Alabama Agreement to Assign Lease to Incorporators Forming Corporation

Description

How to fill out Agreement To Assign Lease To Incorporators Forming Corporation?

It is feasible to allocate time online looking for the legal document format that complies with the state and federal requirements you need.

US Legal Forms offers a vast array of legal documents that have been reviewed by experts.

You can readily download or print the Alabama Agreement to Assign Lease to Incorporators Forming Corporation from our services.

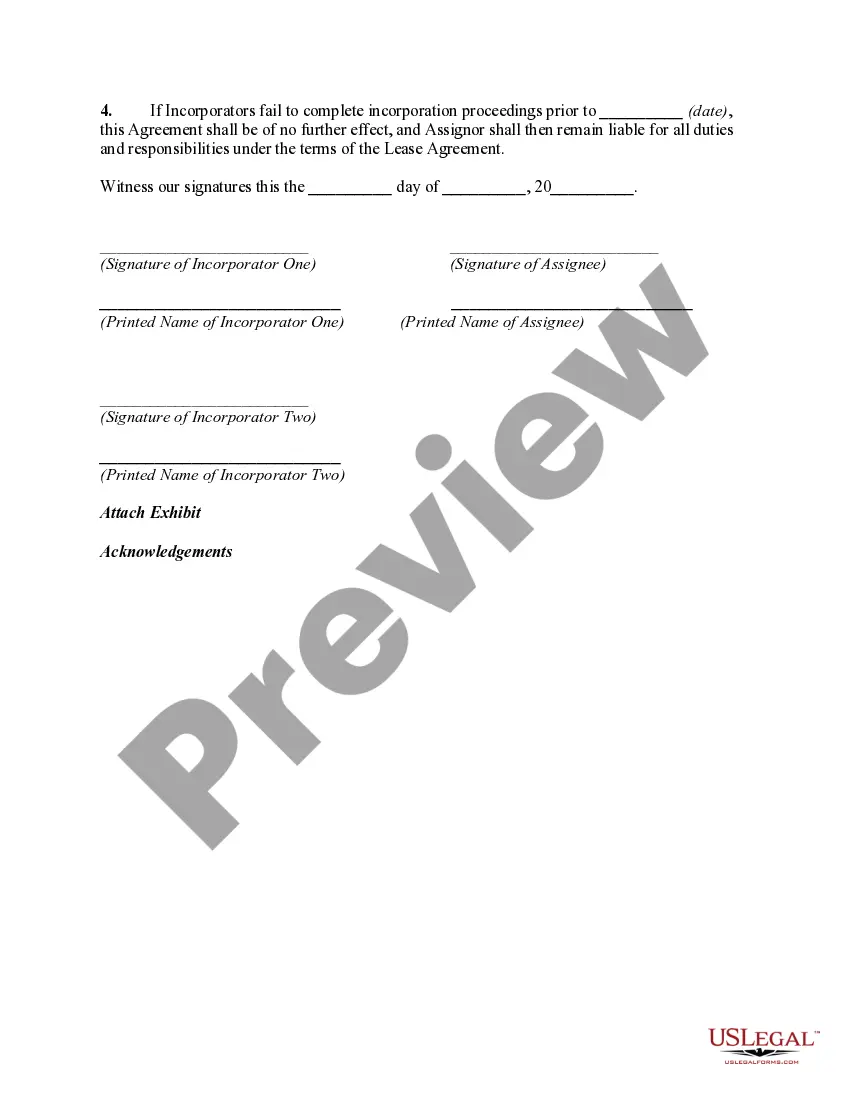

If available, utilize the Preview button to view the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- Subsequently, you can complete, modify, print, or sign the Alabama Agreement to Assign Lease to Incorporators Forming Corporation.

- Each legal document format you purchase is yours indefinitely.

- To obtain another copy of the purchased document, navigate to the My documents tab and click on the respective button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for your area/town of choice.

- Review the document details to confirm you have selected the appropriate document.

Form popularity

FAQ

The Alabama form 65 must be filed by partnerships and certain pass-through entities that operate within the state. This includes any corporation that distributes income or losses among partners or shareholders. Understanding the filing requirements is important, particularly in relation to the Alabama Agreement to Assign Lease to Incorporators Forming Corporation, to ensure compliance and optimize tax benefits.

In Alabama, a will does not need to be notarized to be valid; however, having it notarized can simplify the probate process. A notarized will can provide additional proof of authenticity, reducing the chance of disputes among heirs. This consideration might be relevant when forming your corporation, especially if the Alabama Agreement to Assign Lease to Incorporators Forming Corporation involves estate planning or asset management.

Landlords in Alabama are prohibited from engaging in retaliatory eviction or discrimination against tenants. Additionally, they cannot unlawfully enter rental properties without proper notice. Knowing these restrictions helps you when pursuing an Alabama Agreement to Assign Lease to Incorporators Forming Corporation, ensuring that your lease agreements remain fair and compliant with state laws.

In Alabama, leases do not typically need to be notarized to be legally binding; however, notarization can offer added protection and clarity. For transactions involving the Alabama Agreement to Assign Lease to Incorporators Forming Corporation, having a notarized lease might be beneficial for verifying identities and ensuring all parties are committed to the terms. Thus, while notarization is not required, it could be advantageous.

The K1 form 65 in Alabama is a tax document used by partnerships to report the individual income, deductions, and credits allocated to each partner. This form is essential for filing taxes accurately, especially where business structures intersect with personal tax obligations. If you're forming a corporation that involves partnerships and leases in Alabama, this tax information plays a key role in the overall financial strategies, especially in the context of the Alabama Agreement to Assign Lease to Incorporators Forming Corporation.

Alabama has specific lease laws that outline the rights and obligations of landlords and tenants. These regulations govern topics such as security deposits, lease termination, and maintenance responsibilities. Understanding these laws is vital when engaging in an Alabama Agreement to Assign Lease to Incorporators Forming Corporation, as they help protect your interests and clarify your responsibilities.

Yes, Alabama requires articles of incorporation for forming a corporation in the state. These documents establish your business entity legally and include essential information such as the corporation’s name, purpose, and registered agent. Filing the required documents is a crucial step in the process of setting up an Alabama Agreement to Assign Lease to Incorporators Forming Corporation, ensuring your business operates within the law.

The most common commercial lease agreement is the net lease, which divides certain responsibilities among the landlord and tenant. Typically, tenants cover expenses like property taxes, insurance, and maintenance in addition to rent. This type of arrangement appeals to many businesses seeking predictable costs. Using the Alabama Agreement to Assign Lease to Incorporators Forming Corporation can aid in drafting effective commercial lease agreements.

A lease to assign refers to the process where a tenant transfers their lease obligations and rights to another party. This can occur under specific conditions outlined in the lease agreement. It is important to ensure all legal procedures are followed when making such a transfer. Utilizing the Alabama Agreement to Assign Lease to Incorporators Forming Corporation can simplify this process.

The most common type of leasehold is the tenancy for years. This leasehold automatically ends after a specified period without needing notice from either party. Knowing about the Alabama Agreement to Assign Lease to Incorporators Forming Corporation can aid in understanding the implications of leaseholds, especially in terms of assignments and transfers.