Alabama Miller Trust Forms for Medicaid

Description

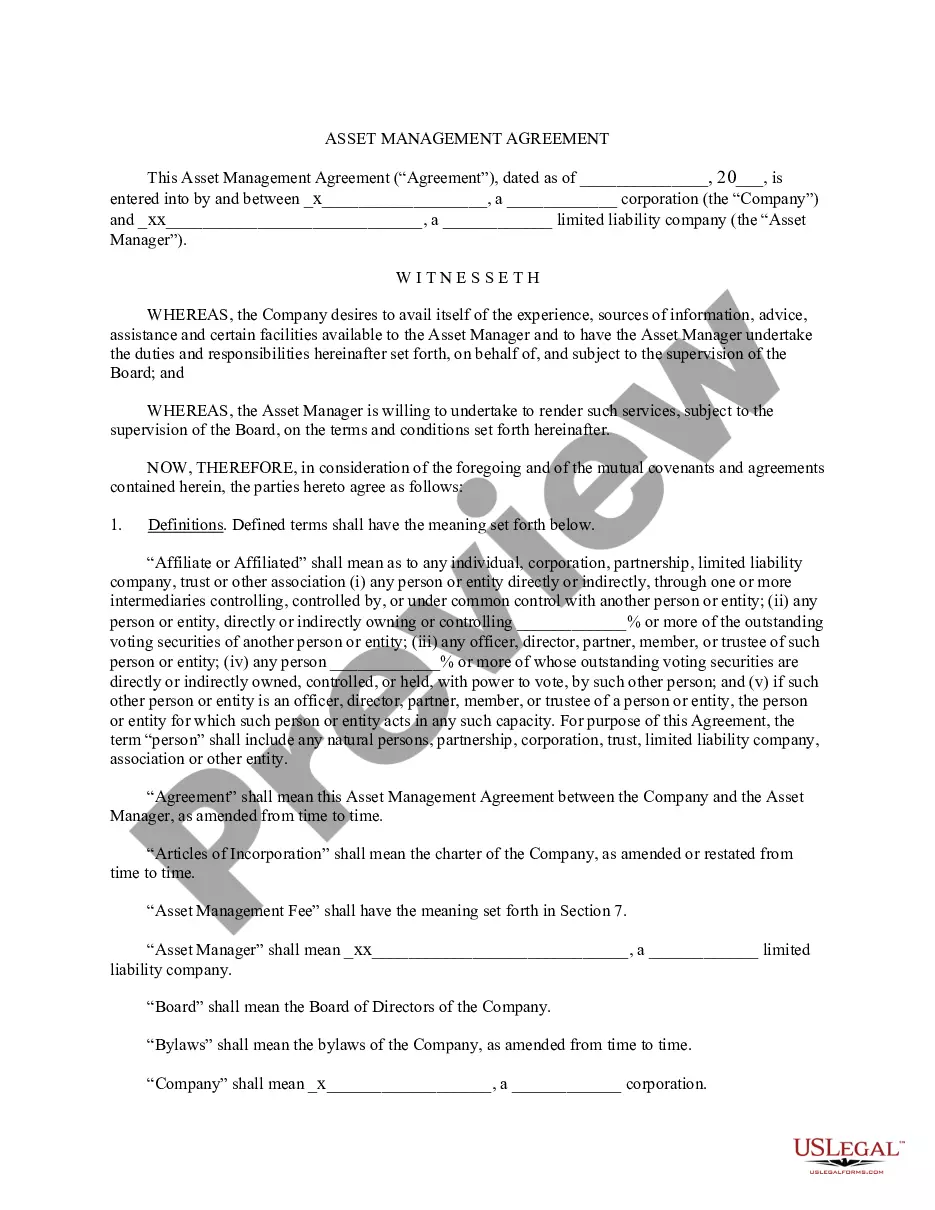

How to fill out Miller Trust Forms For Medicaid?

You have the capability to invest multiple hours online looking for the legitimate document template that meets the federal and state requirements you need.

US Legal Forms provides a vast array of legal forms that can be assessed by professionals.

You can download or print the Alabama Miller Trust Forms for Medicaid from my service.

To find another version of your form, use the Search box to identify the template that matches your needs and requirements.

- If you already have a US Legal Forms account, you may Log In and click on the Acquire button.

- Then, you can fill out, edit, print, or sign the Alabama Miller Trust Forms for Medicaid.

- Every legal document template you receive is yours forever.

- To obtain another copy of a purchased form, navigate to the My documents tab and click the appropriate button.

- If you are visiting the US Legal Forms website for the first time, follow these simple instructions.

- First, ensure you have selected the correct document template for your desired region/area.

- Check the form details to confirm you have chosen the proper form.

- If available, use the Preview button to review the document template as well.

Form popularity

FAQ

Two common problems with Medicaid include long wait times for approval and the complexity of the application process. Many applicants find the need for Alabama Miller Trust Forms for Medicaid daunting, as understanding how to complete them properly can be challenging. Utilizing platforms like uslegalforms can simplify this process, providing you with clear guidance and necessary documents to ease your journey.

Setting up a Miller's trust involves several steps, starting with creating the trust document and naming a trustee. It's essential to include Alabama Miller Trust Forms for Medicaid to ensure compliance with state regulations. After establishing the trust, you must transfer excess income into the trust each month to maintain Medicaid eligibility while preserving your financial well-being.

In Alabama, Medicaid eligibility requires meeting specific criteria concerning income, assets, and residency. You must be a legal resident of Alabama and provide documentation supporting your financial situation. If your income exceeds the limits, using Alabama Miller Trust Forms for Medicaid can help you structure your finances in a way that meets these requirements.

When applying for Medicaid, you will need a variety of paperwork, including financial statements, tax returns, and identification. It's crucial to prepare Alabama Miller Trust Forms for Medicaid if your income is above the allowable limit. These forms streamline the process by ensuring that excess income is properly allocated to maintain your eligibility.

To be Medicaid eligible, an applicant must submit several key documents, including proof of income, identification, and residency in Alabama. You will also need to provide Alabama Miller Trust Forms for Medicaid if you are trying to qualify while exceeding the asset limit. These forms help ensure that your excess income can be redirected into a trust, allowing you to meet eligibility criteria effectively.

Yes, you can utilize a Miller trust to qualify for Medicaid under certain conditions. This trust allows you to set aside excess income, keeping you within the income limits for eligibility. By thoughtfully employing Alabama Miller Trust Forms for Medicaid, you can protect your assets while receiving necessary care. It's an effective strategy for many individuals in Alabama seeking Medicaid benefits.

Yes, Medicaid does examine trusts during the application process. They assess how a trust impacts your financial situation and eligibility for benefits. Understanding how Alabama Miller Trust Forms for Medicaid work can help you navigate these evaluations effectively. Properly structured trusts can safeguard your assets while still allowing you to qualify for Medicaid services.

The income limits for Medicaid in Alabama can change annually, but generally, the threshold is set at different levels for individuals and couples. For those using Alabama Miller Trust Forms for Medicaid, it’s crucial to know the current limits and how trust income is treated. By doing so, you can better plan your finances to meet eligibility criteria. An informed approach will significantly enhance your chances of approval.

A Miller trust allows individuals to qualify for Medicaid without losing valuable assets. It works by funneling excess income into the trust, which helps meet Medicaid's income requirements. By using Alabama Miller Trust Forms for Medicaid, you can maintain eligibility for benefits while still having some level of financial control. This strategy is effective for many seeking assistance in Alabama.

While a Medicaid trust can offer benefits, it may have some disadvantages. Setting up a trust often involves complex legal language and fees. Furthermore, Alabama Miller Trust Forms for Medicaid can be restrictive, limiting how you can use your assets. It is wise to consider these factors carefully before proceeding.