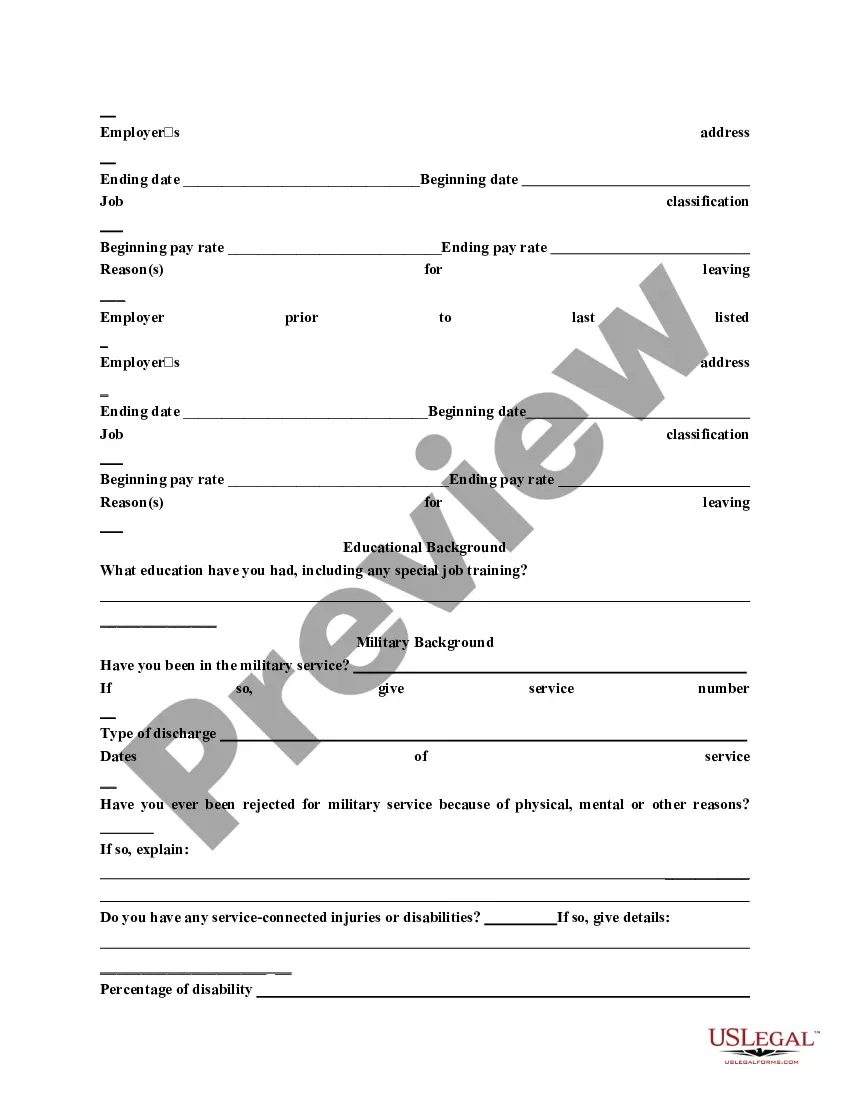

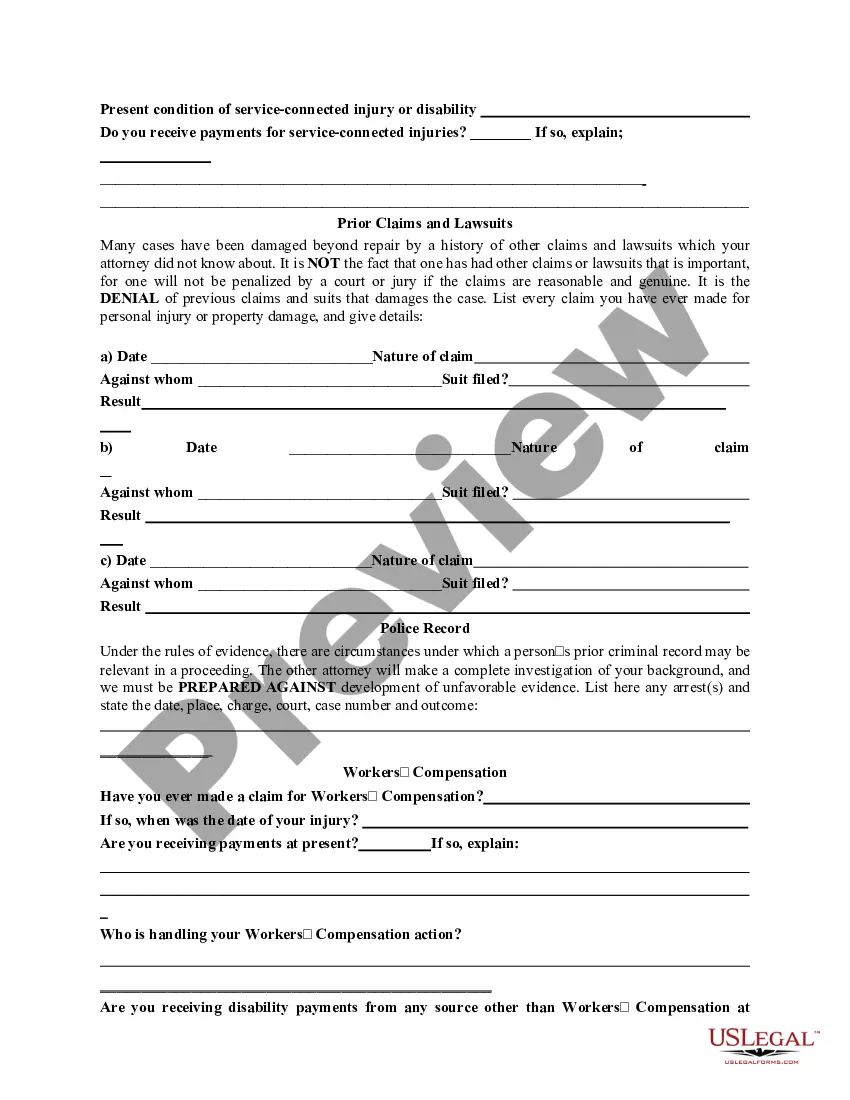

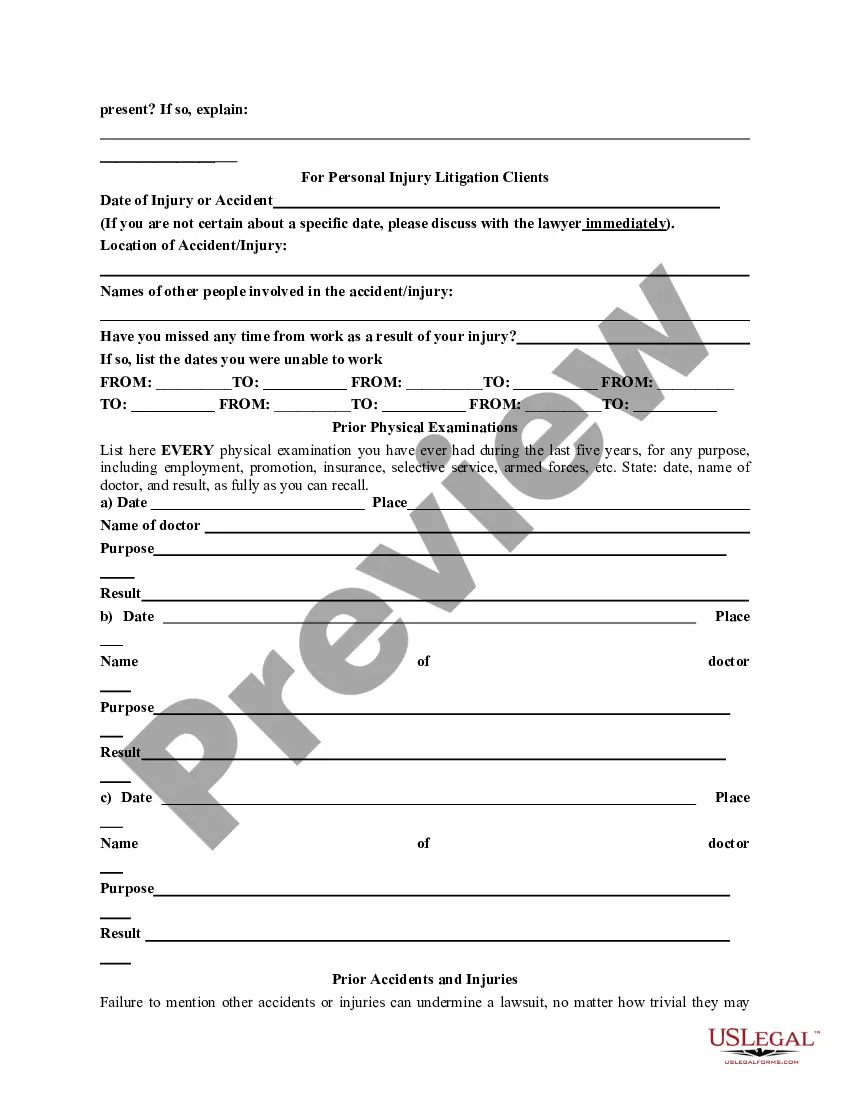

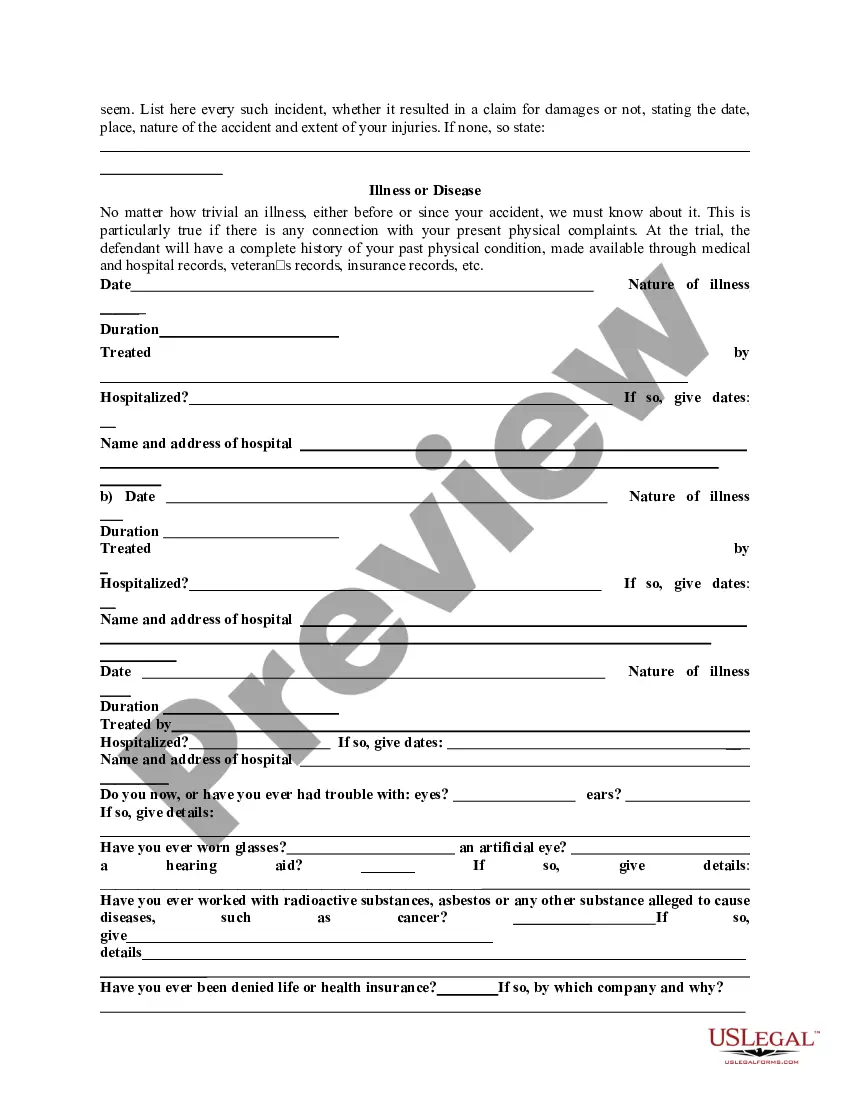

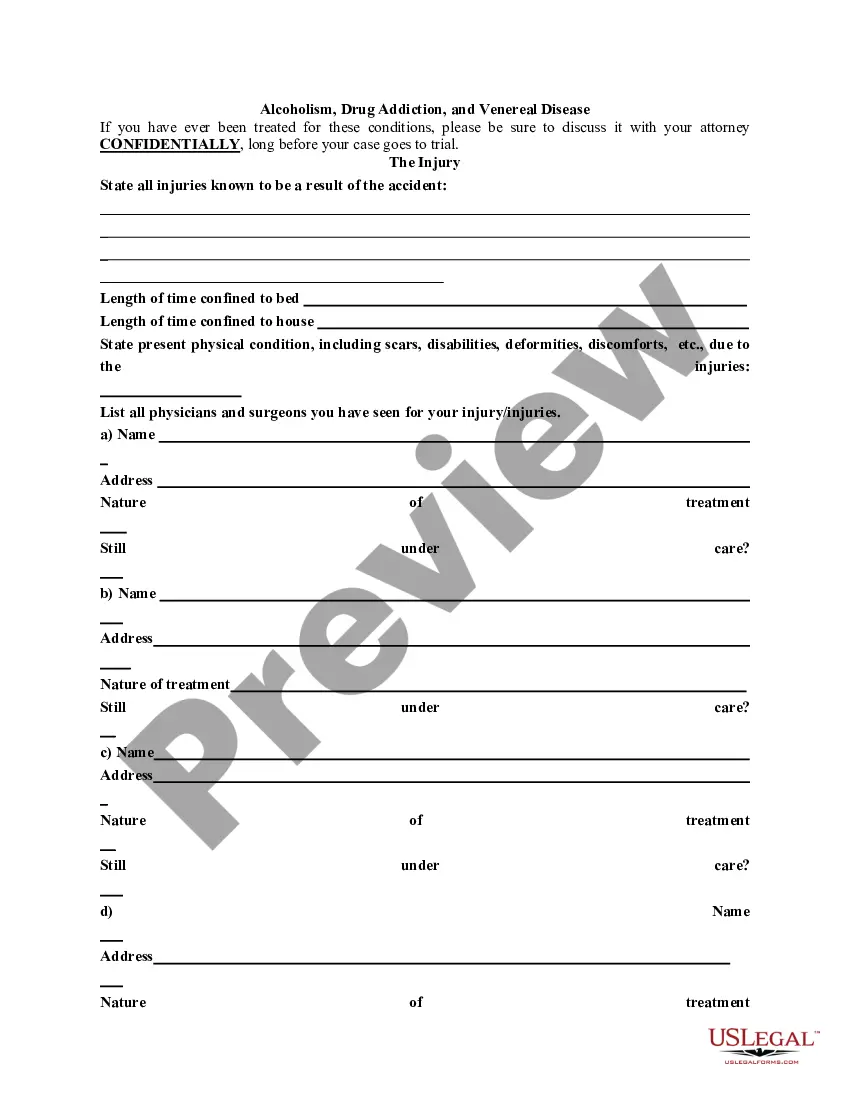

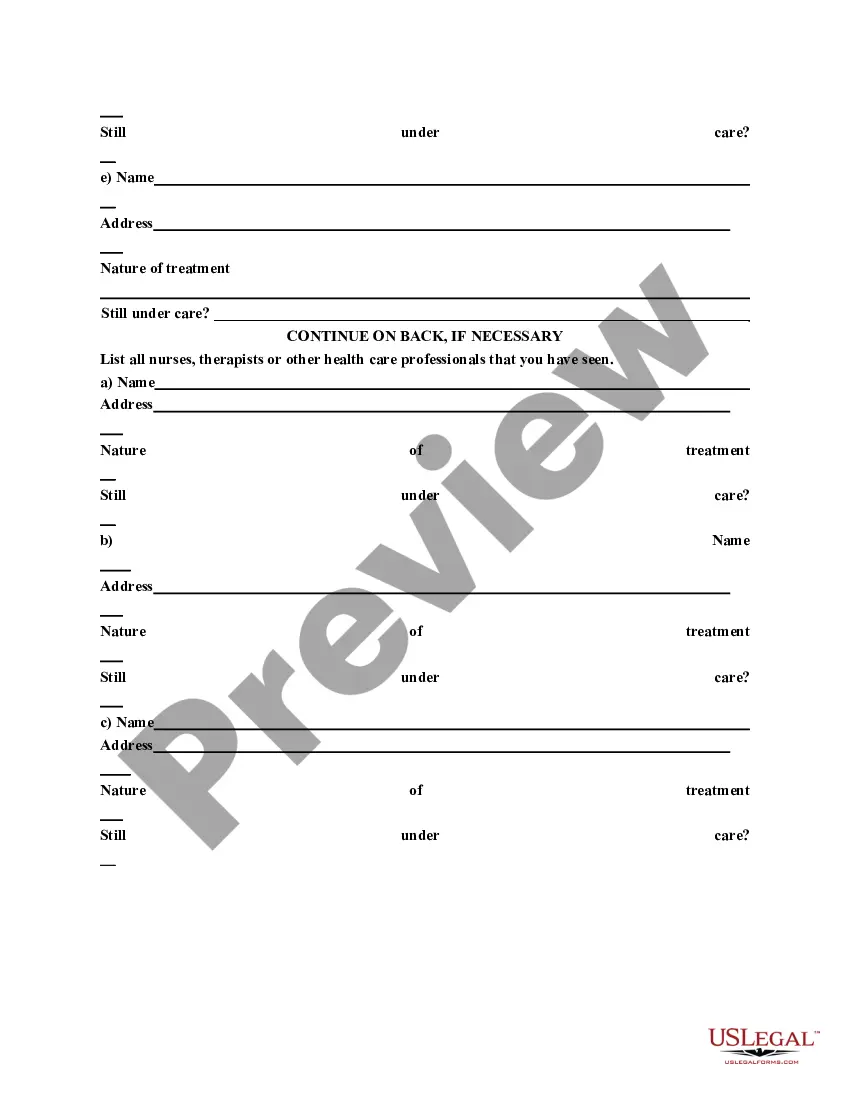

The first part of this questionnaire is designed to be useful in most civil and criminal representations. The last part can be used when screening prospective personal injury litigation clients. The questionnaire can be completed by the attorney during a first meeting with prospective clients or mailed to the client in advance and reviewed at a first meeting.

Alabama General Information Questionnaire

Description

How to fill out General Information Questionnaire?

If you want to complete, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms that can be accessed online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you need.

A range of templates for business and personal purposes are categorized by groups and keywords, or by states. Use US Legal Forms to obtain the Alabama General Information Questionnaire with just a few clicks.

Each legal document format you purchase is yours permanently. You will have access to every form you saved in your account. Click the My documents section and select a form to print or download again.

Be proactive and download and print the Alabama General Information Questionnaire with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and then click the Download button to receive the Alabama General Information Questionnaire.

- You can also access forms you previously saved from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types of legal forms.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to process the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Alabama General Information Questionnaire.

Form popularity

FAQ

Alabama is using Schedule A to determine its unemployment insurance tax rates for 2023, a state labor official told Bloomberg Tax on Jan. 5. Schedule A's tax rates for experienced employers range from 0.2% to 5.4% and include a 0.06% employment security assessment, under state law.

New employers will continue to pay the entry rate of 2.7 percent.

New Hire Paperwork: Alabama Alabama employers must obtain a completed Form A-4, Employee's Withholding Tax Exemption Certificate, from each employee. Alabama does not accept the federal Form W-4. ... Employers must provide notice to new hires regarding misrepresentations with respect to workers' compensation benefits.

Alabama's preliminary, seasonally adjusted September unemployment rate increased slightly from August's rate of 2.1% to 2.2%. September's rate is well below September 2022's rate of 2.6%. The rate represents 50,179 unemployed persons, compared to 48,590 in August and 60,488 in September 2022.

Alabama Announcement Relating to 2023 Unemployment Tax Rates and Wage Base. The Alabama 2023 SUI tax rates were dated December 13, 2022. Schedule C decreased to Schedule A, and the shared cost, a constant added to all employers' rates, decreased to 0.00%. The rates range from 0.20% to 5.40% (0.05% to 6.10% in 2022).

Download your 2023 unemployment insurance tax rate Alabama dropped into the lowest rate schedule (Schedule A) for the first time since 1997. The average tax rate for 2023 is slightly more than a half percent (. 55%), the lowest in recorded history.

Inclusive of the 0.06% Employment Security Enhancement Assessment (ESA), an Employer's rate can vary from 0.20% to 6.80% depending on the one of four rate schedules in effect, plus any applicable shared cost.

Reporting Requirements Employers who fail to report newly hired or recalled workers may be fined up to $25 for each violation. All reports of hire will require the following data: employee's name, address, and social security number; first day of work; and, whether the employee was newly hired or recalled to work.