Alabama Personal Monthly Budget Worksheet

Description

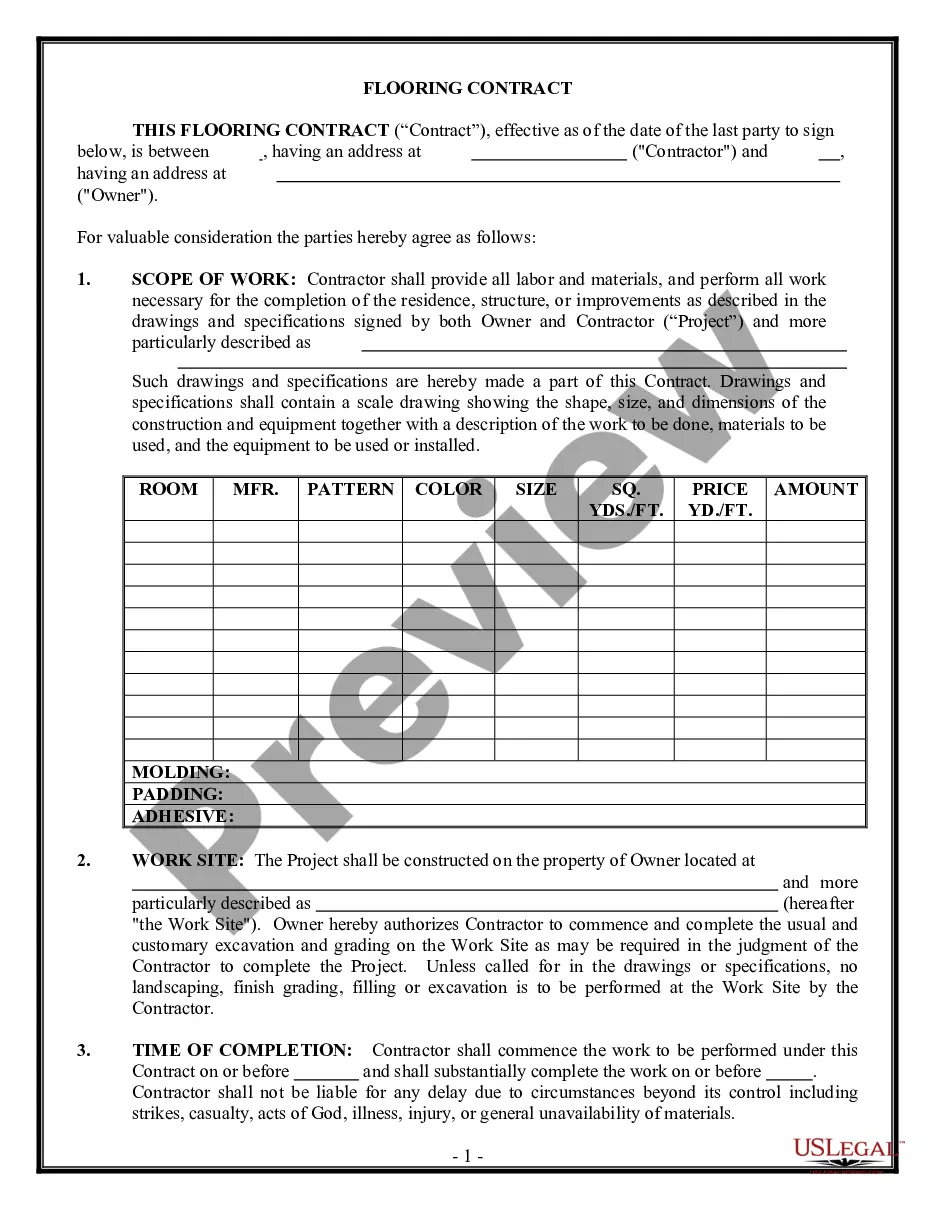

How to fill out Personal Monthly Budget Worksheet?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a selection of legal document templates that you can download or print.

With the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can obtain the most recent versions of forms like the Alabama Personal Monthly Budget Worksheet within moments.

If you already have an account, Log In to download the Alabama Personal Monthly Budget Worksheet from the US Legal Forms catalog. The Download button will be visible on every form you view. You have access to all previously downloaded forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the payment.

Choose the file format and download the document to your device. Edit. Fill out, modify, print, and sign the downloaded Alabama Personal Monthly Budget Worksheet. All forms you have added to your account do not expire and are yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Gain access to the Alabama Personal Monthly Budget Worksheet with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your jurisdiction. Click the Preview button to examine the content of the form.

- Review the form description to confirm that you have chosen the right document.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, affirm your choice by clicking the Buy now button.

- Then, select the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

When starting your budget, list your fixed expenses first, such as rent or mortgage payments. Next, include your utilities, groceries, and transportation costs. Lastly, consider discretionary expenses like dining out and entertainment. An Alabama Personal Monthly Budget Worksheet can guide you through this process, ensuring you don’t miss any crucial categories.

Writing a personal monthly budget involves estimating your monthly income and expenses. Begin by reviewing previous bank statements to identify regular expenses and income patterns, then create a list. With an Alabama Personal Monthly Budget Worksheet, you can easily input your figures and adjust them as necessary, ensuring you remain on track.

To fill out a monthly budget sheet, start by listing all your sources of income, such as your salary and any side hustles. Next, categorize your expenses into fixed costs, variable costs, and discretionary spending. An Alabama Personal Monthly Budget Worksheet can simplify this process by providing structured sections for you to organize your financial data effectively.

The 50/30/20 rule is a budgeting guideline that helps you allocate your income effectively. According to this rule, you should spend 50% of your income on needs, 30% on wants, and 20% on savings or debt repayment. Using an Alabama Personal Monthly Budget Worksheet can help you visualize these allocations, making it easier to stick to your budget.

For an individual, a balanced monthly budget might allocate approximately 50% to needs, 30% to wants, and 20% to savings or debt repayment. However, factors like location, income, and personal goals influence what is considered 'good' for you. An Alabama Personal Monthly Budget Worksheet is a valuable tool for individuals, as it helps in tracking expenses and adjusting allocations to create a budget that feels comfortable and achievable.

A good monthly personal budget depends on your income, expenses, and financial goals. Typically, a budget that prioritizes essentials, savings, and thoughtful discretionary spending is most effective. Utilizing an Alabama Personal Monthly Budget Worksheet can aid you in creating a personalized budget that reflects your unique lifestyle and financial aspirations, empowering you to make informed financial decisions.

The 50/30/20 rule divides your income into three categories: 50% for necessities, 30% for discretionary spending, and 20% for savings. This method helps individuals prioritize their spending and savings effectively. By using an Alabama Personal Monthly Budget Worksheet, you can visually allocate your income according to this rule, helping you to stay organized and meet your financial objectives.

The 70-10-10-10 budget rule suggests that you use 70% of your income for living expenses, 10% for savings, 10% for debt repayment, and 10% for giving or enjoying life. This rule provides a straightforward framework for managing your finances. Incorporating an Alabama Personal Monthly Budget Worksheet can help you track these allocations seamlessly, making it easier to stick to your financial goals.

A common guideline is to allocate about 50% of your monthly income to needs, 30% to wants, and 20% to savings or debt repayment. However, everyone's financial situation is unique. Using an Alabama Personal Monthly Budget Worksheet can help you tailor your spending to your specific requirements, ensuring you manage your finances effectively. Tracking your income and spending habits allows you to adjust these percentages to better fit your lifestyle.

In Alabama, the income threshold for filing taxes generally depends on your filing status and age. For instance, single filers under 65 must file if they earn more than $10,500. Maintaining your financial records with an Alabama Personal Monthly Budget Worksheet will help you stay aware of your income and filing requirements.