Alabama Vehicle Policy

Description

How to fill out Vehicle Policy?

Have you entered a location where you are required to have documentation for potential organization or specific objectives almost every day.

There are numerous legal document templates accessible online, but finding reliable ones isn't straightforward.

US Legal Forms offers thousands of document templates, such as the Alabama Vehicle Policy, designed to meet state and federal regulations.

Once you find the right form, click on Acquire now.

Choose the pricing plan you prefer, enter the necessary information to create your account, and complete the payment with your PayPal or credit card.

- If you are currently acquainted with the US Legal Forms site and already have an account, simply Log In.

- Then, you can download the Alabama Vehicle Policy template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the document you require and ensure it corresponds to your correct area/county.

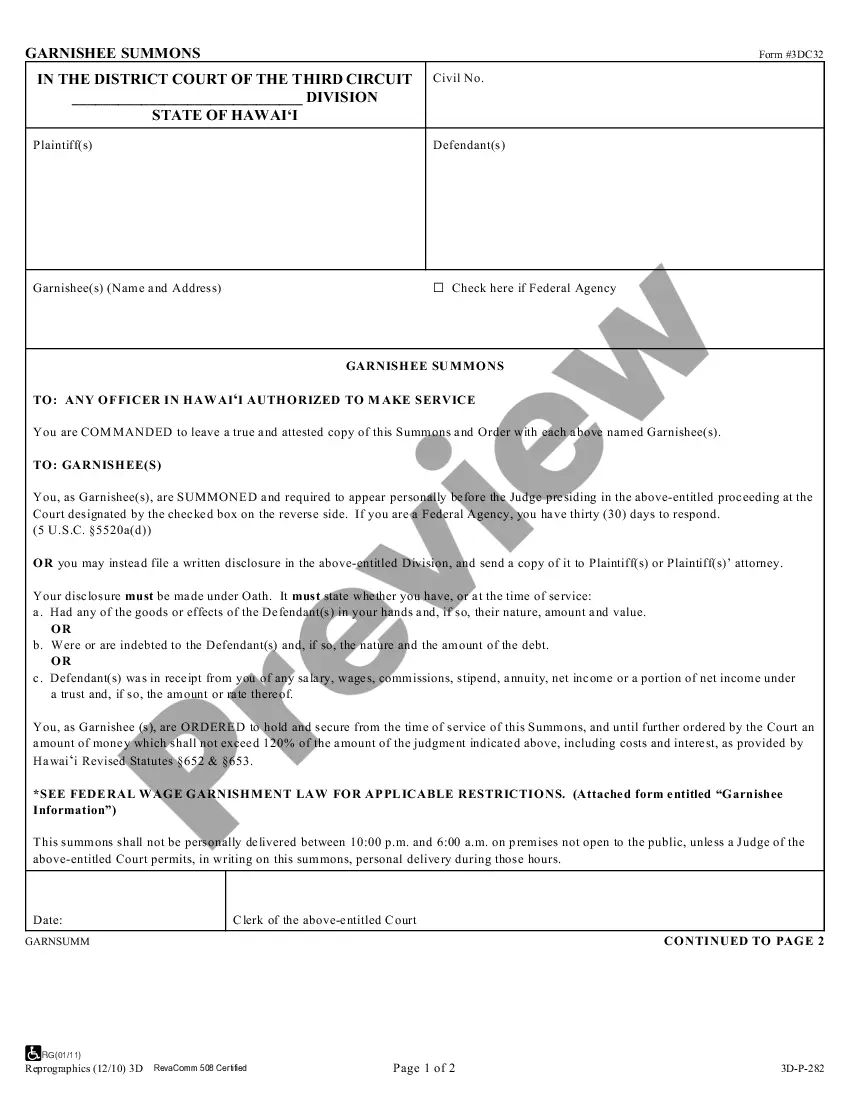

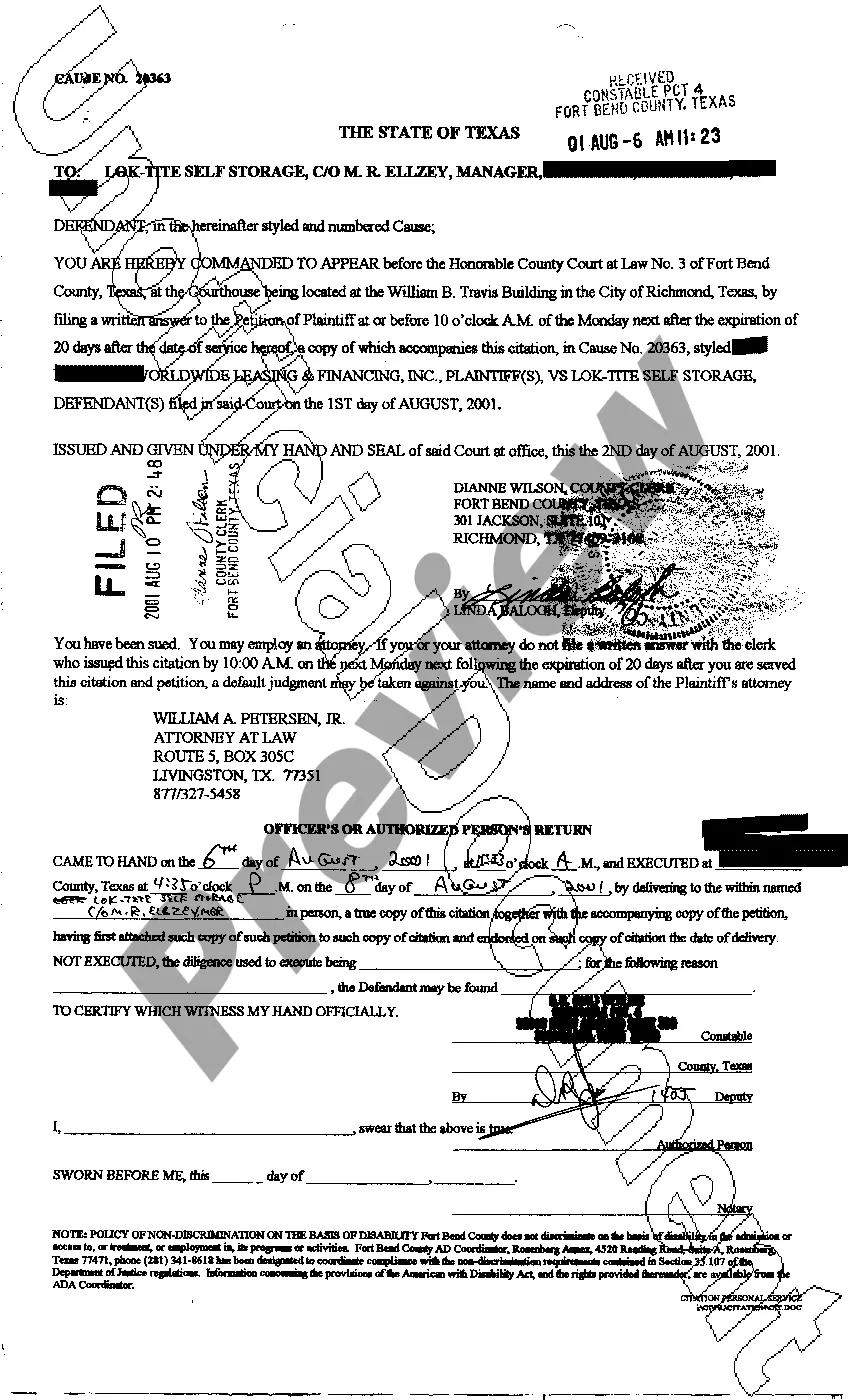

- Utilize the Review button to evaluate the form.

- Check the description to confirm you have chosen the correct document.

- If the form isn't what you seek, use the Lookup field to find a form that fits your needs.

Form popularity

FAQ

No, you cannot register your car in Alabama with out-of-state insurance. Alabama Vehicle Policy requires that insurance coverage be issued by a provider licensed to operate in Alabama. Make sure to obtain Alabama-based insurance before attempting to register your vehicle to ensure a smooth process.

Alabama is not a no-fault state, but a personal injury lawyer can help you get compensation after a car accident.

Alabama drivers are required to carry liability coverage at minimum, which includes protections for bodily injury and property damage. Physical damage coverage includes collision and comprehensive insurance, which protect your car if it's damaged in a collision or an incident other than a collision.

In general, you have only two years to file a lawsuit for a car accident claim in Alabama. If you wait until the statute of limitations has passed, the court will likely bar you from recovery. That means you will collect nothing for your injuries, physical damages, or pain and suffering.

Alabama's mandatory liability insurance law has been in effect 2000.

No, personal injury protection (PIP) is not required in Alabama. PIP is not even available in Alabama. Instead of PIP insurance, Alabama insurance companies offer medical payments insurance (sometimes called MedPay), which helps with hospital bills resulting from a car accident.

Alabama car insurance laws require all drivers to carry bodily injury liability and property damage coverage. Driving without this minimum level of insurance can lead to expensive fines and jail time.

According to Ala. Traffic Code § 32-7-23, Alabama drivers do not have to have personal injury protection (PIP) coverage. This is the insurance commonly used in no-fault states. Instead, Alabama is a tort state, where the at-fault driver must cover the victims' expenses and losses.

To register and operate a vehicle in Alabama, your auto insurance coverage must meet the following minimum requirements: Bodily injury liability: $25,000 per person and $50,000 per accident. Property damage liability: $25,000 per person.

Alabama is not a no-fault state, but a personal injury lawyer can help you get compensation after a car accident.