Alabama Deed of Trust - Multistate

Description

How to fill out Deed Of Trust - Multistate?

If you wish to total, download, or print authorized document templates, utilize US Legal Forms, the premier collection of legal forms, that can be accessed online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you need.

Various templates for commercial and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to obtain the Alabama Deed of Trust - Multistate with just a few clicks.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Alabama Deed of Trust - Multistate. Each legal document template you purchase is yours permanently. You have access to every form you acquired in your account. Visit the My documents section and select a form to print or download again. Stay competitive and download, and print the Alabama Deed of Trust - Multistate with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to get the Alabama Deed of Trust - Multistate.

- You can also access forms you previously acquired in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

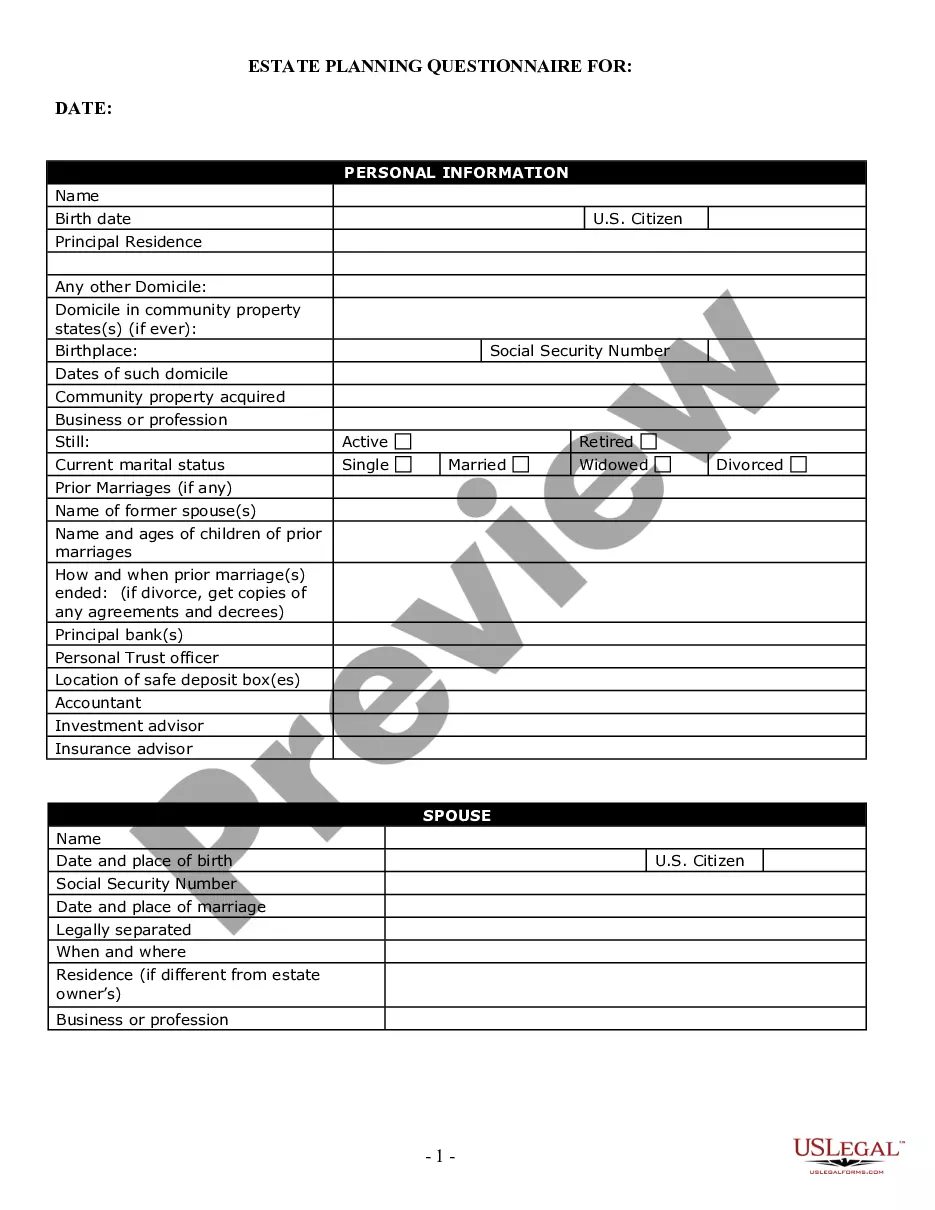

- Step 2. Use the Preview option to browse the form’s content. Don’t forget to review the summary.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Purchase now button. Choose the payment plan you prefer and enter your information to register for an account.

Form popularity

FAQ

States Using Deed of Trust In Alabama, Arizona, Arkansas, Illinois, Kentucky, Maryland, Michigan, Montana and South Dakota, the lender has the choice of either a mortgage or deed of trust. In any other state, you must have a mortgage.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

The majority of the time a deed of trust is used in a real estate transaction in North Carolina, it will be a purchase money mortgage, or a mortgage issued to the borrower by the seller of the home as part of the purchase transaction, unlike a traditional mortgage which is obtained through a bank.

What Is A Deed Of Trust? A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

Discretionary trust deeds are designed to provide clients with maximum flexibility and most modern deeds give the trustee wide powers of variation. However, it is always necessary to check the wording of the trust deed carefully to ensure that a proposed variation is within the scope of the trustee's powers.

Mortgage Deed of Trust Although a Deed of Trust is similar to a Mortgage, which is used in other states, it is not a Mortgage. Good to know: Texas does not use mortgages. Instead, Texas uses Deeds of Trust. The document is referred to as a Deed of Trust because there is a Trustee named for the property.