Alabama Receipt for Balance of Account

Description

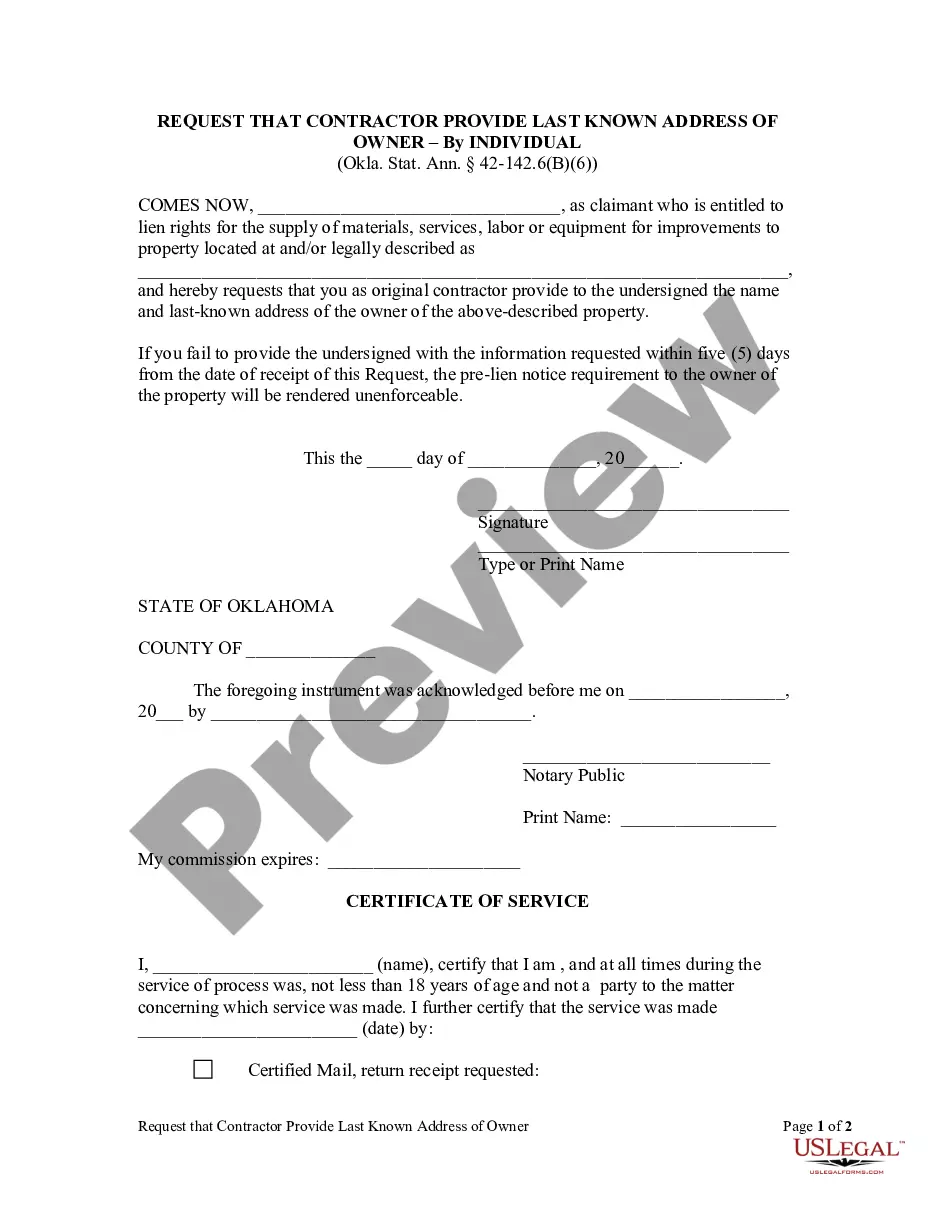

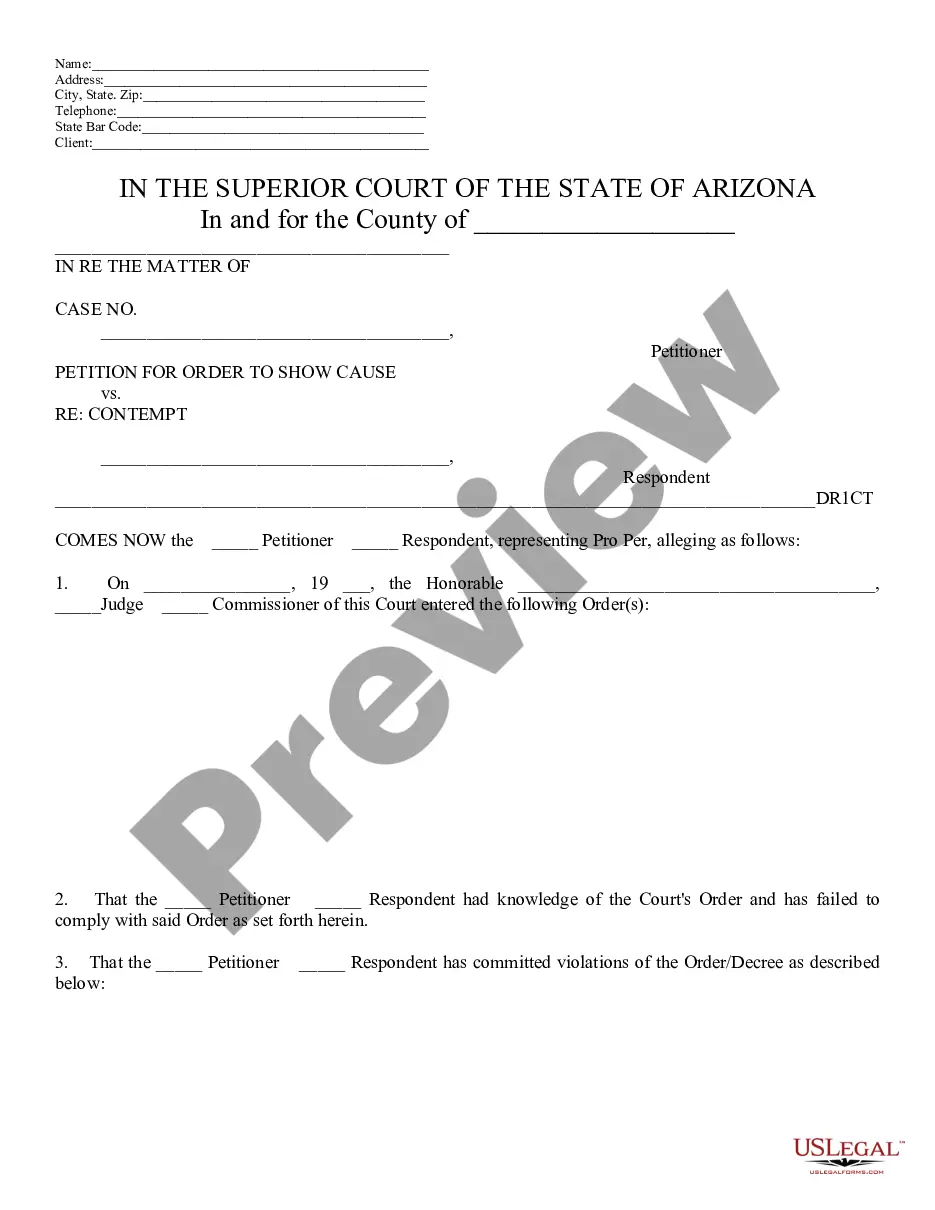

How to fill out Receipt For Balance Of Account?

Locating the appropriate legal document template can be challenging. Naturally, there are numerous online templates available, but how can you find the legal form that you require? Utilize the US Legal Forms website.

This service offers countless templates, including the Alabama Receipt for Balance of Account, which can be utilized for both business and personal purposes. All forms are vetted by experts and comply with state and federal regulations.

If you are already a registered user, Log In to your account and click the Download button to obtain the Alabama Receipt for Balance of Account. Use your account to browse through the legal forms you have purchased previously. Navigate to the My documents section of your account and download an additional copy of the document you require.

Complete, modify, print, and sign the downloaded Alabama Receipt for Balance of Account. US Legal Forms is the leading repository of legal forms where you can find various document templates. Utilize the service to obtain professionally crafted documents that adhere to state regulations.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, confirm that you have selected the correct form for your location. You can review the form using the Review button and check the form summary to ensure it meets your needs.

- If the form does not satisfy your requirements, use the Search field to find the appropriate form.

- Once certain that the form is accurate, click the Purchase now button to acquire the form.

- Select the pricing plan you prefer and fill in the necessary details. Create your account and pay for the purchase using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

Our purpose is to supervise and control the valuation, equalization, assessment of property, and collection of all Ad Valorem taxes.

How to find information on state-issued checks, tax refunds and moreAlabama Department of Revenue. (334) 309-2612. Website.Department of Human Resources (DHR) Public Assistance. (334) 242-9485. Website.State Comptroller's Office. (334) 242-7063. Website.

The Alabama Department of Revenue has implemented increased security measures to protect Alabamians and the state from identity theft and fraud. If you have received a notice asking you to complete an ID Confirmation Quiz, you're in the right place.

Collection Services This division acts as an in-house collection agency for the Alabama Department of Revenue. When the taxpayer's assessment reaches the Collection Services Division, the tax liability already has the full force and effect of a court judgment.

If there is a question about your return, you may receive a request for information letter that asks for missing or additional information or a tax computation change letter that provides explanation of changes made to the tax return.

Where's My Alabama State Tax RefundState: Alabama.Refund Status Website: Status Phone Support: 1-855-894-7391.Hours: Mon. Fri. a.m. 5: 00 p.m.General Information: 1-334-242-1175.2020 State Tax Filing Deadline: 4/15/2021.

In most cases, the Department has three years from the date a tax return is due or filed, whichever is later, to audit your tax return and assess any additional tax, penalty, and interest due. A taxpayer also generally has three years to claim a refund of any tax overpaid.

How to find information on state-issued checks, tax refunds and moreAlabama Department of Revenue. (334) 309-2612. Website.Department of Human Resources (DHR) Public Assistance. (334) 242-9485. Website.State Comptroller's Office. (334) 242-7063. Website.

ACH Debit: Taxpayers who have an account with the Alabama Department of Revenue may register and make e-payments using My Alabama Taxes. Signing up or using MAT, call the MAT Help Desk toll free at 1-800-322-4106 and select the appropriate option for your needs.

Time Limitations In most cases, the Department has three years from the date a tax return is due or filed, whichever is later, to audit your tax return and assess any additional tax, penalty, and interest due.