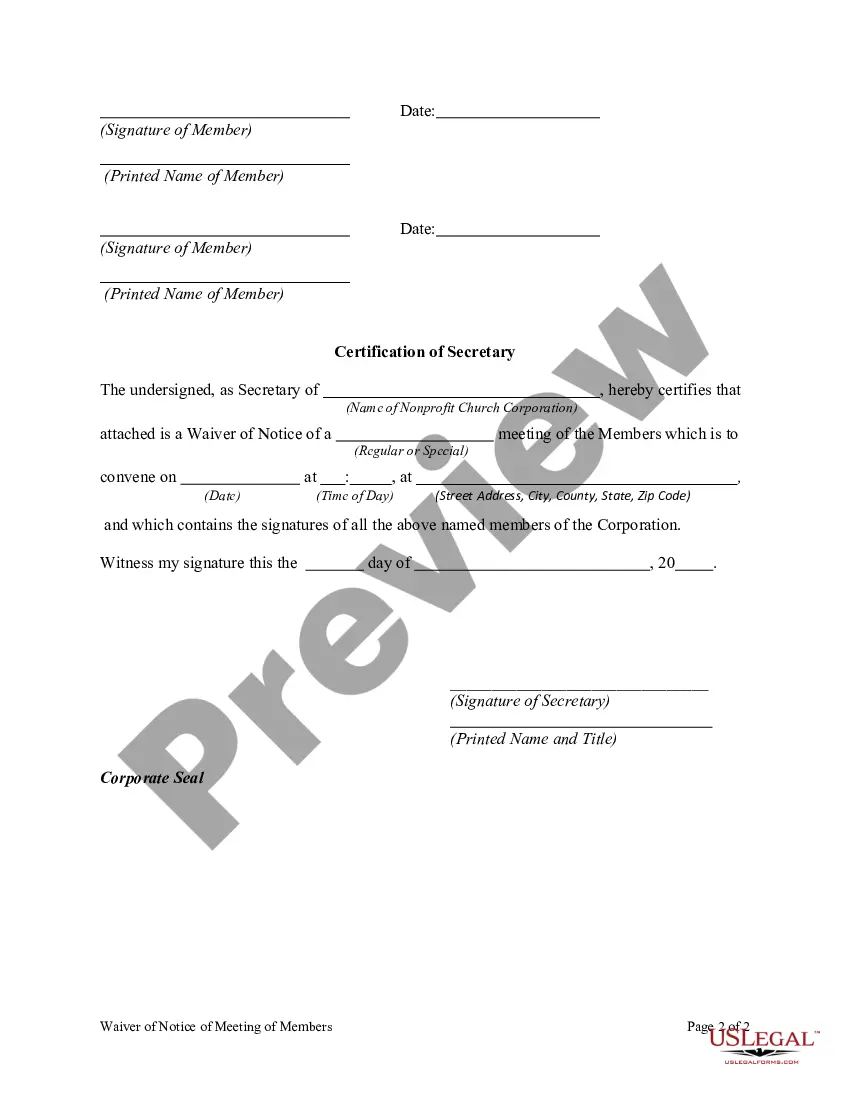

A member of a Nonprofit Church Corporation may waive any notice required by the Model Nonprofit Corporation Act, the articles of incorporation, or bylaws before or after the date and time stated in the notice. The waiver must be in writing, be signed by the member entitled to the notice, and be delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Alabama Waiver of Notice of Meeting of members of a Nonprofit Church Corporation

Description

How to fill out Waiver Of Notice Of Meeting Of Members Of A Nonprofit Church Corporation?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

By utilizing the site, you can access thousands of forms for business and personal use, sorted by categories, states, or keywords. You can find the most recent versions of forms such as the Alabama Waiver of Notice of Meeting of members of a Nonprofit Church Corporation in minutes.

If you are already a member, Log In to download the Alabama Waiver of Notice of Meeting of members of a Nonprofit Church Corporation from the US Legal Forms library. The Download button will be displayed on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the payment. Use your credit card or PayPal account to finalize the transaction.

Choose the format and download the form to your device. Edit the downloaded Alabama Waiver of Notice of Meeting of members of a Nonprofit Church Corporation by filling, modifying, printing, and signing it. Every template you add to your account does not expire and belongs to you permanently. Therefore, to download or print another copy, simply go to the My documents section and click on the form you desire. Access the Alabama Waiver of Notice of Meeting of members of a Nonprofit Church Corporation through US Legal Forms, the most extensive repository of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- If you would like to use US Legal Forms for the first time, here are easy steps to assist you.

- Ensure you have selected the correct form for your city/county.

- Click on the Review button to examine the content of the form.

- Check the form description to confirm that you have picked the right document.

- If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select your preferred payment plan and provide your credentials to register for an account.

Form popularity

FAQ

In most states, spouses are allowed to sit on the board of the same nonprofit as long as the board meets the Internal Revenue Service requirements for nonprofit corporations.

Board basicsA founder can be a director and be on the board. In fact, they usually are. Starting out you as the CEO and the other founder (keep it to one) are directors.

Can my board of directors contain family members? Yes, but be aware that the IRS encourages specific governance practices for 501(c)(3) board composition. In general, having related board members is not expressly prohibited.

Can Spouses Serve on the Same Board? It is generally legal for a couple to be board members at the same time, though some states do have laws that say otherwise.

Many governing documents provide that an officer may be removed by a majority vote of the board members, but that an elected board member may only be removed with a vote of the association membership.

Can my board of directors contain family members? Yes, but be aware that the IRS encourages specific governance practices for 501(c)(3) board composition. In general, having related board members is not expressly prohibited.

It's common for founders to retain control of the board at the A round, at a ratio of or founders:investors. In the latter case, typically two founders will sit on the board, with a third appointed by the majority of common (as opposed to preferred) shareholders.

Can a founder be on the board of directors? We run into this thought process if a founder is generally overly cautious or has a fear of there being a conflict of interest. However, founder is not actually a designated role recognized by the IRS or any state. So, yes, a founder can be on the board.

A conflict of interest occurs when a director, officer, key employee, or other person in a position to influence the nonprofit (an insider) may benefit personally in some way from a transaction or relationship with the nonprofit organization that he or she serves.

Some have few or no qualifications. Unless your bylaws have a provision which states that spouses or co-owners of a condo cannot serve simultaneously on the board of directors, then they both may run for and serve on the board. Q.