Alabama Assignment of Personal Property

Description

How to fill out Assignment Of Personal Property?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the most recent versions of documents such as the Alabama Assignment of Personal Property in just a few minutes.

If the form does not meet your requirements, utilize the Search area at the top of the screen to find one that does.

If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select your preferred pricing plan and provide your information to create an account.

- If you have a monthly subscription, Log In to download the Alabama Assignment of Personal Property from the US Legal Forms library.

- The Download button will appear for each form you view.

- You can find all previously obtained forms within the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

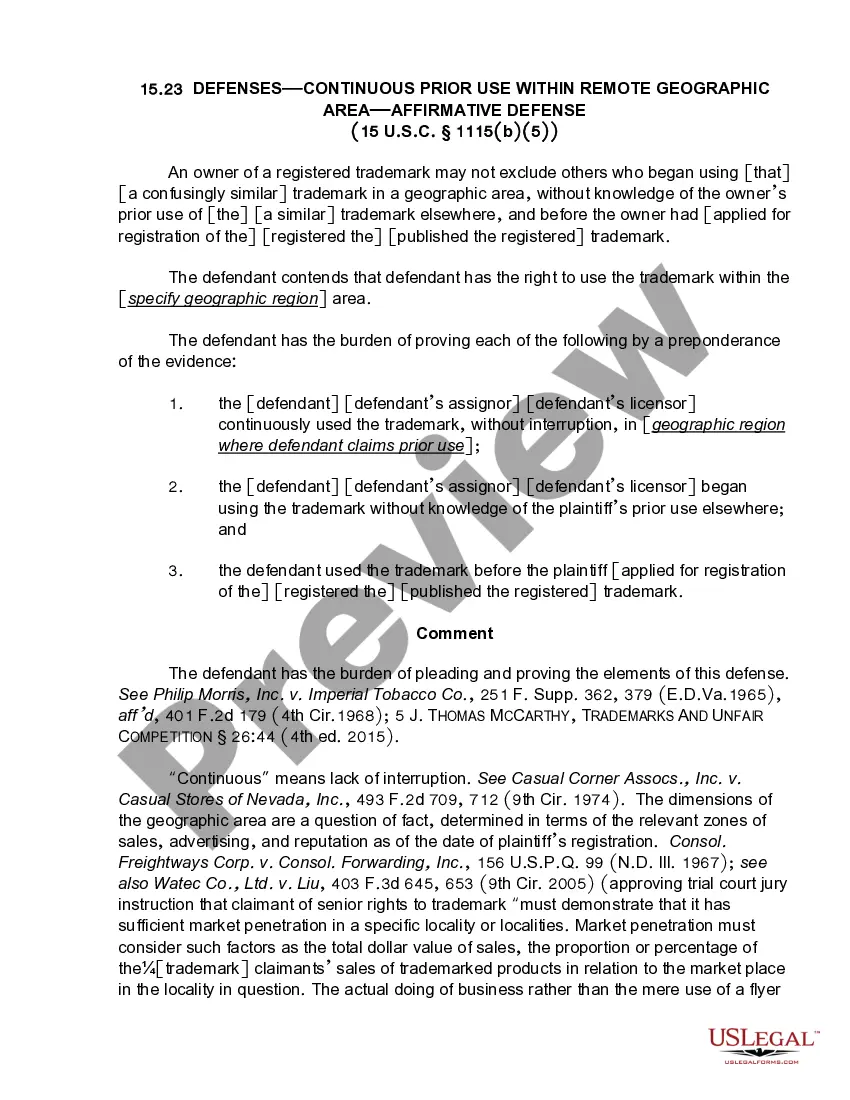

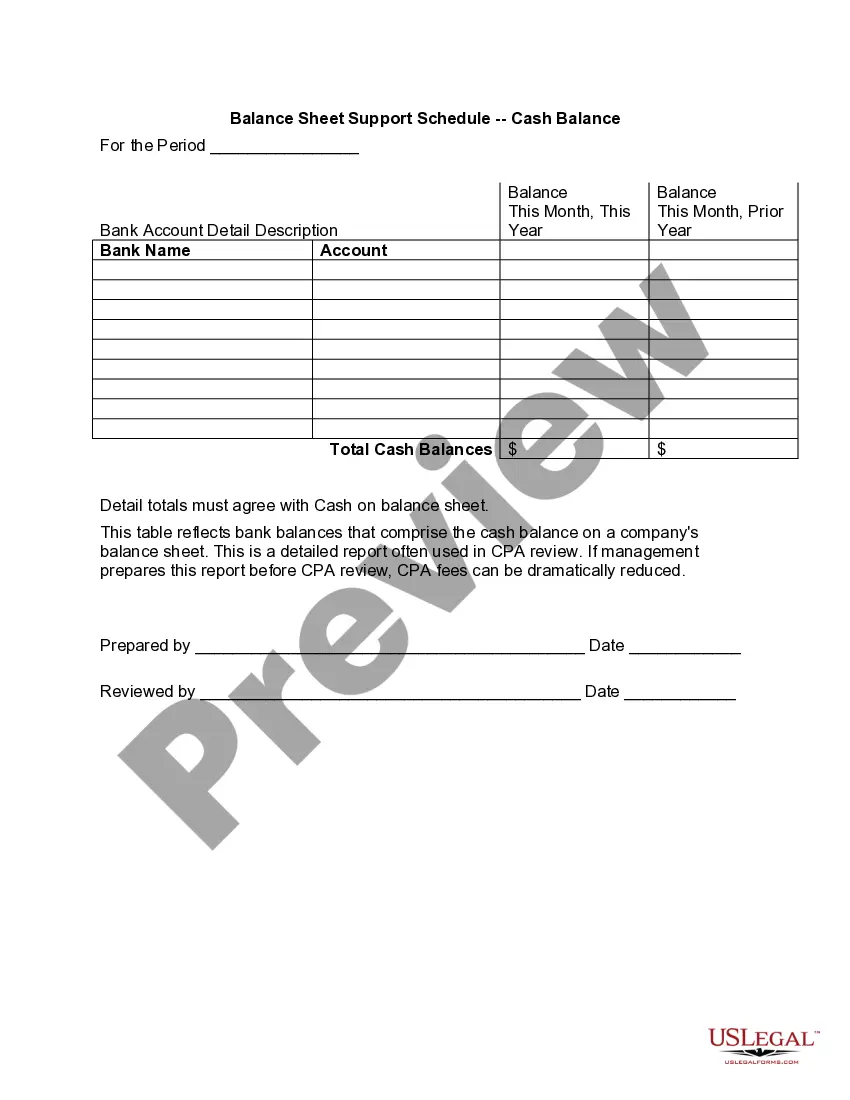

- Ensure you have selected the correct form for your city/state. Click the Preview button to review the form's content.

- Check the form details to confirm that you have chosen the right form.

Form popularity

FAQ

Do I have to pay property taxes? If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax.

(4) Computer software is tangible personal property. The retail sale or licensure of computer software is subject to Sales Tax, Use Tax, or Rental Tax, whether the transaction is effected by a transfer of title, possession, or a license to use or consume.

Most states include in their regulations lists of items which they consider tangible personal property when sold by a contractor. Examples includes: window treatments, most appliances, window air conditioners, tacked down carpet, and other items which can be removed without damage to the structure.

Assessed Value fixed by Alabama Constitution Amendment 373 of the Constitution provides that all real and taxable personal property will be assessed at 20% of its fair market value.

Tangible personal property exists physically (i.e., you can touch it) and can be used or consumed. Clothing, vehicles, jewelry, and business equipment are examples of tangible personal property.

The real estate transfer tax is paid to a local or state agency to transfer real property from one owner to another. The buyer cannot take ownership of the property until the transfer tax has been paid. In Alabama, the transfer tax is usually paid by the buyer.

III. All agricultural, forest, and single-family owner occupied residential property, including owner occupied residential manufactured homes located on land owned by the manufactured home owner, and historic building and sites.

Alabama imposes a transfer tax on each deed, bill of sale, or other instrument that conveys real property in Alabama and that is received for record. The tax amount is 2022 $. 50, if the property value is $500 or less; and 2022 $.

Tangible personal property includes material items such as machinery and equipment, tools, furniture and fixtures, and other items used in a business activity. Tangible personal property is taxable to businesses for Alabama property tax purposes.

The seller is liable for the real estate transfer tax, although it is not uncommon for an agreement to be reached for the buyer to pay the tax. Some states require that the buyer pay the tax if the seller does not pay it or is exempt from paying it.