Alabama Final Notice of Past Due Account

Description

How to fill out Final Notice Of Past Due Account?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides an assortment of legal document templates that you can obtain or customize.

Utilizing the website, you can retrieve thousands of forms for both business and personal use, organized by categories, states, or keywords. You can access the latest versions of forms such as the Alabama Final Notice of Past Due Account within seconds.

If you currently hold a subscription, Log In and obtain the Alabama Final Notice of Past Due Account from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously obtained forms within the My documents section of your account.

Complete the purchase. Use a credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, and print and sign the obtained Alabama Final Notice of Past Due Account.

Every template you add to your account doesn't have an expiration date and belongs to you permanently. Therefore, if you want to obtain or print another copy, simply navigate to the My documents section and click on the form you desire.

Access the Alabama Final Notice of Past Due Account with US Legal Forms, the largest repository of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal requirements.

- Ensure you have selected the appropriate form for your region/locale.

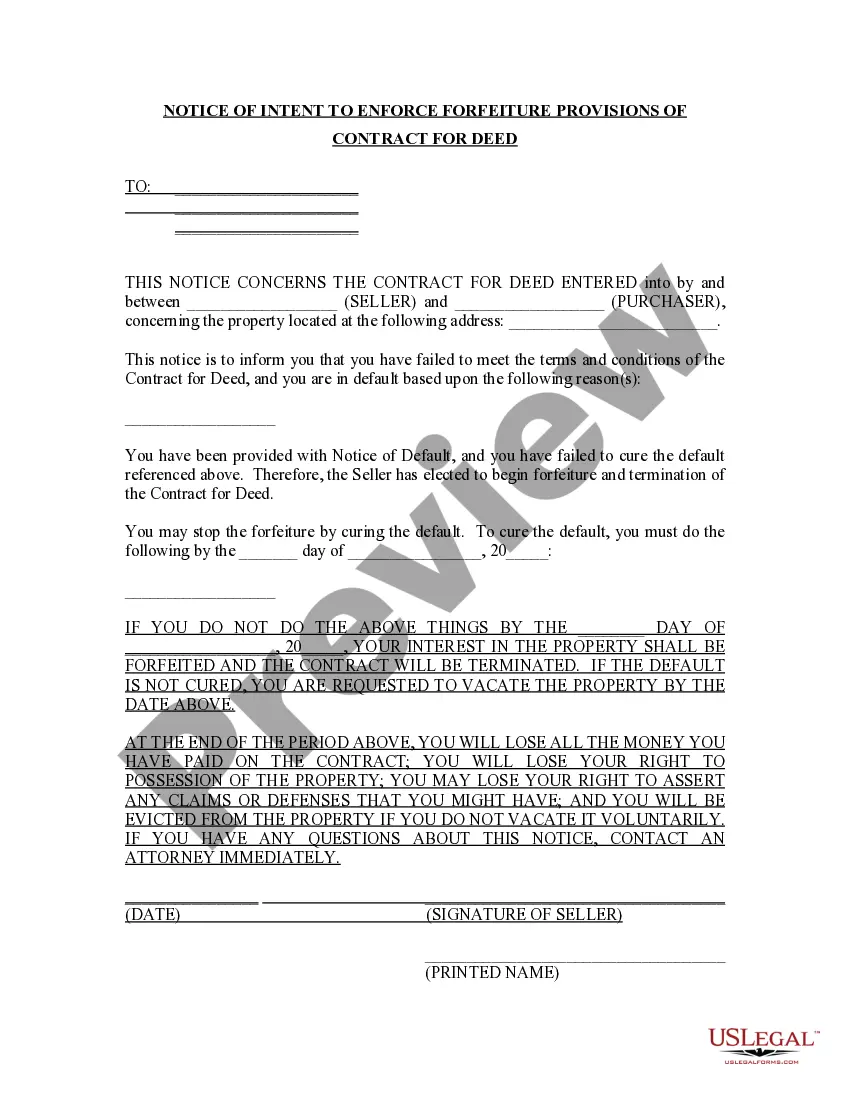

- Click on the Review button to examine the content of the form.

- Read the form details to confirm that you have selected the correct form.

- If the form does not meet your requirements, utilize the Search field at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the pricing plan that suits you and provide your information to register for an account.

Form popularity

FAQ

To check the status of your Alabama state taxes, you can visit the Alabama Department of Revenue's website. They offer online services where you can enter your details to see the status of your return or any outstanding balance. If you have received an Alabama Final Notice of Past Due Account, reviewing your status regularly can help you stay proactive in resolving any tax issues.

The Alabama Department of Revenue administers over 50 different state and local taxes. Most of the taxes administered by the Revenue Department will affect busi- nesses only.

In most cases, the Department has three years from the date a tax return is due or filed, whichever is later, to audit your tax return and assess any additional tax, penalty, and interest due. A taxpayer also generally has three years to claim a refund of any tax overpaid.

Time Limitations A taxpayer also generally has three years to claim a refund of any tax overpaid. However, if the tax was paid by withholding or estimated payments, and you failed to timely file a return, any refund must be claimed within two years from the original due date of the return.

B. Preliminary Assessment Notice (PAN)/Formal Letter of Demand and Final Assessment Notice (FLD/FAN) The issued PAN shall contain the computation of the deficiency tax, as well as the facts on which the proposed deficiency is based.

Our purpose is to supervise and control the valuation, equalization, assessment of property, and collection of all Ad Valorem taxes.

The Alabama Department of Revenue has implemented increased security measures to protect Alabamians and the state from identity theft and fraud. If you have received a notice asking you to complete an ID Confirmation Quiz, you're in the right place.

Where's My Alabama State Tax RefundState: Alabama.Refund Status Website: Status Phone Support: 1-855-894-7391.Hours: Mon. Fri. a.m. 5: 00 p.m.General Information: 1-334-242-1175.2020 State Tax Filing Deadline: 4/15/2021.

How to find information on state-issued checks, tax refunds and moreAlabama Department of Revenue. (334) 309-2612. Website.Department of Human Resources (DHR) Public Assistance. (334) 242-9485. Website.State Comptroller's Office. (334) 242-7063. Website.

How to find information on state-issued checks, tax refunds and moreAlabama Department of Revenue. (334) 309-2612. Website.Department of Human Resources (DHR) Public Assistance. (334) 242-9485. Website.State Comptroller's Office. (334) 242-7063. Website.