Alabama Worksheet for Making a Budget

Description

How to fill out Worksheet For Making A Budget?

Have you ever found yourself in a situation where you require documentation for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, yet sourcing reliable ones isn't straightforward.

US Legal Forms provides a vast array of form templates, including the Alabama Worksheet for Creating a Budget, which can be printed to meet state and federal regulations.

Once you find the right form, click Download now.

Choose your preferred pricing plan, fill in the necessary details to create your account, and complete your purchase using PayPal or a credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Alabama Worksheet for Creating a Budget template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

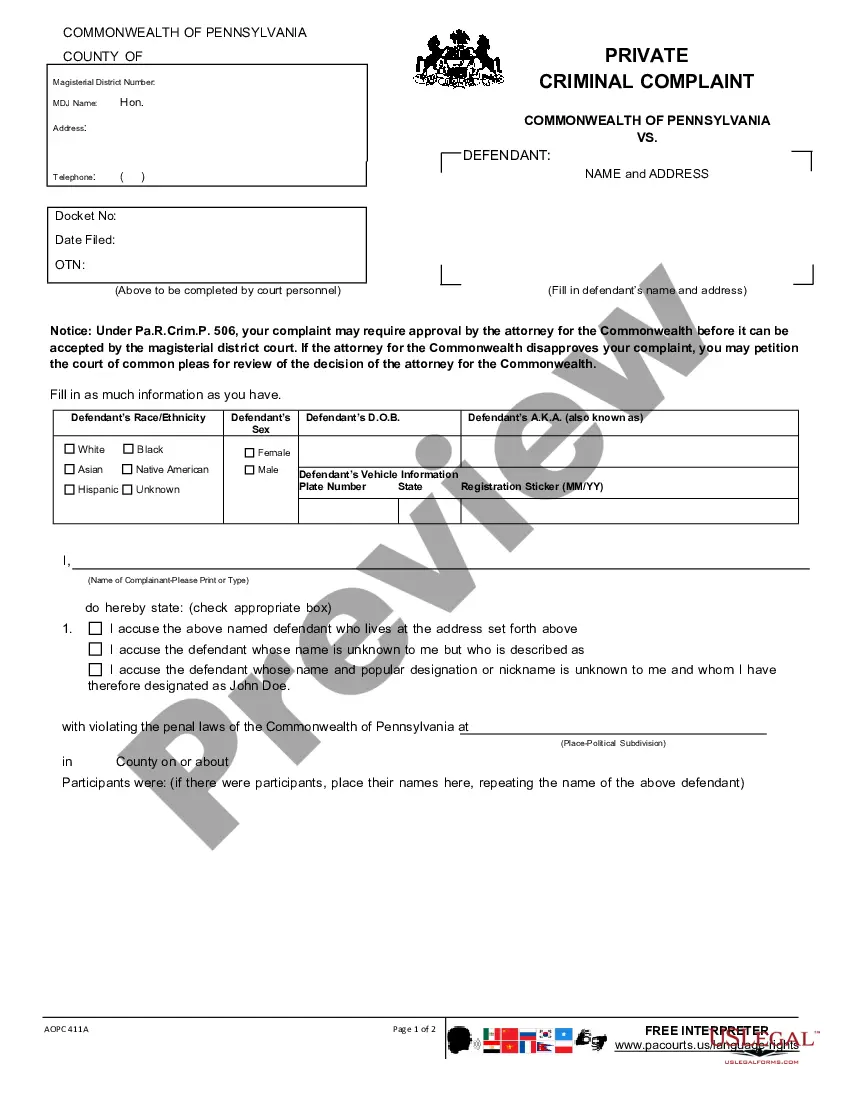

- Use the Preview button to review the form.

- Check the description to confirm that you have selected the correct document.

- If the form isn't what you require, use the Search section to locate the form that meets your needs.

Form popularity

FAQ

How to Create a Monthly Budget in 6 StepsTOTAL YOUR MONTHLY TAKE-HOME PAY.ADD UP WHAT YOU SPEND ON FIXED EXPENSES.ADD UP WHAT YOU SPEND ON NON-MONTHLY COSTS.ADD UP CONTRIBUTIONS TO FINANCIAL GOALS.ADD UP YOUR DISCRETIONARY SPENDING.DO SOME SIMPLE MATH.

5 Steps to Creating a BudgetStep 1: Determine Your Income. This amount should be your monthly take-home pay after taxes and other deductions.Step 2: Determine Your Expenses.Step 3: Choose Your Budget Plan.Step 4: Adjust Your Habits.Step 5: Live the Plan.

10 Things to Include in Your Budget SpreadsheetItem #1- Housing Payment.Item #2- Costs Associated With Your Residence.Item #3- Emergency Fund.Item #4- General Savings Fund.Item #5- Gifts.Item #6- Debt Payments.Item #7- Entertainment Expenses.Item #8- Clothes and Accessories.More items...?

How to Make a Budget Plan: 6 Easy StepsSelect your budget template or application.Collect all your financial paperwork or electronic bill information.Calculate your monthly income.Establish a list of your monthly expenses.Categorize your expenses and designate spending values.Adjust your budget accordingly.

Follow the steps below as you set up your own, personalized budget:Make a list of your values. Write down what matters to you and then put your values in order.Set your goals.Determine your income.Determine your expenses.Create your budget.Pay yourself first!Be careful with credit cards.Check back periodically.

Following the 70/20/10 rule of budgeting, you separate your take-home pay into three buckets based on a specific percentage. Seventy percent of your income will go to monthly bills and everyday spending, 20% goes to saving and investing and 10% goes to debt repayment or donation.

Budget Expense Item CategoriesStaff by position. Record approximate salaries and hours for each job.Benefits.Travel.Fees for training.Consultants and specialists.Meeting expenses.Rent/utilities.Periodicals/written materials/software subscriptions.More items...

How to Build a Budget from ScratchDetermine your after tax income.Calculate your total monthly expenses.Set your savings goalHave fun with the rest.Track your progress and adjust as you go along.Determine your after tax income.Calculate your total monthly expenses.Set your savings goal.More items...

Senator Elizabeth Warren popularized the so-called "50/20/30 budget rule" (sometimes labeled "50-30-20") in her book, All Your Worth: The Ultimate Lifetime Money Plan. The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings.

How to make a monthly budget: 5 stepsCalculate your monthly income. The first step when building a monthly budget is to determine how much money you make each month.Spend a month or two tracking your spending.Think about your financial priorities.Design your budget.Track your spending and refine your budget as needed.