A Trust is an entity which owns assets for the benefit of a third person (beneficiary). Trusts can be revocable or irrevocable. An irrevocable trust is an arrangement in which the grantor departs with ownership and control of property. Usually this involves a gift of the property to the trust. The trust then stands as a separate taxable entity and pays tax on its accumulated income. Trusts typically receive a deduction for income that is distributed on a current basis. Because the grantor must permanently depart with the ownership and control of the property being transferred to an irrevocable trust, such a device has limited appeal to most taxpayers.

Alabama Irrevocable Trust Agreement for Benefit of Trustor's Children and Grandchildren

Description

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

It is feasible to spend hours online seeking the legal document template that satisfies the state and federal requirements you require.

US Legal Forms offers numerous legal templates that can be assessed by professionals.

You can effortlessly obtain or create the Alabama Irrevocable Trust Agreement for the Benefit of Trustor's Children and Grandchildren through the service.

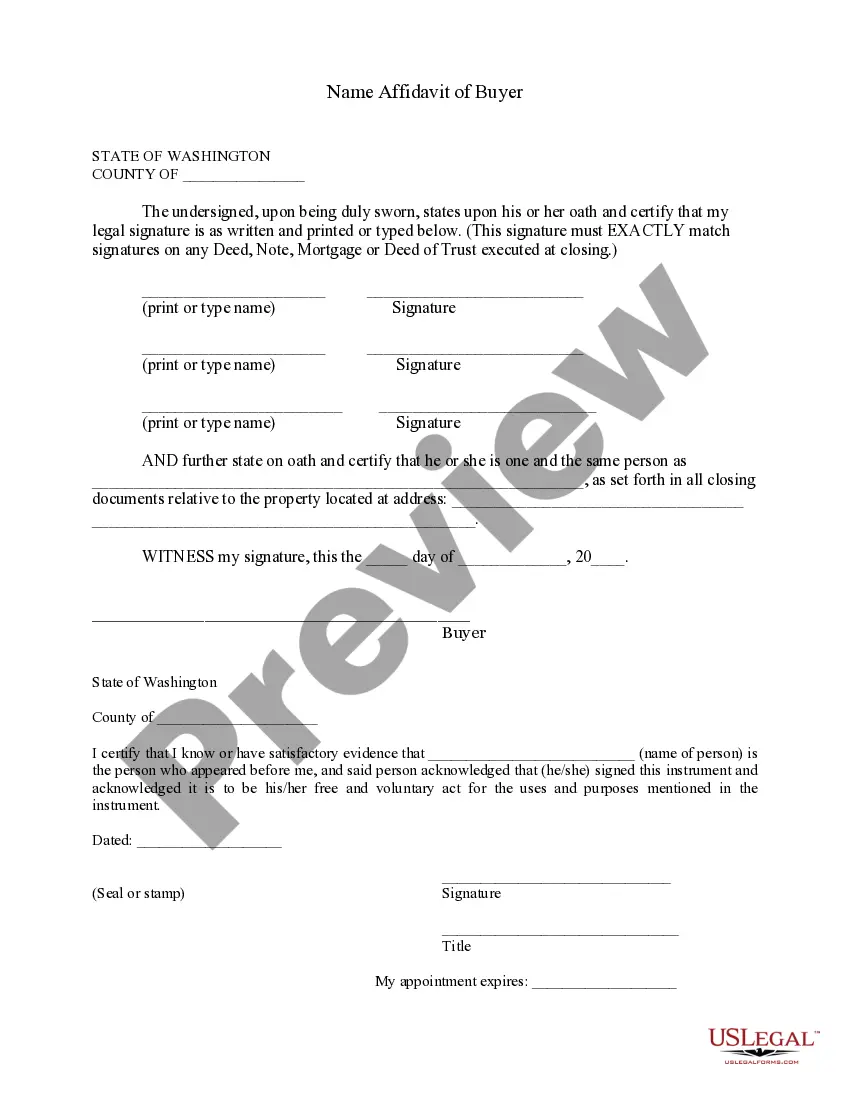

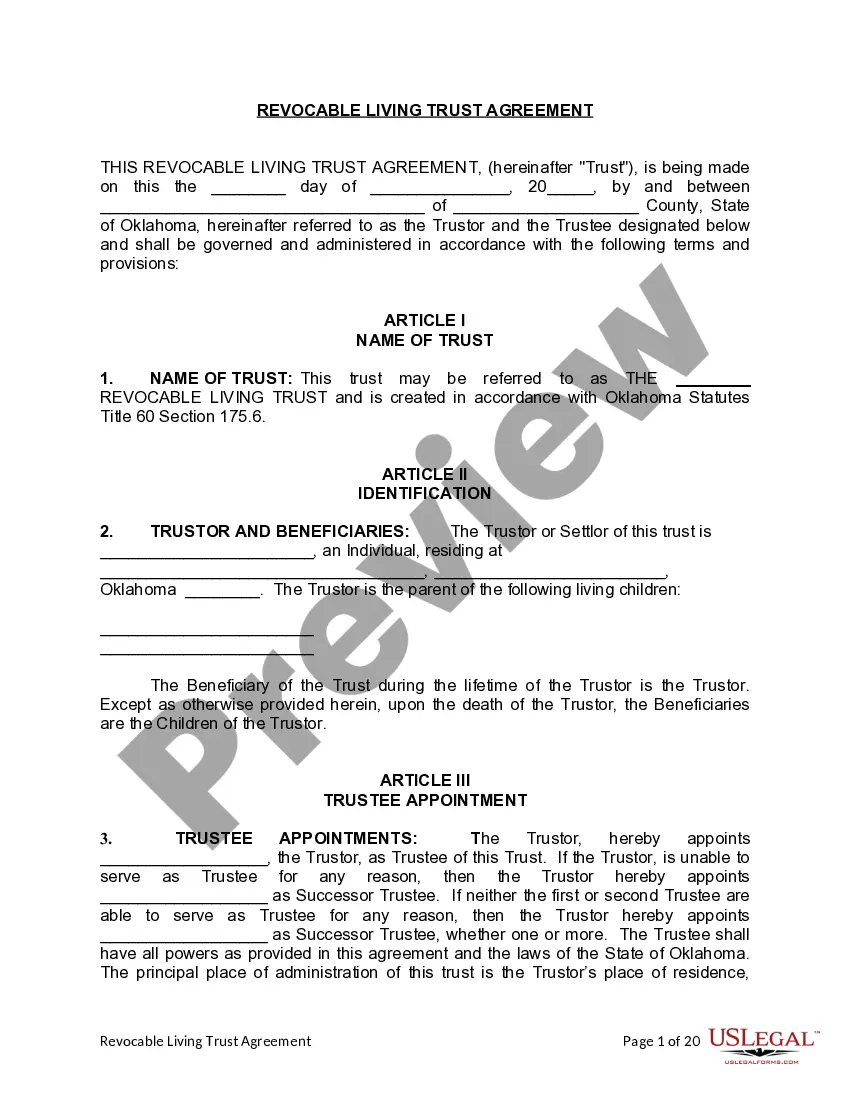

First, verify that you have selected the appropriate document template for the state/city of your choice. Review the form details to ensure you have chosen the correct one. If available, use the Preview button to view the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Obtain button.

- Subsequently, you can complete, modify, create, or sign the Alabama Irrevocable Trust Agreement for the Benefit of Trustor's Children and Grandchildren.

- Every legal document template you acquire is yours forever.

- To retrieve another copy of the acquired form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

An irrevocable trust is a trust that can't be amended or modified. However, like any other trust an irrevocable trust can have multiple beneficiaries. The Internal Revenue Service allows irrevocable trusts to be created as grantor, simple or complex trusts.

While there's no limit to how many trustees one trust can have, it might be beneficial to keep the number low. Here are a few reasons why: Potential disagreements among trustees. The more trustees you name, the greater the chance they'll have different ideas about how your trust should be managed.

Most people inherit assets from irrevocable trusts that only became irrevocable upon the creator's demise. In this situation, if you must pay taxes, they are levied at the same rate as any other type of inherited asset.

So, when asking the question can you change beneficiaries in an irrevocable trust? the answer is generally no you normally cannot change the aspects of an irrevocable trust, like changing beneficiaries.

When an irrevocable trust makes a distribution, it deducts the income distributed on its own tax return and issues the beneficiary a tax form called a K-1. This form shows the amount of the beneficiary's distribution that's interest income as opposed to principal.

Beneficiaries of an irrevocable trust have rights to information about the trust and to make sure the trustee is acting properly. The scope of those rights depends on the type of beneficiary. Current beneficiaries are beneficiaries who are currently entitled to income from the trust.

Trusts can have more than one beneficiary and they commonly do. In cases of multiple beneficiaries, the beneficiaries may hold concurrent interests or successive interests.

Most grandparents choose to put equal amounts of money into each grandchild's individual trust. The trustee can then decide when and how much money to distribute to each grandchild from their individual trust based on the standards written into the trust.

Generally, a trustee is the only person allowed to withdraw money from an irrevocable trust.

Qualifying gifts to an irrevocable trust for the annual gift tax exclusion will involve giving the beneficiary either the right, for a limited time, to withdraw assets given to the trust (a "Crummey withdrawal right") or the use of a trust that lasts only until the beneficiary reaches age 21.