A Trust is an entity which owns assets for the benefit of a third person (the beneficiary). A Living Trust is an effective way to provide lifetime and after-death property management and estate planning. When you set up a Living Trust, you are the Grantor. Anyone you name within the Trust who will benefit from the assets in the Trust is a beneficiary. In addition to being the Grantor, you can also serve as your own Trustee. As the Trustee, you can transfer legal ownership of your property to the Trust. A revocable living trust does not constitute a gift, so there are no gift tax consequences in setting it up.

Alabama Revocable Trust Agreement Regarding Coin Collection

Description

How to fill out Revocable Trust Agreement Regarding Coin Collection?

It is feasible to spend hours online searching for the sanctioned document template that meets the federal and state requirements you need.

US Legal Forms offers countless legal templates that have been assessed by experts.

You can easily obtain or create the Alabama Revocable Trust Agreement Regarding Coin Collection through the services.

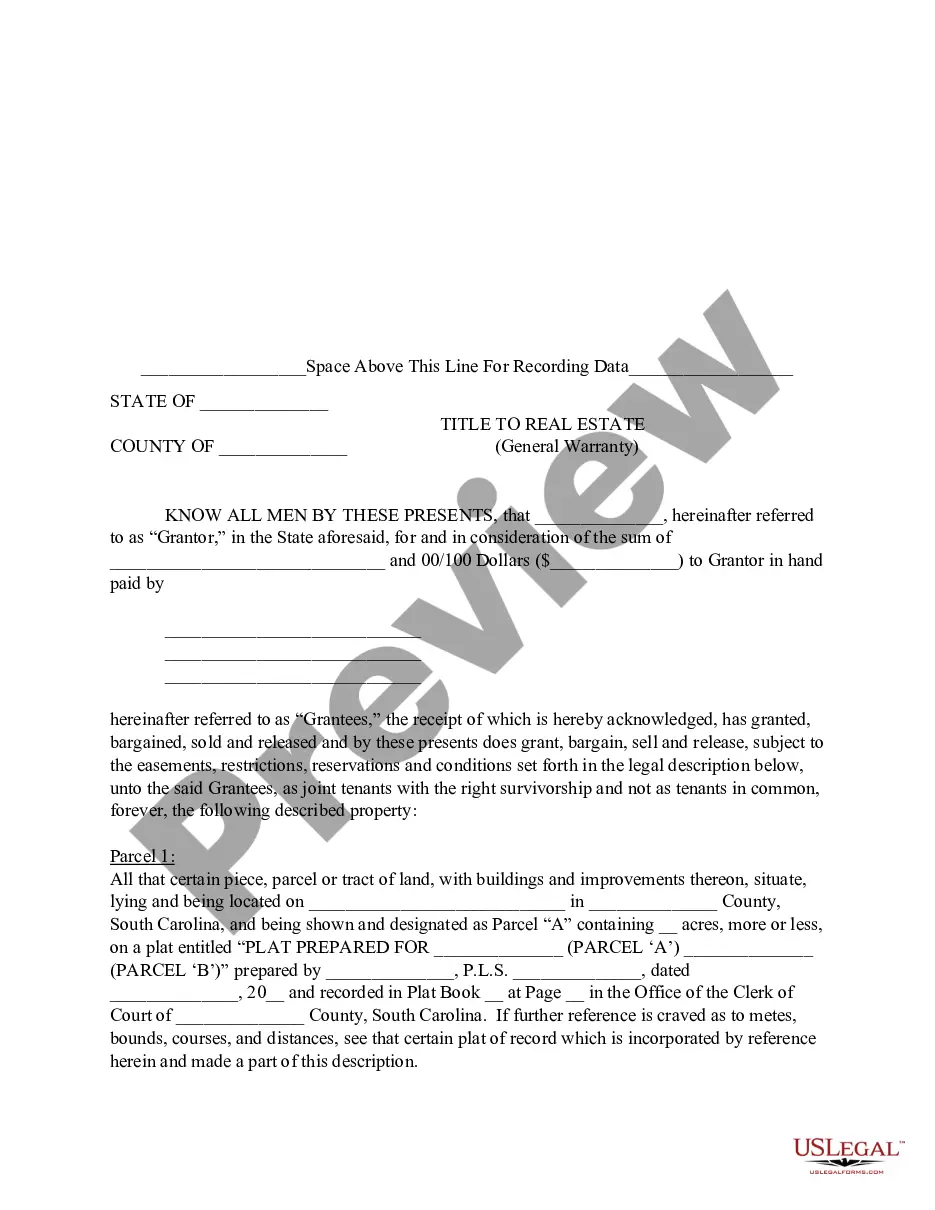

If available, use the Review button to look through the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- Then, you can complete, modify, print, or sign the Alabama Revocable Trust Agreement Regarding Coin Collection.

- Every legal document template you download is yours permanently.

- To acquire another copy of the purchased form, go to the My documents tab and select the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, make sure you have chosen the correct document template for the state/city of your preference.

- Read the form description to ensure you have selected the right type.

Form popularity

FAQ

Setting up a revocable trust in Alabama involves several key steps. First, choose a name for your trust and outline the terms you want to include. Next, use uslegalforms to provide a structured Alabama Revocable Trust Agreement Regarding Coin Collection. Once completed, sign the document and transfer your assets into the trust. Ensure you follow state laws and consult a professional for guidance throughout the process.

To create a revocable trust in Alabama, you need to draft a trust document that outlines the terms and beneficiaries of the trust. You can utilize the resources offered by uslegalforms to generate an Alabama Revocable Trust Agreement Regarding Coin Collection that meets your needs. After drafting, you'll need to fund the trust by transferring ownership of your assets into it. Consulting with a legal professional can ensure proper execution.

One downside of a revocable trust is the lack of asset protection. Since you can change or revoke the trust at any time, it does not shield your assets from creditors. Additionally, establishing an Alabama Revocable Trust Agreement Regarding Coin Collection may involve legal fees and ongoing management. Understanding these limitations can help you make an informed decision.

Yes, creditors can go after assets in a revocable trust. Since a revocable trust allows the grantor to maintain control over the assets, those assets are generally considered part of the grantor’s estate. Therefore, in the event of debt or creditor claims, assets held within an Alabama Revocable Trust Agreement Regarding Coin Collection may be accessible to creditors. It's important to consult a legal expert for personalized advice.

Assets in a revocable trust are typically not protected from creditors or tax claims. The Alabama Revocable Trust Agreement Regarding Coin Collection provides benefits like effective management and distribution of your collection but does not offer immunity from creditors or the IRS. It's advisable to consider additional asset protection strategies or consult an attorney for personalized advice.

If your house is in a revocable trust and you owe taxes, the IRS can place a lien on it. Since the Alabama Revocable Trust Agreement Regarding Coin Collection does not shield property from IRS claims, it is crucial to remain compliant with tax obligations. Consulting with a legal expert can help you understand the implications of placing your home in a trust and the potential for liens.

The IRS can access assets in a revocable trust when you owe taxes, as you retain control over these assets. The Alabama Revocable Trust Agreement Regarding Coin Collection will help in organizing your estate but will not offer protection from tax claims during your lifetime. Keeping accurate records and working with professionals can help reduce the risk of IRS intervention.

Yes, assets held in a revocable trust can be seized by the IRS since the trust is considered part of your taxable estate. The Alabama Revocable Trust Agreement Regarding Coin Collection allows you to manage your assets while retaining control, but it doesn't shield them from IRS claims. It’s essential to explore additional strategies to safeguard specific items like your coin collection from tax liabilities.

Certain assets are typically exempt from IRS seizure, including your home up to a specific equity limit, retirement accounts, and essential personal property. It is important to understand that the Alabama Revocable Trust Agreement Regarding Coin Collection can help protect specific assets such as your coin collection, provided they are structured properly within the trust. Consulting with a legal expert can guide you on which assets may benefit from such a trust.

The downside of placing assets in an Alabama Revocable Trust Agreement Regarding Coin Collection includes the loss of immediate control over those assets. Once assets are in the trust, any changes may require formal processes. Additionally, trusts can incur costs related to setup and ongoing administration, which should be factored in during planning.