Statutory Guidelines [Appendix A(4) IRC 468B] regarding special rules for designated settlement funds.

Alabama Special Rules for Designated Settlement Funds IRS Code 468B

Description

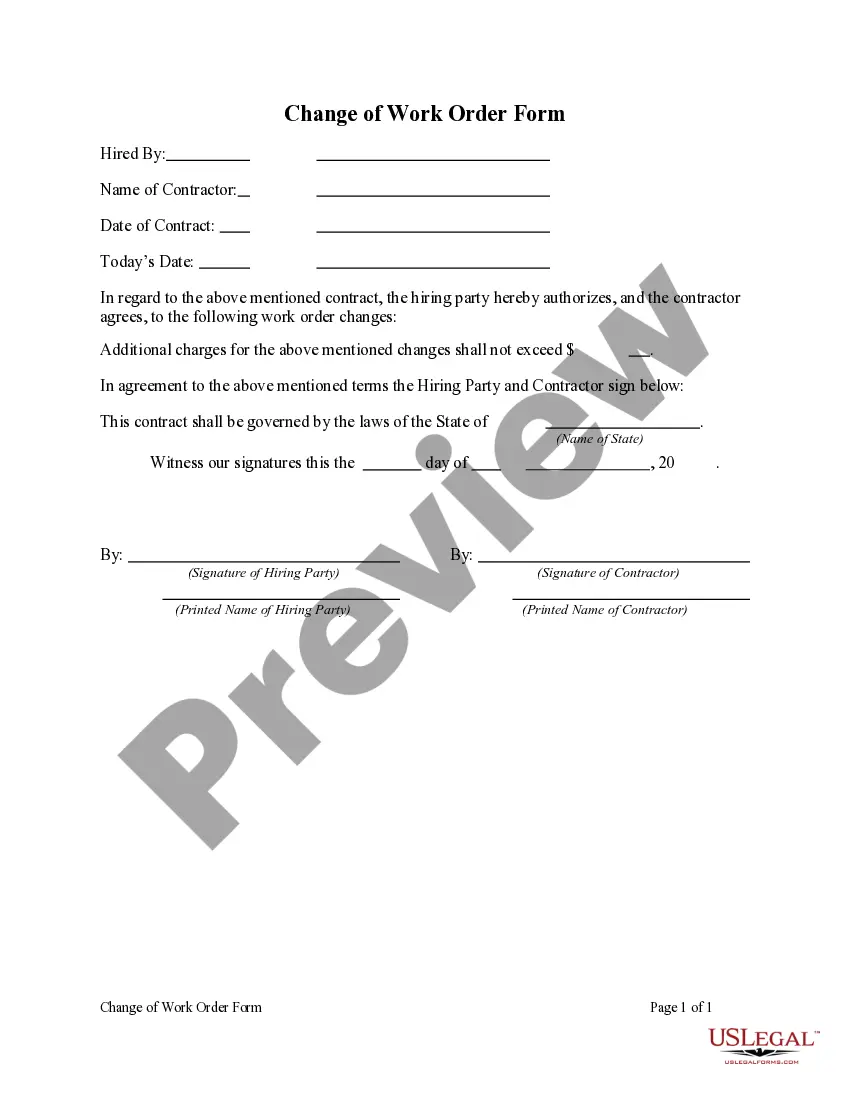

How to fill out Special Rules For Designated Settlement Funds IRS Code 468B?

You are able to devote several hours on the web looking for the authorized document web template that fits the state and federal needs you want. US Legal Forms offers 1000s of authorized varieties which are examined by professionals. You can easily acquire or printing the Alabama Special Rules for Designated Settlement Funds IRS Code 468B from your support.

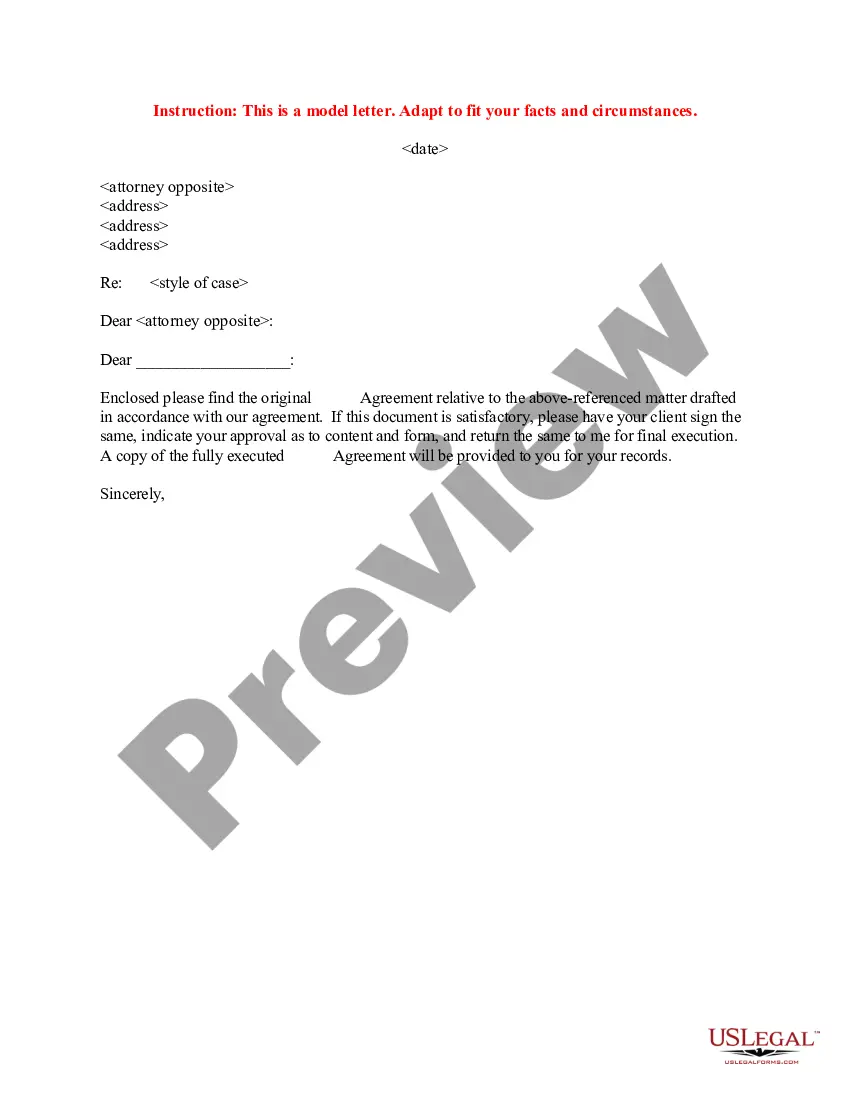

If you already have a US Legal Forms profile, it is possible to log in and click the Acquire option. Next, it is possible to comprehensive, modify, printing, or sign the Alabama Special Rules for Designated Settlement Funds IRS Code 468B. Each and every authorized document web template you buy is your own property for a long time. To obtain yet another duplicate of any obtained form, visit the My Forms tab and click the corresponding option.

If you use the US Legal Forms web site for the first time, follow the basic directions listed below:

- First, make sure that you have selected the correct document web template for the region/metropolis of your choosing. Look at the form description to ensure you have selected the right form. If available, utilize the Review option to search through the document web template also.

- If you want to get yet another model of your form, utilize the Search area to discover the web template that meets your needs and needs.

- Upon having identified the web template you want, click on Purchase now to move forward.

- Find the costs prepare you want, type your accreditations, and register for an account on US Legal Forms.

- Total the purchase. You can use your bank card or PayPal profile to pay for the authorized form.

- Find the file format of your document and acquire it for your product.

- Make changes for your document if necessary. You are able to comprehensive, modify and sign and printing Alabama Special Rules for Designated Settlement Funds IRS Code 468B.

Acquire and printing 1000s of document layouts using the US Legal Forms web site, which provides the biggest selection of authorized varieties. Use professional and express-distinct layouts to tackle your organization or individual demands.

Form popularity

FAQ

The benefits of a QSF for an attorney include: More time to plan for contingency fees using attorney fee deferral. Affording clients extra time to implement settlement planning strategies and comply with government benefits income thresholds.

A QSF is assigned its own Employer Identification Number from the IRS. A QSF is taxed on its modified gross income[v] (which does not include the initial deposit of money), at a maximum rate of 35%.

A qualified settlement fund (QSF), commonly referred to as a 468B Trust, is a legal mechanism used in mass tort lawsuits to expedite the administration and distribution of settlement payments. A QSF is essentially a temporary ?holding tank? for the proceeds of a settlement.

A Qualified Settlement Fund (QSF) allows tax payers involved in litigation to receive settlement funds and potentially avoid tax ramifications until the funds are otherwise paid to the taxpayer. Often times a QSF is used in mass tort or other types of class action litigation.

How do law firms establish qualified settlement funds? Be established pursuant to a court order and is subject to continuing jurisdiction of the court (26 CFR § 1.468B(c)). Resolve one or more contested claims arising out of a tort, breach of contract, or violation of law. A trust under applicable state law.

Internal Revenue Code (IRC) § 468B provides for the taxation of designated settlement funds and directs the Department of the Treasury to prescribe regulations providing for the taxation of an escrow account, settlement fund, or similar fund, whether as a grantor trust or otherwise.

A Qualified Settlement Fund (QSF) is a trust used to accept settlement proceeds from the defendant(s) or insurance company in cases with one or more claims.

§ 1.468B?1 Qualified settlement funds. If a fund, account, or trust that is a qualified settlement fund could be classified as a trust within the meaning of §301.7701?4 of this chapter, it is classified as a qualified settlement fund for all purposes of the Internal Revenue Code (Code).