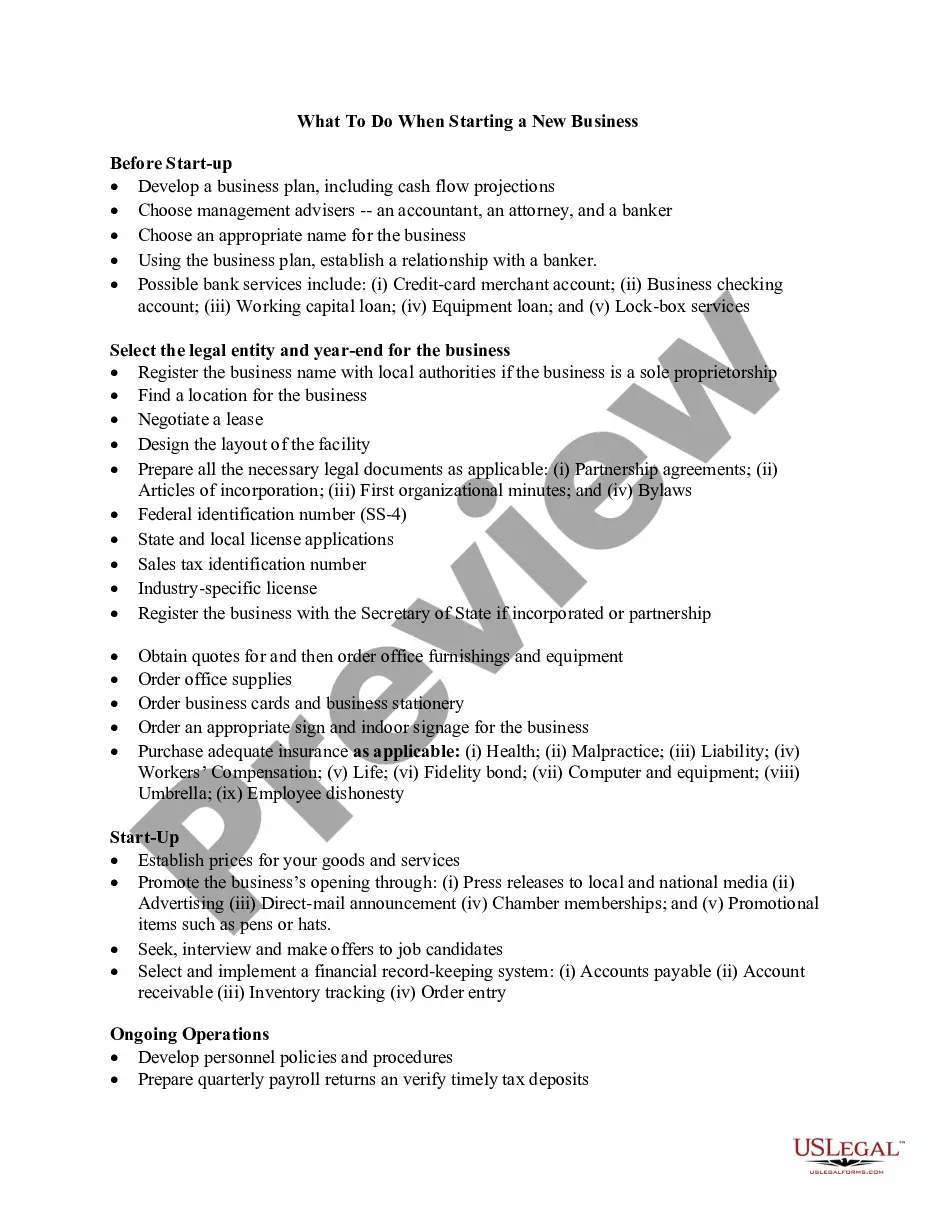

Alabama What To Do When Starting a New Business

Description

How to fill out What To Do When Starting A New Business?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a selection of legal templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Alabama What To Do When Starting a New Business within moments.

If you hold a monthly subscription, Log In and acquire Alabama What To Do When Starting a New Business from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

Complete the transaction. Use a Visa or MasterCard or PayPal account to finalize the payment.

Select the format and download the form to your device. Edit it. Fill out, modify, and print and sign the saved Alabama What To Do When Starting a New Business. Each template you added to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Alabama What To Do When Starting a New Business with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for the region/area.

- Click the Review button to examine the form’s details.

- Check the form information to confirm that you have picked the right form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Next, choose the payment plan you prefer and provide your details to set up an account.

Form popularity

FAQ

In Alabama, LLCs are required to file an annual report to maintain good standing. This report is typically due on April 15th each year, and it helps keep your business compliant with state regulations. Knowing the requirements is essential when considering Alabama What To Do When Starting a New Business, as this ensures your LLC operates smoothly.

Corporations, LLCs, LLPs, and partnerships must register with ADOR to conduct business in Alabama. Standard forms and taxes include sales and use tax, income tax withholding, and unemployment tax. In addition, depending on your startup, you may have to register for and pay additional state taxes.

There isn't a requirement in Alabama for sole proprietors to acquire a general business license, but depending on the nature of your business you may need other licenses and/or permits to operate in a compliant fashion.

12 Things You Must Do Before Starting a BusinessIdentify a creative idea.Write a business plan.Choose a legal structure.Get your business registration, licenses and tax identification.Know your competition and the marketplace.Finance your business.Identify and secure a location.Get proper insurance.More items...

In Alabama, all businesses are required to purchase an annual license to do business known as the Business Privilege License. You must purchase a license in every county where you do business. Licenses can be purchased from your local county Probate Judge.

Before starting your small business in Alabama, you must acquire the necessary identification numbers, licenses or permits for tax registration. Common forms of tax for most businesses will include sales and use tax, unemployment tax and income tax withholding. However, the list of possibilities does not end there.

Business Plan. Almost every business needs a little funding to get started.Partnership Agreement.LLC Operating Agreement.Buy/Sell Agreement.Employment Agreement.Employee Handbook.Non-Disclosure Agreement.Non-Compete Agreement.More items...

It will be necessary when you start dealing with things like insurance, and it is the only way for your business to be legally recognised. Keep in mind that you may need to register as an employer as soon as you start employing people, and the only way you can do this is if your business is already registered.

Alabama. An Alabama business license can cost anywhere from $15 to several hundred dollars, depending on several factors. If your business is based in Alabama, refer to the Alabama Department of Revenue for business license information specific to your business.

The Alabama Secretary of State charges a $200 fee to file the Certificate of Formation. You must also pay a separate Probate Court filing fee, which is at least $50. You must reserve your business name by filing an LLC name reservation. It costs $28 to file online and $10 if filed by mail.