Alabama Disclaimer of Inheritance Rights for Stepchildren

Description

How to fill out Disclaimer Of Inheritance Rights For Stepchildren?

US Legal Forms - among the most significant libraries of legal types in the USA - delivers a wide range of legal record themes it is possible to down load or print out. Making use of the website, you can get a large number of types for enterprise and specific uses, categorized by types, states, or keywords and phrases.You will discover the latest variations of types such as the Alabama Disclaimer of Inheritance Rights for Stepchildren in seconds.

If you have a registration, log in and down load Alabama Disclaimer of Inheritance Rights for Stepchildren from the US Legal Forms collection. The Download option will show up on each type you look at. You have accessibility to all in the past acquired types within the My Forms tab of the bank account.

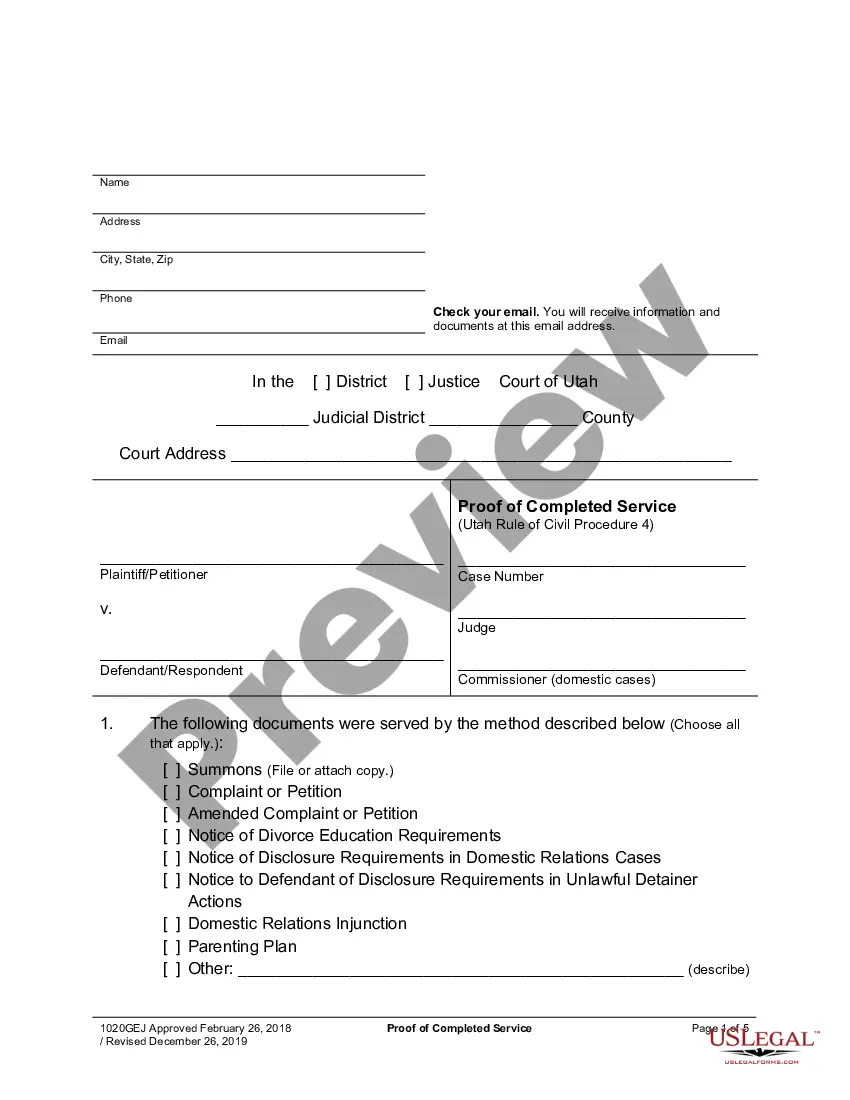

If you would like use US Legal Forms initially, listed here are basic directions to obtain started:

- Be sure to have chosen the right type for your city/area. Select the Preview option to review the form`s information. Look at the type outline to actually have chosen the appropriate type.

- If the type doesn`t suit your requirements, use the Lookup discipline towards the top of the display screen to obtain the one that does.

- If you are satisfied with the form, confirm your selection by visiting the Purchase now option. Then, choose the pricing prepare you like and offer your qualifications to sign up for the bank account.

- Procedure the financial transaction. Make use of Visa or Mastercard or PayPal bank account to finish the financial transaction.

- Pick the file format and down load the form on your own system.

- Make changes. Fill out, modify and print out and signal the acquired Alabama Disclaimer of Inheritance Rights for Stepchildren.

Every single format you included with your account does not have an expiration time and is yours eternally. So, in order to down load or print out an additional copy, just check out the My Forms section and then click about the type you will need.

Gain access to the Alabama Disclaimer of Inheritance Rights for Stepchildren with US Legal Forms, one of the most comprehensive collection of legal record themes. Use a large number of expert and express-particular themes that satisfy your organization or specific demands and requirements.

Form popularity

FAQ

How Can I Exclude My Stepchild? You don't have to do anything to ensure that your stepchildren get nothing from your estate. Unless you designate them in your will, your stepchildren have no rights to the property.

Which Assets Pass by Intestate Succession If you die with:here's what happens:a spouse and parentsspouse inherits the first $100,000 of your intestate property, plus 1/2 of the balance of your intestate property parents inherit remaining intestate propertyparents but no children or spouseparents inherit everything5 more rows

The non-custodial parent, despite their standing in any child support or custody issues, has primary authority over them, unless they are barred by legal action from asserting that parental right. even before your spouse dies you have no legal rights over your step children.

Trusts. A trust offers a more reliable method that works in nearly any circumstance. To keep assets from going directly to stepchildren on your death, you can set up a trust and name your spouse as the trustee. If you do this, however, your spouse will decide where assets go, so they may still go to stepchildren.

A last will and testament: Name your stepchildren as beneficiaries of your will. You can designate a set amount for them or instruct that they receive a percentage of whatever your estate is worth at the time of your death. A trust: Create a trust and make your stepchildren beneficiaries.

You can create a trust during your lifetime or through your will and name your child as the beneficiary. You can also appoint a trustee who will be responsible for distributing the trust income and principal ing to your instructions. A Trust can offer several advantages over leaving money directly to your child.

General Requirements . To be valid, a Will must be in writing. It must be signed, dated, and witnessed ing to all the formal requirements of execution in Code of Alabama §43-8-131.

Children Can Present a More Complicated Picture Consider the following: Foster children and stepchildren ? Stepchildren you never legally adopted and foster children will not automatically inherit. Adopted children ? Children you legally adopted will receive a share equal to your biological children.