Alabama Sample Letter for Notice of Change of Address - Awaiting Refund

Description

How to fill out Sample Letter For Notice Of Change Of Address - Awaiting Refund?

If you need to compile, obtain, or produce legal document templates, turn to US Legal Forms, the top selection of legal documents available online.

Employ the site’s straightforward and user-friendly search feature to acquire the documents you need.

A range of templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Every legal document template you purchase is yours permanently.

You will have access to every document you obtained in your account. Go to the My documents section and select a document to print or download again.

- Use US Legal Forms to retrieve the Alabama Sample Letter for Notice of Change of Address - Awaiting Refund with just a few clicks.

- If you are an existing US Legal Forms customer, Log In to your account and click the Get option to locate the Alabama Sample Letter for Notice of Change of Address - Awaiting Refund.

- You can also find forms you have previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

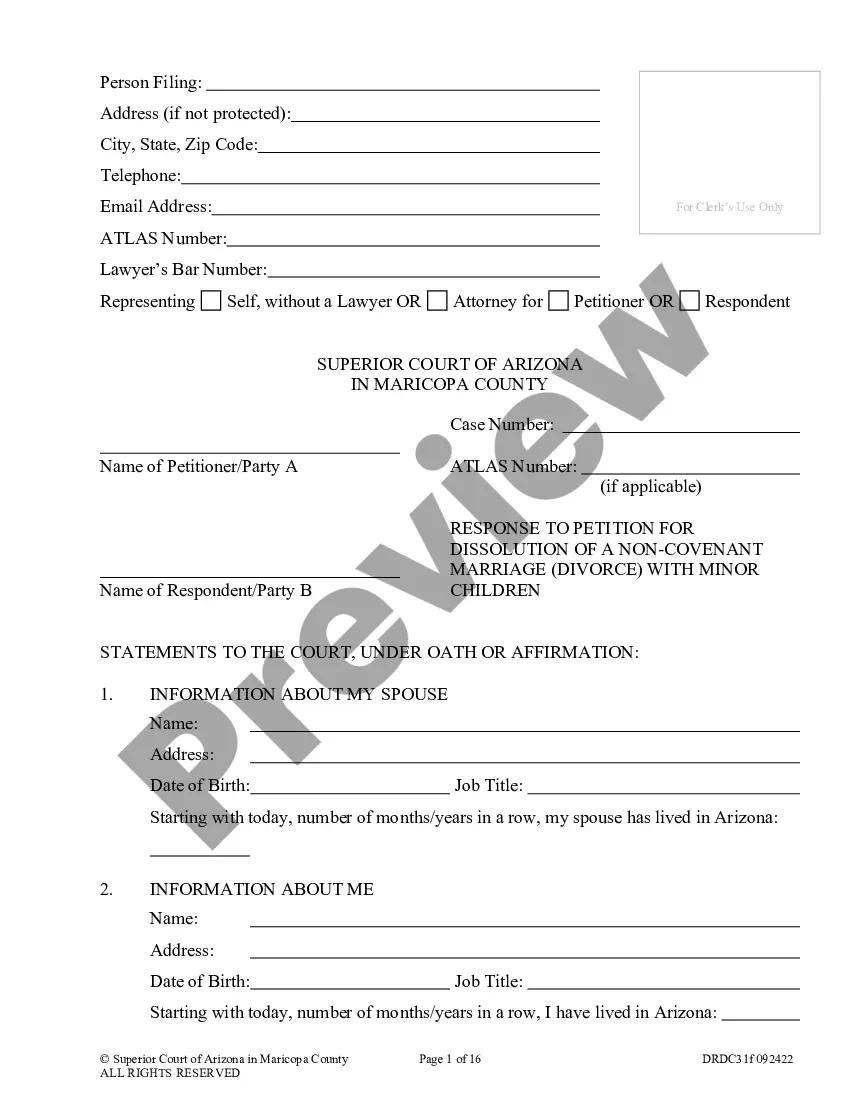

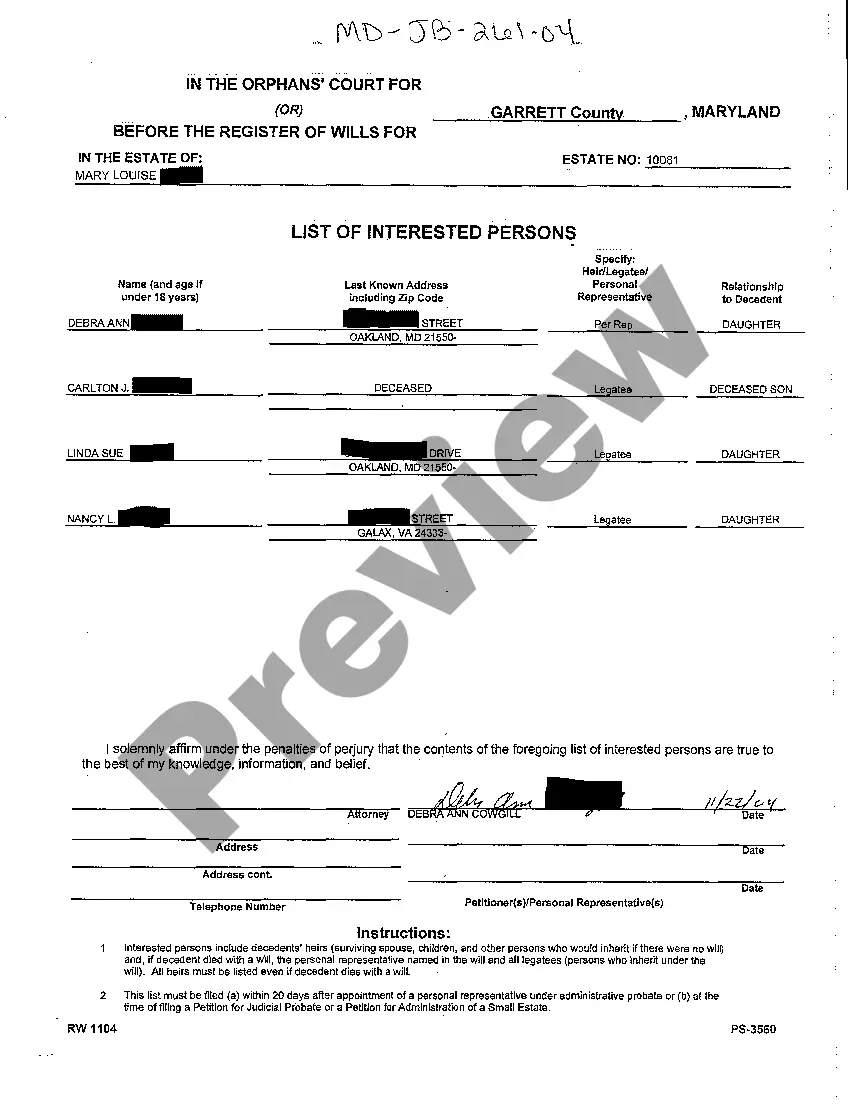

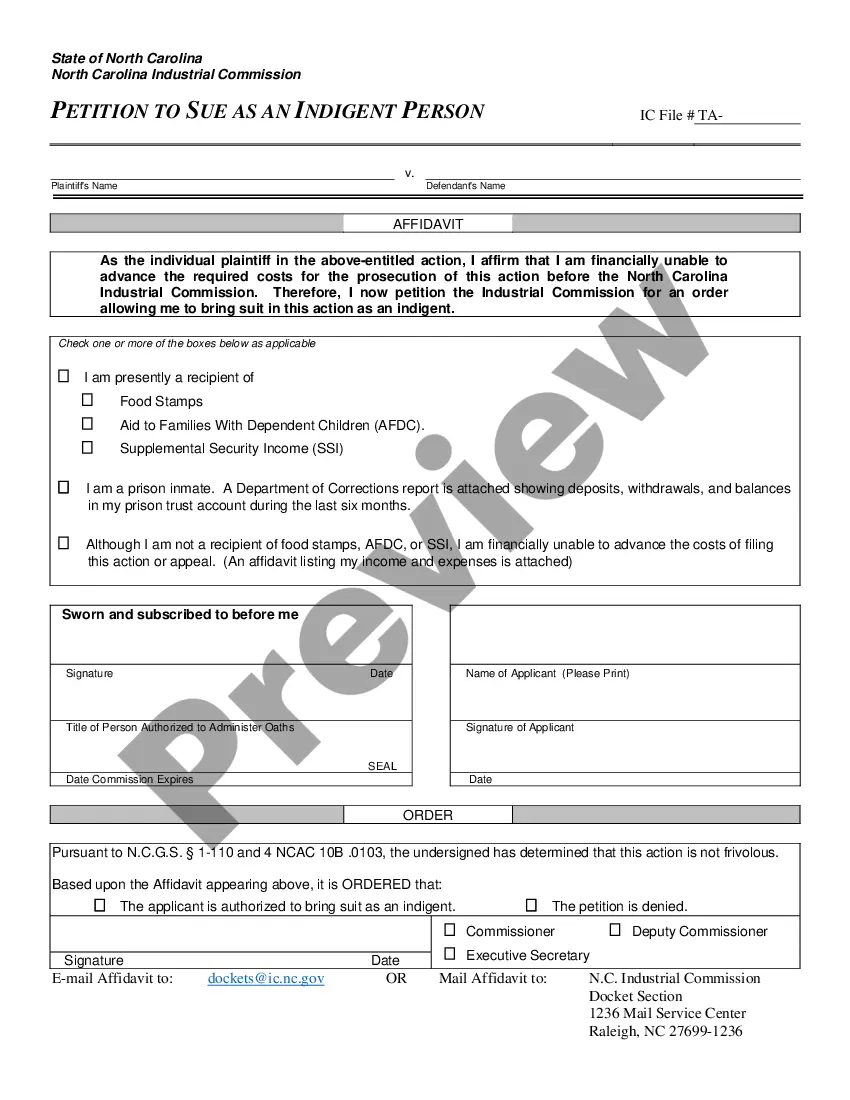

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the contents of the form. Make sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternative types of your legal form template.

- Step 4. After identifying the form you need, click the Buy now button. Choose your preferred payment plan and provide your information to register for an account.

- Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Alabama Sample Letter for Notice of Change of Address - Awaiting Refund.

Form popularity

FAQ

To change your address with the IRS, you may complete a Form 8822, Change of Address (For Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns) and/or a Form 8822-B, Change of Address or Responsible Party Business and send them to the address shown on the forms.

Form 40A is Alabama's Individual Resident Income Tax Return (short version) and it applies to full year residents only. Please keep in mind that if you file Form 40A close to the deadline, there might be a delay of 90 days until you receive the refund.

Business entities are liable for the Alabama business privilege tax for each taxable year during which the entity is in legal existence regardless of the level of business activity. With certain exceptions, the minimum business privilege tax is $100, and the maximum business privilege tax is $15,000.

Friday a.m. p.m. (Closed for lunch noon 1 p.m.)

Also called the Registration and Annual Report for Canadian Securities Form, Form 40-F is a filing with the US Securities and Exchange Commission (SEC) used by Canadian companies that want to offer their securities to United States investors.

You must complete your U.S. income tax return first, before you can prepare the Alabama tax return. The UA Tax Office usually hosts several tax seminars with the Alabama Department of Revenue to assist nonresident aliens with filing the Alabama tax return.

Call the numbers below for more information:Individual Income Tax: 334-353-0602.Corporate Income Tax: 334-242-1200.Pass-through Entities: 334-242-1033.Sales and Use Tax: 334-242-1490.Business Privilege Tax: 334-353-7923.Withholding Tax: 334-242-1300.

If there is a question about your return, you may receive a request for information letter that asks for missing or additional information or a tax computation change letter that provides explanation of changes made to the tax return.

You'll need to complete the Alabama DMV change of address form and either mail it to ALEA (Alabama Law Enforcement Agency) Licensing Services Division, P.O. Box 1471, Montgomery AL, 36102-1471 or drop it off at any ALEA Driver License Office.