Alabama Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises

Description

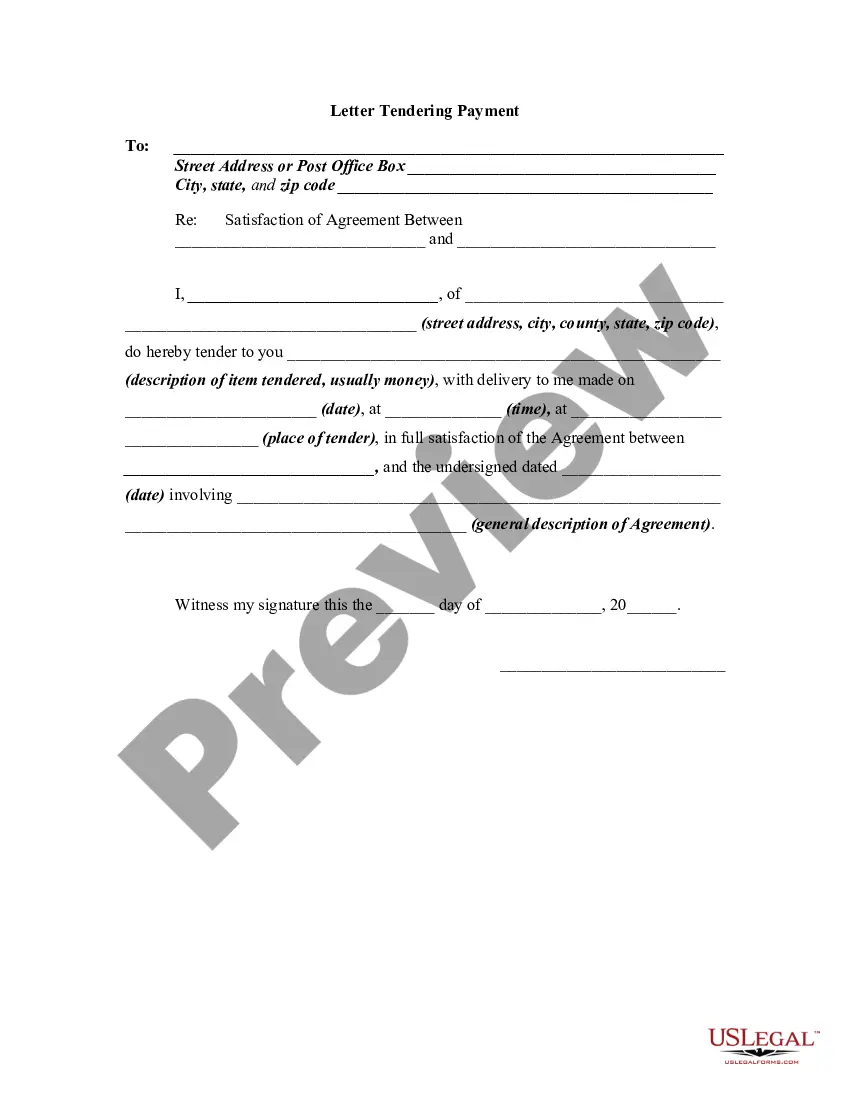

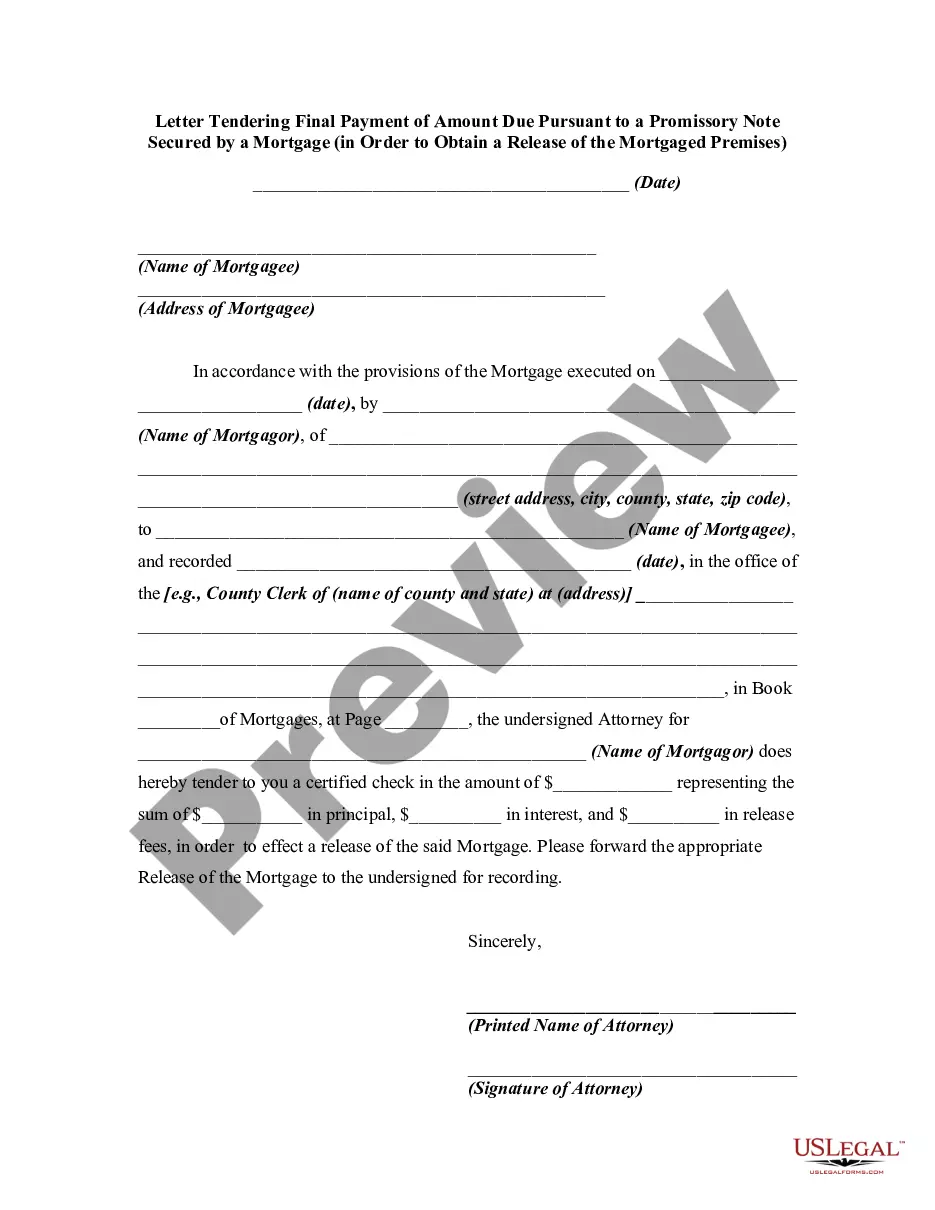

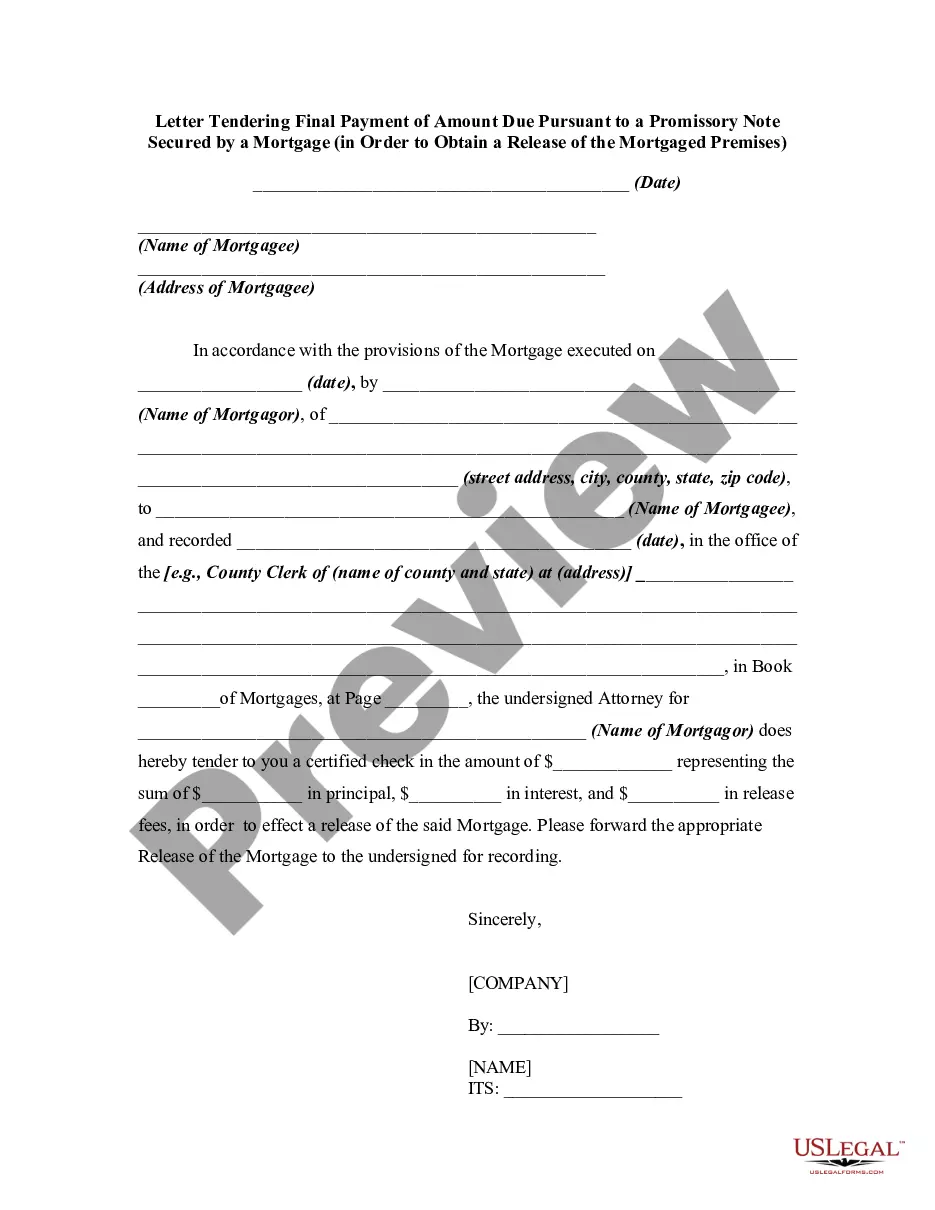

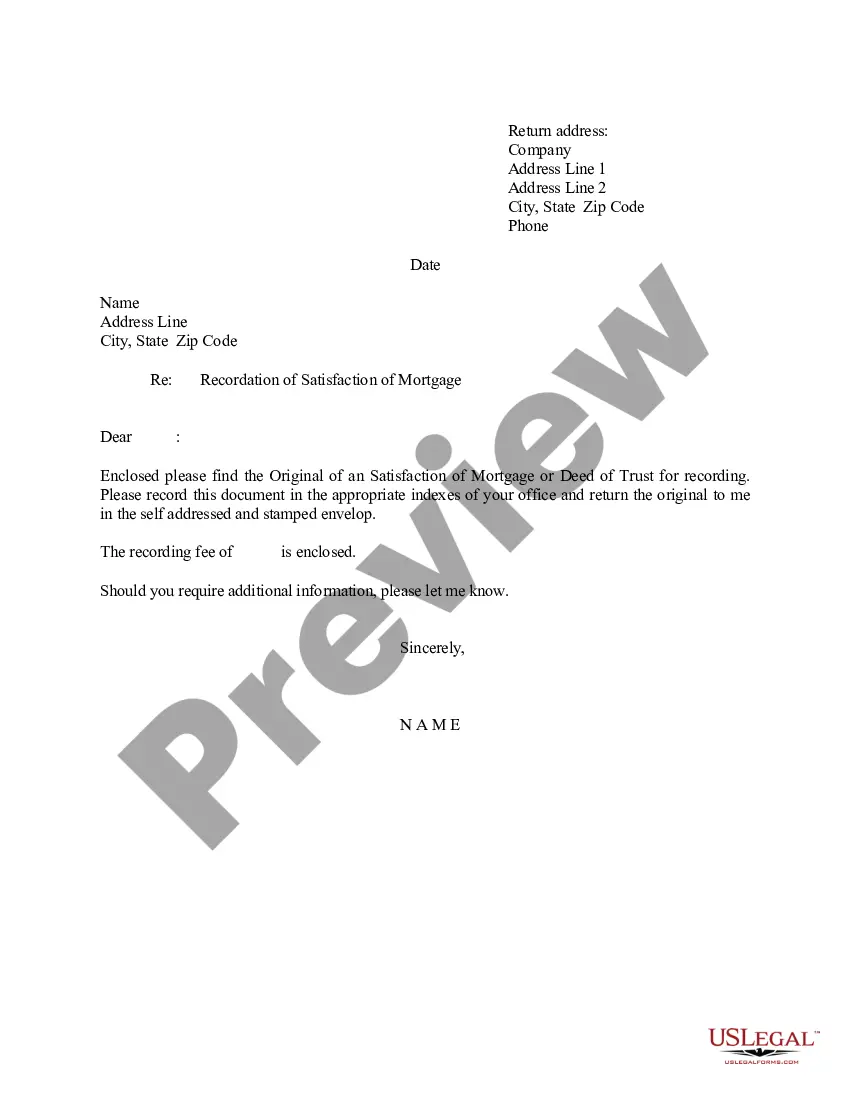

How to fill out Letter Tendering Payment In Order To Obtain Release Of Mortgaged Premises?

Choosing the best lawful papers design might be a have a problem. Obviously, there are tons of templates available on the Internet, but how do you get the lawful type you need? Make use of the US Legal Forms website. The assistance provides a large number of templates, for example the Alabama Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises, which can be used for organization and personal needs. All of the forms are checked by experts and fulfill federal and state requirements.

Should you be previously authorized, log in to your account and click the Down load switch to obtain the Alabama Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises. Make use of account to appear from the lawful forms you possess ordered formerly. Visit the My Forms tab of the account and acquire another backup of the papers you need.

Should you be a new end user of US Legal Forms, listed below are easy recommendations so that you can adhere to:

- Very first, make certain you have chosen the appropriate type for your metropolis/area. It is possible to check out the shape using the Review switch and read the shape description to make certain this is basically the right one for you.

- In case the type will not fulfill your requirements, utilize the Seach area to find the appropriate type.

- Once you are positive that the shape is proper, click the Get now switch to obtain the type.

- Choose the rates program you would like and enter in the necessary details. Make your account and purchase the order using your PayPal account or credit card.

- Opt for the document structure and acquire the lawful papers design to your gadget.

- Comprehensive, modify and print out and signal the attained Alabama Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises.

US Legal Forms may be the biggest library of lawful forms that you can find various papers templates. Make use of the company to acquire skillfully-made paperwork that adhere to state requirements.

Form popularity

FAQ

Alabama law generally gives homeowners a one-year redemption period after a foreclosure sale.

If you miss four consecutive mortgage payments (120 days), most lenders begin the process of foreclosure on your home. If you miss one mortgage payment, lenders will often issue you a 15-day grace period to pay without incurring a penalty.

A foreclosure stays on your credit report for seven years from the date of the first missed payment that led to it, but its impact on your credit score will likely fade earlier than that. Foreclosure may hurt your ability to get a new mortgage.

A few potential ways to stop a foreclosure and keep your home include reinstating the loan, redeeming the property before or after the sale, or filing for bankruptcy. Working out a loss mitigation option, like a loan modification, will also stop a foreclosure.

Alabama is a non-judicial foreclosure state, which means that a mortgage holder doesn't have to take the homeowner to court to reclaim the home if the mortgage falls behind. There are still steps the mortgage holder has to take to foreclose on the home.

Stages of Foreclosure in Alabama There are three stages to a foreclosure in Alabama. The first stage is what happens before the home is put up for sale. The second is what happens after the home is sold. The third occurs only if the person who lost the home doesn't move out after the home is sold.

In Alabama, most lenders foreclose utilizing the non-judicial process. Mortgage holders typically resort to non-judicial foreclosure because it is so much quicker. Alabama law does not require the lender to notify the debtor before starting either foreclosure process.

Alabama has no definite statute of limitations as to when a lender must begin foreclosure proceedings. If you are behind with your mortgage payments, the lender can begin foreclosure proceedings at any time.