of factors, such as filing status, some Alabama taxpayers may claim a standard deduction of up to $7,500. But the standard deduction for most taxpayers in the state is $2,000 ($4,000 for joint filers).

If you have to pay FBT on the entertainment expense, then you can claim it as a business expense and it will reduce your taxable income. If you do not pay FBT on your entertainment expense, you cannot claim it as a business expense and therefore cannot use it to reduce your taxable income.

Eligible expenses that can be deducted as state and local income taxes include: Withholding for state and local income taxes, as shown on your Form W-2 or Form 1099. Estimated tax payments you made during the year. Extension tax payments you made during the year.

This temporary 100% deduction was designed to help restaurants, many of which have been hard-hit by the COVID-19 pandemic. Entertainment expenses, like a sporting event or tickets to a show, are still non-deductible. However, team-building activities for employees are deductible.

We have two bookkeeping recommendations for expenses: Travel expenses should be completely separate from entertainment, including meals while traveling. Travel expenses are 100% deductible, except for meals while traveling, which are 50% deductible in 2020 but 100% deductible in 2021/22.

Home office expenses.Vehicle and travel expenses.Clothing, laundry and dry-cleaning.Education.Industry-related deductions.Other work-related expenses.Gifts and donations.Investment income.

If you paid taxes on any of the following items during the last tax year, you could deduct them from your taxable income:Real estate taxes.FICA tax (Social security and Medicare)Federal self-employment taxes.Railroad retirement tax.City, county, and occupational tax.State unemployment insurance tax.Federal gift taxes.More items...?