Alabama Security Agreement involving Sale of Collateral by Debtor

Description

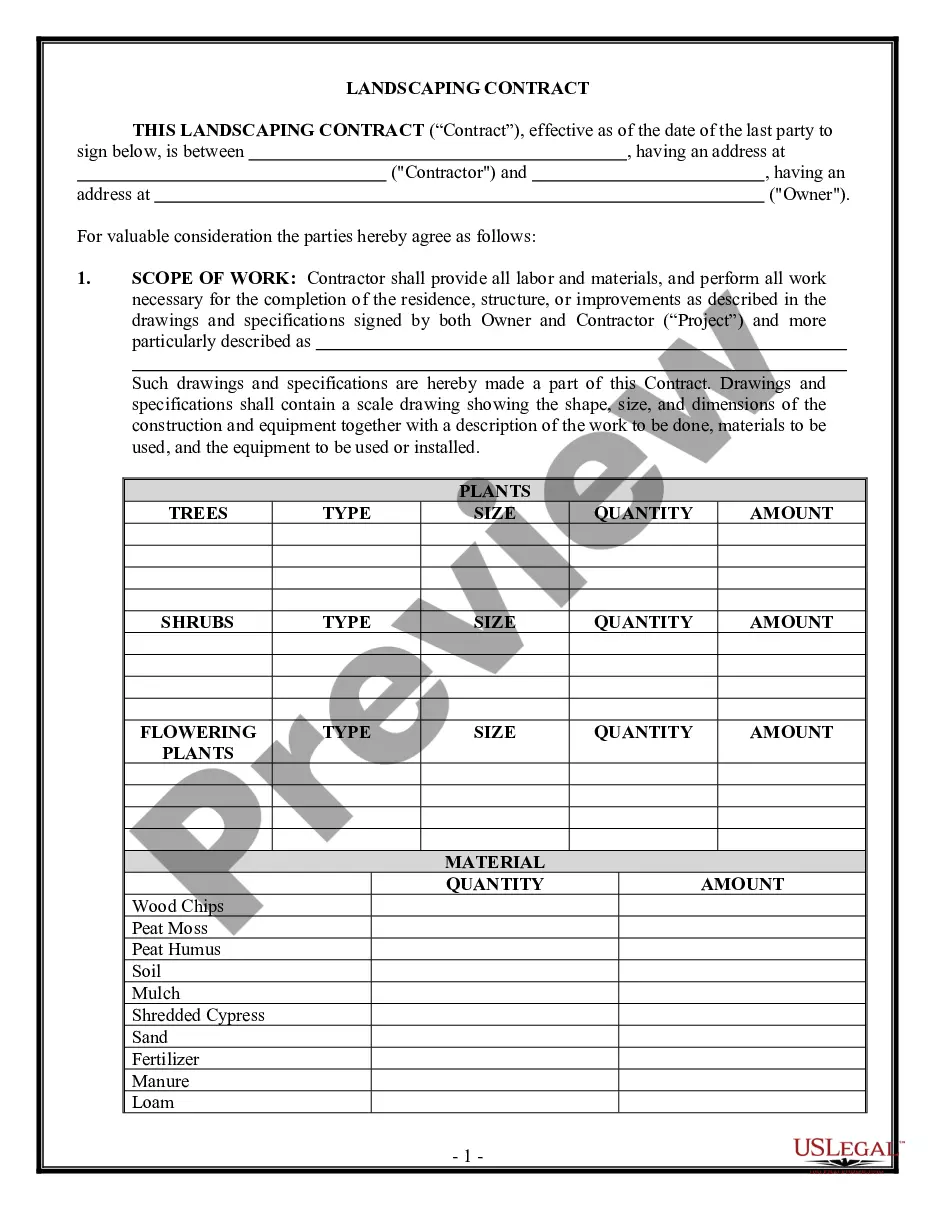

How to fill out Security Agreement Involving Sale Of Collateral By Debtor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a selection of legal document templates that you can download or print.

Through the website, you can access thousands of forms for business and individual needs, organized by categories, states, or keywords. You can locate the most recent versions of forms such as the Alabama Security Agreement related to Sale of Collateral by Debtor within minutes.

If you already have a subscription, Log In and download the Alabama Security Agreement concerning Sale of Collateral by Debtor from the US Legal Forms library. The Download button will appear on each document you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the document to your device. Edit. Fill out, modify, print, and sign the downloaded Alabama Security Agreement related to Sale of Collateral by Debtor. Every document you add to your account has no expiration date and is yours indefinitely. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Alabama Security Agreement involving Sale of Collateral by Debtor with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and needs.

- Ensure you have selected the correct form for your city/county.

- Click the Review button to evaluate the document's content.

- Check the form summary to confirm you have selected the appropriate document.

- If the form does not meet your requirements, use the Search box at the top of the screen to find the one that fits.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Next, choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Under the Uniform Commercial Code (UCC), the secured party has specific rights including the ability to access and repossess collateral upon default, as specified in the Alabama Security Agreement involving Sale of Collateral by Debtor. They can also sell the collateral to recover debts owed. It is essential for both secured parties and debtors to understand these rights to ensure compliance and facilitate smoother transactions. Access to legal resources can assist in navigating these rights effectively.

To make a security interest enforceable, the secured party must attach the interest to the collateral and perfect it, usually through filing a financing statement. The Alabama Security Agreement involving Sale of Collateral by Debtor provides the foundational documentation to initiate this process. Perfection may also involve taking possession of the collateral. Properly executing these steps protects the secured party's interests.

A security agreement is a contract that grants the lender a security interest in specific collateral while a lien is a legal claim against that collateral. The Alabama Security Agreement involving Sale of Collateral by Debtor lays out the terms and conditions governing this relationship. In essence, the security agreement creates the lien by outlining the rights and obligations of each party. Knowing the difference helps better navigate financial agreements.

Collateral rights refer to the specific claims a secured party has over the collateral to secure a debt, as established in an Alabama Security Agreement involving Sale of Collateral by Debtor. These rights include the ability to repossess or sell the collateral if the debtor defaults on payment. Both parties must clearly understand these rights to prevent disputes and ensure smoother transactions. Proper documentation helps clarify these rights.

A secured creditor has the right to enforce the security interest in the collateral upon default by the debtor, as specified in the Alabama Security Agreement involving Sale of Collateral by Debtor. This may include taking possession of the collateral or selling it to recover owed amounts. Secured creditors have priority over unsecured creditors when it comes to claims on the collateral. Understanding these rights helps creditors protect their interests.

Yes, the debtor retains specific rights in the collateral outlined in the Alabama Security Agreement involving Sale of Collateral by Debtor. They have the right to sell, lease, or use the collateral under certain conditions as long as it does not conflict with their security agreement. It is important to note that their use of the collateral should align with the agreement terms. This enables debtors to maintain flexibility in managing their assets.

The debtor has a fundamental right to retain possession of the collateral as long as they fulfill their obligations under the Alabama Security Agreement involving Sale of Collateral by Debtor. This means they can use the collateral while making payments as agreed. If the debtor repays their debt satisfactorily, they maintain ownership of the collateral. Understanding these rights is essential for both debtors and creditors.

Creating an Alabama Security Agreement involving Sale of Collateral by Debtor requires gathering all necessary information from both creditor and debtor. Structure the document to include clear definitions and terms, along with signatures from both parties. Utilizing professionally designed templates from platforms like uslegalforms can simplify the process and ensure legal compliance.

Creating a security contract involves drafting a document that specifics the terms under which a debtor grants a creditor rights over certain collateral. It is essential to include detailed descriptions of the collateral, the obligations of each party, and the remedies available to the creditor. The process can be streamlined using resources from platforms like uslegalforms, which provide templates and guides tailored for Alabama Security Agreements.

For a creditor to establish an enforceable security interest under an Alabama Security Agreement involving Sale of Collateral by Debtor, three key requirements must be met: attachment, perfection, and enforceability. First, the debtor must have rights in the collateral. Second, the creditor must take necessary steps to perfect their security interest, such as filing a financing statement. Lastly, the agreement needs to comply with applicable laws governing security interests.