Alabama Blind Trust Agreement

Description

How to fill out Blind Trust Agreement?

Have you ever found yourself in a situation where you require documents for various organizational or personal tasks nearly every day.

Many legal document templates can be found online, but finding reliable ones is not easy.

US Legal Forms offers a vast collection of form templates, including the Alabama Blind Trust Agreement, which is designed to meet both state and federal standards.

Select a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can download another copy of the Alabama Blind Trust Agreement anytime, if needed. Just click on the required form to download or print the document template.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Alabama Blind Trust Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- 1. Find the form you need and ensure it is for the correct state/region.

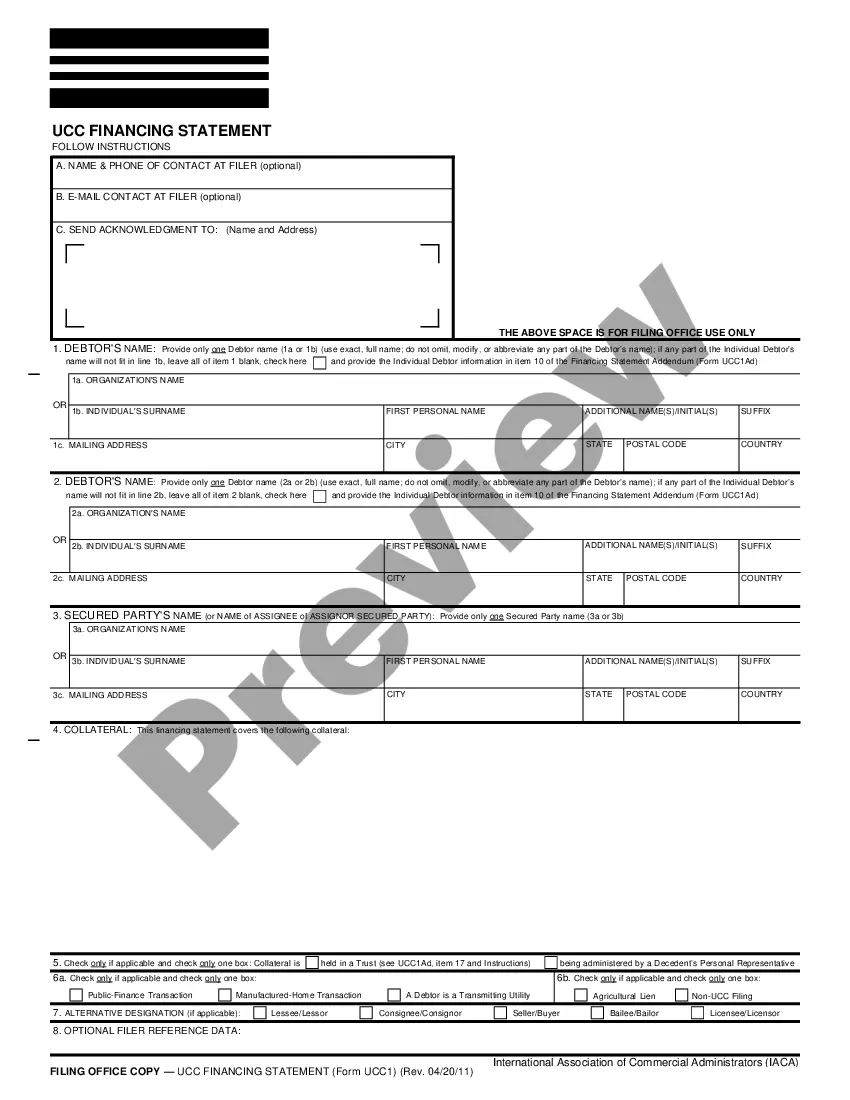

- 2. Utilize the Review option to check the form.

- 3. Review the details to confirm you have selected the right form.

- 4. If the form is not what you seek, use the Search field to locate a form that meets your needs and requirements.

- 5. Once you find the appropriate form, click Purchase now.

- 6. Choose your payment plan, provide the necessary information to create your account, and complete the payment using your PayPal or credit card.

Form popularity

FAQ

Setting up a blind trust requires you to select a reliable trustee who will manage your assets without your input. Begin by drafting the Alabama Blind Trust Agreement, which outlines the trust's terms and ensures that you do not have control over the trust assets during its operation. Once the agreement is in place, transfer the assets to the trust, and allow the trustee to handle investments and distributions according to the terms established. Consider using USLegalForms for guidance and templates that facilitate this process effectively.

Writing a trust agreement involves several key steps to ensure its legal validity. First, you must clearly identify the trust's purpose and specify the involved parties, including the grantor, trustee, and beneficiaries. Next, outline how the assets will be managed and distributed within the framework of the Alabama Blind Trust Agreement. For those who want assistance, USLegalForms provides templates and resources to help you create a compliant trust agreement seamlessly.

Withdrawing assets from an Alabama blind trust agreement is generally not permitted while the trust is active. The purpose of a blind trust is to provide a level of distance between the trust creator and asset management. However, after the trust's term ends or it is dissolved, assets can be accessed. Consulting with an attorney can clarify your options and rights concerning withdrawals.

To create an Alabama blind trust agreement, you first need to consult with a legal professional who specializes in trust law. This expert can guide you through the intricate legal requirements and help you draft the necessary documents. Once established, appoint a reliable trustee to manage the trust's assets independently. Proper guidance will ensure that your blind trust meets legal standards and effectively serves your intentions.

The four main types of trusts include living trusts, testamentary trusts, revocable trusts, and irrevocable trusts. Each type serves different purposes and comes with specific legal implications. An Alabama blind trust agreement falls under the category of irrevocable trusts, as it usually cannot be altered once established. Understanding these varying types aids in selecting the most suitable trust for your needs.

People choose an Alabama blind trust agreement for various reasons, primarily to maintain privacy and avoid conflicts of interest. By establishing this type of trust, individuals can separate their personal financial interests from their professional decisions. This arrangement is particularly beneficial for politicians or executives who may operate in sensitive sectors. Consequently, a blind trust can protect both personal credibility and public trust.

A blind trust is an arrangement where the trust's creator does not have knowledge of its assets during its term. This approach is often utilized to avoid potential conflicts of interest, especially for public officials or business leaders. An Alabama blind trust agreement can be an effective tool for those who wish to remain uninfluenced by their personal investments. Ultimately, this structure fosters an environment of impartial asset management.

In an Alabama blind trust agreement, an independent trustee is appointed to manage the assets. The creator of the trust gives up control over the specific assets and their management. This trustee makes decisions without consulting the trust creator, ensuring that personal interests do not influence management. Engaging a qualified trustee is key to maintaining the integrity of the trust.

A trust is a legal arrangement that allows one party to manage assets for the benefit of another. In contrast, an Alabama blind trust agreement limits the knowledge of the trust's assets to the person who manages it. This separation helps prevent any conflicts of interest. Understanding these differences is crucial when deciding on the best option for your estate planning.

To form a blind trust in Alabama, the first step is to draft an Alabama Blind Trust Agreement, which outlines the trust's terms and conditions. You should include the names of the trustee and beneficiaries, as well as the assets being placed into the trust. It is important to consult with a legal professional to ensure that the agreement complies with state laws. Additionally, using platforms like US Legal Forms can simplify the process by providing templates and guidance to help you create a valid blind trust.