Alabama Letter to Creditors Notifying Them of Identity Theft for New Accounts

Description

How to fill out Letter To Creditors Notifying Them Of Identity Theft For New Accounts?

Are you in the situation where you require documents for both business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding ones you can rely on isn't easy.

US Legal Forms provides a vast array of template documents, such as the Alabama Letter to Creditors Notifying Them of Identity Theft for New Accounts, that are designed to comply with federal and state requirements.

Once you find the appropriate document, click on Purchase now.

Choose the pricing plan you want, fill in the necessary information to create your account, and pay for the order with your PayPal or Visa or Mastercard. Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Alabama Letter to Creditors Notifying Them of Identity Theft for New Accounts at any time, if needed. Simply select the required document to download or print the template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and begin making your life a bit easier.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Alabama Letter to Creditors Notifying Them of Identity Theft for New Accounts template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you need and ensure it is for the correct city/state.

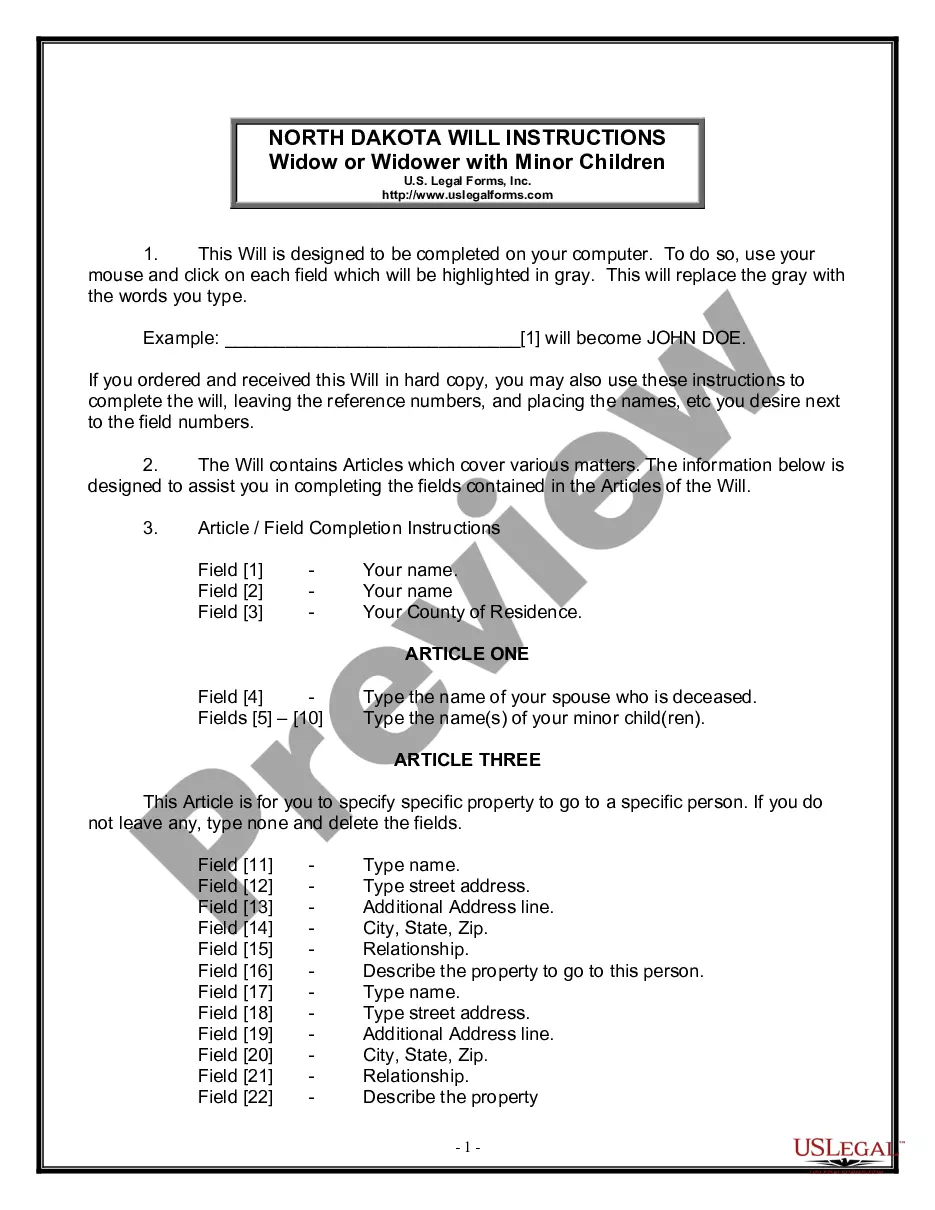

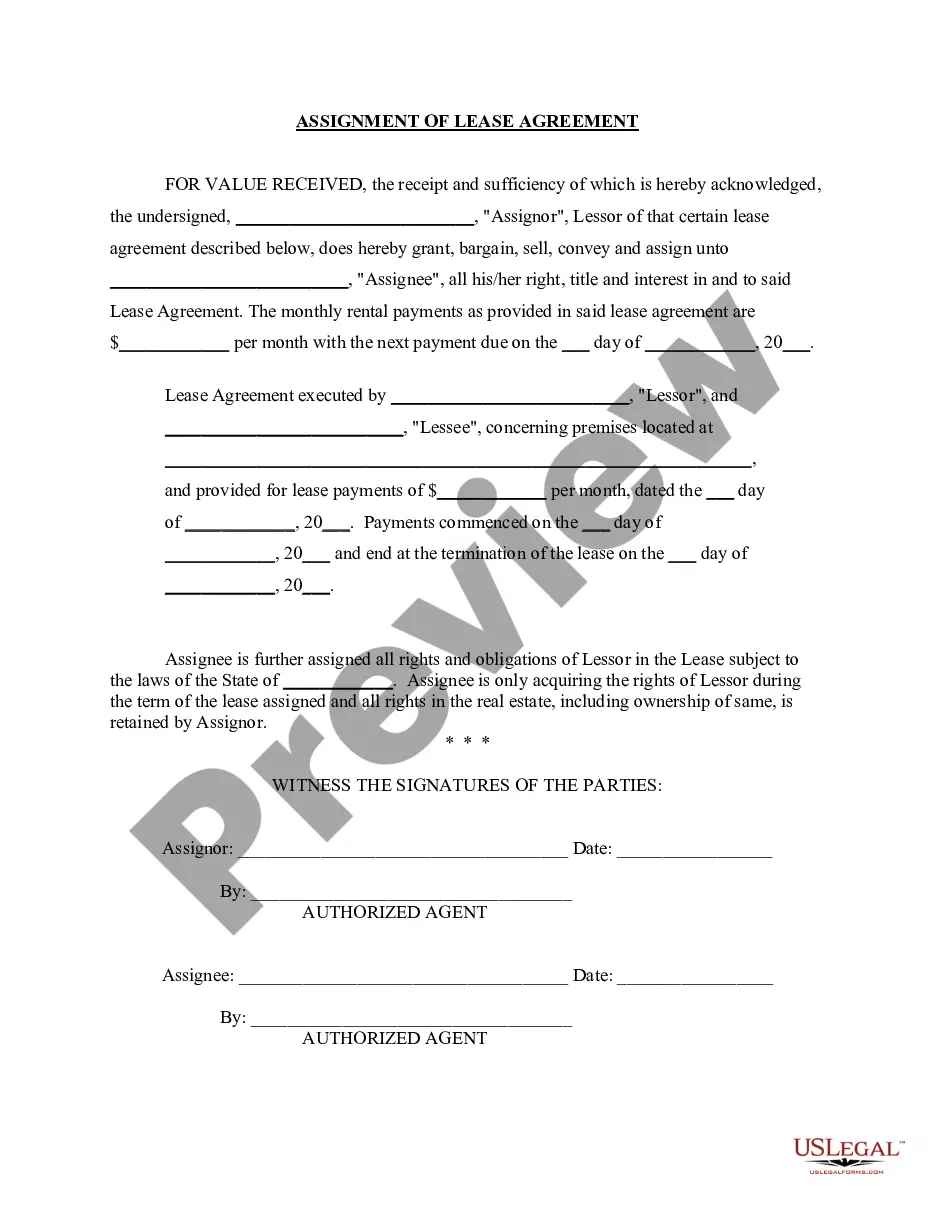

- Use the Preview button to examine the document.

- Review the details to ensure you have chosen the right document.

- If the document isn't what you are looking for, use the Search field to find the document that fits your needs.

Form popularity

FAQ

Each of the three major credit reporting agencies (Equifax, Experian and TransUnion) offers consumers the ability to place a ?security freeze,? or deny access to, their credit reports. A security freeze means that your credit file cannot be shared with potential creditors.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

In Alabama, a person commits identity theft ing to Alabama Code Section § 13A-8-192 if he or she: Obtains, records or accesses identifying information that would assist in accessing financial resources, obtaining identification documents or obtaining benefits of the victim.

File a police report with your local law enforcement agency. A police report provides you with a document saying you've been a victim, which can be helpful ? when requesting a 7-year extended fraud alert on your credit reports, for instance. This type of fraud alert requires a police or FTC Identity Theft Report.

As soon as that agency processes your fraud alert, it will notify the other two, which then also must place fraud alerts in your file. Equifax: 1-800-525-6285; .equifax.com. Experian: 1-888-397-3742; .experian.com. TransUnion: 1-800-680-7289; .transunion.com.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

To buy a copy of your report, contact the nationwide credit bureaus: Equifax: 1-800-685-1111; Equifax.com/personal/credit-report-services. Experian: 1-888-397-3742; Experian.com/help. TransUnion: 1-888-909-8872; TransUnion.com/credit-help.

Look out for notifications that a tax return has been filed under your name. Additionally, if you receive a W-2, 1099, or any other tax form from a company you've never worked for, it might mean that someone obtained your Social Security number and is using it for employment purposes.